Canadian Economy

CANADIAN ECONOMY

Economy Stalls in the Fourth Quarter; Manufacturing Output Up 0.4% in December

HIGHLIGHTS

- Real gross domestic product growth was essentially unchanged in the fourth quarter of 2022, as slower inventory accumulation and weaker investment offset positive contributions from household spending and net trade.

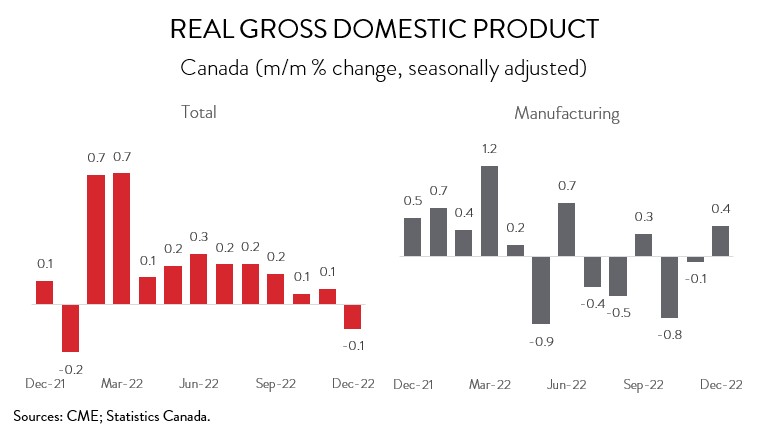

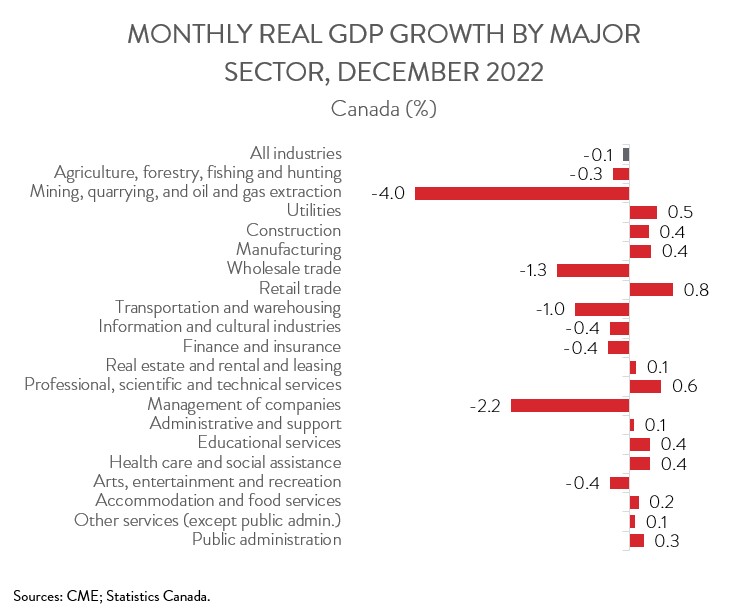

- The Canadian economy edged down 0.1% in December, the first contraction since January 2022. A preliminary estimate indicates that real GDP increased 0.3% in January.

- The decrease spanned 8 of 20 industries, with mining, quarrying, and oil and gas extraction contributing the most to the decline.

- Manufacturing output increased 0.4% in December, up for the first time in three months.

- Output was up in 6 of 11 major manufacturing subsectors, led by the chemical, petroleum and coal product, and automotive industries.

- The Canadian economy unexpectedly stalled in Q4, though this was largely attributable to a big drag from inventories, a notoriously volatile component of GDP. While most other components came in roughly as expected, the weak headline figure increases the likelihood that the Bank of Canada will hold its benchmark interest rate steady at its meeting next week.

