International Trade

Merchandise Trade

April 2022

Export Growth Slows in April and Trade Surplus Narrows

HIGHLIGHTS

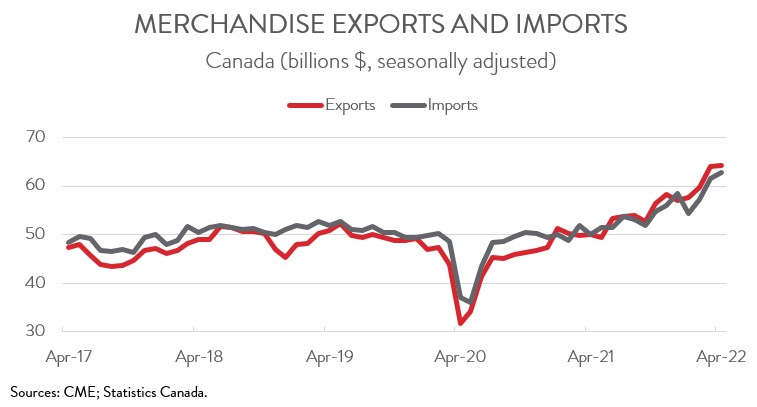

- Canadian merchandise exports rose 0.6% to $64.3 billion in April, while merchandise imports climbed 1.9% to $62.8 billion.

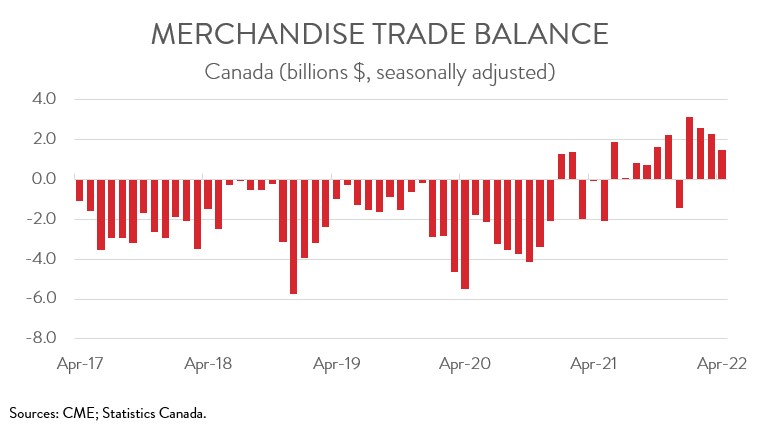

- With imports outpacing exports, Canada’s merchandise trade surplus narrowed from $2.3 billion in March to $1.5 billion in April.

- After removing price effects, export and import volumes were down 2.1% and 0.4%, respectively.

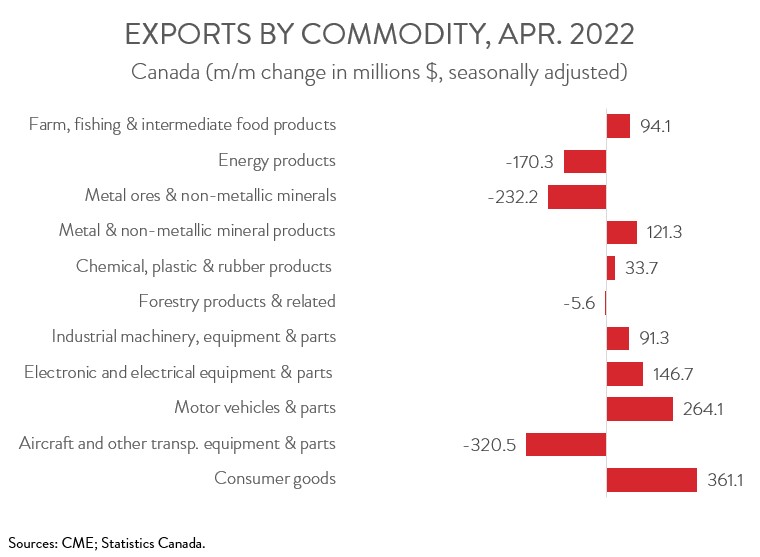

- The increase in nominal exports spanned 7 of 11 major commodity groups, led by consumer goods and motor vehicles and parts.

