Manufacturing Sales

Manufacturing Sales

MAY 2021

Factory Sales Fall for Second Consecutive Month in May

HIGHLIGHTS

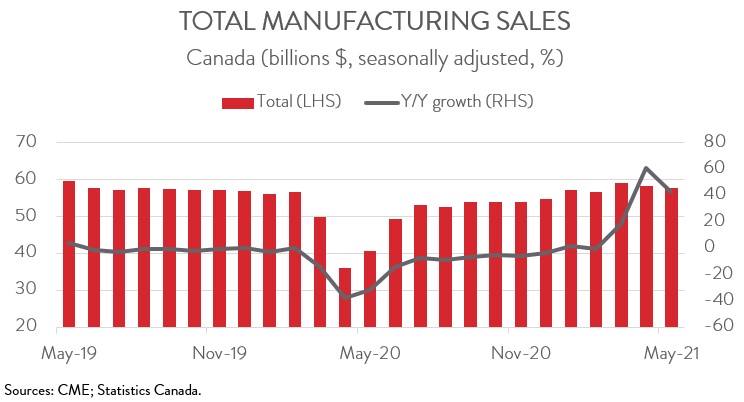

- Manufacturing sales fell 0.6% to $57.9 billion in May, the second straight decline and third in the last four months.

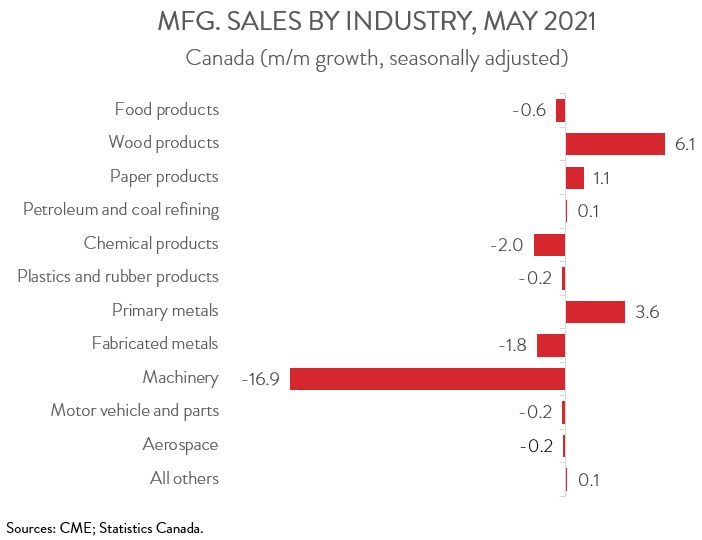

- The decrease in sales spanned 7 of 11 major industries, led by declines in machinery, chemical products, and fabricated metals.

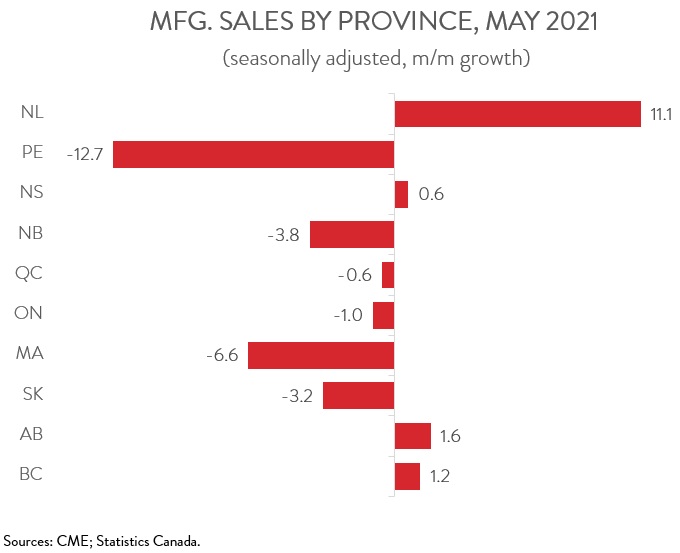

- Sales were down in 6 of 10 provinces, with Ontario, Manitoba, and Quebec contributing the most to the decline. Sales in Alberta rose to a record high.