REAL GDP ESSENTIALLY UNCHANGED IN FOURTH QUARTER

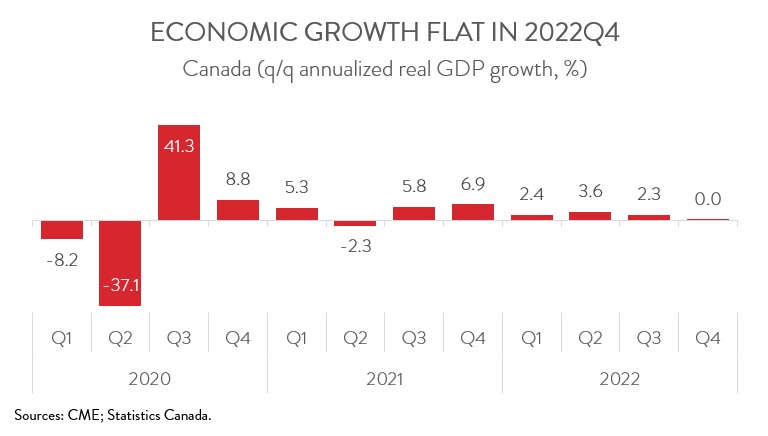

Real gross domestic product growth was essentially unchanged (0.0% annualized) in the fourth quarter of 2022, well below the Bank of Canada’s forecast of 1.3% growth and the consensus expectation of a 1.6% advance.

The weaker than expected result was largely attributable to a big drag from inventories, a notoriously volatile component of GDP. While most other components came in roughly as expected, the weak headline figure increases the likelihood that the Bank of Canada will hold its benchmark interest rate steady at its next meeting on March 8th.

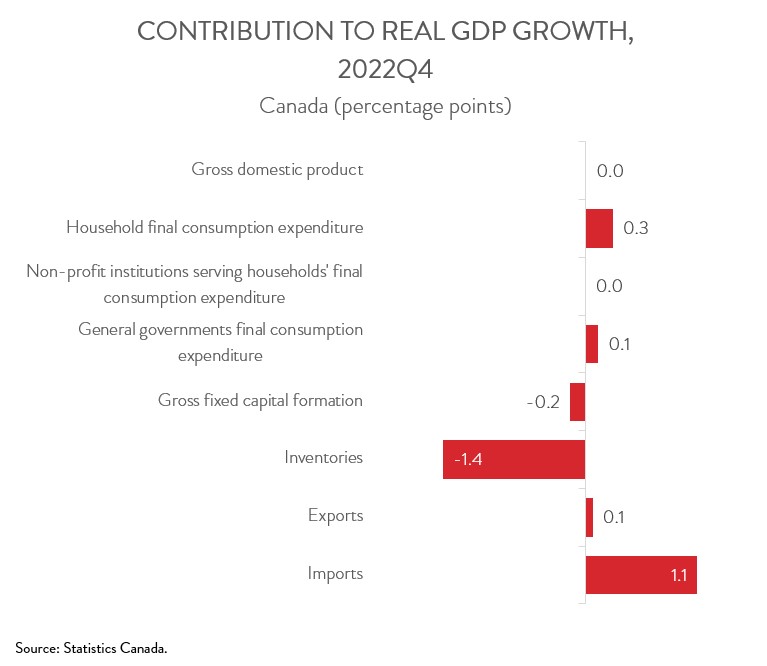

ECONOMY DRAGGED DOWN BY SLOWER INVENTORY ACCUMULATION AND WEAKER INVESTMENT

Inventories subtracted 1.4 percentage points from growth in the fourth quarter of 2022, as inventory accumulation slowed in Q4 following record accumulations in the prior two quarters. Business investment was another source of weakness, as a 27.6 % annualized plunge in machinery and equipment purchases more than offset a 10.2% increase in non-residential construction. At the same time, residential investment fell for the third straight quarter, down 8.8% in Q4, amid high interest rates.

On the positive side of the ledger, household spending rose 2.0% in Q4. The increase was led by spending on durable goods, especially purchases of new car and trucks, with Statistics Canada noting that a gradual easing of supply chain issues boosted manufacturers’ ability to meet consumer demand in Q4. Net trade was also positive contributor in the fourth quarter, as exports eked out growth of 0.8% and imports fell 12.0%.

REAL GDP DIPS 0.1% IN DECEMBER

Turning to monthly data, the Canadian economy edged down 0.1% in December, the first contraction since January 2022. A preliminary estimate indicates that real GDP increased 0.3% in January, setting the stage for a rebound in the first quarter of 2023.

