Canadian Economy

CANADIAN ECONOMY

Real GDP Advances 0.2% in January; Manufacturing Declines for First Time in Four Months

HIGHLIGHTS

- The Canadian economy grew 0.2% in January, the eighth consecutive monthly gain. A preliminary estimate indicates that real GDP growth accelerated to 0.8% in February.

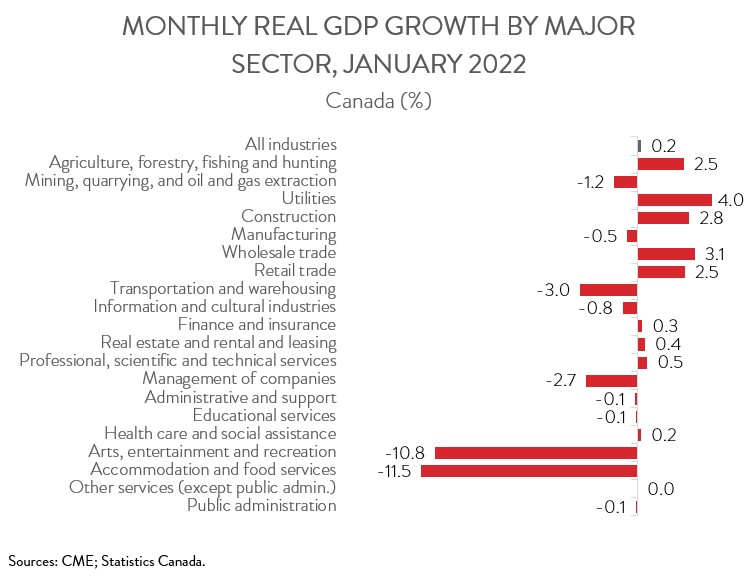

- The increase in GDP spanned only 9 of 20 industries, with construction, wholesale and retail trade, and utilities making the biggest contributions to growth. High-contact services were weighed down by the reintroduction of public health measures.

- Manufacturing output fell 0.5% in January, the first decline in four months.

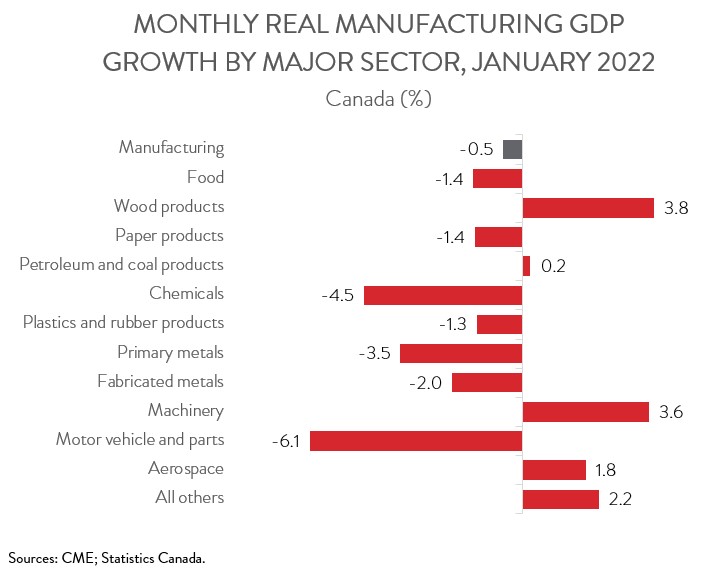

- Output was down in 7 of 11 major manufacturing subsectors, led by chemicals and motor vehicle and parts. Solid gains in machinery manufacturing and wood product manufacturing provided some offset.

- The Canadian economy’s good start to the year, combined with evidence that real GDP growth picked up steam in February, has led analysts to upgrade their growth estimates for the first quarter. It has also increased the odds of a 50-basis point interest rate hike at the Bank of Canada’s April 13th meeting.

ECONOMY EXPANDS 0.2% IN JANUARY; MANUFACTURING SHRINKS 0.5%

The Canadian economy grew 0.2% in January, the eighth consecutive monthly gain. A preliminary estimate indicates that real GDP growth accelerated to 0.8% in February.

