Canadian Economy

CANADIAN ECONOMY

Canadian Economy Recovers Further Ground in February, Manufacturing Shrinks on Auto Sector Disruptions

HIGHLIGHTS

- The Canadian economy expanded 0.4% in February, the tenth straight monthly gain. An advance estimate suggests that real GDP grew an additional 0.9% in March.

- The gains in February were widespread, spanning 13 of 16 major sectors, led by a rebound in retail trade.

- Manufacturing GDP contracted 0.9% in February, following 1.5% growth in January. This left output in the sector 3.3% below its pre-COVID peak.

- Output was down in just 4 of 11 of Canada’s largest manufacturing subsectors. The motor vehicle and parts industry posted the largest decline, as it continued to be weighed down by the global semiconductor shortage.

- The GDP figures for February and the flash estimate for March suggest that the Canadian economy was just 1.3% below its pre-pandemic level in March and that it expanded at an impressive 6.7% seasonally adjusted annual rate in the first quarter. While non-essential high-contact services likely suffered a setback in April as third wave restrictions were imposed in many parts of the country, recent evidence suggests that the Canadian economy should bounce back quickly once COVID-19 is brought under control.

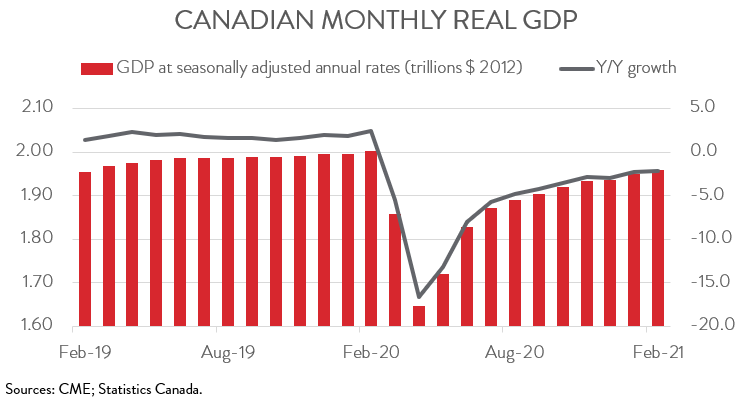

ECONOMY EXPANDS 0.4% IN FEBRUARY

The Canadian economy expanded 0.4% in February, the tenth straight monthly gain. Statistics Canada also released a flash estimate for March, which showed real GDP growing an additional 0.9% in that month.

The GDP figures for February and the flash estimate for March suggest that the Canadian economy was just 1.3% below its pre-pandemic level in March and that it expanded at an impressive 6.7% seasonally adjusted annual rate in the first quarter. While non-essential high-contact services likely suffered a setback in April as third wave restrictions were imposed in many parts of the country, recent evidence suggests that the Canadian economy should bounce back quickly once COVID-19 is brought under control. An acceleration in vaccinations should help sustain the economic recovery.

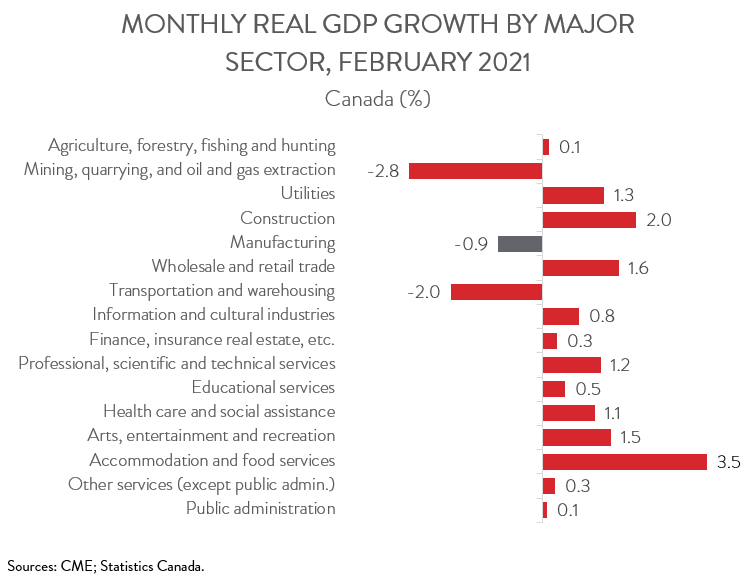

REAL GDP GAINS WIDESPREAD

The gains in February were broad-based, spanning 13 of 16 major sectors. Retail trade output jumped 4.5% in February, as many provinces lifted or eased lockdown measures that had led to output declines in December and January.

