Manufacturing Sales

Manufacturing Sales

July 2022

Factory Sales Decline for Third Month in a Row

HIGHLIGHTS

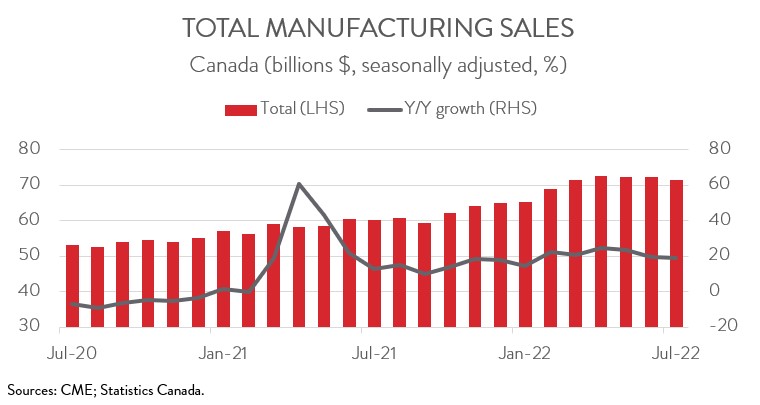

- Manufacturing sales fell 0.9% to $71.6 billion in July, the third consecutive monthly decline following seven straight months of increases.

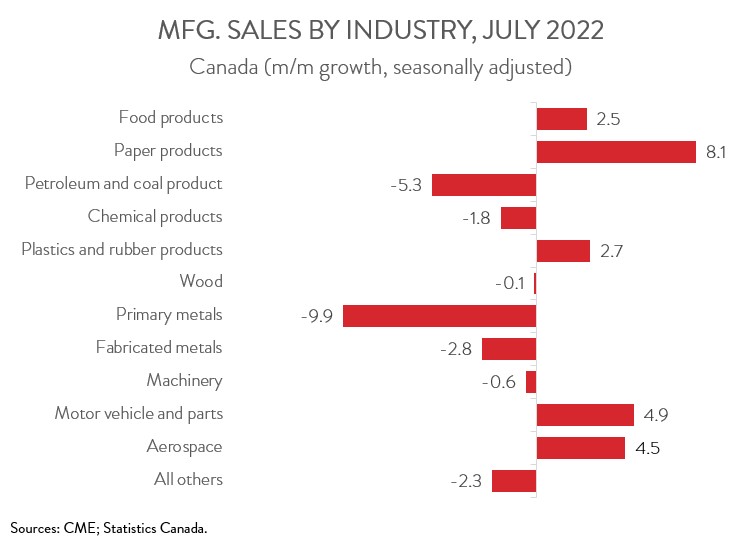

- Sales were down in 6 of 11 major industries, headlined by significant declines in the primary metal and petroleum and coal product industries.

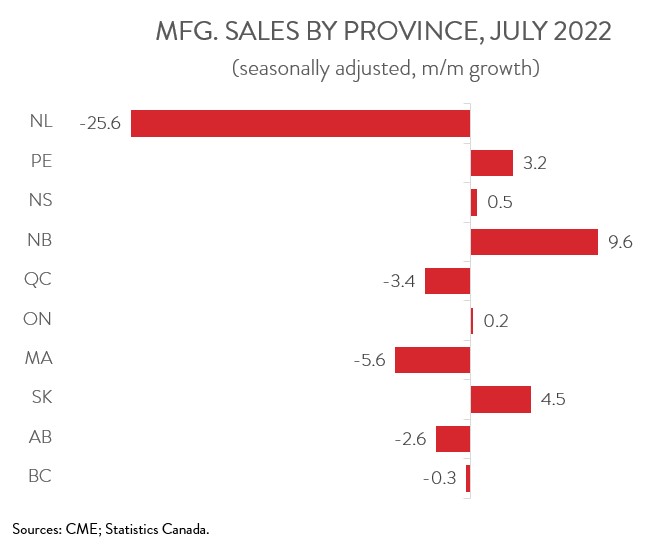

- The sales decrease spanned 5 of 10 provinces, with Quebec and Alberta posting the steepest drops.

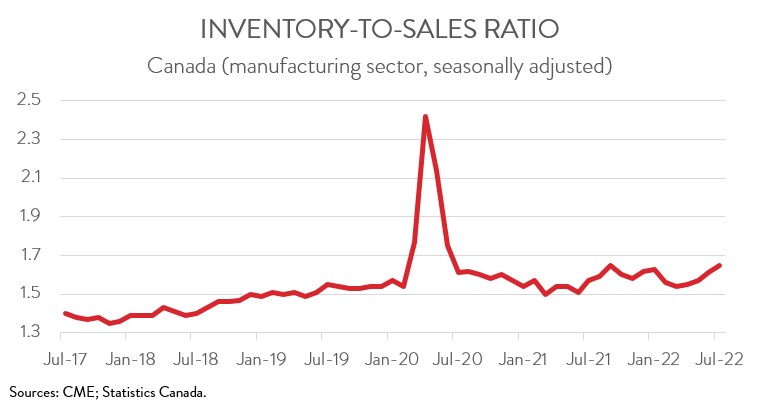

- Total inventories continued their relentless upward march, increasing to yet another record high and driving up the inventory-to-sales ratio from 1.61 in June to 1.65 in July.

