Canadian Economy

CANADIAN ECONOMY

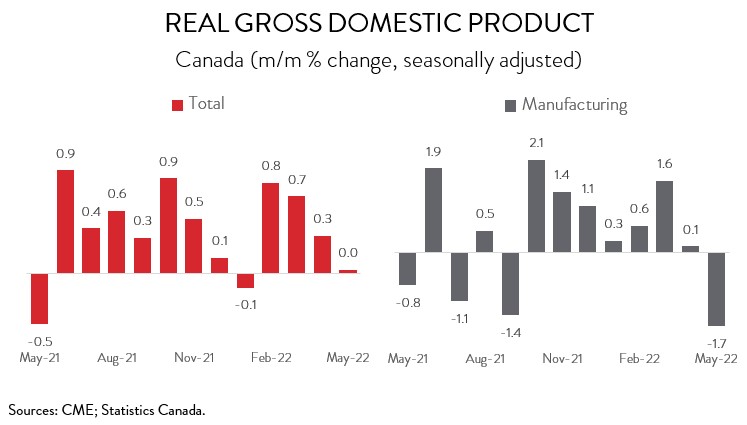

Canadian Economy Holds Steady in May; Manufacturing Output Falls 1.7%

HIGHLIGHTS

- The Canadian economy recorded no growth in May, better than the initial estimate of a 0.2% drop. A preliminary estimate indicates that real GDP edged up 0.1% in June.

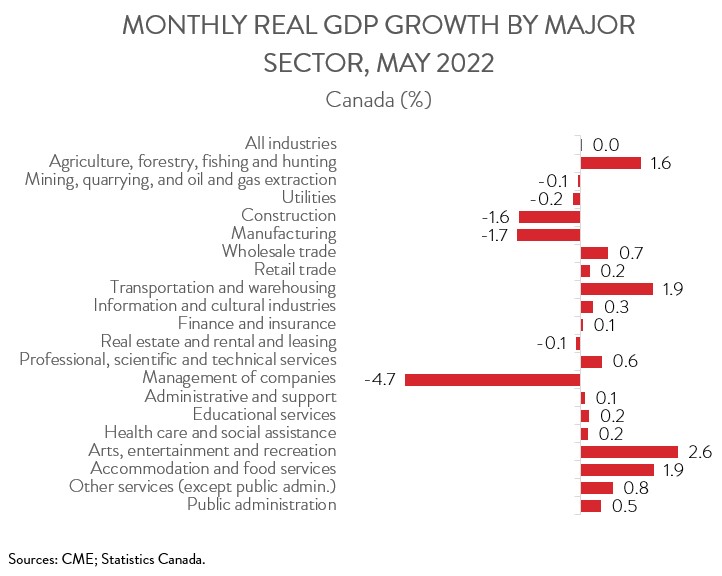

- Output was up in 14 of 20 industries, with transportation and warehousing, accommodation and food services, and wholesale trade making the biggest contributions to growth.

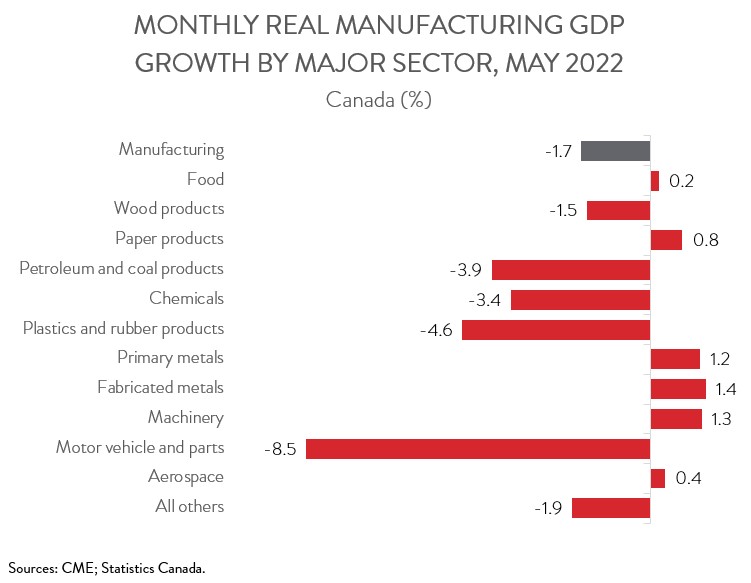

- Manufacturing output fell 1.7% in May, following seven months of growth. Fortunately, an advance estimate suggests that the sector registered growth in June.

