Canadian Economy

CANADIAN ECONOMY

Canadian Economy Expanded 4.5 Per Cent in May as Lockdowns Eased

HIGHLIGHTS

- The Canadian economy expanded 4.5 per cent in May, following two months of unprecedented declines. A flash estimate suggests that the economy climbed a further 5 per cent in June.

- The gains were widespread, spanning 14 of 16 major industries, led by strong growth in accommodation and food services, construction, and wholesale and retail trade. Output was down in arts, entertainment and recreation and in public administration.

- Manufacturing output increased 7.4 per cent in May, still leaving it nearly one-quarter below pre-pandemic levels.

- Output was up in just 6 of 11 manufacturing subsectors, as the rebound was concentrated in motor vehicle and parts.

- Today’s GDP report confirms that the economic recovery began in May and appeared to pick up steam in June. But, thereafter, the recovery is likely to follow a prolonged and bumpy course, in large part due to ongoing virus containment measures.

Sources: CME; Statistics Canada.

ECONOMY BEGINS HEALING IN MAY

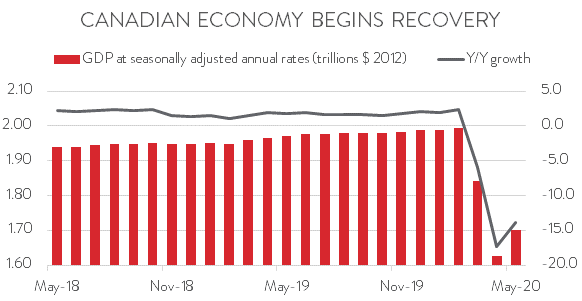

The Canadian economy climbed 4.5 per cent in May, following two months of unprecedented declines over March and April. A preliminary estimate from Statistics Canada suggests that the economy posted a further gain of 5 per cent in June, which would leave economic activity 10.4 per cent below February’s pre-pandemic level. It also implies that the economy shrank at an eye watering annualized rate of 40.7 per cent in the second quarter. (Official second quarter GDP numbers will be released on August 28th.)

Today’s GDP report confirms that the economic recovery began in May and appeared to pick up steam in June, with the back-to-back gains attributable to fiscal and monetary stimulus and the easing of lockdowns. But, thereafter, the recovery is likely to follow a prolonged and bumpy course, in large part due to ongoing virus containment measures. In other words, the economy faces a long uphill battle to get back to pre-crisis levels.

MOST INDUSTRIES SHARE IN MAY GAIN

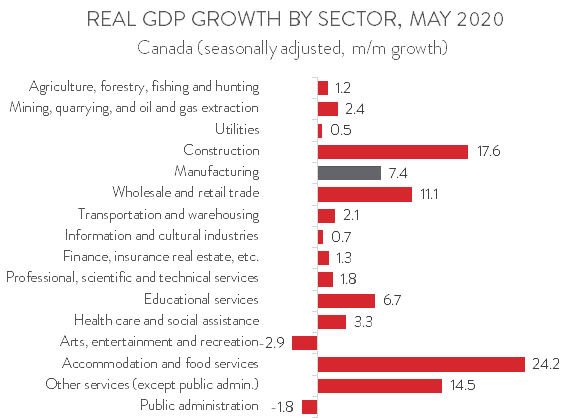

The gains in May were widespread, spanning 14 of 16 major industries. Accommodation and food services experienced the fastest growth at 24.2 per cent. Despite the double-digit increase, output remained 57.4 per cent below February’s level.

Construction output jumped 17.6 per cent, its largest monthly increase on record, thanks to the easing of COVID-19 restrictions, particularly in Ontario and Quebec.

Wholesale and retail trade expanded 11.1 per cent. The gain in wholesale trade was led by building material and supplies merchant wholesalers, while motor and vehicle parts dealers contributed the most to growth on the retail side.

Mining, quarrying, and oil and gas extraction output increased 2.4 per cent in May. Rising production in metal ore mining more than offset declines in oil and gas extraction, its fourth decrease in five months, and in support activities for mining and oil and gas extraction.

Transportation and warehousing output rose 2.1 per cent, its first increase in five months, led by gains in truck transportation and in transportation support activities. Although air transportation output also edged up in May, it was still 96 per cent below January’s level.

On the negative side, output in arts, entertainment and recreation fell 2.9 per cent, its third monthly decline in a row. May was the second straight month in which no professional sports were played. The public administration sector also experienced its third consecutive monthly decline in May, with output down 1.8 per cent.

MANUFACTURING OUTPUT BOUNCES BACK

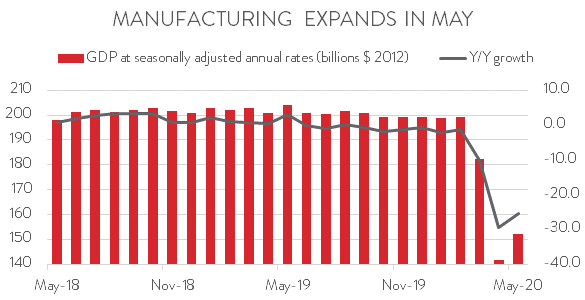

The manufacturing sector also saw its fortunes start to turn around in May, with output rising 7.4 per cent. However, this still leaves the sector with a big hole to climb out of, given that output plunged by a total of 28.9 per cent over March and April. Put another way, even with May’s gain, manufacturing output remained 23.7 per cent lower than February’s pre-pandemic level.

MANUFACTURING GAINS CONCENTRATED IN AUTO INDUSTRY

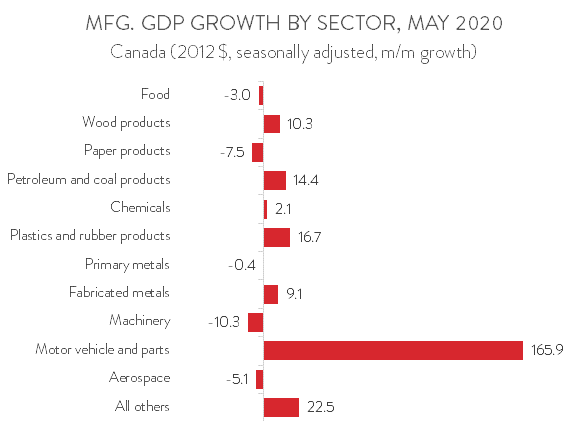

Output was up in just 6 of 11 manufacturing subsectors in May. The rebound was concentrated in motor vehicle and parts, with the restart of the auto industry driving output up 165.9 per cent. Despite the triple-digit gain, output remained 72.7 per cent below February’s level.

Three subsectors experienced double-digit growth: plastics and rubber parts (16.7 per cent), petroleum and coal products (14.4 per cent), and wood products (10.3 per cent). The expansion in the petroleum and coal products industry was attributable to refineries ramping up production.

Unfortunately, some manufacturing subsectors continued to struggle in May. Machinery output fell 10.3 per cent, its fourth straight monthly decline. Aerospace output contracted for the seventh straight month, down 5.1 per cent. Output in both paper and food manufacturing declined for the second month in a row, falling 7.5 per cent and 3.0 per cent, respectively. Finally, primary metal manufacturing inched down 0.4 per cent, its fifth straight monthly decline.

Sources: CME; Statistics Canada.