Canadian Economy

CANADIAN ECONOMY

Canadian Economy Continues to Grind Out Growth; Manufacturing Output Falls for Fifth Time in Seven Months

HIGHLIGHTS

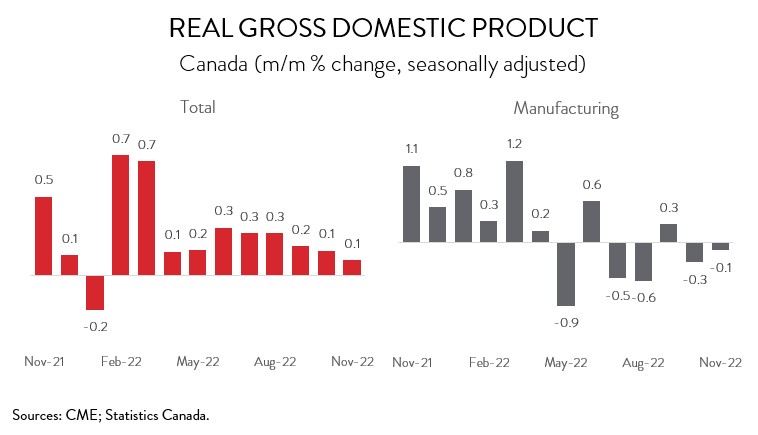

- The Canadian economy edged up 0.1% in November, matching October’s gain. A preliminary estimate indicates that real GDP was essentially unchanged in December.

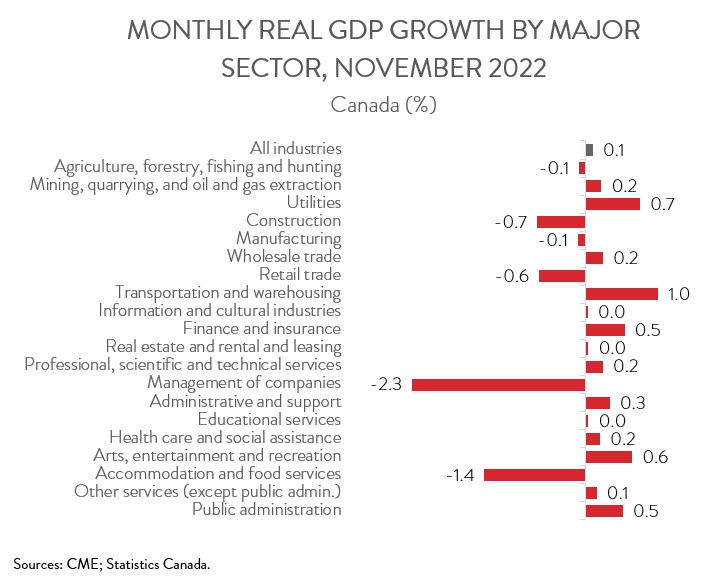

- The increase spanned 14 of 20 industries, with the bulk of the gains coming from the services side of the economy.

- Manufacturing output shrank 0.1% in November, the fifth decline in seven months.

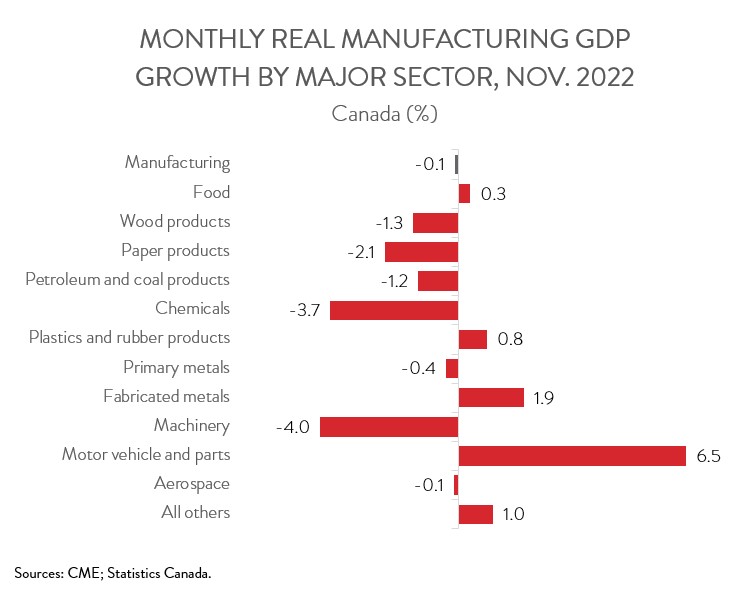

- Output was down in 7 of 11 major manufacturing subsectors, with declines in the chemical and machinery industries more than offsetting an increase in the motor vehicle and parts sector.