- Output was down in 5 of 11 major manufacturing subsectors, headlined by a significant decline in the motor vehicle and parts industry. Decent increases were observed in the machinery, fabricated metal, and primary metal industries.

- While the May data and the June advance estimate suggest that the Canadian economy is slowing down, it also indicates that second quarter annualized growth came in at 4.6%, a notable contrast to the decline observed in the U.S. However, slowing U.S. economic activity, combined with the Bank of Canada’s aggressive interest rate hike campaign, will very likely lead to much cooler growth in the coming quarters.

ECONOMY SEES NO GROWTH IN MAY

The Canadian economy recorded no growth in May, better than the initial estimate of a 0.2% drop. A preliminary estimate indicates that real GDP edged up 0.1% in June.

After expanding for seven straight months, manufacturing output fell 1.7% in May, the biggest monthly drop since April 2021. The sector has not gained much traction over the past two-plus years. As of May 2022, manufacturing GDP was 0.4% below its pre-pandemic level. On a positive note, an advance estimate suggests that the sector registered growth in June.

While the May data and the June advance estimate suggest that the Canadian economy is slowing down, it also indicates that second quarter annualized growth came in at 4.6%, a notable contrast to the decline observed in the U.S. However, slowing U.S. economic activity, combined with the Bank of Canada’s aggressive interest rate hike campaign, will very likely lead to much cooler growth in the coming quarters.

MOST SECTORS POST GROWTH IN MAY

Output was up in 14 of 20 industries in May. The transportation and warehousing sector contributed most to the growth with a gain of 1.9%, the fourth increase in as many months. Notably, air transportation posted its third straight double-digit monthly growth, attributable to higher movements of both cargo and passengers. Although this was the sector’s strongest four-month pace in the 25-year history of the data, output was still 7.2% below its February 2020 pre-COVID level.

Accommodation and food services output also climbed 1.9% in May, up for the fourth month in a row. Output in this sector is now above its pre-pandemic level, as consumers continue to unleash pent-up demand and return to dining out and traveling.

Wholesale trade output rose 0.7% in May, the first increase in four months. Gains were concentrated in food, beverage and tobacco wholesaling, machinery, equipment and supplies wholesaling, and motor vehicle and motor vehicle parts and accessories wholesaling. In the latter subsector, it was first increase in five months.

On the negative side, the construction industry’s month was almost as bad as manufacturing’s. Construction output was down 1.6% in May, the second straight monthly decline. According to Statistics Canada, many of Ontario’s unionized construction workers were on strike during the month, causing delays in numerous construction projects.

MANUFACTURING DECLINE DRIVEN BY MOTOR VEHICLE AND PARTS INDUSTRY

Turning back to manufacturing, output was down in 5 of 11 major subsectors in May. Motor vehicle and parts manufacturing plunged 8.5%, weighed down by the ongoing global semiconductor chip shortage and retooling at some assembly plants. This was the sector’s biggest monthly decline since September 2021.

Elsewhere, chemical manufacturing output fell 3.4% in May, down for the third month in a row. At the same time, plastics and rubber product manufacturing output shrank 4.6%, possibly due to the decline in auto industry activity, a major purchaser of its products. Finally, petroleum and coal product manufacturing output dropped 3.9%, following six months of growth.

On a positive note, decent increases were observed in the machinery (+1.3%), fabricated metal (+1.4%), and primary metal (+1.2%) industries. This was the machinery industry’s third consecutive monthly advance.