Manufacturing output increased 0.4% in December, up for the first time in three months. For 2022 as a whole, manufacturing output posted growth of 3.6%, the strongest gain among the goods-producing industries. The automotive sector drove the increase, as supply chain issues and semiconductor shortages subsided as the year progressed. However, much of the growth in overall manufacturing occurred in the first half of the year. Indeed, output contracted in the final two quarters of 2022, leaving the sector with little momentum heading into 2023Q1.

DECEMBER DECLINE DRIVEN BY MINING AND OIL AND GAS INDUSTRY

The decline in output in December spanned 8 of 20 industries. Mining, quarrying, and oil and gas extraction fell 4.0% in December. However, the decrease largely stemmed from one-off factors, namely unplanned maintenance and a pipeline leak south of the border that disrupted the supply of Canadian crude oil to the Keystone Pipeline System.

Wholesale trade contracted 1.3% in December, the third decline in four months and the largest since February 2022. The most notable decrease was observed in wholesalers of construction and industrial equipment.

Transportation and warehousing output fell for the first time in four months, down 1.0% in December. As noted by Statistics Canada, winter storms severely impacted both air and railway transportation that month.

On the upside, the public sector rose 0.4% in December, up for the 11th straight month. All subsectors posted gains, led by health care and social assistance.

Retail trade advanced 0.8% in December, rebounding from a 0.7% decline in November. Growth in the sector was bolstered by higher sales at new car dealers and at gasoline stations.

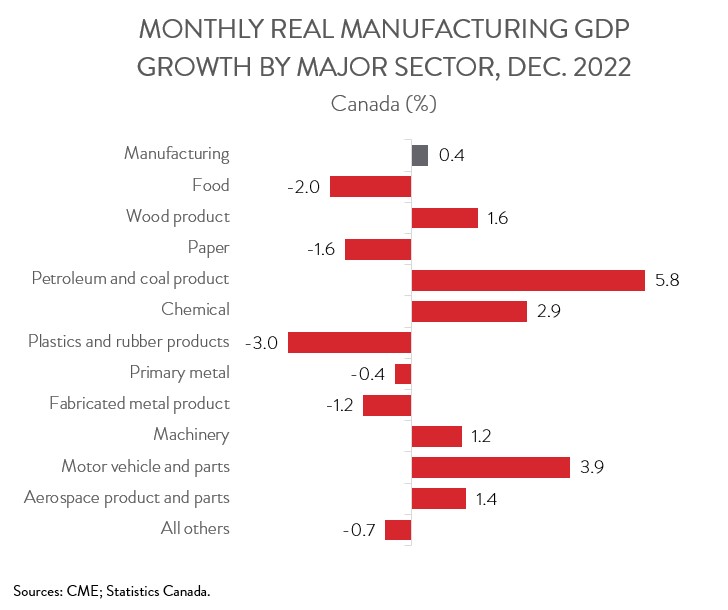

MANUFACTURING INCREASE LED BY CHEMICAL, PETROLEUM AND COAL PRODUCT, AND AUTOMOTIVE INDUSTRIES

Turning back to manufacturing, output was up in 6 of 11 major subsectors in December. The chemical manufacturing sector contributed the most to the growth, with output increasing 2.9%. This was the sector’s third increase in four months and was driven by the pharmaceutical and medicine and basic chemical subsectors.

The petroleum and coal product manufacturing industry posted its first increase in five months, with output up 5.8% in December. Still, over the past 12 months, the sector’s output has decreased by 0.5%.

Motor vehicle and parts manufacturing output rose 3.9% in December, building on the 5.3% gain in November. The increase was driven by motor vehicle parts manufacturing, with production in this subsector returning to its pre-pandemic level for the first time since the fall of 2020. In contrast, motor vehicle assembly manufacturing has experienced a much more sluggish recovery, as its output is still nearly one-third below the pre-COVID level.

On the negative side, food manufacturing output fell 2.0% in December, down for the fourth month in a row. Output was down in six of nine subsectors, led by bakeries and tortilla manufacturing, meat product manufacturing, and seafood product preparation and packaging.