Canadian Economy

CANADIAN ECONOMY

Economic Recovery Moderating

HIGHLIGHTS

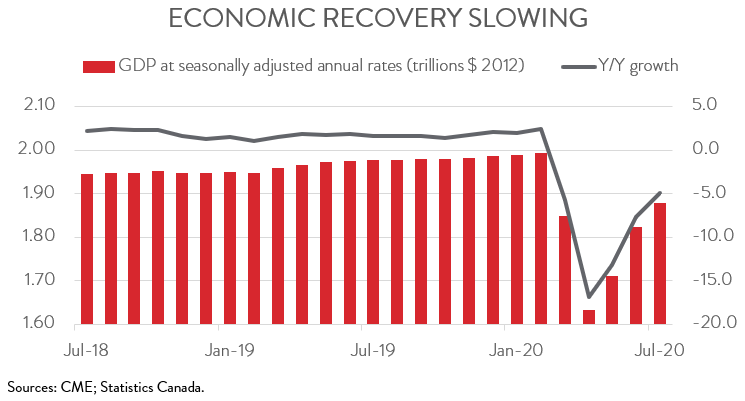

- The Canadian economy expanded 3.0 per cent in July, building on gains of 4.8 per cent in May and 6.5 per cent in June. A preliminary estimate indicates real GDP grew an additional 1.0 per cent in August.

- As of July, the Canadian economy had recouped 78.6 per cent of its COVID-related losses and was 5.8 per cent below its February 2020 level.

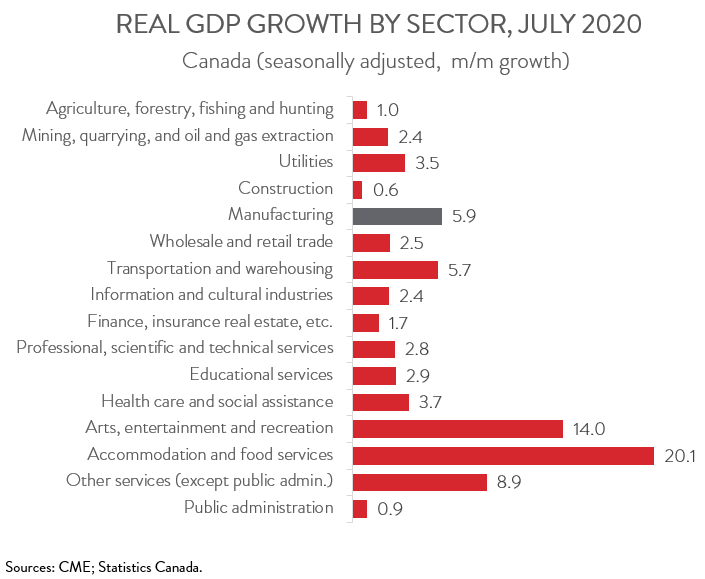

- The gains were broad-based, spanning all 16 major sectors, with the largest increases coming in accommodation and food services and in arts, entertainment and recreation.

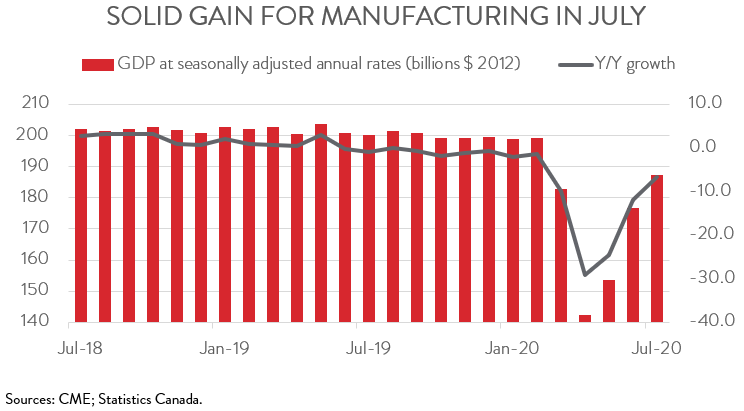

- Manufacturing output increased 5.9 per cent in July, its third consecutive monthly gain, leaving it 6.1 per cent below its pre-pandemic level.

- Output was up in 9 of 11 manufacturing subsectors, led once gain by motor vehicle and parts.

- Today’s GDP report is consistent with predictions that Canada’s economy posted a strong rebound in the third quarter. But with advances moderating through the summer, and with a second wave of infections currently striking the country, economic growth in the fourth quarter will be much slower.

