Manufacturing Sales

Manufacturing Sales

March 2023

Factory Sales Rise 0.7% in March on Higher Volumes

HIGHLIGHTS

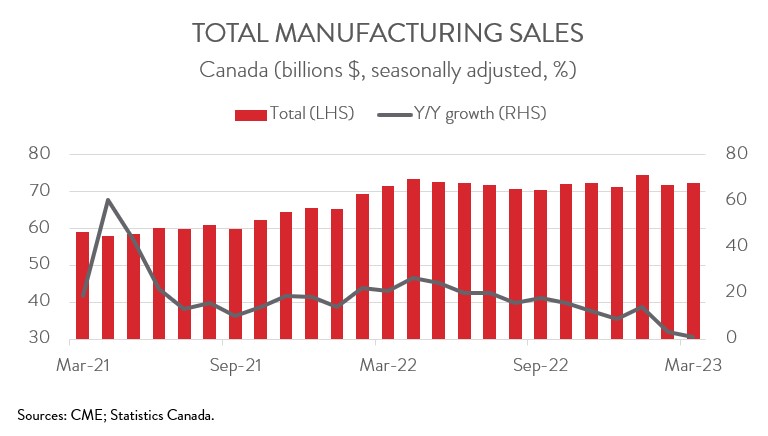

- Manufacturing sales climbed 0.7% to $72.3 billion in March, following a 3.6% decrease in February.

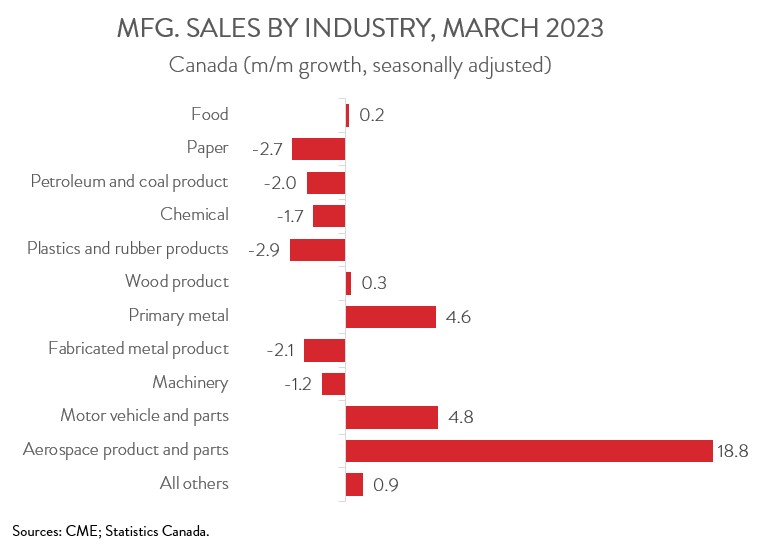

- Sales were up in just 5 of 11 major industries, led by the motor vehicle and parts, aerospace product and parts, and primary metal industries.

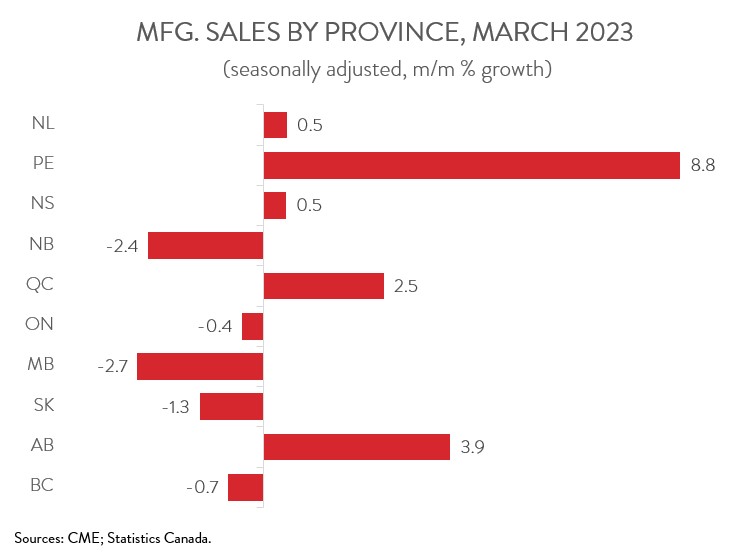

- Regionally, sales rose in 5 of 10 provinces, with gains in Quebec and Alberta more than offsetting a pullback in Ontario.

- The inventory-to-sales ratio edged down from 1.73 in February to 1.72 in March.

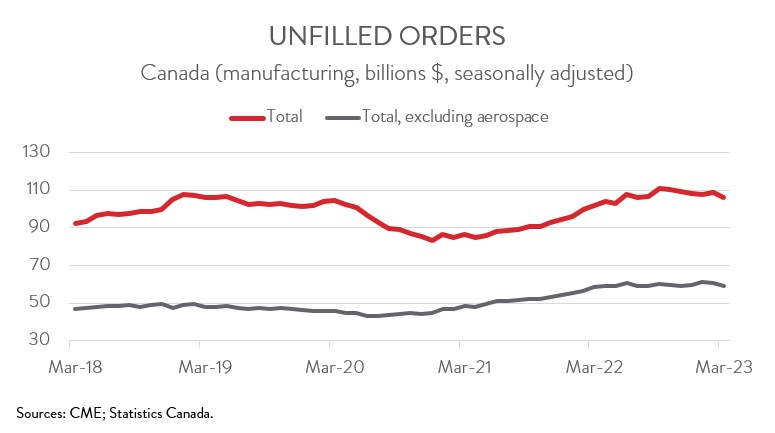

- Forward-looking indictors were discouraging, with unfilled orders and new orders down 2.2% and 3.5%, respectively.