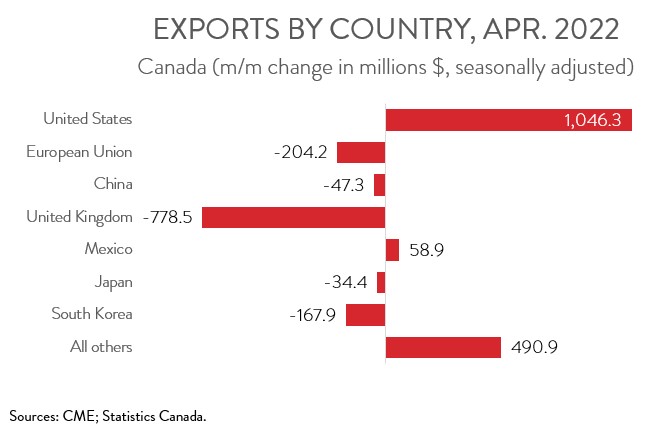

- Exports to the U.S. rose 2.1% to $50.4 billion in April, while exports to the rest of the world decreased 4.7% to $13.9 billion.

- Although today’s report was disappointing, the slowdown in export activity is likely to be temporary. Higher commodity prices should provide a boost commodity-based exports, while a further easing in supply chain disruptions should support exports of manufactured goods.

EXPORT AND IMPORT GROWTH SLOWS IN APRIL

After two months of strong increases, Canadian merchandise trade activity slowed in April. Total exports rose 0.6% to $64.3 billion, while imports climbed 1.9% to $62.8 billion. The increase in both exports and imports was entirely due to higher prices, as real exports and real imports were down 2.1% and 0.4%, respectively.

Although today’s report was disappointing, the slowdown in export activity is likely to be temporary. Higher commodity prices should provide a boost to commodity-based exports, while a further easing in supply chain disruptions should support exports of manufactured goods.

CANADA’S TRADE SURPLUS NARROWS FOR THE THIRD STRAIGHT MONTH

With imports outpacing exports, Canada’s merchandise trade surplus narrowed for the third straight month from $2.3 billion in March to $1.5 billion in April. Breaking these data down, our trade surplus with the U.S. narrowed from a record high of $12.2 billion in March to $11.6 billion in April. At the same time, our trade deficit with the rest of the world widened slightly from $9.9 billion to $10.1 billion.

INCREASE IN EXPORTS DRVIEN BY CONSUMER GOODS AND MOTOR VEHICLES AND PARTS

The increase in exports spanned 7 of 11 product categories. Exports of consumer goods rose 5.0% to $7.5 billion in April, building on the 5.3% gain in March. The increase in April was driven by higher exports of prepared and packaged seafood products, which in turn was attributable to higher crab prices and volumes.

Exports of motor vehicles and parts climbed 3.9% to $7.1 billion in April, the highest level since October 2020 and the sixth increase in seven months. This is yet another positive sign that semiconductor shortages are continuing to ease for the auto sector.

On the negative side, exports of aircraft and other transportation equipment and parts nosedived 16.9% to $1.6 billion in April. In particular, aircraft exports fell steeply, mainly due to lower exports of business aircraft.

At the same time, exports of energy products decreased 0.9% to $18.0 billion in April, down for the first time in four months. Export volumes of crude oil recorded a notable decline, weighed down by planned maintenance shutdowns at oil sands upgrader facilities in Alberta.

CANADIAN EXPORTS TO THE U.S. UP FOR FOURTH STRAIGHT MONTH

Exports to the U.S. climbed 2.1% to $50.4 billion in April, up for the fourth month in a row. On the other hand, exports to the rest of the world fell 4.7% to $13.9 billion, the first decline in three months. Among Canada’s major non-U.S. trading partners, only exports to Mexico were up, while exports to the U.K., the EU, South Korea, China, and Japan were down. The decrease in exports to the U.K. was driven by lower exports of gold, while the decrease in exports to South Korea was attributable to lower exports of copper ores.