Manufacturing Sales

Manufacturing Sales

Refined petroleum and motor vehicles drive manufacturing sales higher in March

Overview

Manufacturing sales reached their highest level since October, fueled by recovering activity in petroleum refining and motor vehicles. Based on trade data published earlier this month, the increase in output in those two industries was driven by higher export demand.

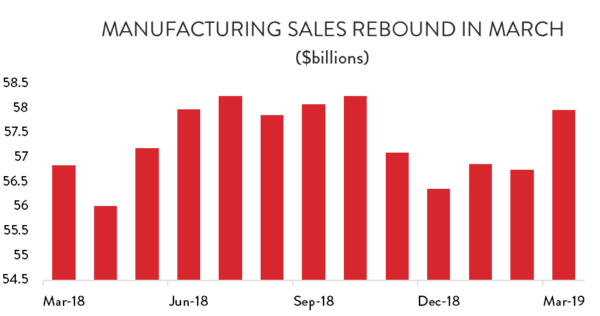

Overall, manufacturing output across Canada was up 2.1 per cent in March, reaching a five-month high just shy of $58.0 billion. That represents the fastest month-over-month increase in sales in more than a year. Although there is still some work to do before manufacturing activity returns to levels seen last October, it at least appears as if the sector has turned the corner after hitting a drought in the final quarter of 2018 and into the first couple months of this year.

Because of that weakness earlier in the year, manufacturing sales growth is tracking at a much slower pace than we saw last year. Through the first quarter of 2019, sales are about 2.1 per cent higher than they were over the same period last year. That’s less than half the average growth rate we saw for 2018 as a whole.

Prices and Volumes

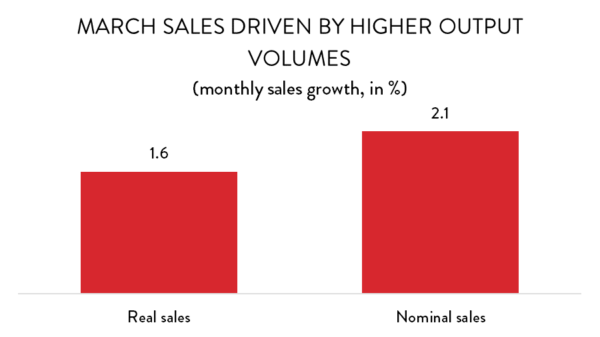

Sales growth in March was driven by a mix of higher production volumes and more favourable prices. Volume-based sales were up by 1.6 per cent compared to February – their largest increase since last May. Production gains were largely concentrated in durable goods industries, along with petroleum refining.

With that increase, production volumes in Canadian manufacturing have effectively recovered their losses since October. However, output growth remains sluggish. Through the first quarter of 2019, production volumes are just 0.5 per cent higher than they were over the same period last year.

Forward-Looking Indicators

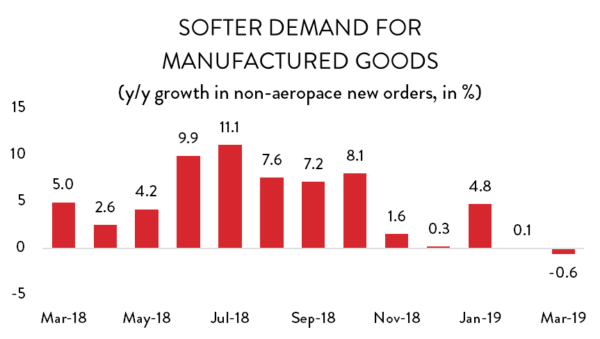

Although output levels were higher in March, forward-looking indicators were somewhat weaker. New, non-aerospace manufacturing orders fell by 1.5 per cent in March, with steep declines in orders for machinery, forest products, and plastics and rubber products. New orders have been noticeably softer compared to last summer, pointing to weaker growth in the months ahead.

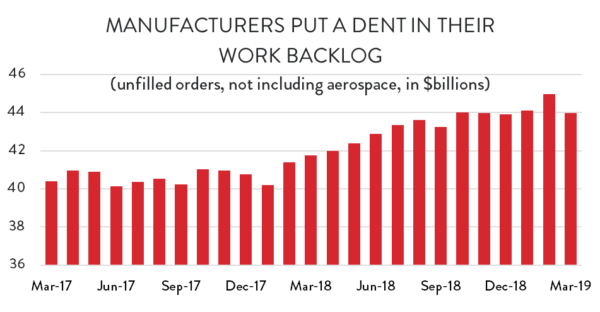

Slowing new orders and higher production activity in March allowed manufacturers to put a significant dent in their backlog of unfinished work. Unfilled orders (not including aerospace) had been rising steadily through most of last year and into 2019, reaching as high as $45.0 billion in February. However, they dropped significantly in March, falling by 2.2 per cent to just below $44.0 billion in March. Even so, unfilled orders remain high compared to their historical average, suggesting that there’s plenty of catch-up work left to do.

