Canadian Economy

CANADIAN ECONOMY

Economy Posts First Monthly Decline in a Year in April; Manufacturing Output Down for Second Time in Three Months

HIGHLIGHTS

- Real GDP fell 0.3% in April, the first decline in 12 months, as the economy was hit by third wave restrictions.

- A preliminary estimate indicates that the economy contracted an additional 0.3% in May.

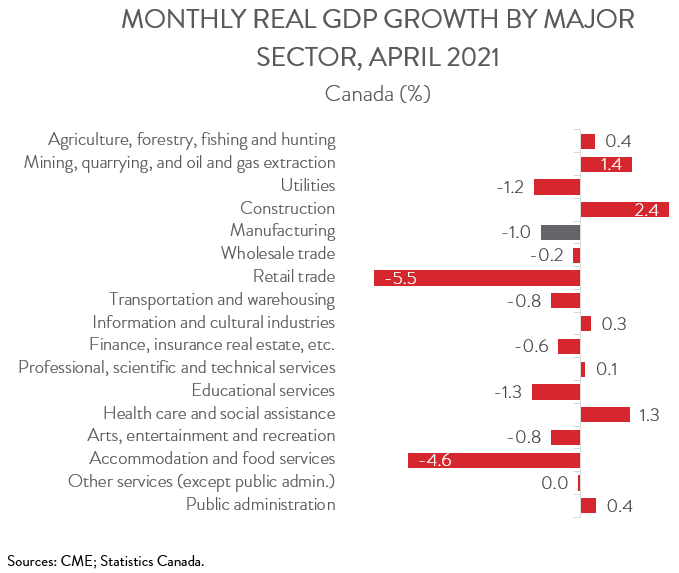

- The drop in GDP in April spanned 10 of 17 major industries, with retail trade experiencing the biggest decline.

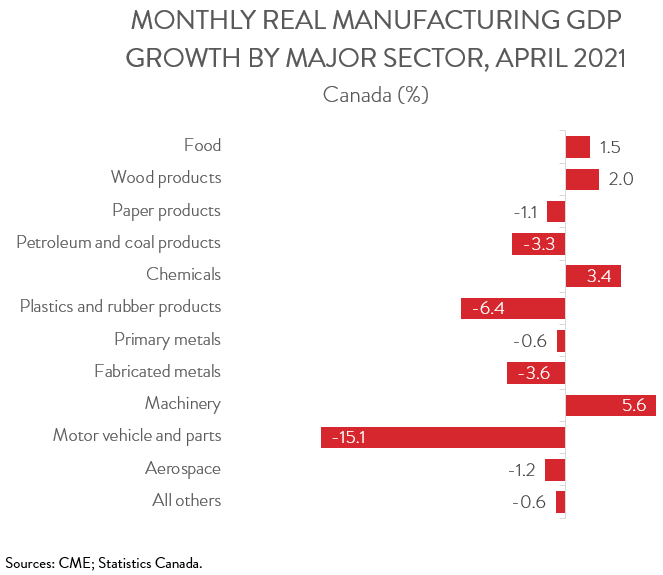

- Manufacturing output decreased 1.0%, its second decline in three months.

- Output was down in 7 of 11 major manufacturing subsectors, headlined by a 15.1% decline in the motor vehicle and parts industry.

- The economic struggles over April and May were mainly the result of tightening public health restrictions aimed at slowing the third wave of COVID-19. However, the GDP declines were much more modest than the record plunge experienced last spring, highlighting just how much households and businesses have adapted to the reality of living under a pandemic. And, with vaccination rates going up quickly, economic activity is poised to accelerate sharply over the second half of the year.

ECONOMY CONTRACTS 0.3% IN APRIL

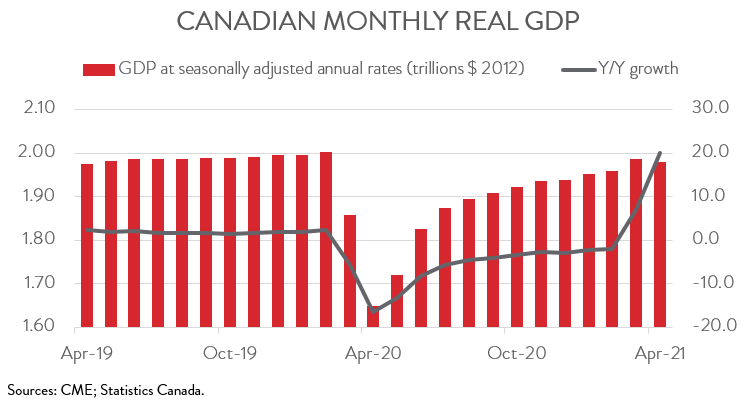

After increasing for 11 months in a row, real gross domestic product (GDP) contracted by 0.3% in April, leaving the economy 1.2% smaller than its pre-pandemic level. A Statistics Canada preliminary estimate suggests that the economy shrank an additional 0.3% in May.

