Canadian Economy

Canadian Economy

Canadian economy stumbles to end the year

Overview

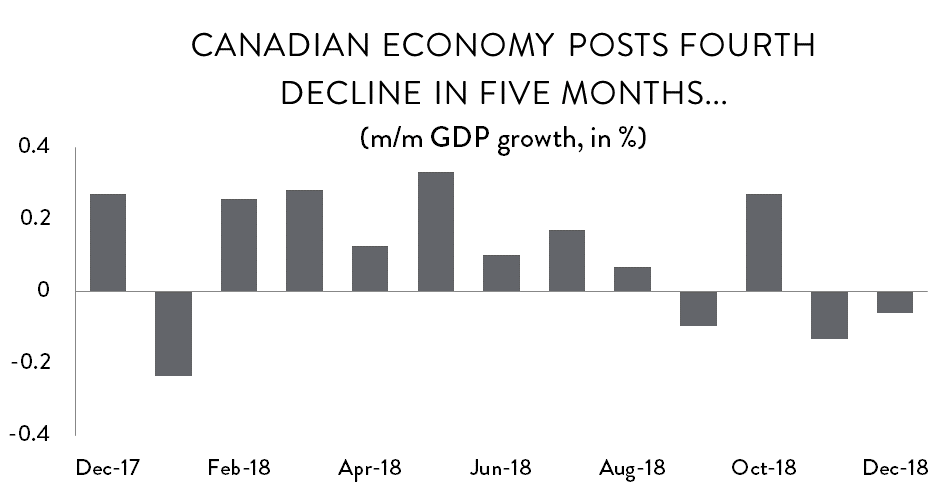

The Canadian economy ended the year on a weak note, posting its third decline in four months. However, there was enough momentum from a strong October to eke out a small gain for the fourth quarter of 2018.

Beginning with the monthly numbers, GDP fell by 0.06 per cent in December – equivalent to a modest annualized decline of about 0.7 per cent. Meanwhile, November’s growth figure was revised downward from a preliminary estimate of -1.2 per cent to -1.5 per cent. As was the case in November, the drop in December was driven by weakness in energy, manufacturing and construction.

Fourth Quarter Results

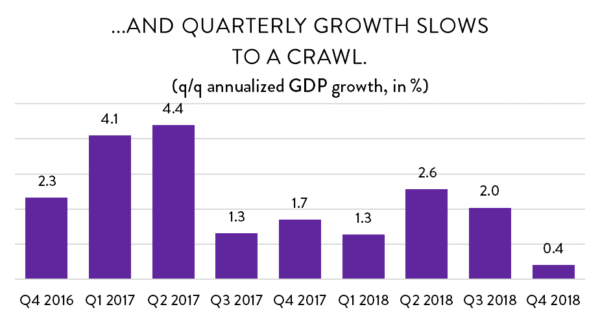

Despite two consecutive monthly declines, GDP was up slightly for the fourth quarter, thanks to a strong October. Even so, the Canadian economy grew by just 0.4 per cent on an annualized basis in Q4, its weakest showing since the spring of 2016 when wildfires ravaged the Ft. McMurray area and shut down most oil production in Alberta.

With Q4 results in, the first figures for 2018 as a whole are also available. While there will undoubtedly be some minor revisions over the next several months, current estimates suggest that the Canadian economy grew by about 1.8 per cent for the year – slightly below expectations of growth in the range of 2.0 per cent. That 1.8 per cent growth is considerably lower than the healthy 3.0 per cent increase in 2017, but comfortably higher than in each of the two previous years.