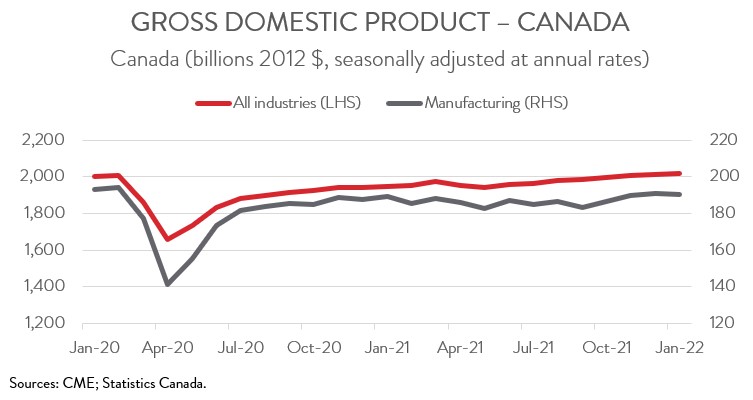

Manufacturing output fell 0.5% in January, down for the first time in four months. Unfortunately, the sector’s recovery continues to lag that of the overall economy, weighed down by supply chain disruptions and labour shortages that are hampering the ability of manufacturers to increase production. While headline GDP was 0.4% above its pre-pandemic level in January 2022, manufacturing output was 2.2% below this threshold. On a positive note, the sector looks to have rebounded in February, as Statistics Canada’s flash estimate partly attributes that month’s advance to a notable increase in manufacturing activity.

The Canadian economy had a good start to the year, providing yet more evidence of its growing ability to withstand restrictions on activity compared to when they were first introduced in the spring of 2020. This, combined with evidence that real GDP growth picked up steam in February, has led analysts to upgrade their growth estimates for the first quarter. It has also increased the odds of a 50-basis point interest rate hike at the Bank of Canada’s April 13th meeting.

JANUARY’S INCREASE IN ACTIVITY MIXED

The increase in GDP was not widespread, spanning only 9 of 20 industries. Construction led with way with a 2.8% expansion. This was the sector’s third increase in four months and was driven by gains in all subsectors.

Wholesale trade also had a strong month, with output rising 3.1%, the sixth consecutive monthly advance. This was followed by retail trade, which was up 2.5%. As noted by Statistics Canada, higher activity at motor vehicle and parts dealers contributed the most to the retail sector’s growth, as a higher volume of imports of motor vehicles in the fourth quarter of 2021 injected some much-needed inventory at auto dealerships.

Output growth in the utilities sector surged 4.0% in January, its fastest pace since January 2016. The outsized gain was attributable to frigid weather throughout most of the country, which drove demand for both electricity and natural gas for heating purposes.

On the negative side, the reintroduction of pandemic health measures hampered activity in high-contact services. In January, accommodation and food services tumbled 11.5%, transportation and warehousing services declined 3.0%, and arts, entertainment and recreation plummeted 10.8%. All three sectors experienced their largest declines since April 2020.

MANUFACTURING DECLINE DRIVEN BY CHEMICAL AND MOTOR VEHICLE AND PART SECTORS

Turning back to manufacturing, output was down in 7 of 11 major subsectors in January. Chemical manufacturing was the biggest contributor to the decline, with output shrinking 4.5%. This was the sector’s worst performance since April 2020, and it largely erased the gains of the past three months. The lion’s share of the blame for this downturn could be pinned on pharmaceutical and medicine manufacturing, as it posted a double-digit decrease in January.

Motor vehicle and parts manufacturing output fell 6.1%, the first decline in four months. As highlighted in Statistics Canada’s manufacturing sales report, several auto assembly plants were forced to shut down production in January due to supply chain disruptions and semiconductor shortages.

Declines in these industries were partly offset by solid advances in machinery manufacturing (+3.6%) and in wood product manufacturing (+3.8%), with both subsectors bouncing back from contractions in December. More modest gains were recorded in the aerospace (+1.8%) and petroleum and coal product (+0.2%) industries.