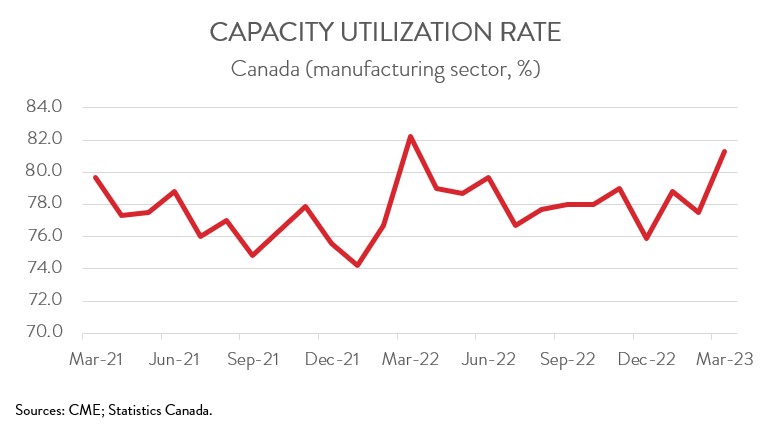

- The manufacturing sector’s capacity utilization rate hit its highest level in a year, increasing from 77.5% in February to 81.3% in March.

- Despite the gain in March, manufacturing sales have increased by only 0.9% over the last 12 months, the weakest gain since February 2021. With forward-looking indicators trending lower, the near-term outlook is also fraught with uncertainty.

MANUFACTURING SALES UP 0.7% IN MARCH

Manufacturing sales climbed 0.7% to $72.3 billion in March, following a 3.6% decrease in February. Sales in constant dollars rose 1.1% in March, indicating that a higher volume of goods were sold in March.

Despite the gain in March, manufacturing sales have increased by only 0.9% over the last 12 months, the weakest gain since February 2021. The tepid pace of growth is consistent with a sector that is being held back by slower demand for consumer goods amid sharply higher interest rates and the ongoing post-COVID shift to spending on services. With forward-looking indicators trending lower, the near-term outlook is also fraught with uncertainty.

AUTO AND AEROSPACE INDUSTRIES LEAD THE GAINS

Sales increased in just 5 of 11 major industries in March. Following an 6.8% decline in February, motor vehicle and parts sales rose 4.8% to $8.1 billion in March. On a year-over-year basis, sales were up a robust 18.8%. As noted in today’s report, the auto industry is benefitting from easing supply chain disruptions that have enabled it to increase production. However, higher costs for raw materials have also forced automakers to raise prices. This, combined with higher interest rates, is weighing down demand for new vehicles.

Meanwhile, sales in the aerospace product and parts industry soared 18.8% to $2.1 billion in March, the highest level since March 2020. On a year-over-year basis, sales were up a whopping 61.2%, coinciding with a surge in demand for air travel in the post-pandemic era.

In more good news, sales of primary metals rose 4.6% to $6.0 billion in March on both higher prices and volumes. The gains were led by the non-ferrous metal (except aluminum) production and processing subsector, as concerns over the U.S. banking crisis led to higher prices and increased demand for gold and silver.

On the negative side, sales in the petroleum and coal product industry fell 2.0% to $8.7 billion in March on lower prices. This was the second consecutive monthly decline and the lowest level since January 2022. Prices for refined petroleum energy products (including liquid biofuels) have been trending lower due to economic concerns and stress in the U.S. banking sector.

SALES UP IN FIVE PROVINCES, LED BY QUEBEC AND ALBERTA

Regionally, sales were up in 5 of 10 provinces in March. Sales in Quebec increased the most, up 2.5% to $18.3 billion, owing largely to higher sales of aerospace product and parts and primary metals. Alberta was another growth leader, with sales rising 3.9% to 9.1 billion in March, mainly on higher sales of petroleum and coal products. The strong gains in these provinces were partially offset by a pullback in Ontario, which saw sales dip 0.4% to $31.7 billion, mainly due to sharply lower sales of petroleum and coal products.

INVENTORIES CLIMB TO A NEW ALL-TIME HIGH

Total inventories rose 0.5% to a new record high of $124.5 billion in March, with the computer and electronic product and primary metal industries posting the largest gains. But with sales rising at an even faster pace, the inventory-to-sales ratio decreased from 1.73 in February to 1.72 in March. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. The total value of unfilled orders declined 2.2% to $106.2 billion in March, down for the fifth time in six months. The decrease was primary driven by the aerospace product and parts and machinery industries. At the same time, the total value of new orders fell 3.5% to $69.9 billion, also down for the fifth time in six months.

CAPACITY UTILIZATION RATE RISES TO HIGHEST LEVEL IN A YEAR

Finally, the manufacturing sector’s capacity utilization rate hit its highest level in a year, increasing from 77.5% in February to 81.3% in March. The transportation equipment and primary metal industries recorded the most noteworthy advances.