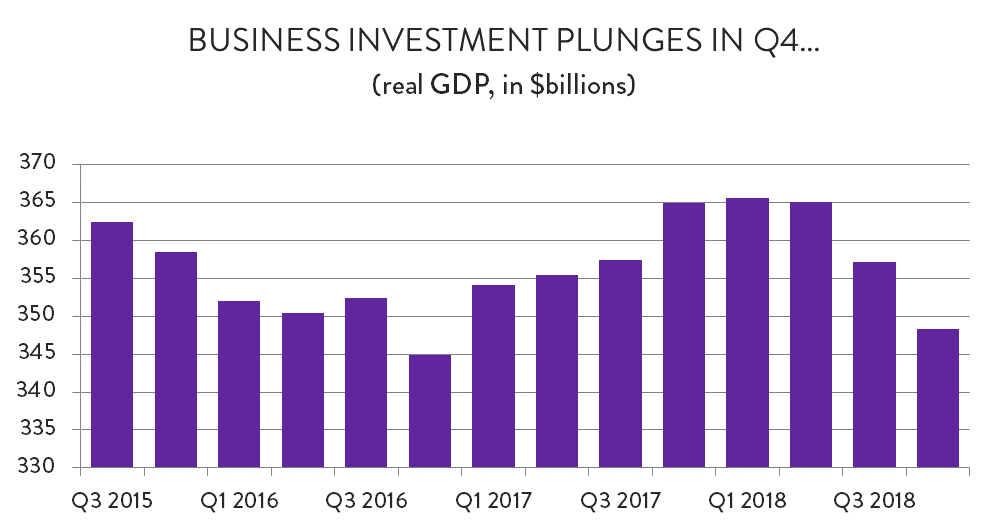

The biggest concern coming out of the quarterly GDP numbers was, once again, a worrying drop in business investment. Since late 2016, gross fixed capital formation in the business sector had been slowly recovering from a dramatic decline in the wake of the oil price crash. However, that recovery ground to a halt in the second quarter of 2018. Business investment fell by 2.2 per cent in Q3 and then again by 2.5 per cent in Q4, erasing almost all of the gains made since the recovery began. GDP in business capital spending is now a full 13 per cent below its peak in the fourth quarter of 2014.

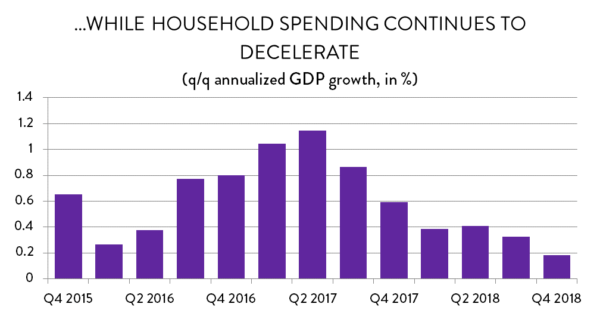

In fact, there was little to cheer about in the quarterly GDP figures at all. Not only did business capital spending decline significantly, but government spending and exports were down as well. For its part, household spending was up 1.1 per cent compared to Q3, but consumer activity is clearly decelerating. That 1.1 per cent gain is the slowest increase in household spending GDP in almost six years. The only reason quarterly GDP came out positive in Q4 was because of a decline in imports (which counts as a negative for domestic economic growth) and a sharp spike in non-farm inventories.

