Policy Submissions & Government Consultations

Supporting Business Scale-Up and Technology Adoption

See How CME Helped Last Year

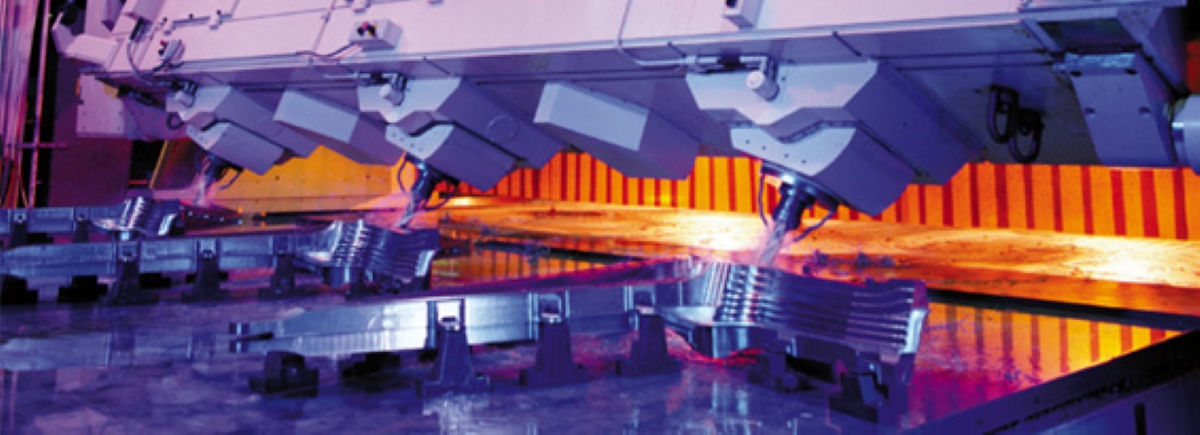

CME AT WORK: STIMULATE INNOVATION, INVESTMENT & THE ADOPTION OF ADVANCED TECHNOLOGIES

Canada lags other industrialized countries when it comes to business investment, digitalization, and the adoption of advanced technologies. Canada also suffers from relatively low rates of business research and development (BERD) spending, commercialization, and intellectual property (IP) generation. All these factors hold back the ability to grow the Canadian economy and workforce.

Manufacturing is not faring any better than the overall economy. Non-residential business investment per worker in manufacturing is three times lower in Canada than in the U.S. As a result, the capital stock of Canadian factories was near a 30-year low in 2021, while it was at a record high in the U.S.

Manufacturing Canada's Future: An Industrial Strategy - Policy Recommendations

To stimulate innovation, investment, and the adoption of advanced technologies in Canada’s manufacturing sector, governments should:

- Introduce a shared federal/provincial 20 per cent refundable manufacturing investment tax credit (ITC)

- Enhance and reform the Scientific Research and Experimental Development (SR&ED) program and implement a complementary patent box regime

- Recapitalize and extend the Strategic Innovation Fund (SIF) program for at least ten more years, providing a minimum of $2.5 billion in annual funding to support large capital projects in manufacturing

- Provide targeted program support for small and medium-sized enterprises (SMEs), including providing funding for technology demonstration tours and site visits that showcase leading technologies

- Increase coordination across all levels of government to remove interprovincial trade barriers, harmonize regulations, and reduce red tape