Canadian Economy

CANADIAN ECONOMY

Canadian Economy Posts Record Decline in Second Quarter

HIGHLIGHTS

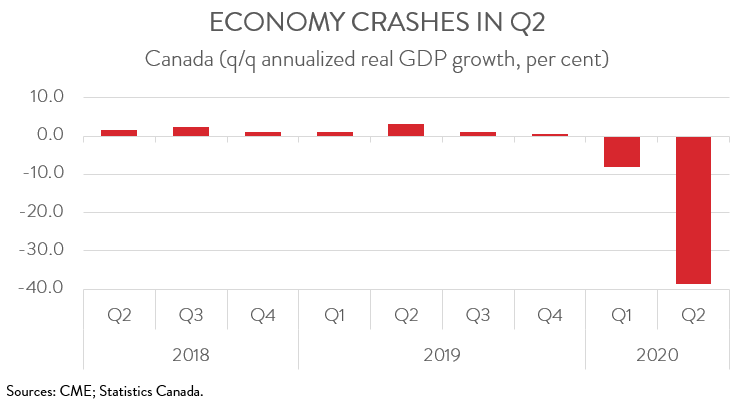

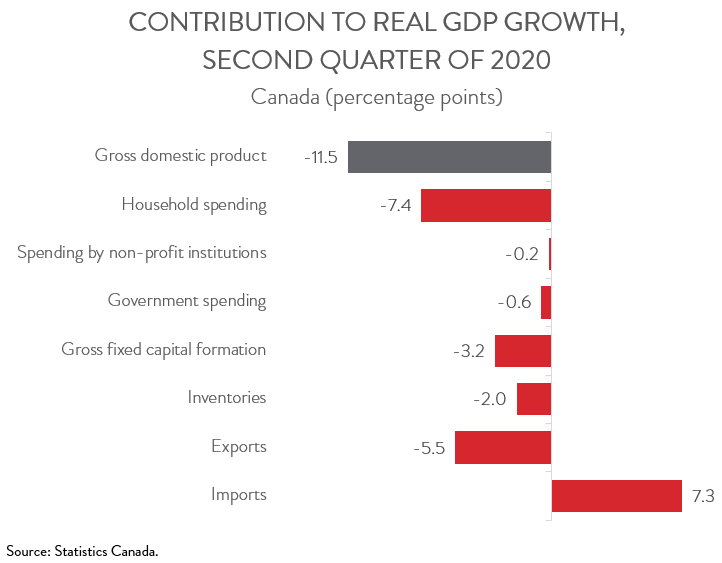

- Real GDP in Canada plunged 11.5 per cent in the second quarter (-38.7 per cent at an annualized rate), the sharpest quarterly decline on records going back to 1961.

- Most GDP components also posted record declines, including a 13.1 per cent drop in household spending.

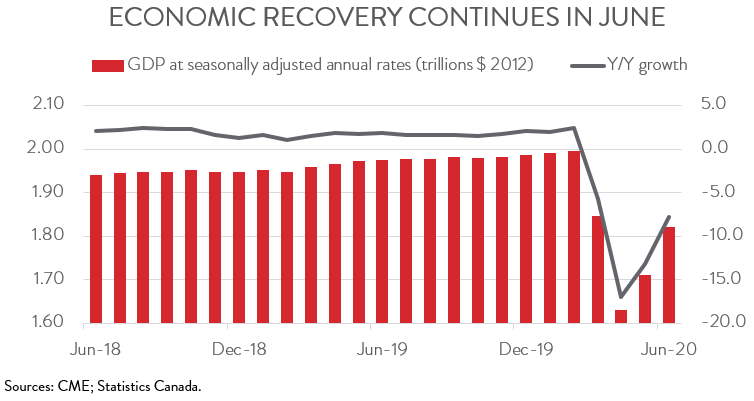

- The economy expanded by 6.5 per cent in June, extending the 4.8 per cent gain seen in May.