- Canada’s manufacturing sector has been struggling to gain traction lately, consistent with the slowdown in global manufacturing activity. This development is predominately the result of softer demand for durable goods and cooler construction activity stemming from the rapid increase in interest rates.

REAL GDP ADVANCES 0.1% IN NOVEMBER

The Canadian economy edged up 0.1% in November, matching October’s gain. A preliminary estimate indicates that real GDP was essentially unchanged in December.

Manufacturing output shrank 0.1% in November, the fifth decline in seven months. Accordingly, the sector’s GDP fell to its lowest level since January 2022, leaving it 0.5% below its pre-pandemic level. Over the past 12 months, manufacturing output has increased by 1.5%, only about half the rate of the overall economy. To make matters worse, an advance estimate indicates that manufacturing sales fell 1.8% in December, suggesting that the sector’s downturn persisted, and possibly steepened, at the end of 2022.

While the Canadian economy has been holding up better than expected, the recent slight gains correspond to a decline in per capita terms. Notably, the manufacturing sector has been struggling to gain traction lately, consistent with the slowdown in global manufacturing activity. This development is predominately the result of softer demand for durable goods and cooler construction activity stemming from the rapid increase in interest rates.

NOVEMBER GAINS DRIVEN BY SERVICES-PRODUCING INDUSTRIES

November’s increase in output spanned 14 of 20 industries. The bulk of the gains came from the services side of the economy (+0.2%), more than offsetting a decline in the goods-producing industries (-0.1%).

The transportation and warehousing sector led the way with a 1.0% gain in November, up for the third month in a row. As noted by Statistics Canada, the transportation sector’s recovery was bolstered by the removal of all COVID-19 border restrictions, including vaccination, mandatory use of the ArriveCAN app, and testing and quarantine requirements for all travellers entering Canada by land, air, or sea on October 1, 2022.

After decreasing for three months in a row, the finance and insurance sector posted an increase of 0.5% in November, its fastest growth since March 2022. The growth in November was driven by gains in household mortgage and non-mortgage debt related to the high interest rate environment and an increase in fixed-term deposits at chartered banks.

The public sector rose 0.3% in November, up for the seventh straight month. Public administration (+0.5%) contributed the most to the growth, followed by health care and social assistance (+0.2%), also up for a seventh month in a row.

On the downside, construction output contracted 0.7% in November. The interest rate sensitive residential building construction subsector was the main driver behind the decrease, registering its seventh decline in eight months and its largest monthly drop since May 2022.

Retail trade output shrank 0.6% in November, led by declines at food and beverages stores, building material and garden equipment and supplies dealers, and general merchandise stores. Notably, the food and beverage stores subsector fell to its lowest level since April 2018, with beer, wine and liquor stores contributing the most to the decline, with still-high inflation weighing on demand.

Finally, the accommodation and food services sector contracted 1.4% in November, down for the first time in four months. After rebounding from the impact of the Omicron variant in the first half of 2022, activity in the food services and drinking places subsector has been essentially flat in recent months.

MANUFACTURING DECLINE LED BY CHEMICAL AND MACHINERY INDUSTRIES

Turning back to manufacturing, output was down in 7 of 11 major subsectors in November. The chemical manufacturing sector contributed the most to the decline, with output shrinking 3.7%. This was the sector’s biggest monthly decrease since May 2021 and was driven by the pharmaceutical and medicine manufacturing subsector.

Machinery manufacturing also had a tough month, with output contracting 4.0% in November, the fourth decline in five months. The sector’s output is down 5.3% since July 2022, with the agricultural, construction and mining machinery and industrial machinery subsectors contributing the most to the decline.

On the plus side, motor vehicle and parts manufacturing output jumped 6.5% in November, the first advance in four months. All three subsectors—motor vehicle, motor vehicle body and trailer, and motor vehicle and parts—were up in the month. Unfortunately, while auto production continues to rebound from depressed levels in mid-2001, output was still 14.0% below its pre-pandemic level in November. Among major manufacturing subsectors, only the aerospace industry has experienced a slower recovery.