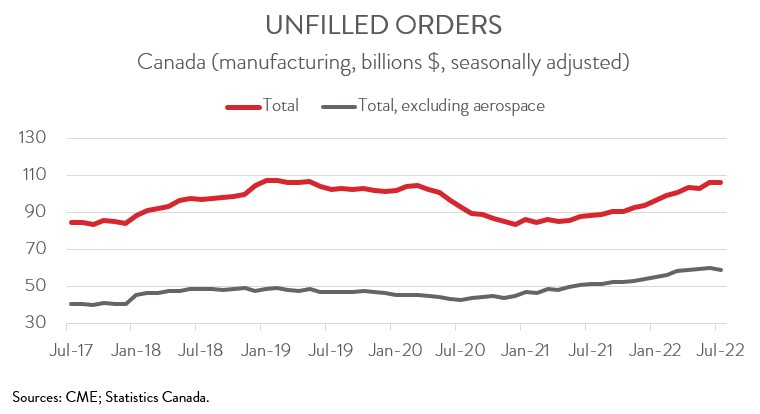

- Forward-looking indictors were discouraging, with unfilled orders remaining unchanged and new orders declining 5.3%.

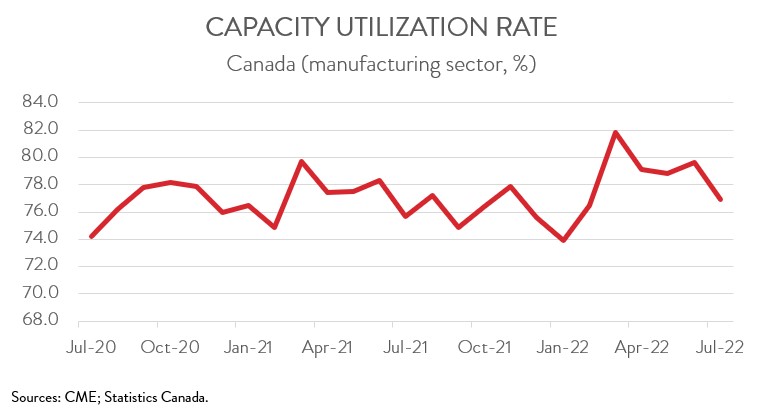

- The manufacturing sector’s capacity utilization rate decreased from 79.6% in June to 76.9% in July.

- Sales in volume terms have increased for two straight months and are up 7.3% on a year-over-year basis. This suggests that Canada’s manufacturing sector has remained somewhat resilient in the face of ongoing headwinds including high production costs, snarled supply chains, workforce shortages, and a slowdown in the global economy.

MANUFACTURING SALES FALL 0.9%

Manufacturing sales fell 0.9% to $71.6 billion in July, the third consecutive monthly decline following seven straight months of increases. On a more positive note, inflation-adjusted (real) factory sales rose 0.6%.

Although today’s report was largely disappointing, the declines were driven by lower prices. In volume terms, sales have increased for two straight months and are up 7.3% on a year-over-year basis. This suggests that Canada’s manufacturing sector has remained somewhat resilient in the face of ongoing headwinds including high production costs, snarled supply chains, workforce shortages, and a slowdown in the global economy.

SALES DOWN IN 6 OF 11 MAJOR INDUSTRIES

The decline in nominal sales spanned 6 of 11 major industries. The primary metal industry posted its largest decline on record, decreasing 9.9% to $5.6 billion in July, on lower prices and volumes sold. According to Statistics Canada, unplanned interruptions at some major primary metal manufacturers as well as concerns over a possible global economic slowdown affected the industry.

Sales of petroleum and coal products decreased 5.3% to $10.3 billion in July, down for the second month in a row. The drop in July was entirely the result of lower prices, as sales in real terms rose 5.9%. However, despite the decline, petroleum and coal product sales were nearly 70.0% higher than the same month last year.

The declines were partly offset by increases in food manufacturing sales, which climbed 2.5% to a record high of $11.8 billion in July, mainly on higher sales in the grain and oilseed milling industry. At the same time, sales in the motor vehicle and parts sector rose 4.9% to $7.1 billion in July, the second consecutive monthly increase. Notably, sales of motor vehicle parts hit their third-highest level on record.

QUEBEC AND ALBERTA POST BIGGEST DECLINES

Regionally, sales were down in five of ten provinces in July. Quebec saw the steepest losses, with sales decreasing 3.4% to $17.6 billion, mainly on lower sales in the primary metal industry. This was the province’s first monthly decline this year.

In Alberta, factory sales fell 2.6% to $9.1 billion in July. This was the biggest month-over-month decline since April 2020 and was fueled by lower sales of petroleum and coal products. However, despite the big drop, total sales in July were up 26.3% on a year-over-year basis.

On a happier note, sales in New Brunswick climbed 9.6% to $2.5 billion in July, primarily on higher sales of non-durable goods. With this gain, factory sales in the province were 48.7% higher than the same month last year.

INVENTORY-TO-SALES RATIO INCREASES

Total inventories continued their relentless upward march, increasing 1.2% to a new record high of $118.1 billion in July, up for the 19th month in a row. As noted by Statistics Canada, higher material prices have been the main contributor to the increase in inventories since the beginning of the COVID-19 pandemic.

As a result, the inventory-to-sales ratio increased from 1.61 in June to 1.65 in July, the highest point since September 2021. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. The total value of unfilled orders remained unchanged at $106.3 billion in July. Higher unfilled orders in the transportation equipment industry were offset by lower unfilled orders in the computer and electronic and machinery industries.

At the same time, the total value of new orders fell 5.3% to $71.6 billion. The decline was mainly due to lower new orders of aerospace product and parts and motor vehicles, with higher new orders of motor vehicle parts providing a partial offset.

CAPACITY UTILIZATION RATE FALLS

Finally, the manufacturing sector’s capacity utilization rate decreased from 79.6% in June to 76.9% in July. The wood product, machinery, primary metal, and chemical industries experienced some of the largest percentage declines. The declines were partially offset by a higher capacity utilization rate in the petroleum and coal product industry.