Labour Market Trends

International Trade

Merchandise Exports Tumble in November

highlights

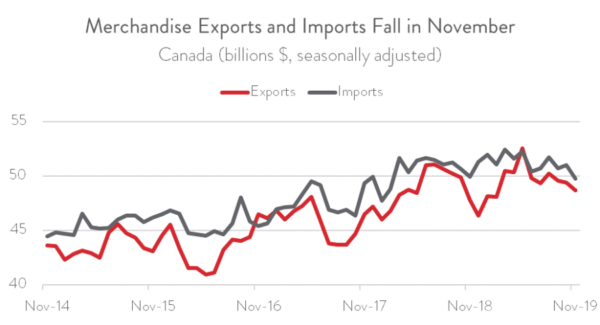

- Merchandise exports fell by 1.4 per cent to $48.7 billion in November, the third consecutive monthly decline. Imports fell even faster, down 2.4 per cent to $49.8 billion.

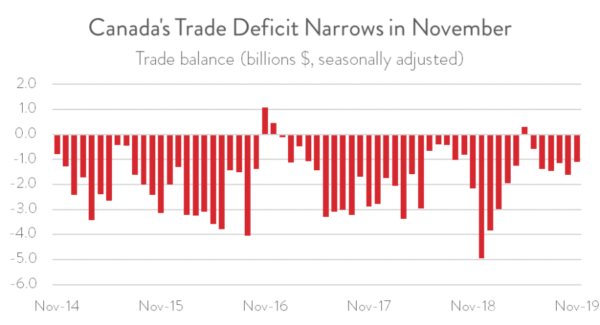

- The trade deficit narrowed from $1.6 billion in October to $1.1 billion in November.

- The export picture was even uglier after removing the effect of prices, as volumes tumbled by 2.7 per cent. Import volumes were down 1.3 per cent.

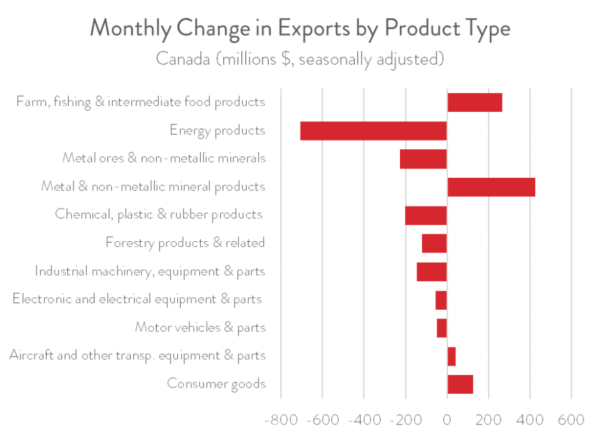

- Exports fell in 7 of 11 major categories, with the steepest fall coming in energy products.

- A huge decline in exports to the United States more than offset decent increases to other major markets such as the United Kingdom, the rest of the European Union, China, and Mexico.

- While the impacts of one-off factors (CN rail strike and Keystone pipeline shutdown) suggest that the December trade report will look better, this should not take away from the facts that Canadian exports are on a very weak trend and fourth quarter GDP growth is likely to be soft.

EXPORTS AND IMPORTS FALL IN NOVEMBER

The November merchandise trade report from Statistics Canada was largely bereft of good news. Exports tumbled by 1.4 per cent to $48.7 billion, its third straight monthly decline. Imports fell by an even steeper 2.4 per cent to $49.8 billion. After removing the effect of prices, export volumes tumbled by 2.7 per cent and imports dropped by 1.3 per cent.

Trade activity was disrupted in November by one-off factors—the CN rail strike and the Keystone pipeline shutdown—and this suggests that the December data should look better. Even so, this should not take away from the facts that Canadian exports are on a very weak trend and fourth quarter GDP growth is likely to be soft.

TRADE DEFICIT NARROWS TO $1.1 BILLION

With imports falling more steeply than exports, Canada’s trade deficit narrowed from $1.6 billion in October to $1.1 billion in November. Canada’s trade surplus with the United States, its largest trading partner, narrowed from $5.1 billion to $4.2 billion, a six-month low. At the same time, Canada’s trade deficit with the rest of the world narrowed from $6.7 billion to $5.3 billion.

EXPORTS FALL IN MOST MAJOR PRODUCT TYPES

Exports fell in 7 of 11 major categories in November. Energy products posted the biggest decline of over $700 million, coinciding with the CN rail strike and a shutdown in the Keystone pipeline following a leak in South Dakota. The CN rail strike likely had wider impacts, as declines were recorded in other categories including metal ores and non-metallic minerals, chemical, plastic and rubber products, industrial machinery, equipment and parts, forestry products, electronic and electrical equipment and parts, and motor vehicles and parts. Trade activity in this latter category was also likely disrupted by the GM strike in the US. On the positive side of the ledger, gains were recorded in metal and non-metallic mineral products, farm, fishing and intermediate food products, and consumer goods.

EXPORTS TO THE US PLUNGE

Exports to the US plunged by $1.2 billion in November, the biggest decline since June. Exports to South Korea also fell. These declines more than offset export increases to other major trading partners, including the United Kingdom, the rest of the European Union, China, and Mexico. Exports to the rest of the world fell by about $50 million.

All charts are sourced from CME; Statistics Canada.