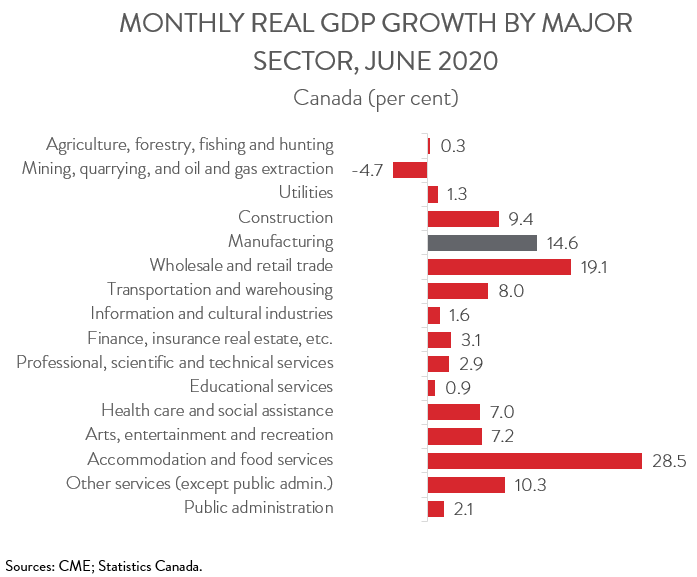

- Output rose in 15 of 16 major industries, with only mining, quarrying, and oil and gas extraction contracting.

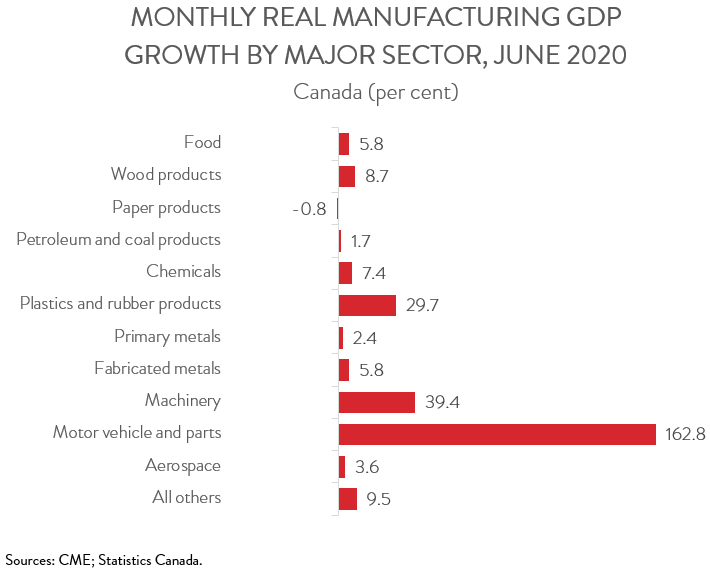

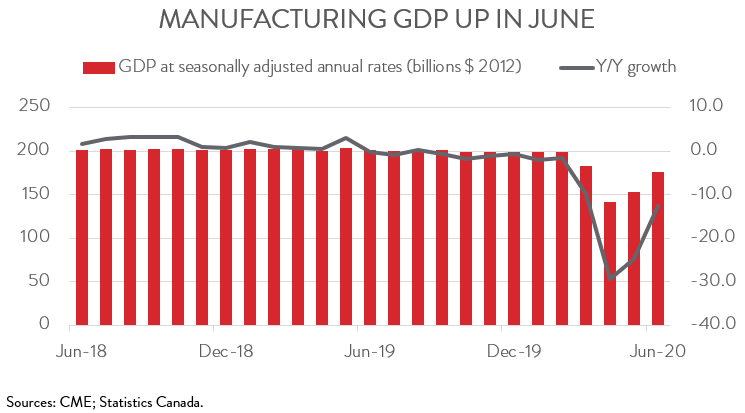

- After increasing by 8.1 per cent in May, manufacturing output expanded a further 14.6 per cent in June, not enough to prevent a mind-numbing 56.8 per cent annualized drop in the second quarter.

- Activity increased in 10 of 11 major manufacturing subsectors, led by a sharp rise in motor vehicle and parts output. Only the paper products industry shrank in June.

- As expected, the Canadian economy posted a record decline in the second quarter. Fortunately, the economy has been expanding solidly since May and is on track to post a strong third quarter rebound. However, a full recovery is still likely a long way off, as several sectors will continue to struggle until a vaccine or effective treatment for COVID-19 is available.