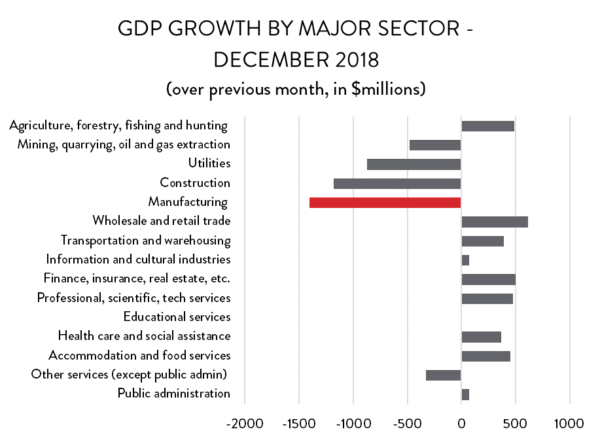

Monthly Growth by Industry

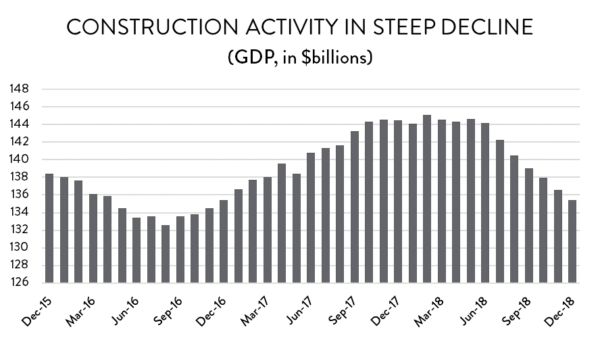

Turning back to the monthly GDP numbers, the decline in economic activity in December was heavily concentrated in goods-producing industries. Although a relatively small sector of the Canadian economy, the steepest drop was in utilities, where both electricity generation/distribution and natural gas utilities were down sharply. GDP in utilities plunged by 21.4 per cent on an annualized basis ($873 million). Meanwhile, the much larger manufacturing and construction sectors were also down significantly. GDP in construction fell by nearly 10 per cent on an annualized basis ($1.2 billion), while manufacturing was down 8.0 per cent ($1.4 billion). The decline in construction activity is especially remarkable. GDP in that sector has fallen for seven consecutive months and is now at its lowest level in a year.

On the positive side, there was solid growth across the services sector in December. GDP in accommodation and food services was up 12.8 per cent (annualized), while professional, scientific and technical services industries were up 5.2 per cent. There were also notable gains in finance and insurance industries, as well as transportation and warehousing.

Manufacturing Sector GDP – Overview

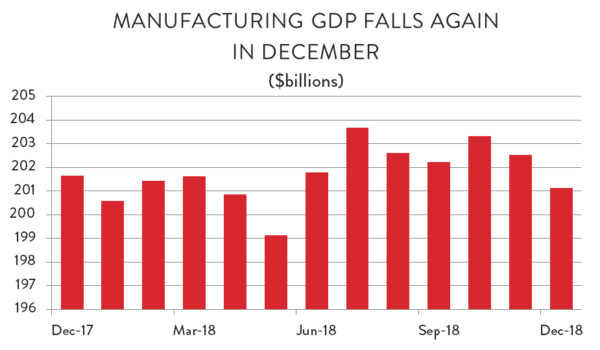

Looking more closely at manufacturing, December marked the second consecutive month where GDP fell considerably, and the fourth drop in the last five months. The 8.0 per cent annualized decline adds to the 4.6 per cent decrease in November (revised upward from the previous estimate of 5.6 per cent).

However, recent declines notwithstanding, 2018 was not a bad year for Canadian manufacturing. All told, GDP growth for the year is currently estimated at about 2.2 per cent, which is above the average for the Canadian economy as a whole.

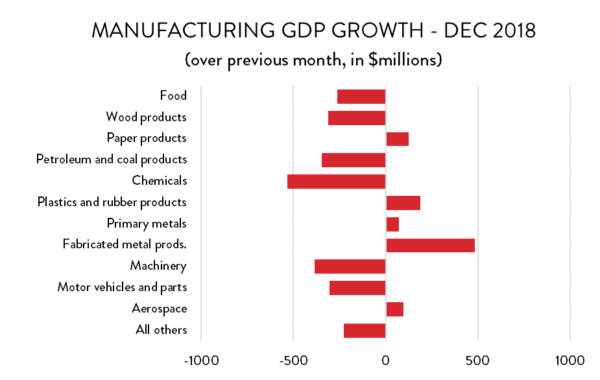

Manufacturing Sector GDP – By Industry

Within the sector, most of the losses in December were concentrated in non-durable goods industries. GDP in non-durable goods fell by 12.5 per cent on an annualized basis ($1.0 billion), compared to a decline of 4.1 per cent ($380 million) for durable goods.

On the non-durable goods side, the largest drops were in chemicals production and petroleum refining, which fell by $533 million and $347 million, respectively. There were also notable declines in wood products ($313 million) and food processing ($264 million). Finally, one of Canada’s smaller manufacturing industries that seldom gets mentioned also had a rough month. Businesses in printing and related support activities saw GDP decline by $306 million, which works out to a staggering 54 per cent drop on an annualized basis.

As for durable goods, the news wasn’t better as much as it was less bad. Machinery and motor vehicles and parts GDP were both down for the second month in a row, with declines of $384 million and $304 million respectively. There was also a notable drop in computers and electronics GDP, but that decline represented a climbdown from a spike in November. On the positive side, there were solid gains in fabricated metals production (up $483 million), as well as non-metallic minerals ($106 million). Most other major durable goods industries posted modest increases.