International Trade

Merchandise Trade

February 2022

Energy Products Propel Exports to Record High

HIGHLIGHTS

- Canadian merchandise exports rose 2.8% to an all-time high of $58.7 billion in February, while merchandise imports climbed 3.9% to $56.1 billion.

- As a result, Canada’s merchandise trade surplus narrowed from $3.1 billion in January to $2.7 billion in February.

- After removing price effects, export and import volumes were up 0.5% and 2.0%, respectively.

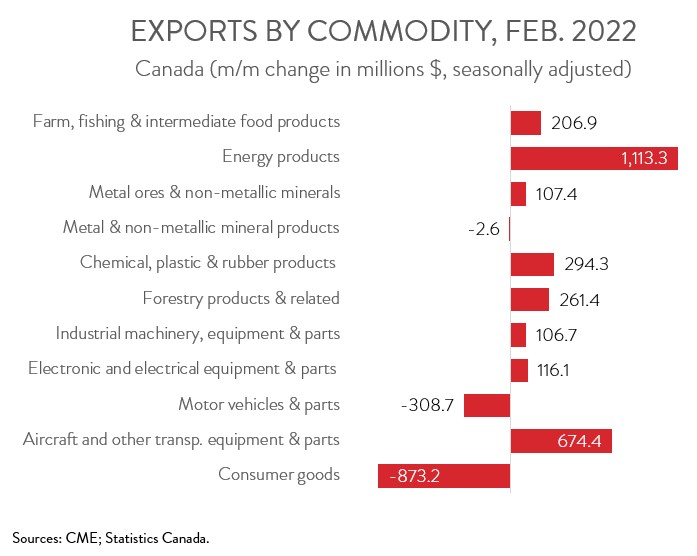

- The increase in exports spanned 8 of 11 major commodity groups, with the bulk of the gains attributable to higher exports of energy products.

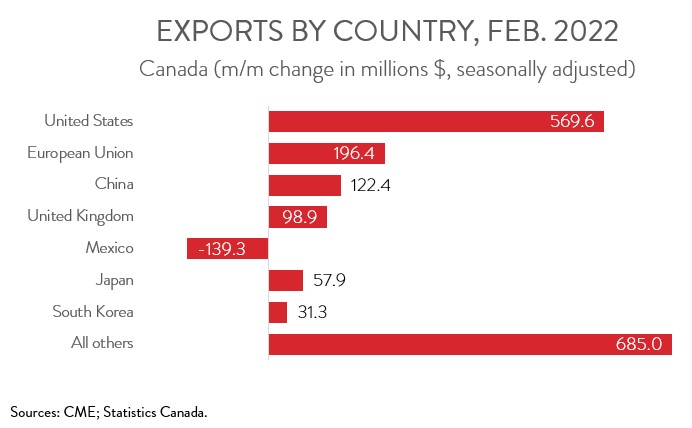

- Exports to the U.S. rose 1.3% to $44.8 billion in February, while exports to the rest of the world increased 8.1% to $14.0 billion.

- As in January, widespread inflation boosted both exports and imports in February. In particular, higher crude oil prices propelled energy exports to a record high, with this one product category accounting for more than two-thirds of the total increase in exports. Given that commodity prices surged after Russia invaded Ukraine on February 24, higher inflation will continue to buoy nominal exports in March.

EXPORTS AND IMPORTS BOTH RISE IN FEBRUARY

Canadian merchandise exports rose 2.8% to an all-time high of $58.7 billion in February, while merchandise imports climbed 3.9% to $56.1 billion. In volume terms, real exports and real imports were up 0.5% and 2.0%, respectively. Notably, Statistics Canada found that border blockades had little impact on export and import volumes in February, as most road shipments were rerouted.

As in January, widespread inflation boosted both exports and imports in February. In particular, higher crude oil prices propelled energy exports to a record high, with this one product category accounting for more than two-thirds of the total increase in exports. Given that commodity prices surged after Russia invaded Ukraine on February 24, higher inflation will continue to buoy nominal exports in March.

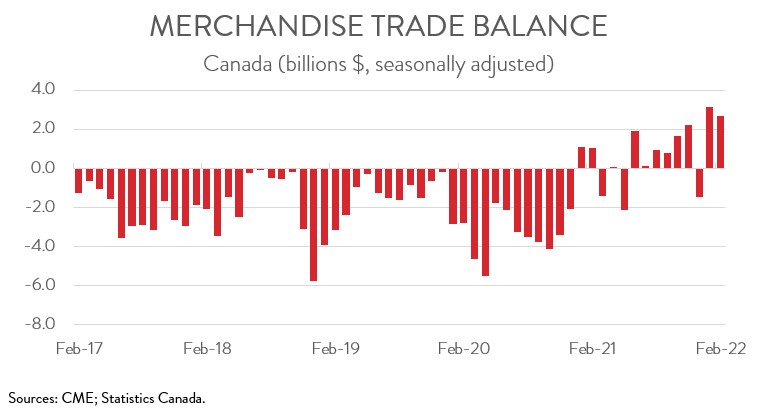

CANADA’S TRADE SURPLUS NARROWS

Canada’s merchandise trade surplus narrowed from $3.1 billion in January to $2.7 billion in February. Breaking these data down, our trade surplus with the U.S. widened from $9.7 billion in January to $10.3 billion in February. This was Canada’s largest trade surplus with its southern neighbour since December 2005. At the same time, our trade deficit with the rest of the world widened from $6.6 billion to $7.7 billion.

INCREASE IN EXPORTS FUELED BY ENERGY PRODUCTS

The increase in exports spanned 8 of 11 product categories. Exports of energy products rose 7.8% to a record high of $15.4 billion in February, accounting for more than one-quarter of total exports. Exports of crude oil contributed the most to the growth, thanks largely to higher prices.

Exports of non-energy products were up 1.2% in February. Exports of aircraft and other transportation equipment and parts surged 54.0% to $1.9 billion that month, more than offsetting the steep 32.9% fall in January. Exports of aircraft more than tripled in February, attributable to higher exports of private jets and commercial aircraft.

On the negative side, exports of consumer goods decreased 11.4% to $6.8 billion in February. After posting record highs in the previous three months, exports of pharmaceutical products returned to more typical levels in February.

At the same time, exports of motor vehicles and parts fell 5.0% to $5.8 billion, down for the second month in a row, as the auto industry continues to be hampered by supply chain issues and semiconductor shortages.

CANDIAN EXPORTS TO MOST MAJOR TRADING PARTNERS INCREASE

Exports to the U.S. rose 1.3% to $44.8 billion in February, while exports to the rest of the world increased 8.1% to $14.0 billion. Among Canada’s major non-U.S. trading partners, exports to the EU, China, the U.K., Japan, and South Korea were up, while exports to Mexico were down. The increase in exports to the EU was partly attributable to higher exports of pharmaceutical products and crude oil to Italy.