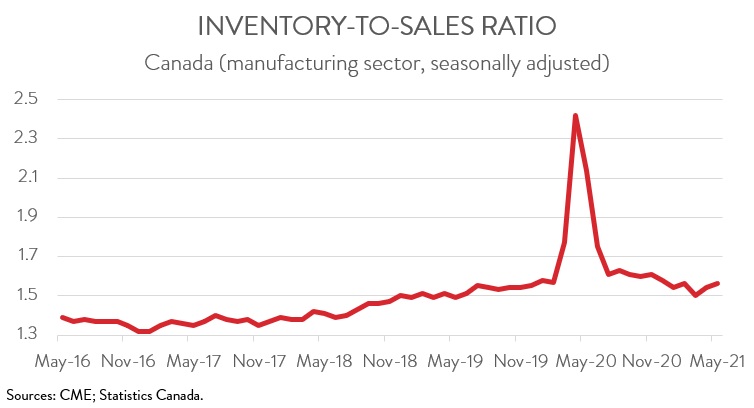

- The inventory-to-sales ratio increased from 1.54 in April to 1.56 in May.

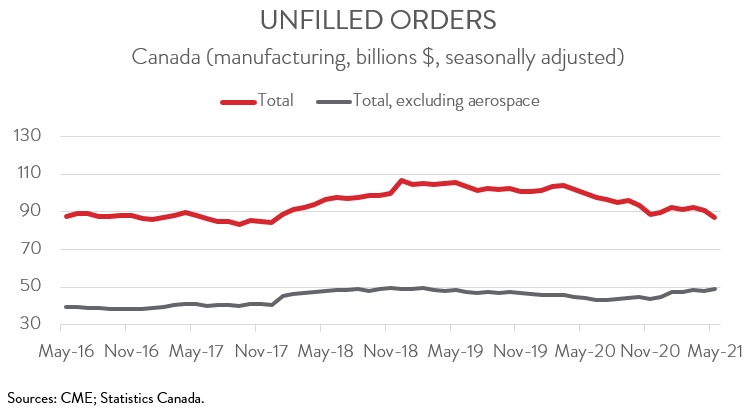

- Forward-looking indictors were negative, with new and unfilled orders down 4.0% and 4.1%, respectively.

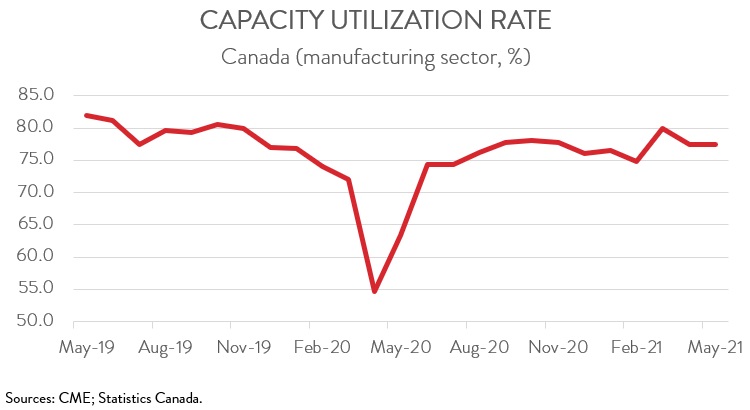

- The capacity utilization rate remained stable at 77.5% in May.

- The May factory sales report was largely disappointing. While declines in February and April could be largely pinned on the auto sector, the weakness in May was more broad-based. However, despite this recent weakness, the manufacturing sector’s outlook is expected to brighten as the global economy picks up speed amid the reopening and as supply chain disruptions gradually ease.

FACTORY SALES DOWN 0.6% IN MAY

Manufacturing sales fell 0.6% to $57.9 billion in May, the second straight decline and the third in the last four months. Despite this recent poor performance, sales were 1.8% above the pre-pandemic level. The story in May was even more disappointing when stripping out price effects. In constant dollar terms, manufacturing shipment volumes were down 2.5%.

