Manufacturing Sales

Manufacturing Sales

December 2022

Factory Sales End Year on Sour Note

HIGHLIGHTS

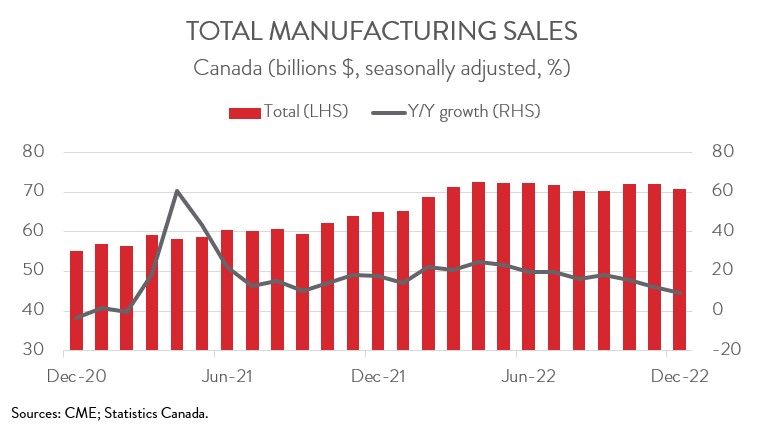

- Manufacturing sales fell 1.5% to $71.0 billion in December, the second consecutive monthly decrease.

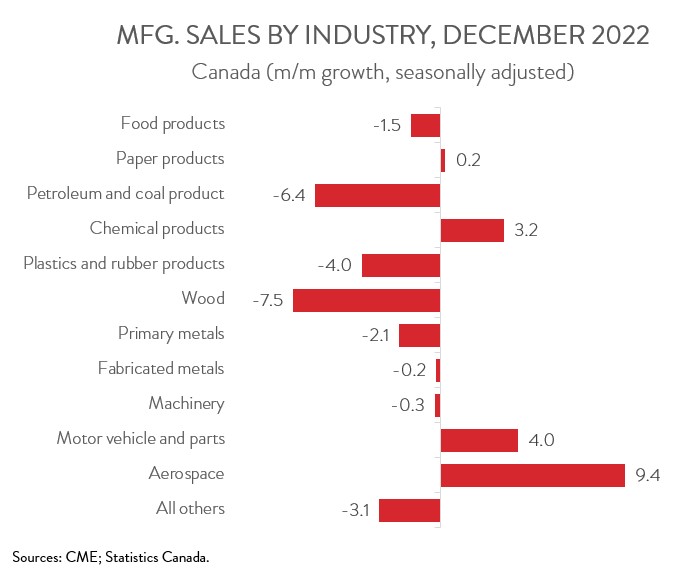

- Sales were down in 7 of 11 major industries, led by a substantial decline in the petroleum and coal product industry.

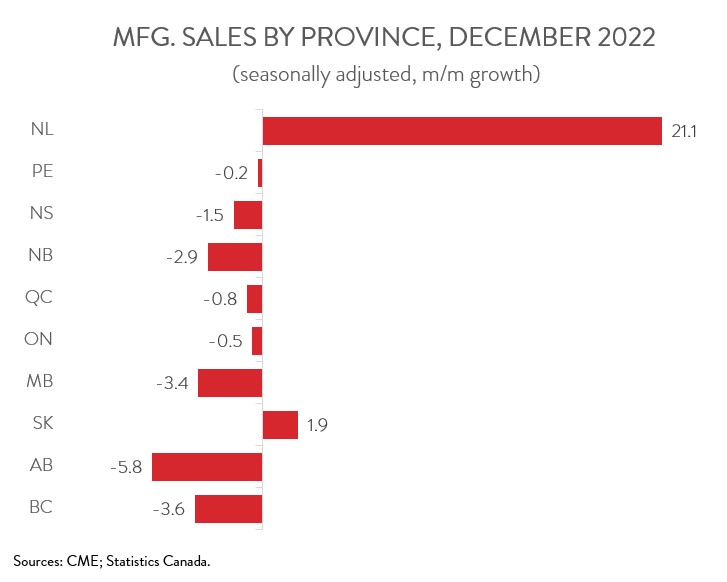

- Regionally, sales decreased in 8 of 10 provinces, with sales falling the most in Alberta and increasing the most in Newfoundland and Labrador.

