Manufacturing Sales

MANUFACTURING SALES

Manufacturing Sales Decline Again

highlights

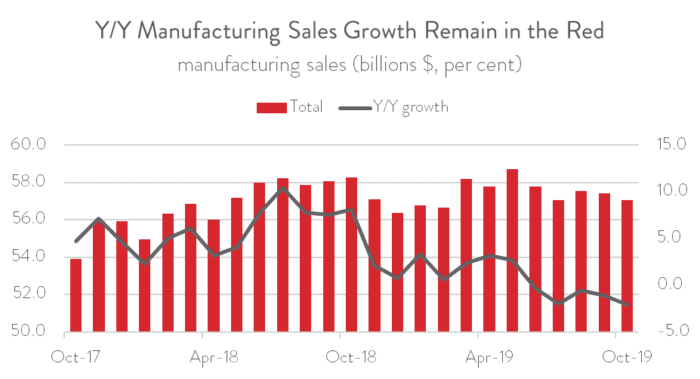

- Manufacturing sales fell 0.7 per cent in October 2019, the second consecutive monthly decline. Sales were also down 2.1 per cent on a year-over-year basis.

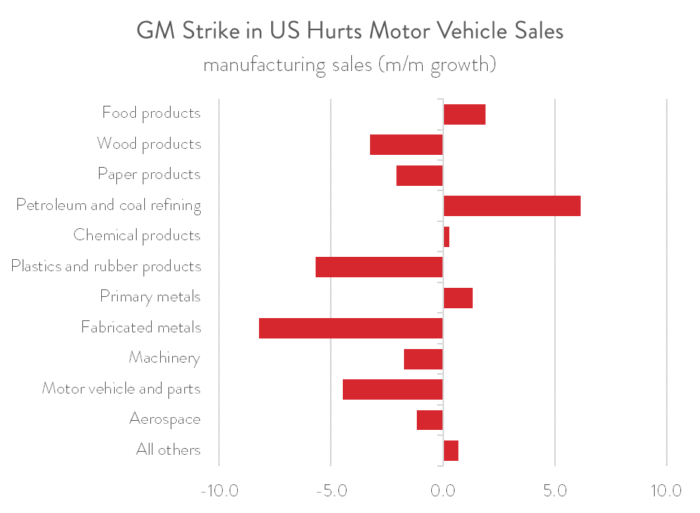

- Motor vehicle and parts sales fell 4.5 per cent, reflecting the impact of the GM strike in the US. Petroleum and coal refining posted its first sales increase in five months.

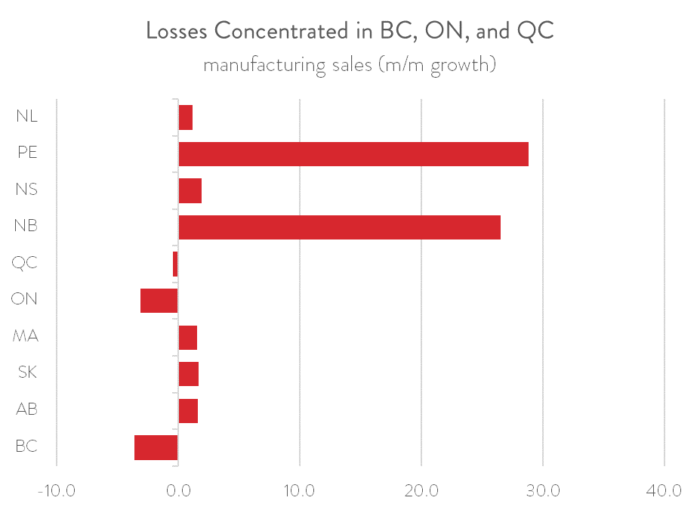

- Declines were concentrated in three provinces: BC, Ontario, and Quebec, with all other provinces posting increases.