The May factory sales report was largely disappointing. While declines in February and April could be largely pinned on the auto sector, which continues to be hit hard by the global shortage of semiconductors, the weakness in May was more broad-based. However, despite this recent weakness, the manufacturing sector’s outlook is expected to brighten as the global economy picks up speed amid the reopening and as supply chain disruptions gradually ease.

MACHINERY INDUSTRY SUFFERS STEEP DROP IN SALES

The decrease in sales in May spanned 7 of 11 major industries. Following record high sales in April, sales of machinery plunged 16.9% to $3.1 billion in May, mainly due to lower sales of agricultural, construction and mining machinery. As in other sectors, machinery manufacturers are seeing their production affected by supply chain disruptions, including microchip shortages.

Chemical product sales fell for the first time in five months in May, down 2.0% to $5.2 billion in May, attributable to lower sales in the basic chemicals and pharmaceutical and medicine manufacturing industries. Despite the decline, chemical product sales in May were up 17.3% compared to the pre-pandemic level in February 2020.

Sales of fabricated metal products decreased 1.8% to $3.6 billion in May, on lower sales of boiler, tank and shipping containers and coating, engraving, cold and heat treating and allied products. This left sales in the fabricated metals industry 2.7% below their pre-COVID levels.

On the positive side of the ledger, wood product sales hit yet another record, increasing 6.1% to $5.4 billion in May. The increase was entirely due to higher prices, as shipment volumes fell 4.7%. Given that prices for lumber and other wood products fell sharply in June, next month’s report could be a down one for this industry.

Sales of primary metal products rose 3.6% to a record $4.9 billion in May, fueled by higher sales of alumina and aluminum production and processing. Sales in the primary metal products industry have enjoyed a nice run, declining only once in the past 13 months.

ONTARIO, MANITOBA AND QUEBEC SEE BIGGEST DECLINES

Regionally, sales were down in 6 of 10 provinces, with Ontario, Manitoba and Quebec seeing the biggest declines. Sales in Ontario fell 1.0% to $24.0 billion in May, with the machinery, chemical, and transportation equipment industries contributing the most to the decline. Following two straight monthly increases, sales in Manitoba dipped 6.6% to $1.7 billion, weighed down by lower sales of food, machinery, and transportation equipment. Finally, sales in Quebec were down 0.6% to $14.6 billion in May, on lower sales of machinery, petroleum, and chemicals.

Fortunately, strong sales growth in Alberta, B.C, and Newfoundland and Labrador provided some offset. Sales in Alberta rose for the 13th consecutive month, up 1.6% to a record high of $7.2 billion. The growth in May was driven by higher sales of wood, petroleum, and chemicals. Sales in B.C. increased 1.2% to $5.5 billion, the fifth gain in sixth months, while sales in Newfoundland and Labrador were up 11.1% to $510.3 million, largely making up for an 11.9% drop in April.

INVENTORY-TO-SALES RATIO EDGES UP AGAIN

Total inventories rose 0.7% to $90.3 billion in May on higher inventories of chemical, petroleum, and wood products. This, combined with the decrease in sales, pushed up the inventory-to-sales ratio from 1.54 in April to 1.56 in May, the second straight monthly increase. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. After falling 2.0% in April, unfilled orders declined 4.1% to $87.1 billion in May, led by a big drop in the aerospace industry. Excluding aerospace, unfilled orders were up 2.3% in May.

It was a similar story for new orders. Following a 6.7% decrease in April, new orders dropped 4.0% to $54.1 billion in May. Once again, the blame fell on the shoulders of the aerospace industry. Removing aerospace products from the equation, new orders rose 2.0% in May.

CAPACITY UTILIZATION RATE HOLDS STEADY

Finally, the manufacturing sector’s capacity utilization rate remained stable at 77.5% in May. This is higher than the February 2020 rate of 74.0% but lower than the 2019 average of 79.6%.