Labour Market Trends

Labour Market Trends

October 2020

Canadian Employment Growth Slows in October, as Renewed Restrictions Make Impact

HIGHLIGHTS

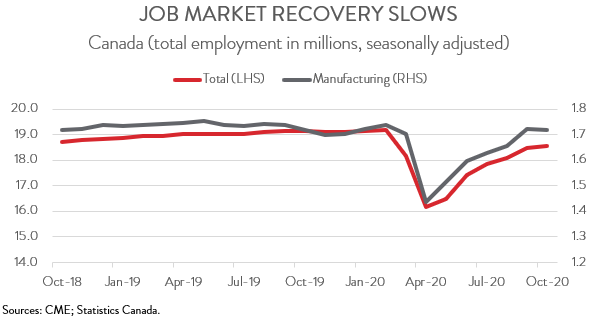

- Employment rose by 83,600 (+0.5 per cent) in October, the slowest increase since the recovery began in May.

- Last month’s gain brought employment to within 636,000 (-3.3 per cent) of its February level.

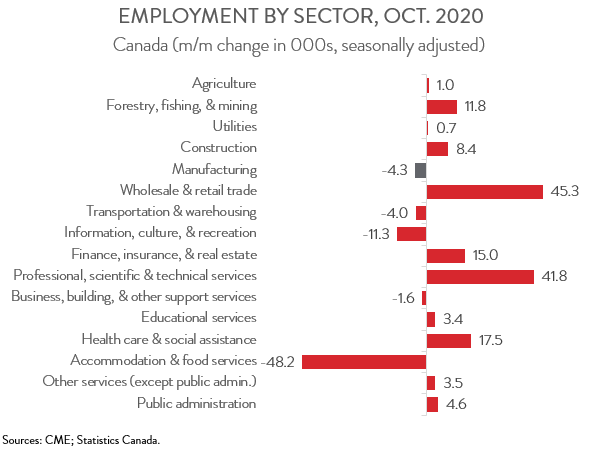

- Employment was up in 11 of 16 major industries. Large gains in wholesale and retail trade and professional services more than offset a substantial decline in accommodation and food services.

- Employment in the manufacturing sector fell by 4,300 (-0.2 per cent), its first decline in six months. The sector has still recouped 94 per cent of its pandemic-related job losses.

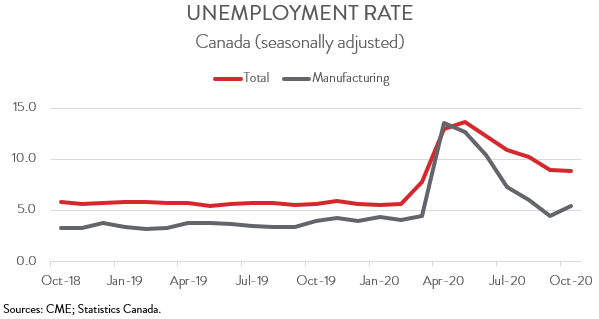

- The unemployment rate inched down from 9.0 per cent in September to 8.9 per cent in October.

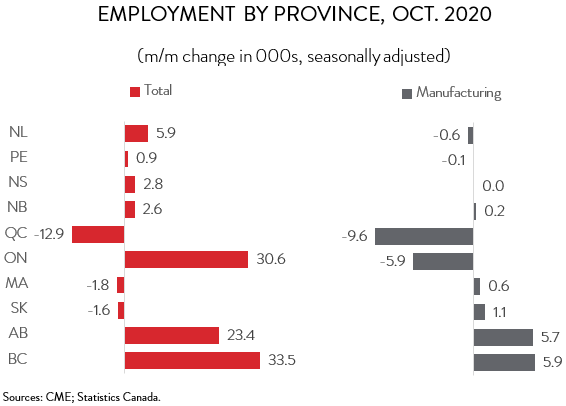

- Employment increased in 7 of 10 provinces. BC, Ontario, and Alberta saw the largest gains, while Quebec, Manitoba, and Saskatchewan registered losses.

- As expected, Canadian job growth slowed sharply in October, with losses concentrated in pandemic-exposed industries as new restrictions were implemented in virus hot spots. With several provinces struggling to contain a second wave of COVID-19 infections, the labour market recovery will remain fragile and patchy in the months ahead.

EMPLOYMENT INCREASES FOR SIXTH STRAIGHT MONTH

Employment rose by 83,600 (+0.5 per cent) in October, the slowest increase since the recovery began in May. Last month’s gain brought employment to within 636,000 (-3.3 per cent) of its February level, with the Canadian economy recovering close to 80 per cent of its pandemic losses.

As expected, Canadian job growth slowed sharply in October, with losses concentrated in pandemic-exposed industries as new restrictions were implemented in virus hot spots. With several provinces struggling to contain a second wave of COVID-19 infections, the labour market recovery will remain fragile and patchy in the months ahead.

MANUFACTURING POSTS FIRST MONTHLY JOB LOSS SINCE BEGINNING OF RECOVERY

Employment was up in 11 of 16 major industries, led by notable gains in wholesale and retail trade (+45,300) and professional services (+41,800). As of October, employment exceeded pre-COVID levels in four industries: utilities, finance, insurance and real estate, professional services, and educational services.

On the negative side, the manufacturing sector experienced net job losses of 4,300 in October, its first decline since the recovery began in May. But even with this decline, the sector has still recovered 94 per cent of its COVID-induced job losses, a quicker recovery than that of the overall economy.

The biggest losses occurred in industries most affected by the reintroduction of public health restrictions, including a net decline of 48,200 in accommodation and food services. This is also the industry that has recovered the least, with employment in October 19.2 per cent below its February 2020 level. At the same time, employment was down in information, culture and recreation (-11,300) and in transportation and warehousing (-4,000).

UNEMPLOYMENT TICKS DOWN A NOTCH

The unemployment rate inched down from 9.0 per cent in September to 8.9 per cent in October. This is down from a peak of 13.7 per cent in May. On the other hand, the unemployment rate in the manufacturing sector increased from 4.5 per cent to 5.4 per cent. However, this is still well down from its April peak of 13.6 per cent.

EMPLOYMENT UP IN 7 0F 10 PROVINCES

Employment increased in 7 of 10 provinces in October. BC (+33,500), Ontario (+30,600), and Alberta (+23,400) posted the largest gains. Ontario’s gain came despite the fact Toronto, Peel, and Ottawa were moved back to modified Stage 2 restrictions on October 10. Quebec was not as lucky. It saw overall employment fall by 12,900, as the province raised the public alert level in Montreal and Quebec City to “red” on October 1. In fact, Quebec was responsible for the lion’s share of the national decline in accommodation and food services employment. Meanwhile, employment was also down in Manitoba (-1,800) and Saskatchewan (-1,600).

As noted by Statistics Canada, among the four most populated provinces, employment was closest to February 2020 levels in British Columbia (-2.4 per cent) and Quebec (-2.9 per cent), and farthest in Ontario (-3.8 per cent) and Alberta (-4.4 per cent).

The story in manufacturing was mixed, with employment up in five provinces, down in four, and stable in one. BC (+5,900) and Alberta (+5,700) boasted the biggest increases, while Quebec (-9,600) and Ontario (-5,900) registered the largest losses.