Accommodation and food services was another sector that received a lift from the easing of public health measures. Output climbed 3.5% in February, the first increase in six months, with food services and drinking places contributing the most to growth. Even with this increase, however, accommodation and food services output remained 39.5% below its February 2020 level.

Construction output rose 2.0%, building on gains seen in December and January. All subsectors advanced in February, with residential building construction experiencing the fastest growth.

On the negative side, mining, quarrying, and oil and gas extraction fell 2.8% in February, the first decline in six months. Output was down in both oil and gas extraction and in mining and quarrying, more than offsetting a solid advance in mining support activities.

Transportation and warehousing shrank 2.0%. Most subsectors posted declines, including support activities for transportation, air transportation, and rail transportation. In February, transportation and warehousing output was down 19.3% compared to the same month a year ago.

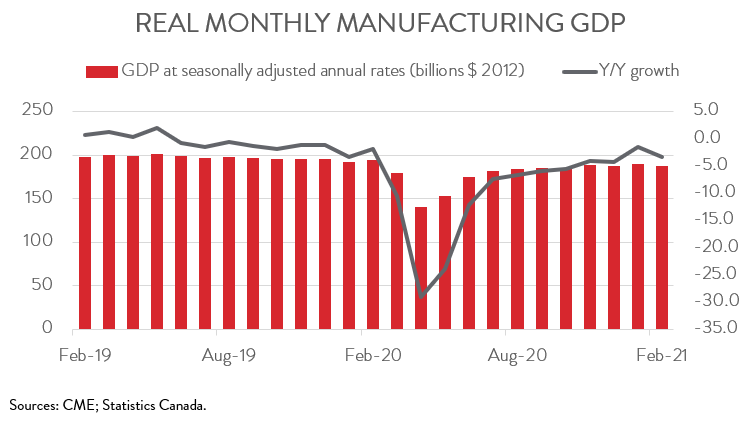

MANUFACTURING ACTIVITY SHRINKS

Manufacturing GDP contracted 0.9% in February, following 1.5% growth in January, continuing a pattern of alternating increases and declines seen since last September. The drop in February left output in the sector 3.3% below its pre-COVID peak.

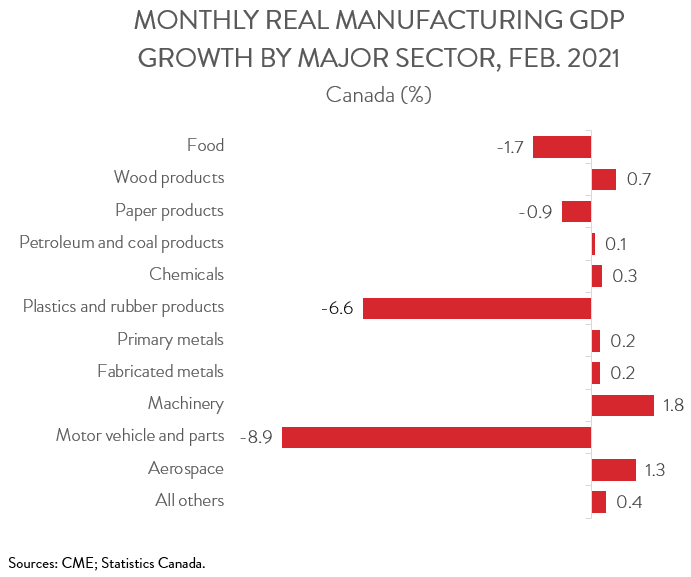

MANUFACTURING LOSSES CONCENTRATED IN AUTO SECTOR

Output was down in just 4 of 11 of Canada’s largest manufacturing subsectors. Motor vehicle and parts posted the largest drop (-8.9%), as it continued to be weighed down by the global semiconductor shortage. The losses in February left the subsector’s output 19.6% below the pre-COVID level, making it the furthest from a full recovery among the group of 11 major manufacturing subsectors.

Plastics and rubber products also had a tough month. Output fell 6.6% in February, partly due to lower demand from motor vehicle and parts manufacturers. At the same time, food manufacturing was down 1.7%. Meat product manufacturing contributed the most to the decline, as several processing plants were temporarily closed due to COVID-19 outbreaks. Paper products (-0.9%) was the other major subsector to see output fall in February.

Among the subsectors that posted growth in February, machinery led the way with a 1.8% advance, its second consecutive monthly gain. Wood product manufacturing rose 0.7%, up for the ninth time in ten months, as it continued to benefit from strong housing markets in both Canada and the United States. Aerospace activity climbed 1.3% in February, building on the 1.5% growth seen in January. Despite these back-to-back gains, however, aerospace output remained 16.4% below year-ago levels.