International Trade

Merchandise Trade

AUGUST 2021

Canada’s Trade Surplus Widens in August as Exports Rise and Imports Fall

HIGHLIGHTS

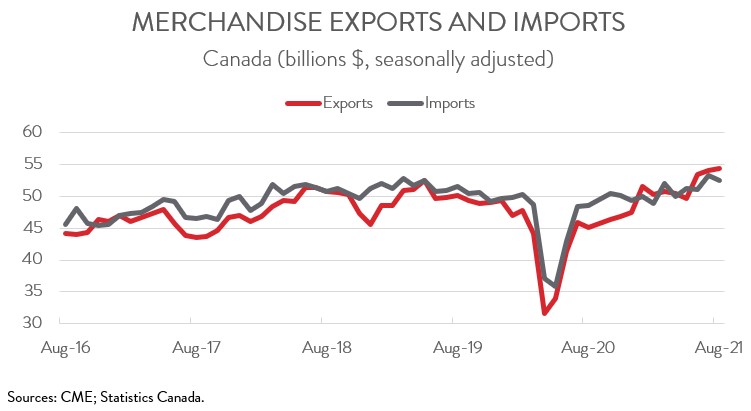

- Canadian merchandise exports increased 0.8% to $54.4 billion in August, while merchandise imports fell 1.4% to $52.5 billion.

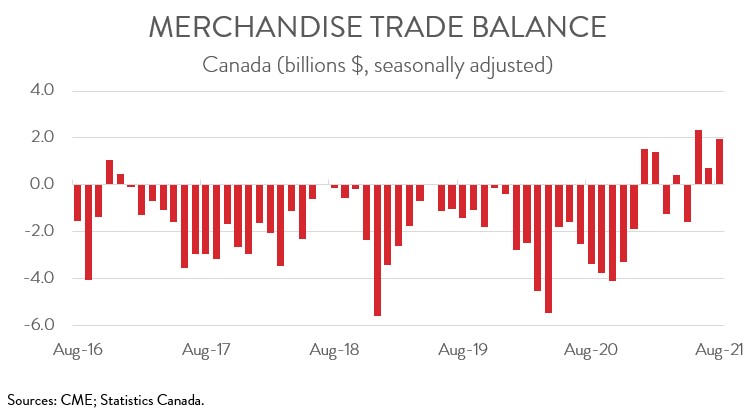

- Canada’s merchandise trade surplus widened from $736 million in July to $1.9 billion in August.

- In volume terms, real exports were up 2.3%, while real imports were down 3.2%.

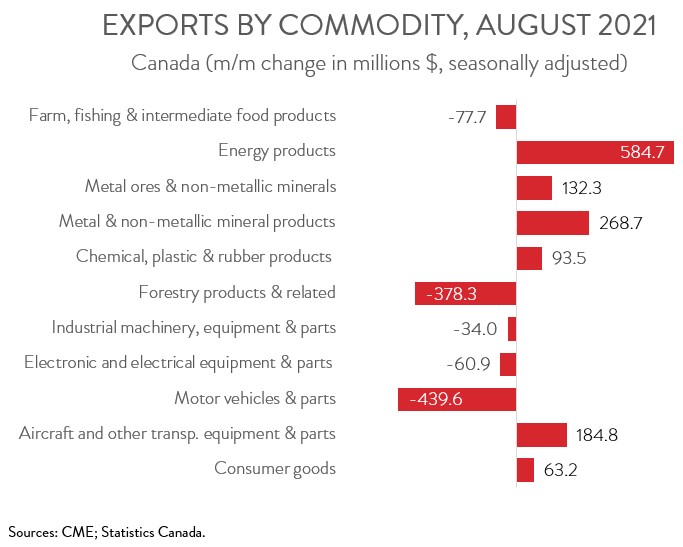

- The increase in exports spanned 6 of 11 major commodity groups, with energy products contributing the most to the growth. Exports of motor vehicles and parts posted the largest decline.

