International Trade

International Trade

Energy and motor vehicles drive export gains in March

Trade Overview

Canadian exports were up in March, easily recovering February’s losses. Once again, crude oil and other energy products drove monthly gains, assisted this time by an uptick in motor vehicles and parts exports.

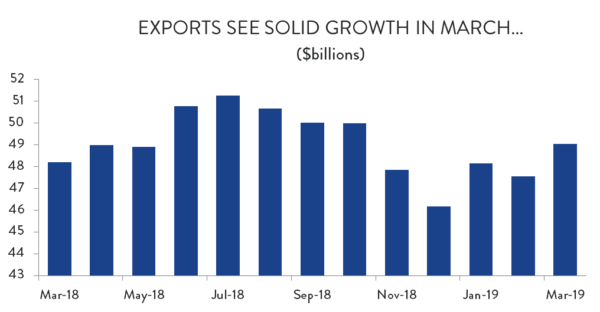

All told, exports were up by a healthy 3.2 per cent in March to reach a total value of $49.0 billion. That increase marks just the second time in the last eight months that exports have risen. However, the most recent increase, combined with strong gains in January, has put current monthly exports well clear of December’s trough and on the way to returning to last summer’s levels. Exports are about 6.2 per cent higher than they were in December, but remain 4.3 per cent below July’s peak.

That said, recent gains are coming after a prolonged period of weakness for Canadian exports. As a result, export growth remains poor on a year-over-year basis. Total sales to foreign markets in March were just 1.8 per cent higher than they were 12 months ago.

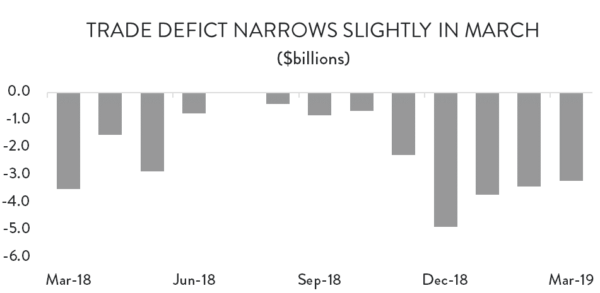

Once again, the story is similar on the import side. Canadian purchases of foreign goods were up 2.5 per cent in March – more than enough to offset the (revised) 1.8 per cent decline in February. Since exports grew by more than imports, Canada’s trade deficit narrowed slightly – from (a revised) $3.4 billion in February to $3.2 billion in March.

Prices and Volumes

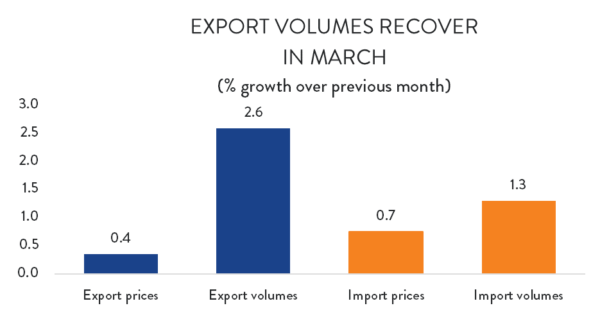

In sharp contrast to February’s trade report, export gains in March were driven by higher sales volumes. While export prices mostly held steady – rising by an average of 0.4 per cent – volumes were up by a healthy 2.6 per cent. However, those gains were nowhere near enough to offset the 4.8 per cent decline in February. Exports volumes remain about 3.1 per cent below October’s levels.

On the import side, trade gains were the result of a mix of Canadians buying more foreign goods, as well as paying more for those products. Import volumes were up 1.3 per cent in March supported by a 0.7 per cent increase in average prices.

Exports by Product Type

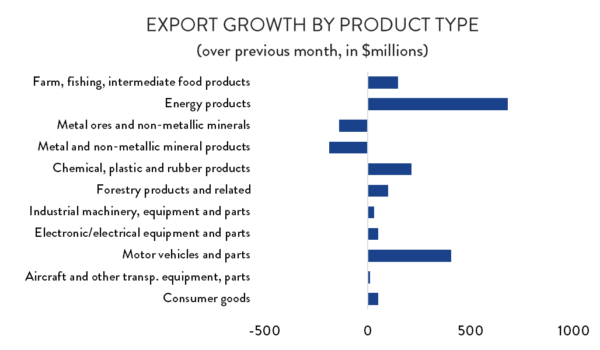

Export gains in March were widespread. Of the eleven main product categories, nine were higher and just two lower.

