Manufacturing Sales

Manufacturing Sales

January 2023

Factory Sales Start the Year on a High Note

HIGHLIGHTS

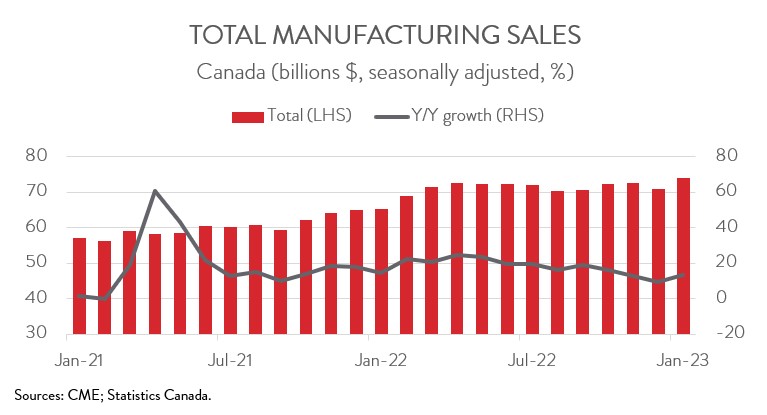

- Manufacturing sales soared 4.1% to $73.9 billion in January, more than making up for the 2.1% drop in December.

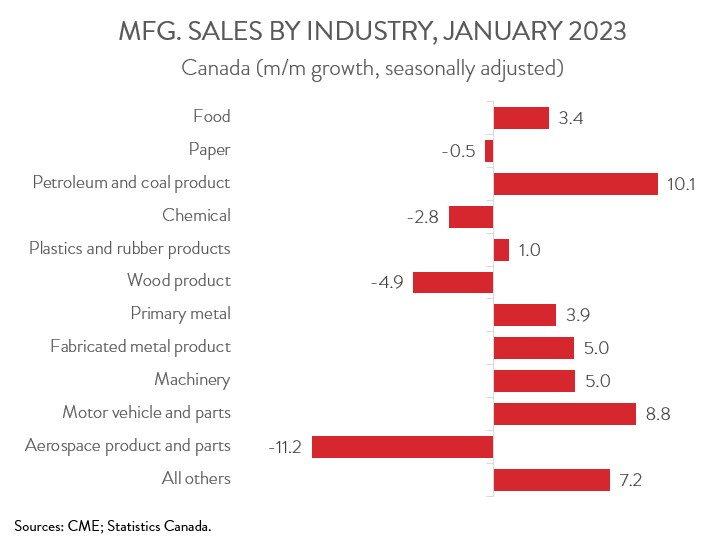

- Sales were up in 7 of 11 major industries, powered by gains in the petroleum and coal product, motor vehicle and parts, and food industries.

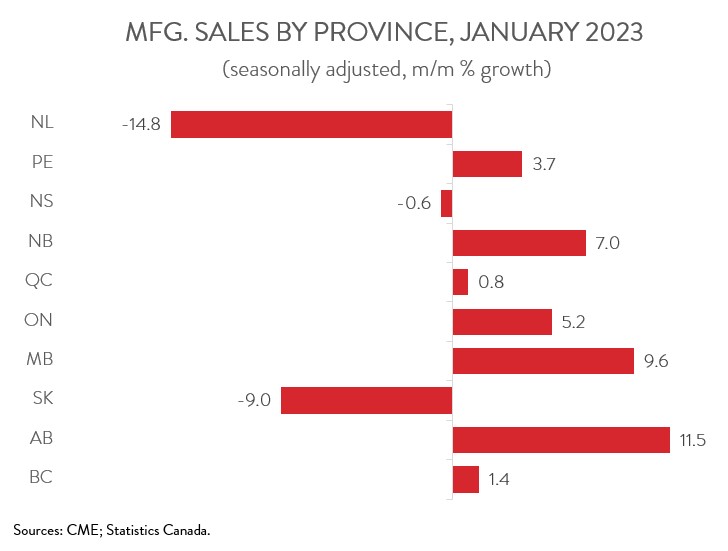

- Regionally, sales rose in 7 of 10 provinces, with sales increasing the most in Ontario and Alberta.