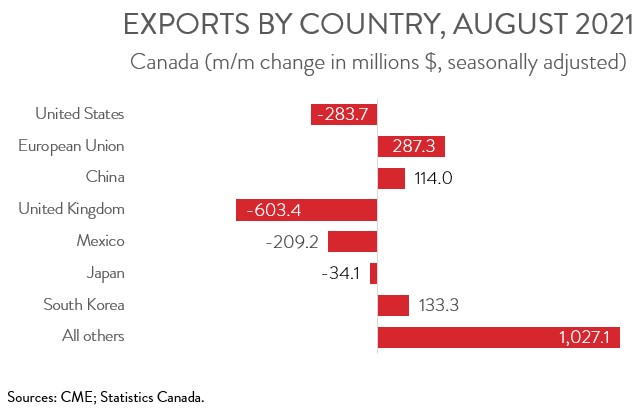

- Exports to the U.S. fell 0.7% to $40.8 billion in August, while exports to the rest of the world rose 5.5% to $13.7 billion.

- The increase in real exports in August makes it likely that trade will add to GDP growth in the third quarter after weighing it down in Q2. The positive momentum is expected to continue in the coming months, but the recovery will likely be bumpy due to ongoing supply chain challenges as well as other economic effects of the COVID-19 pandemic.

MERCHANDISE EXPORTS UP FOR THIRD MONTH IN A ROW

Canadian merchandise exports increased 0.8% to $54.4 billion in August, building on the cumulative 8.6% increase in June and July. On the other hand, merchandise imports fell 1.4% to $52.5 billion, though they remained near July’s record high. In volume terms, the picture was even more encouraging: real exports were up 2.3%, while real imports were down 3.2%.

The increase in real exports in August makes it likely that trade will add to GDP growth in the third quarter after weighing it down in Q2. The positive momentum is expected to continue in the coming months, but the recovery will likely be bumpy due to ongoing supply chain challenges as well as other economic effects of the COVID-19 pandemic. Recently, these supply chain disruptions have been exacerbated by energy supply shortages in several regions.

TRADE SURPLUS WIDENS

Canada’s merchandise trade balance remained in a surplus position, widening from $736 million in July to $1.9 billion in August. Canada has posted trade surpluses in six of the first eight months of 2021, the best run since 2014. Our trade surplus with the U.S. widened from $6.8 billion in July to $8.6 billion in August, the largest monthly trade surplus with our southern neighbour in 13 years. Canada’s trade deficit with the rest of the world widened from $6.0 billion to $6.7 billion over the same period.

INCREASE IN EXPORTS LED BY ENERGY PRODUCTS

The increase in exports spanned 6 of 11 major commodity groups. Exports of energy products increased 5.1% in August to $12.0 billion, the highest level since March 2014. Exports of crude oil were up for the fourth month in a row, attributable to increased volumes. Coal exports also contributed to the monthly increase, thanks to the combined effect of higher prices and higher volumes. Finally, exports of natural gas posted a double-digit increase, helped by the fact that natural gas prices have risen each month since April.

Exports of metal and non-metallic mineral products rose 4.0% in August to a record $6.9 billion. Higher export values of copper, iron and steel, and aluminum products accounted for more than three-quarters of this gain.

In more good news, exports of aircraft and other transportation equipment were up 9.2% to $2.2 billion, extending the 8.5% gain seen in July.

On the downside, exports of motor vehicles and parts declined 7.3% in August to $5.6 billion, more than offsetting the 6.1% increase in July. Parts supply issues, especially of semiconductors, continues to force Canadian motor vehicle manufacturers to limit production. (It should also be noted that the decline in overall imports was predominately driven by motor vehicles and parts.)

Exports of forestry products and building and packaging materials also had a tough month, falling 7.9% to $4.4 billion. The decline was mainly attributable to lower exports of lumber and other sawmill products, which fell for the second consecutive month on lower prices.

NON-U.S. EXPORTS POST SOLID INCREASE

Canada’s exports to the U.S. fell 0.7% to $40.8 billion in July, the first decline in three months. This was more than offset by higher exports to the rest of the world, which were up 5.5% to $13.7 billion. Among Canada’s major non-U.S. trading partners, exports to the European Union, South Korea, and China were up on the month, while exports to the United Kingdom, Mexico, and Japan were down. The increase in exports to South Korea and China was largely attributable to higher exports of coal.