As noted above, energy and motor vehicles producers were the big winners in March. Led by crude oil and natural gas, energy exports were up 7.7 per cent compared to February. That increase (of about $680 million) accounted for about 45 per cent of Canada’s overall export gains in March. For their part, motor vehicles and parts exports were 5.5 per cent higher ($406 million) compared to February. That increase lifts exports of those goods to their highest level since October but there remains a long hill to climb before exports return to levels seen in the spring of 2017.

Elsewhere, agriculture and intermediate food product exports were up 4.8 per cent – enough to recover February’s losses. Those gains come in spite of declining canola exports as Canadian producers struggle with curtailed access to the Chinese market. There was also solid growth in exports of basic chemicals, plastics and forest products.

The only product categories where exports fell in March were raw metals/minerals and associated products. Raw metals and minerals exports were down 8.1 per cent compared to February ($140 million), driven lower by copper and other metal ores. Meanwhile lower gold shipments drove metal/mineral product exports down by about 3.7 per cent ($188 million).

Exports by Destination

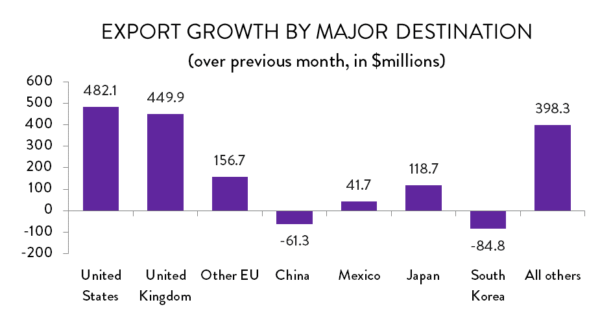

On a dollar-value basis, most of Canada’s export gains in March were in higher sales to the United States and the the United Kingdom. US-bound exports were up by $482 million – a 1.3 per cent increase – while sales to the UK were up almost as much ($450 million). However, since the UK is a much less important trading partner for Canada, that $450-million increase represents a 33 per cent jump compard to February. Exports to Germany and the Netherlands were also up in March, as were sales to Saudi Arabia, India and Japan.

On the negative side, there was a sharp decline in exports to Hong Kong (a major global shipping hub). Deliveries to that location dropped by $316 million, or nearly 70 per cent. Exports to China and South Korea were also down, as were sales to several destinations within the EU – Italy, Spain and Belgium.

Imports by Product Type

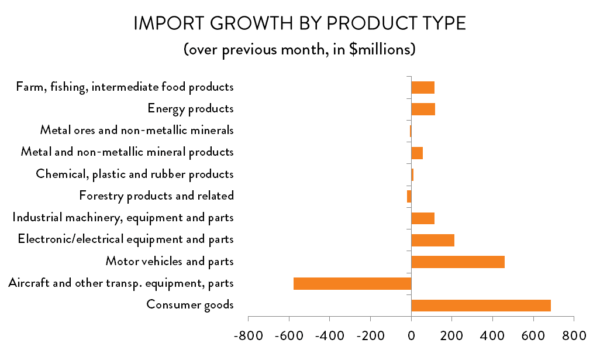

Gains were relatively widespread on the import side as well, with Canadian purchases of foreign goods up in seven of the 11 major product categories. On a dollar-value basis, the largest increase was in imports of consumer goods, which rose by $685 million (6.7 per cent) compared to February. Food, clothing, pharmaceuticals and other general household product imports were all higher. Motor vehicles and parts imports also saw healthy gains of about $460 million (4.9 per cent).

The only area where imports fell significantly in March was in the aerospace sector where purchases fell by $579 million (about 20 per cent) compared to February. However, that decrease came after a surge in imports of those goods in January and February. Aerospace imports remain well above December levels.

Imports by Country

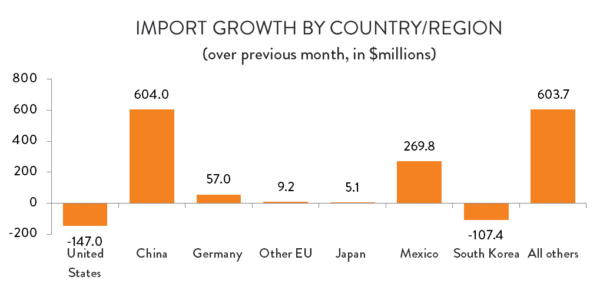

In spite of ongoing diplomatic tensions between the two countries, Canadians bought a lot more Chinese goods in March. Imports from that country jumped by $604 million (nearly 16 per cent) compared to February. Imports from Mexico were also sharply higher – up $270 million, or 18 per cent – as were purchases of goods from Saudi Arabia.

Offsetting those increases were lower imports from the United States, which fell by $147 million (0.4 per cent). Imports were also lower from Belgium ($110 million) and South Korea ($107 million).