Sources: CME; Statistics Canada.

REAL GDP FALLS AN ANNUALIZED 38.7 PER CENT IN SECOND QUARTER

Real GDP in Canada plunged 11.5 per cent in the second quarter, the sharpest quarterly decline on records going back to 1961. Expressed at an annualized rate, the Canadian economy shrank 38.7 per cent.

The historic decline reflected widespread shutdowns of non-essential businesses, stay-at-home orders, and border closures. Fortunately, the weakness was front-loaded, with real GDP posting sharp declines in March and April. But with the economy expanding at a solid pace since May, it is on track to post a strong rebound in the third quarter. However, a full recovery is still likely a long way off, as several sectors will continue to struggle until a vaccine or effective treatment for COVID-19 is available.

MOST GDP COMPONENTS SEE RECORD DECLINES

All major GDP components except imports (which are subtracted from GDP) contributed to the second quarter decline. Household spending fell a record pace of 13.1 per cent, owing to a sharp drop in consumer confidence and limited opportunities to spend because of mandatory business closures and travel restrictions.

Business investment plunged 16.2 per cent, due to the temporary shutdown of some projects, plant closures, low oil prices, and heightened uncertainty. At the same time, export and import volumes dropped 18.4 per cent and 22.6 per cent, respectively, as Canada’s major trading partners also shut down parts of their economies to slow the spread of the coronavirus. Finally, there was a large draw down in non-farm business inventories during the quarter, as businesses had to contend with supply chain disruptions.

ECONOMY POSTS SECOND STRAIGHT MONTHLY GAIN IN JUNE

Turning to the monthly data, real GDP climbed 6.5 per cent in June, extending the 4.8 per cent gain seen in May. The jump in June was the largest monthly increase on record, but it still left economic activity 8.7 per cent below February’s pre-pandemic level. Statistics Canada’s advance estimate indicates that real GDP increased by a further 3.0 per cent in July.

ECONOMIC GAINS WIDESPREAD

Output increased in 15 of 16 major industries in June. Four industries enjoyed double-digit gains—accommodation and food services (28.5 per cent), wholesale and retail trade (19.1 per cent), manufacturing (14.6 per cent), and other services (10.3 per cent). The gain in accommodation and food services output was driven by the food services and drinking places sector, as dining-in options became more widely available, especially on patios and other outdoor areas.

Both components of wholesale and retail trade saw big gains in June. Retail trade output jumped 22.3 per cent, surpassing its pre-pandemic level of activity, while wholesale trade output climbed a record 15.8 per cent. The gain in retail trade was led by motor vehicle and parts dealers, while motor vehicle and motor vehicle parts and accessories wholesaling contributed the most to growth on the wholesale side.

Construction output expanded 9.4 per cent in June, building on a 17.3 per gain in May. According to Statistics Canada, the increase was attributable to the continued easing of emergency restrictions, which allowed construction sites to return to near-normal levels of activity.

On a negative note, mining, quarrying, and oil and gas extraction output fell 4.7 per cent in June, its third decline in four months. The decline was largely the result of a 58 per cent plunge in support activities for mining and oil and gas extraction, which reflected lower drilling and rigging services.

MANUFACTURING ENJOYS DOUBLE-DIGIT GAIN IN JUNE

Manufacturing’s 14.6 per cent output increase in June followed an 8.1 per cent expansion in May. But despite these vigorous back-to-back gains, manufacturing output still plummeted at a mind-numbing annualized rate of 56.8 per cent in the second quarter. Also, output in June was still 11.8 per cent below its February level.

MOTOR VEHICLE AND PARTS OUTPUT SURGES IN JUNE

The gains in manufacturing were also widespread, with output increasing in 10 of 11 major subsectors. The motor vehicle and parts industry led the way with a massive gain of 162.8 per cent. June represented the first full month of production in North America’s automotive industry following COVID-19-related shutdowns that began in mid-March. Two other subsectors also posted double-digit increases: machinery manufacturing (39.4 per cent) and plastics and rubber products (29.7 per cent). Paper products manufacturing was the only subsector to experience a drop in output in June, although the decline was limited to just 0.8 per cent.