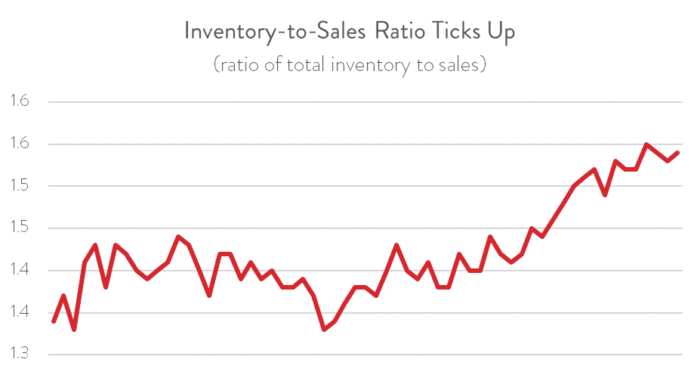

- The inventory-to-sales ratio ticked up in October, while unfilled orders also fell. Both readings are bearish for future production.

- While a share of the blame for the recent slide in sales can be pinned on temporary factors as well as a slowing global economy, this does not diminish the need for policy action to build a much more competitive manufacturing business investment climate.

MANUFACTURING SALES FALL 0.7 PER CENT IN OCTOBER

Manufacturing sales fell 0.7 per cent to $57.1 billion in October, the second consecutive monthly drop. This represents a 2.1 per cent year-over-year decline. In volume terms, sales were down 0.4 per cent on the month and 0.8 per cent on the year. While a share of the blame for the recent slide in sales can be pinned on temporary factors as well as a slowing global economy, this does not diminish the need for policy action to build a much more competitive manufacturing business investment climate.

MOTOR VEHICLE AND PARTS SALES HURT BY GM STRIKE IN THE US

Sales of motor vehicles and parts fell by a steep 4.5 per cent in October, following a more modest 0.2 per cent dip in September. The decline in October reflected lower production at some Canadian plants that were affected by the General Motors strike in the United States. Now that the strike has been resolved, expect this category to rebound in November.

Several other industries also posted declines in October, including fabricated metals, plastics and rubber products, wood and paper products, machinery, and aerospace. These decreases were partly offset by gains in petroleum and coal refining, food products, and primary metals. The 6.2 per cent jump in petroleum and coal refining was this industry’s first increase in five months. Statistics Canada noted that several major refineries ramped up production following shutdowns and maintenance in September. Despite this increase, petroleum and coal refining sales were still down 8.0 per cent on a year-over year basis.

SALES DECLINES CONCENTRATED IN BC, ONTARIO, AND QUEBEC

Sales declines in October were concentrated in three provinces: BC, Ontario, and Quebec. BC saw the biggest decrease at 3.7 per cent, with lower sales in paper and wood products contributing to this result. Sales in Ontario fell 3.1 per cent, not a surprise given the drop in the motor and vehicle parts industry. Sales in Quebec were down a comparatively more modest 0.4 per cent.

On a positive note, all other provinces posted increases in October, with PEI and New Brunswick leading the way with growth of 28.8 per cent and 26.5 per cent, respectively. Sales also rose in all three prairie provinces (Manitoba, Saskatchewan, and Alberta) in October, partly offsetting big declines in September.

INVENTORY-TO-SALES RATIO EDGES UP; UNFILLED ORDERS DIP

Manufacturing inventories also fell in October, but not fast enough to offset the decline in sales. As a result, the ratio of inventory-to-sales ticked up from 1.53 in September to 1.54 in October. This ratio, considered a leading indicator of future production, has been trending up since January 2017. A rising inventory-to-sales ratio is a bearish signal that manufacturers may need to cut back production to better align inventories with sales. This ratio has historically averaged 1.37.

At the same time, unfilled orders also fell by 1.5 per cent to $97.6 billion in October. Excluding the volatile aerospace sector, unfilled orders were down an even steeper 1.9 per cent. Lower unfilled orders also point to slower demand in the coming months. On a positive note, unfilled orders were revised upwards in September from $97.4 billion to $99.0 billion.

All charts are sourced from CME; Statistics Canada.