Canadian Economy

CANADIAN ECONOMY

Economy Shrinks for Second Straight Month; Manufacturing Output Down for Third Time in Four Months

HIGHLIGHTS

- Real GDP contracted 0.3% in May, following a 0.5% decline in April.

- The drop in GDP in May spanned 10 of 17 major industries, with construction and high-contact services experiencing the biggest declines.

- Manufacturing output decreased 0.8%, its third decline in four months.

- Output was down in 6 of 11 major manufacturing subsectors, with food, chemicals, and fabricated metals contributing the most to the decline.

- Although the last two monthly GDP releases have been disappointing, the coming months are expected to bring much better news. Indeed, a preliminary estimate indicates that the economy rebounded by 0.7% in June. Moreover, the recovery is expected to strengthen in the second half of the year as the pandemic and related restrictions ease. Still, the outlook remains highly uncertain due to several factors, including the emergence of the more transmissible Delta variant and the persistence of global supply chain issues and cost pressures.

ECONOMY CONTRACTS 0.3% IN MAY

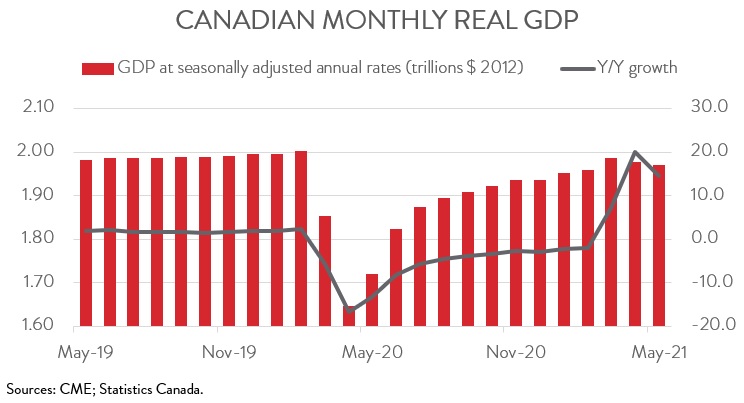

After declining by 0.5% in April, real GDP fell a further 0.3% in May. As a result, total economic activity was 1.5% below February 2020’s pre-pandemic level.

Although the last two monthly GDP releases have been disappointing, the coming months are expected to bring much better news. Indeed, based on preliminary information, Statistics Canada estimates that the economy rebounded by 0.7% in June. This points to an approximate 2.5% annualized increase in real GDP in the second quarter. Moreover, the recovery is expected to strengthen in the second half of the year as the pandemic and related restrictions ease, thanks to widespread vaccination coverage in Canada. Still, the outlook remains highly uncertain due to several factors, including the emergence of the more transmissible Delta variant and the persistence of global supply chain issues and cost pressures.

CONSTRUCTION AND HIGH-CONTACT SERVICES LEAD THE DECLINES

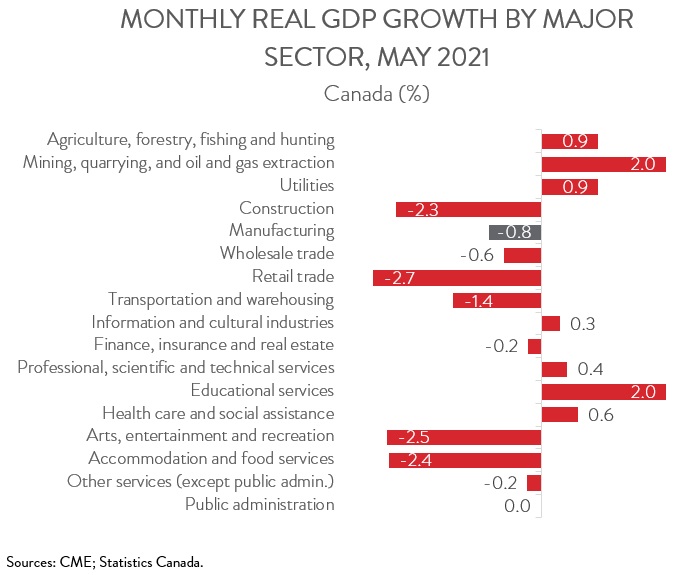

The decline in GDP in May spanned 10 of 17 major industries. Construction output fell 2.3%, its first decline in six months. While non-residential building construction edged up 0.1%, this was more than offset by a 4.2% decrease in residential building construction, its first setback since November 2020.