ECONOMY GROWS 3 PER CENT IN JULY

The Canadian economy expanded 3.0 per cent in July, building on gains of 4.8 per cent in May and 6.5 per cent in June. A preliminary estimate indicates real GDP grew an additional 1.0 per cent in August. As of July, the Canadian economy had recouped 78.6 per cent of its COVID-related losses and was 5.8 per cent below its February 2020 level.

Today’s GDP report is consistent with predictions that Canada’s economy posted a strong rebound in the third quarter. But with the initial boost from the economic reopening fading, the gain in July was slower than June, and initial estimates indicate growth cooled even further in August. These moderating advances, combined with the emerging second wave of infections striking the country, suggest that economic growth in the fourth quarter will be much slower.

ALL SECTORS POST GROWTH IN JULY

The gains in output were broad-based, spanning all 16 major industries. Accommodation and food services saw the biggest increase, at 20.1 per cent. Arts, entertainment and recreation was not too far behind, boasting a 14.0 per cent gain. However, despite these advances, output in arts, entertainment and recreation and in accommodation and food services remained 53.0 per cent and 33.3 per cent below their respective February 2020 levels.

Output rose by 5.7 per cent in the transportation and warehousing sector, led by gains in support activities for transportation and truck transportation. Air transportation activity was also up in July, but it remained nearly 92 per cent below its January 2020 level.

Mining, quarrying, and oil and gas extraction climbed 2.4 per cent in July, partly offsetting a 4.6 per cent decline in June. However, as noted by Statistics Canada, oil and gas extraction output decreased for the fourth time in five months as both oil sands extraction and oil and gas extraction (except oil sands) fell to levels not seen since the second half of 2017.

Retail trade’s impressive recovery continued. After surpassing pre-pandemic levels in June, output climbed a further 0.4 per cent in July. At the same time, wholesale trade expanded by 4.6 per cent, with all its subsectors posting growth.

MANUFACTURING OUTPUT UP 5.9 PER CENT IN JULY

Manufacturing output climbed by 5.9 per cent in July, its third straight monthly increase, as factories continued to ramp up production. As of July, the sector had recovered nearly 80 per cent of its March and April losses, leaving output 6.1 per cent below its pre-pandemic level. But as with the broader economy, the manufacturing recovery likely entered a more moderate phase starting in August.

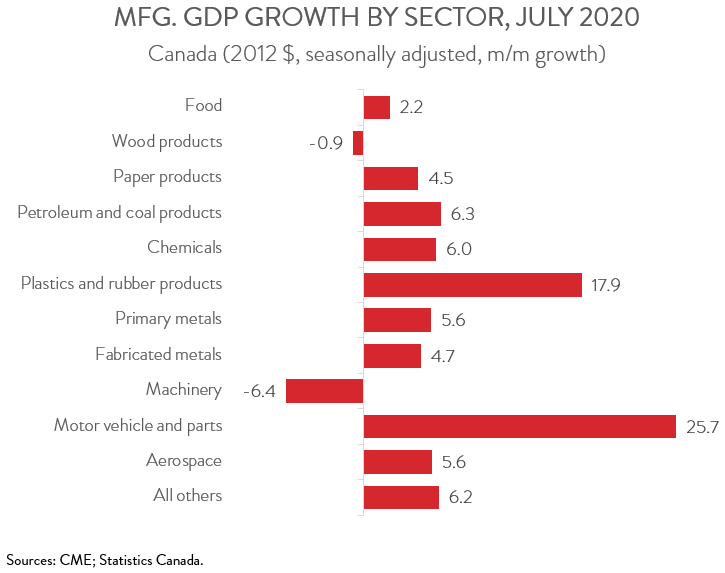

AUTO INDUSTRY CONTINUES TO DRIVE MANUFACTURING RECOVERY

Output was up in 9 of 11 major manufacturing subsectors in July. Once again, the gains were led by the auto industry. Output of motor vehicle and parts increased by 25.7 per cent, leaving it only 2.1 per cent below where it was in February 2020. As noted by Statistics Canada, auto factories continued to scale up production to meet increased consumer demand, following extended shutdowns between mid-March and mid-May.

Plastics and rubber products manufacturing, which saw output jump 17.9 per cent, was the other major sector to post a double-digit gain in July. Notable increases were also recorded in petroleum and coal products (+6.3 per cent) and chemical manufacturing (+6.0 per cent). On the negative side, these solid gains were partly offset by declines in machinery manufacturing (-6.4 per cent) and wood products manufacturing (-0.9 per cent).