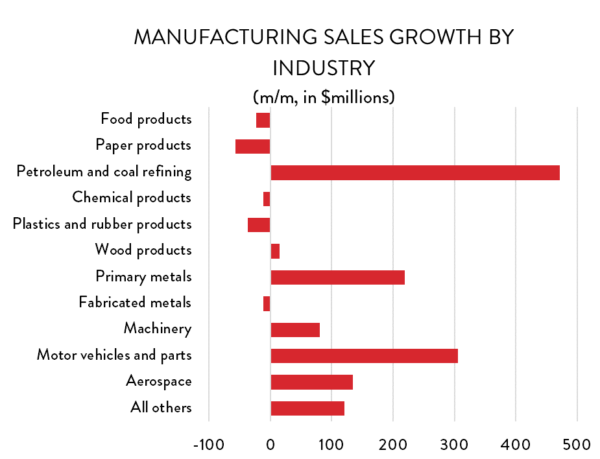

Manufacturing Sales by Industry

At the industry level, manufacturing output gains were heavily concentrated in durable goods industries; petroleum refining was the only major non-durable industry to see any growth at all in March. That said, refinery output was up significantly, leading all other industries for the second month in a row. Petroleum production was 8.2 per cent higher compared to February – an increase of about $471 million and equivalent to about 40 per cent of all manufacturing sales growth in March. The value of refinery production has been steadily increasing in 2019 but remains about 10 per cent below October levels.

Motor vehicles and parts producers also enjoyed solid gains in March. Sales were up 6.5 per cent ($319 million) – easily enough to counter losses in February. However, looking back over the last 18 months, auto production in Canada has been remarkably flat and it remains well below early 2017 levels.

March also saw healthy gains in primary metals (up 5.3 per cent), aerospace (7.7 per cent), machinery (2.2 per cent), and computers and electronics (3.8 per cent). Although it’s one of Canada’s smaller manufacturing sub-sectors, computers and electronics have enjoyed a surge in activity recently; production levels are 14 per cent higher than they were a year ago.

On the negative side, there was widespread softness across a range of non-durable goods industries. Paper products output was down 2.2 per cent ($57 million). Plastics and rubber products were 1.3 per cent lower ($37 million) and food processing was off slightly, dropping by 0.3 per cent ($24 million).

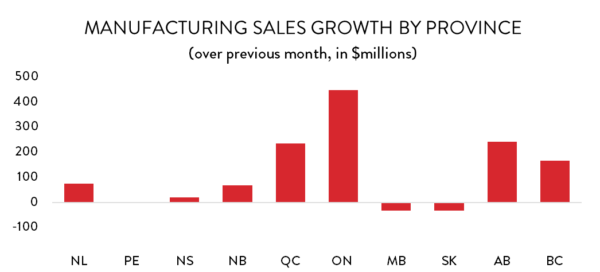

Manufacturing Sales by Province

Looking across the country, output was higher in most provinces in March, with only Manitoba and Saskatchewan posting lower production levels. The largest increase in Canada on a dollar-value basis was in Ontario, where higher motor vehicles production pushed overall sales up by $450 million (1.7 per cent) compared to February. That increase was easily enough to help Ontario’s manufacturing sector rebound from a poor showing the previous month.

Manufacturing activity was also up strongly in Alberta, where petroleum refining pushed overall provincial output up by $242 million (3.9 per cent). For its part, Quebec built on its strong gains in February, with output increasing by another $237 million (1.7 per cent) in March. Sales were also higher across Atlantic Canada and in BC.

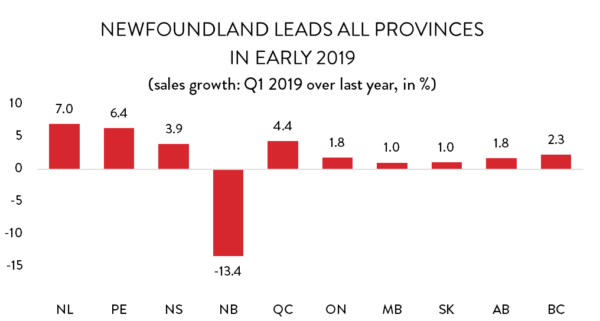

Through the first quarter of 2019, the fastest growth in manufacturing across Canada has been on the east coast. Output levels in Newfoundland and Labrador and PEI are up by 7.0 per cent and 6.4 per cent, respectively, compared to the first quarter of 2018. Elsewhere, growth has been generally slower than what we saw last year. The next fastest-growing provinces in Q1 were Quebec and Nova Scotia, where sales activity is tracking 4.4 per cent and 3.9 per cent above last year’s levels.