Ongoing public health measures continued to weigh down sectors most affected by restrictions on in-person services. Declines were recorded in retail trade (-2.7%), arts, entertainment and recreation (-2.5%), and accommodation and food services (-2.4%). Activity in arts, entertainment and recreation was less than half its pre-pandemic level, making it the furthest from a full recovery.

After declining by 0.4% in April, finance, insurance and real estate output fell a further 0.2%. The lion’s share of the blame for this downturn can be pinned on the real estate and rental and leasing sector, which has also experienced two straight monthly declines. In fact, output fell 0.8% and 0.4%, respectively, in April and May, attributable to a slowdown in home resale activity in most Canadian urban centres.

On the positive side, output in mining, quarrying, and oil and gas extraction expanded for the third time in four months, up 2.0% in May. The gains were widespread, with oil and gas extraction (+2.6%), support activities for mining and oil and gas extraction (3.2%), and mining and quarrying (0.3%) all up on the month.

Educational services advanced 2.0% in May, partly rebounding from a 3.3% decline in April. The increase was attributable to activity at Ontario’s elementary and secondary schools returning to normal following the Government of Ontario’s decision to move the annual spring break from mid-March to mid-April.

MANUFACTURING DOWN 0.8% IN MAY

Manufacturing output fell 0.8% in May, the third decline in four months. The sector rebounded sharply last summer following the first wave of COVID-19, with output expanding by a cumulative 32.7% between May and September 2020. But activity has slowed considerably since then, increasing by a total of just 1.4% between October 2020 and May 2021. The decline in May left the sector’s GDP 3.5% below the pre-COVID level.

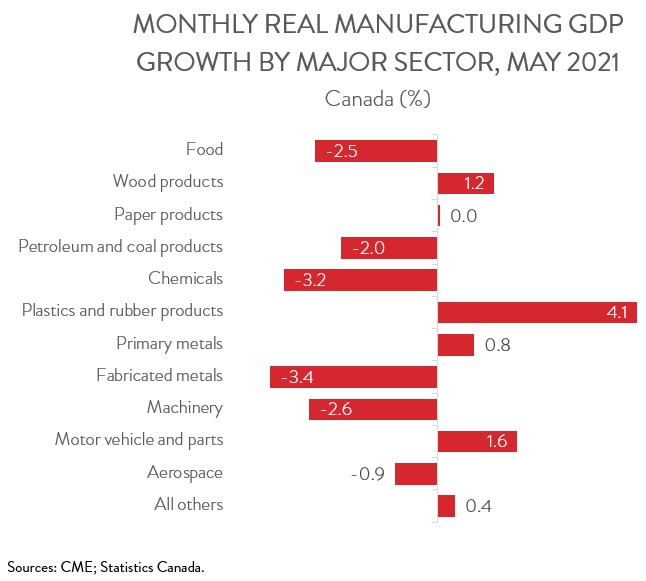

FOOD, CHEMICALS, AND FABRICATED METALS CONTRIBUTE MOST TO THE DECLINE IN MANFUACTURING

Manufacturing output was down in 6 of 11 major subsectors. Food manufacturing tumbled 2.5%, the third decline in four months and the largest since April 2020. Despite the recent setbacks, the sector was still operating above pre-pandemic levels in May.

Notable declines were also recorded in chemicals (-3.2%), fabricated metals (-3.4%), and machinery (-2.6%). Like the auto industry, activity in the machinery sector continues to be affected by the global shortage of semiconductors.

Among the manufacturing subsectors that recorded an increase in May, the ones that contributed the most to growth were plastics and rubber products (+4.1%), motor vehicle and parts (+1.6%), and wood products (+1.2%). Despite the increase in motor and vehicle parts, output in May was still 26.0% below its pre-pandemic level, an indication of just how disruptive the global microchip shortage has been to automotive production.