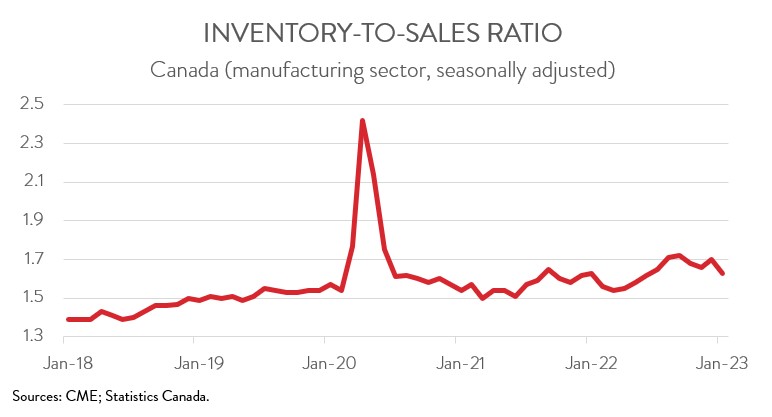

- The inventory-to-sales ratio declined from 1.70 in December to 1.63 in January, its lowest reading since June 2022.

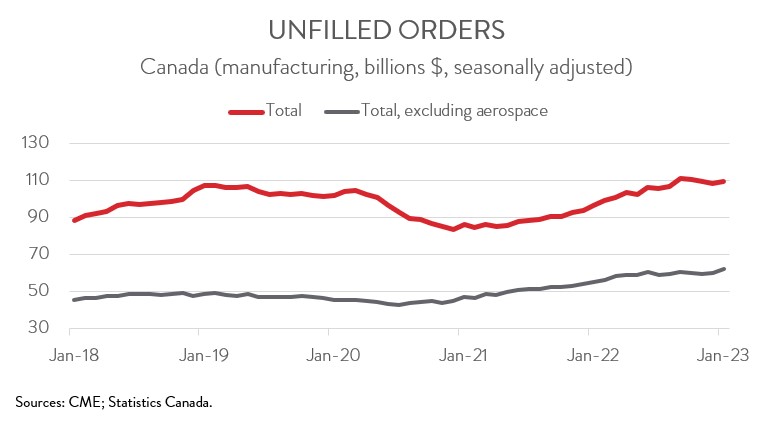

- Forward-looking indictors were encouraging, with unfilled orders and new orders up 1.0% and 7.1%, respectively.

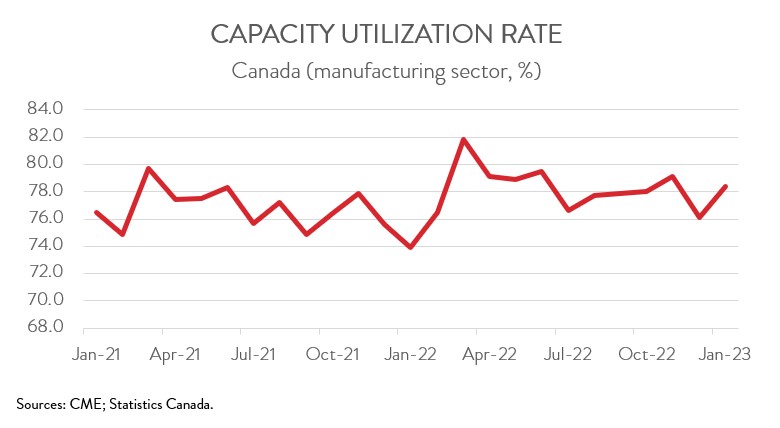

- The manufacturing sector’s capacity utilization rate climbed from 76.1% in December to 78.4% in January.