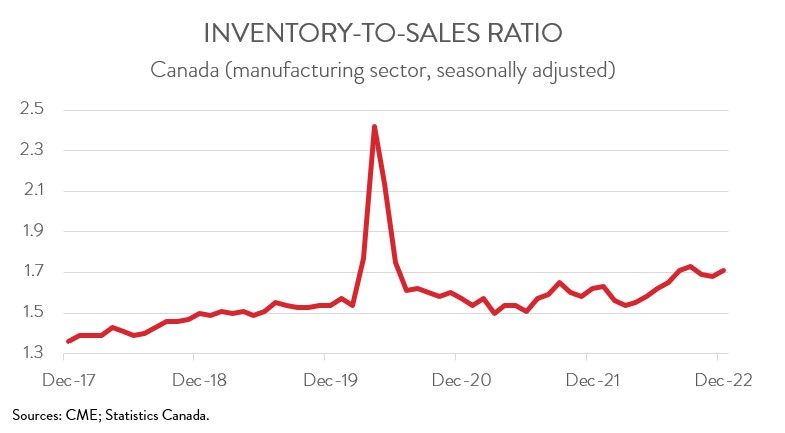

- The inventory-to-sales ratio increased from 1.68 in November to 1.71 in December.

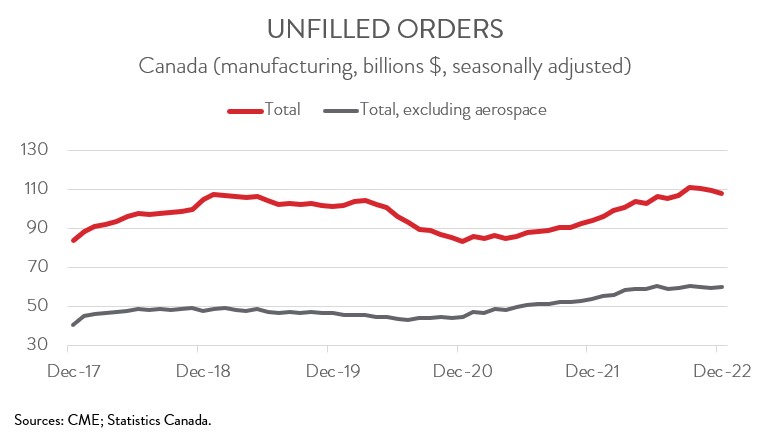

- Forward-looking indictors were soft, with unfilled orders and new orders down 1.2% and 2.2%, respectively.

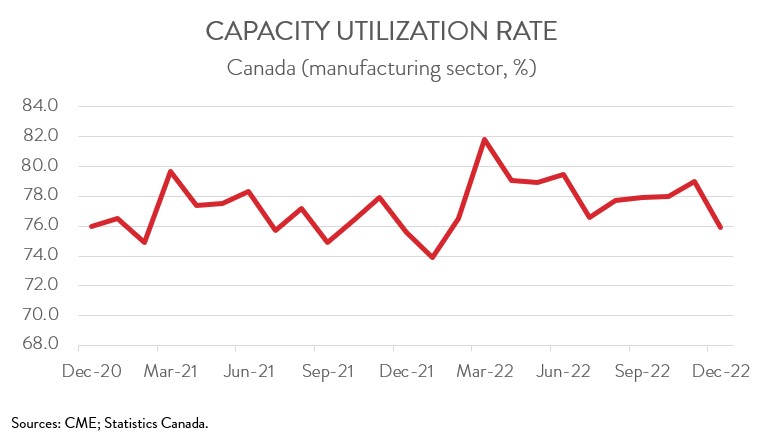

- The manufacturing sector’s capacity utilization rate decreased from 79.0% in November to 75.9% in December, its lowest point since January 2022.

