International Trade

Merchandise Trade

November 2023

Exports Decline in November, Shrinking the Trade Surplus

HIGHLIGHTS

- Canada’s merchandise exports declined 0.6% to $65.7 billion in November, while imports rose 1.9% to $64.2 billion.

- The country’s trade surplus narrowed from $3.2 billion in October to $1.6 billion in November.

- In real (or volume terms), exports were down 0.3% and imports were up 2.1%.

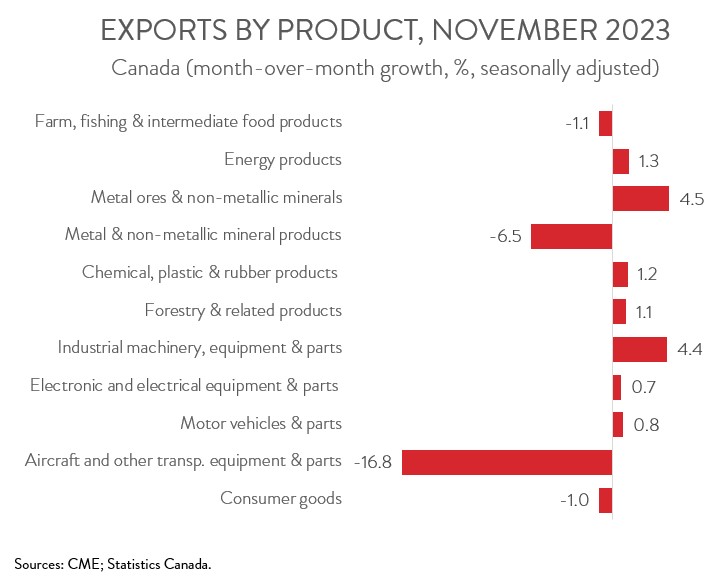

- The decrease in nominal exports spanned 4 of 11 product sections and was driven by lower exports of metal and non-metallic mineral products and aircraft and other transportation equipment and parts.

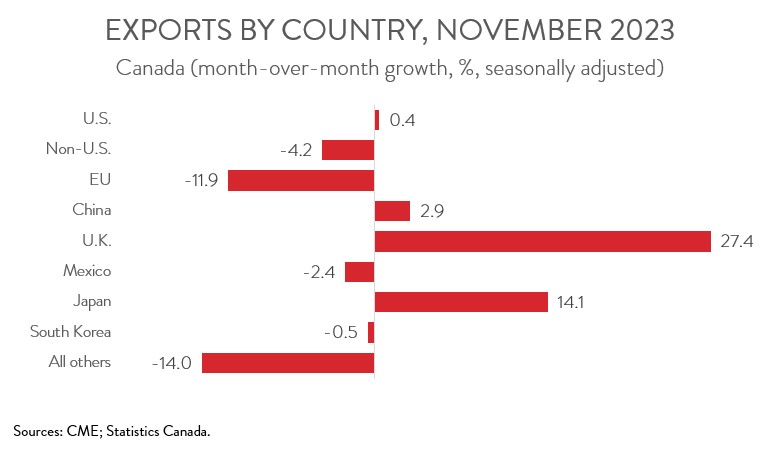

- Exports to the U.S. edged up 0.4% to $51.6 billion in November, while exports to the rest of the world declined 4.2% to $14.2 billion.

- Despite the decline in exports, today’s report further raises the odds that net trade will contribute positively to GDP growth in the fourth quarter, bouncing back from a big drop in exports in Q3 that was partly driven by strike-related disruptions to critical trade infrastructure.

EXPORTS DECLINE FOR FIRST TIME IN FIVE MONTHS

Canada’s merchandise exports declined 0.6% to $65.7 billion in November, down for the first time since June. Meanwhile, merchandise imports rose 1.9% to $64.2 billion, partly making up for a 2.9% decrease in the previous month. In real (or volume terms), exports were down 0.3% and imports were up 2.1%.

Despite the decline in exports, today’s report further raises the odds that net trade will contribute positively to GDP growth in the fourth quarter, bouncing back from a big drop in exports in Q3 that was partly driven by disruptions to critical trade infrastructure resulting from strikes at BC ports and the St. Lawrence Seaway.

However, the near-term outlook remains cloudy, as demand for Canadian exports is expected to be held back by slower global economic growth. In addition, potential job action looms at the Port of Montreal. If a strike occurs, it will not only cause immediate economic harm, but it will also deliver another blow to Canada’s reputation as a stable and dependable trading partner.

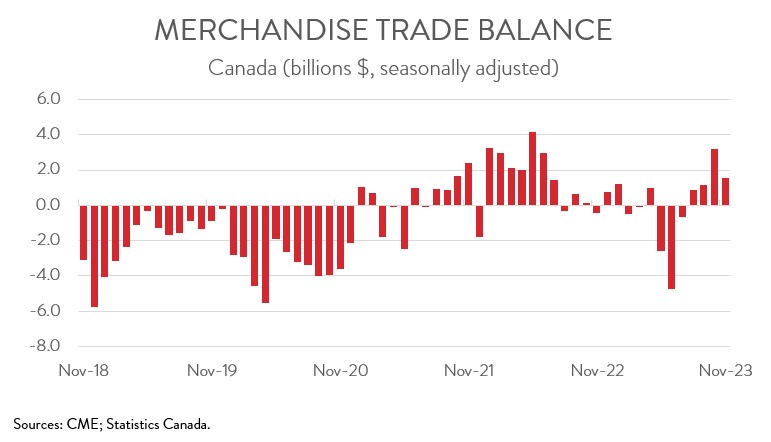

TRADE SURPLUS NARROWS

Canada’s trade balance remained in a surplus position for the fourth consecutive month, but it narrowed from $3.2 billion in October to $1.6 billion in November. Breaking the numbers down, Canada’s trade surplus with the U.S. narrowed from $12.1 billion in October to $11.7 billion in November. At the same time, our trade deficit with the rest of the world widened from $9.0 billion to $10.1 billion.

EXPORTS DOWN IN FOUR PRODUCT SECTIONS

The decrease in exports spanned 4 of 11 product sections. Exports of metal and non-metallic mineral products fell 6.5% to $7.3 billion in November. The decline was driven by lower exports of unwrought gold, silver, and platinum group metals, which in turn was mainly the result of lower gold asset transfers between financial institutions.

Following a surge in October, exports of aircraft and other transportation equipment and parts plunged 16.8% to $2.4 billion in November, living up to its reputation as a volatile sector. Notably, exports of aircraft decreased in November, mainly on lower exports of business jets to the U.S.

On the positive side of the ledger, exports of energy products climbed 1.3% to $16.3 billion in November, the fourth increase in five months. Energy products are by far Canada’s most important export category, accounting for about one-quarter of merchandise exports during the month.

At the same time, exports of industrial machinery, equipment and parts climbed 4.4% to a record high of $4.5 billion, also up for the fourth time in five months.

EXPORTS TO THE U.S. EDGE UP

Exports to the U.S. edged up 0.4% to $51.6 billion in November, partly offsetting a 1.0% decline in October. Meanwhile, exports to the rest of the world fell 4.2% to $14.2 billion, the biggest one-month drop since June. Among Canada’s major non-U.S. trading partners, exports to the EU, Mexico, and South Korea were down, while exports to the U.K., Japan, and China were up. The decrease in exports to countries other than the U.S. was propelled by lower exports of other transportation equipment to Saudi Arabia and lower exports of unwrought gold to Switzerland.