- Today’s report raises hope that the impact of slower global economic growth on Canada’s manufacturing sector will not be as bad as feared. That said, the prospects for sales growth in the coming months are modest, with high interest rates expected to weigh on demand for manufactured goods, especially durables.

MANUFACTURING SALES SOAR IN JANUARY

Manufacturing sales soared 4.1% to $73.9 billion in January, more than making up for the 2.1% drop in December. In real terms, the picture was similarly upbeat, with sales in constant dollars rising 3.8%.

Today’s report raises hope that the impact of slower global economic growth on Canada’s manufacturing sector will not be as bad as feared. That said, the prospects for sales growth in the coming months are modest, with high interest rates expected to weigh on demand for manufactured goods, especially durables.

PETROLEUM AND COAL PRODUCT INDUSTRY FUELS MONTHLY GAIN

Sales increased in 7 of 11 major industries in January. Following two consecutive monthly declines, sales in the petroleum and coal product industry jumped 10.1% to $10.3 billion in January. Higher volumes played a significant role in the increase, thanks in part to weather-related refinery disruptions in the U.S. that lifted Canadian exports.

The motor vehicle and parts industry also had a strong month, with sales rising 8.8% to $8.2 billion in January, the highest level since July 2020 and in line with the pre-pandemic average. However, despite the recovery, Statistics Canada noted that the auto sector still continues to experience some supply chain challenges and shipping capacity constraints.

In more good news, food industry sales climbed 3.4% to $12.4 billion in January, up for the first time in three months. The grain and oilseed subsector led the way, rebounding from a weak December when a major oil crushing plant experienced an equipment failure.

On the negative side, sales in the aerospace product and parts industry plunged 11.2% to $1.6 billion in January, fully erasing the strong gains observed in December. However, despite the decline, sales on a year-over-year basis were up 16.7% in January.

At the same time, chemical sales decreased 2.8% to $5.7 billion, down for the second time in three months. The decline was largely due to lower sales in the pharmaceutical and medicine subsector, with a large gain in the pesticide, fertilizer and other agricultural chemical subsector acting as a partial offset.

SALES IN ONTARIO AND ALBERTA INCREASE THE MOST

Regionally, sales were up in 7 of 10 provinces in January. Following a decrease in December, sales in Ontario climbed 5.2% to $32.6 billion in January, powered by the motor vehicle and parts industry. In Alberta, sales jumped 11.5% to a record high of $9.7 billion in January, thanks to the combined efforts of the petroleum and coal product, chemical, and food industries.

On the other side of the spectrum, sales in Saskatchewan fell 9.0% to $2.2 billion in January, owing almost entirely to a substantial decline in the chemical industry. In Newfoundland and Labrador, sales dropped 14.8% to $307.8 million, the first decrease in six months.

INVENTORIES EDGE UP

Total inventories edged up 0.3% to $120.7 billion in January, led by the machinery, primary metal, and food industries. Accordingly, the inventory-to-sales ratio decreased from 1.70 in December to 1.63 in January, its lowest reading since June 2022. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS ENCOURAGING

Forward-looking indictors were encouraging. After three straight monthly declines, the total value of unfilled orders rose 1.0% to $109.7 billion in January. The increase was driven by the other transportation equipment, fabricated metal product, and electrical equipment, appliance and component industries.

At the same time, the total value of new orders jumped 7.1% to $75.1 billion, also up for the first time in four months. The transportation equipment and petroleum and coal products industries contributed the most to the growth.

CAPACITY UTILIZATION RATE RISES

Finally, the manufacturing sector’s capacity utilization rate rose from 76.1% in December to 78.4% in January. The petroleum and coal product and transportation equipment industries recorded the most significant increases, while the computer and electronic product and miscellaneous sectors experienced the most noteworthy declines.