Canadian Economy

CANADIAN ECONOMY

Economy Strengthens in Fourth Quarter; Manufacturing Output Posts Third Straight Monthly Gain in December

HIGHLIGHTS

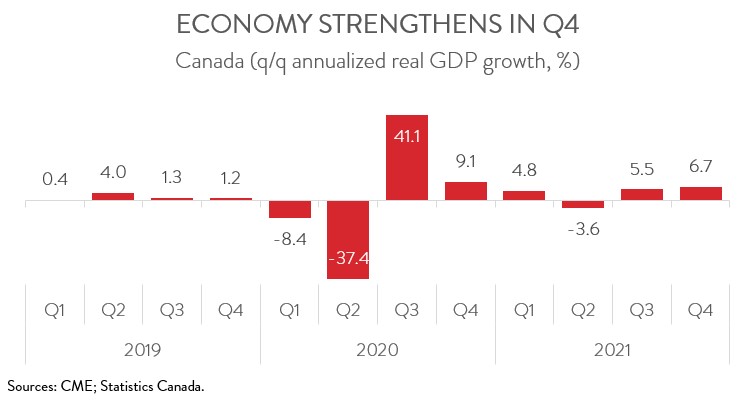

- The Canadian economy ended the year on a high note, expanding at an annualized rate of 6.7% in the fourth quarter.

- Real GDP was essentially unchanged in December, but a flash estimate indicates that the economy grew 0.2% in January.

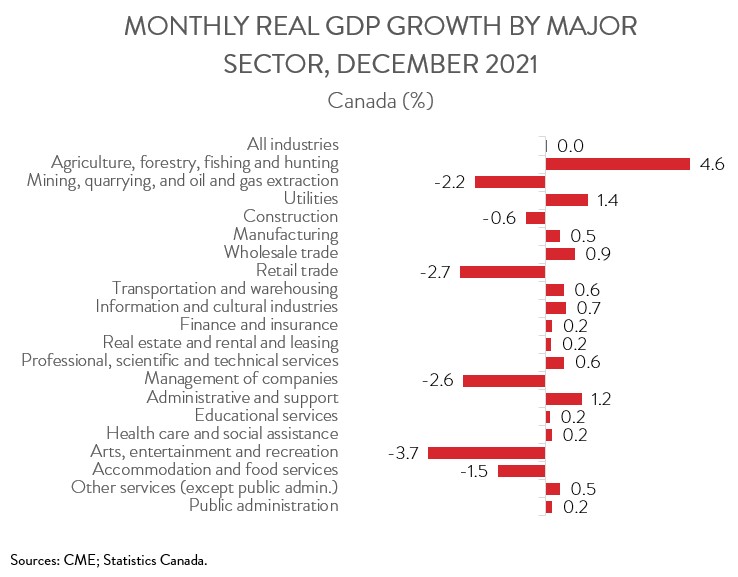

- Output rose in 14 of 20 industries in December, with agriculture, forestry, fishing and hunting, wholesale trade, and manufacturing making the biggest contributions to growth.

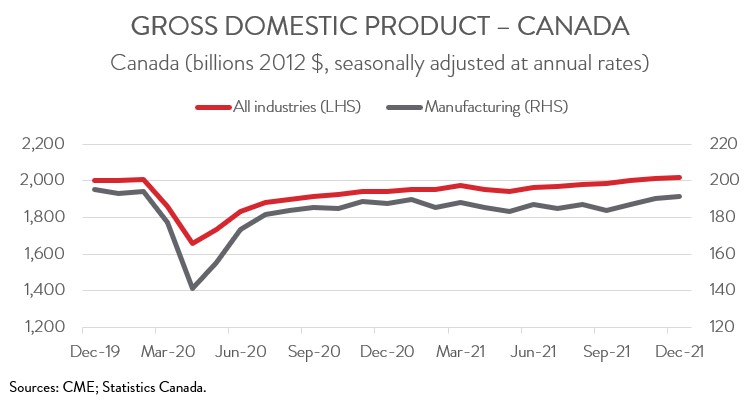

- Manufacturing output rose 0.5% in December. Growth for the full year came in at 4.5%, bouncing back from two consecutive annual declines.

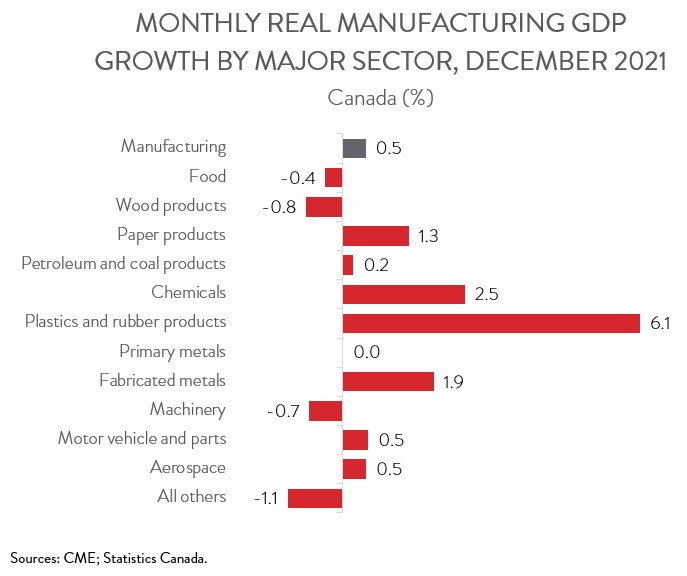

- Output was up in 7 of 11 major manufacturing subsectors, led by plastics and rubber products, chemicals, and fabricated metal products.

- Today’s report indicates that the Canadian economy had solid momentum heading into 2022, although first quarter growth is tracking to be much slower than that observed in the second half of 2021, attributable to Omicron-related restrictions.