- For the second consecutive year, manufacturing sales posted a double-digit gain, hitting a record high of $850.9 billion in 2022. However, the increase was less impressive in real terms, indicating that the sharp rise in nominal sales was primarily due to higher prices. Sales in constant dollars rose 4.8% to $622.8 billion last year, still shy of 2019’s pre-pandemic level of $633.6 billion.

MANUFACTURING SALES FALL 1.5% IN DECEMBER

Factory sales fell 1.5% to $71.0 billion in December, the second consecutive monthly decrease. In real terms, the picture was similarly downbeat, with sales in constant dollars edging down 0.3%.

For the second consecutive year, manufacturing sales posted a double-digit gain, hitting a record high of $850.9 billion in 2022. However, the increase was less impressive in real terms, indicating that the sharp rise in nominal sales was primarily due to higher prices. Sales in constant dollars rose 4.8% to $622.8 billion last year, still shy of 2019’s pre-pandemic level of $633.6 billion.

PETROLEUM AND COAL PRODUCT INDUSTRY FUELS MONTHLY DECLINE

Sales decreased in 7 of 11 major industries. Petroleum and coal product sales fell 6.4% to $9.6 billion in December, the second consecutive monthly decline. The decrease was entirely due to lower prices, as sales in constant dollars rose 0.9%. Despite the back-to-back declines, nominal sales of petroleum and coal products have increased 27.4% in the last 12 months.

The wood product industry also had a tough month, with sales decreasing 7.5% to $3.3 billion in December, the lowest level since August 2020. The decline was attributable to both lower prices and volumes. Higher interest rates are dragging down residential construction in both Canada and the US, resulting in lower demand for wood products. On a year-over-year basis, wood product sales were down 16.9%.

At the same time, food industry sales declined 1.5% to $12.0 billion in December, down for the second month in a row. The decrease was largely driven by lower sales in the grain and oilseed milling industry.

On the plus side, three major industries posted decent gains in December: motor vehicle and parts (+4.0%), chemical (+3.2%), and aerospace product and parts (+9.4%). This was the first sales increase for the aerospace and product and parts industry since September 2022.

SALES IN ALBERTA DECREASE THE MOST

Regionally, sales were down in eight of ten provinces in December. Sales in Alberta decreased the most, down 5.8% to $8.8 billion, owing almost entirely to lower sales of petroleum and coal products. In BC, sales fell 3.6% to $5.5 billion in December, mainly due to a decline in the wood product industry. At the same time, sales in Ontario decreased 0.5% to $30.9 billion, mainly on lower sales of plastics and rubber products.

Only Newfoundland and Labrador posted a notable gain in December, with sales surging 21.1% to $354.4 million, the highest level since May 2022. Unfortunately, despite the strong end to the year, Newfoundland and Labrador was the only province to see average annual sales fall in 2022.

INVENTORIES EDGE UP

Total inventories edged up 0.1% to $121.3 billion in December, mainly on higher inventories in the chemical, and electrical equipment, appliance and component industries. With sales down in the month, the inventory-to-sales ratio increased from 1.68 in November to 1.71 in December. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS SOFT

Forward-looking indictors were soft. The total value of unfilled orders fell for the third consecutive month, down 1.2% to $108.3 billion in December. The decrease was driven by the transportation equipment, plastics and rubber products, and fabricated metal product industries. At the same time, the total value of new orders declined 2.2% to $69.6 billion, also down for the third month in a row.

CAPACITY UTILIZATION RATE DROPS

Finally, the manufacturing sector’s capacity utilization rate decreased from 79.0% in November to 75.9% in December, its lowest point since January 2022. The food, wood product, and non-metallic mineral product industries recorded the most significant declines, while the petroleum and coal product sector experienced the most noteworthy increase.