The economic struggles over April and May were mainly the result of tightening public health restrictions aimed at slowing the third wave of COVID-19. However, the GDP declines were much more modest than the record plunge experienced last spring, highlighting just how much households and businesses have adapted to the reality of living under a pandemic. And, with vaccination rates going up quickly, economic activity is poised to accelerate sharply over the second half of the year.

HIGH-CONTACT SERVICES HIT BY TIGHTENED PUBLIC HEALTH RESTRICTIONS

The decline in GDP in April spanned 10 of 17 major industries. Retail trade plunged 5.5%, as many areas of the country tightened lockdown measures on non-essential stores. Despite this decline, the sector’s output in April was 2.1% above the pre-pandemic level.

Similarly, accommodation and food services contracted 4.6%, another sector highly sensitive to stricter public health measures. Food services and drinking places was down 6.5%. This more than offset a 0.5% gain in accommodation services, which was driven by an increase in camping activity.

Finance, insurance and real estate declined 0.6%, its first decline since last April. Real estate, rental and leasing contracted 0.7%, attributable to slowing home resale activity in many Canadian urban centres. Finance and insurance output also fell in April, down 0.6%.

On the positive side, output in the construction sector rose 2.4%, its sixth consecutive monthly increase. All subsectors were up on the month, with residential building construction contributing the most to growth.

Mining, quarrying, and oil and gas extraction expanded 1.4%, its seventh gain in eight months. All three subsectors posted growth, including a 7.9% advance in support activities for mining, and oil and gas extraction.

MANUFACTURING DOWN 1.0% IN APRIL

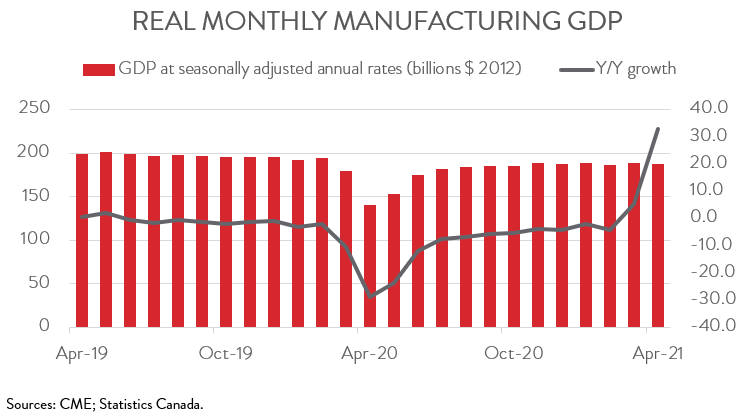

Manufacturing output fell 1.0% in April, the second decline in three months. After rebounding sharply last summer, manufacturing activity has cooled considerably, expanding by a total of just 1.0% since October 2020. As of April, manufacturing output was 3.7% below its pre-COVID level.

GLOBAL CHIP SHORTAGE CONTINUES TO WEIGH ON AUTO SECTOR

Manufacturing output was down in 7 of 11 major subsectors. Motor vehicle and parts output nosedived 15.1%, the sixth decline in seven months, as the global semiconductor shortage continued to disrupt automotive production. With this decline, the industry’s output was 28.0% below its pre-pandemic level, making it the furthest from a full recovery among the major manufacturing subsectors.

Three other subsectors posted notable declines in April. Plastics and rubber products output contracted 6.4%, partly attributable to lower demand from motor vehicle and parts manufacturers. Petroleum and coal products fell 3.3%, as some refineries suspended activities to conduct maintenance. Finally, fabricated metals declined by 3.6%, down for the first time in four months.

Four major subsectors posted gains in April: machinery (+5.6%), chemicals (+3.4%), wood products (+2.0%), and food (+1.5%). Statistics Canada attributed the growth in the food manufacturing sector to a jump in seafood product preparation production associated with an earlier than usual start to snow crab fishing.