ECONOMY EXPANDS AT 6.7% ANNUALIZED PACE IN FOURTH QUARTER

The Canadian economy ended the year on a high note, expanding at an annualized rate of 6.7% in the fourth quarter, building on the 5.5% gain in Q3. This left full-year 2021 real GDP growth at a robust 4.6%, following the steep 5.2% drop in 2020.

Today’s report indicates that the Canadian economy had solid momentum heading into 2022, although first quarter growth is tracking to be much slower than that observed in the second half of 2021, attributable to Omicron-related restrictions. While the economy is already picking up steam as these restrictions have been eased, geopolitical risks have added a new dimension to an already uncertain economic environment.

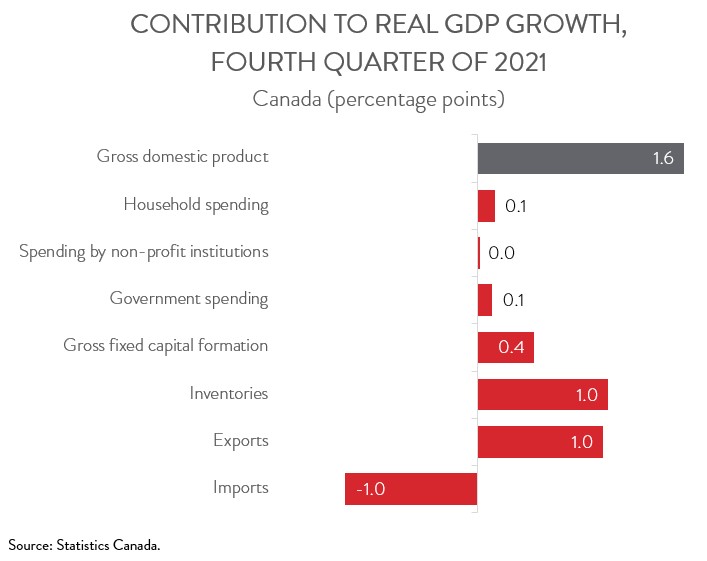

FOURTH QUARTER GROWTH DRIVEN BY AN ACCUMULATION OF INVENTORIES AND BUSINESS INVESTMENT

The accumulation of business non-farm inventories (+$11.0 billion) was a major contributor to growth during the fourth quarter as both manufacturers and wholesalers benefitted from the gradual easing of supply chain disruptions. Manufacturers of non-durable goods accounted for the bulk of the sector’s inventory increase, with a smaller accumulation of durable goods inventories. Business gross fixed capital formation (+8.2%) was another key growth driver, with residential and non-residential investment up 10.2% and 6.7%, respectively.

International trade also expanded at a decent clip, with exports and imports up 3.2% and 3.4%, respectively. The gains in bilateral trade were primarily driven by motor vehicles and parts and travel services. Automakers were able to ramp up production in the fourth quarter despite continuing to grapple with the global semiconductor shortage. At the same time, there was a marked increase in travel for the second straight quarter, as countries around the world loosened restrictions.

On the negative side, household spending rose by a disappointing 1.0% in the fourth quarter. Spending patterns partly shifted back toward services as the economy continued to reopen, notwithstanding the new restrictions that were imposed in the final month of the quarter. In fact, household spending on services was up 2.4%, while spending on goods was down 0.7%.

REAL GDP ESSENTIALLY UNCHANGED IN DECEMBER; MANUFACTURING RISES 0.5%

Turning to monthly data, real GDP was essentially unchanged in December, the weakest performance since May 2021, and partly attributable to the impact of the Omicron wave on client-facing industries. Preliminary information indicates that the economy advanced 0.2% in January, a surprise given that strict public health measures were still in place in many parts of the country at the beginning of the month.

Manufacturing output increased by 0.5% in December, the third consecutive monthly gain. Growth for the full year came in at 4.5%, bouncing back from two consecutive annual declines. Unfortunately, Statistics Canada’s flash estimate indicates that the manufacturing sector started 2022 on the wrong foot, posting a notable decline in January.

DECEMBER GAINS LED BY AGRICULTURE, WHOLESALE TRADE, AND MANUFACTURING

Output was up in 14 of 20 industries in December. The agriculture, forestry, fishing and hunting sector led the way with an expansion of 4.6%. However, this gain did not prevent the industry from posting a sizeable 8.1% decline in 2021, as record-setting heat, drought and forest fires in Western Canada severely affected crop production.

Wholesale trade output grew 0.9% in December, up for the fifth consecutive month. Increases were concentrated in three subsectors: motor vehicle and motor vehicle parts and accessories wholesaling, machinery, equipment and supplies, and personal and household goods wholesaling.

On the negative side, mining, quarrying, and oil and gas extraction output fell 2.2% in December, with all subsectors contributing to the decline. This was the sector’s first back-to-back monthly declines since March-April of 2020.

The retail trade sector also posted a notable decrease in December, with output tumbling 2.7%. This fully erased the gains made during the second half of the year. Statistics Canada attributed the large decline to supply chain disruptions and the reintroduction of public health restrictions right before the busiest part of the holiday shopping season.

PLASTICS AND RUBBER PRODUCTS MAKES BIGGEST CONTRIBUTION TO MANFUACTURING GROWTH

The increase in manufacturing was widespread, spanning 7 of 11 major industries. Plastics and rubber products manufacturing contributed the most to growth, with output climbing 6.1% in December. Notable gains were also observed in chemical manufacturing (+2.5%) and in fabricated metal product manufacturing (+1.9%), both of which were up for the third month in a row. Declines in machinery manufacturing (-0.7%), food manufacturing (-0.4%), and wood product manufacturing (-0.8%) offset some of the growth.