Canadian Economy

CANADIAN ECONOMY

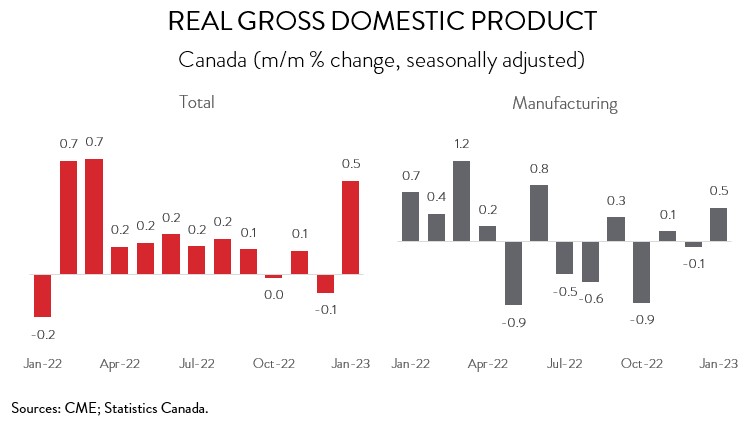

Canadian Economy and Manufacturing Both Make Solid Gains in January

HIGHLIGHTS

- The Canadian economy expanded by 0.5% in January and a flash estimate points to a further 0.3% rise in February.

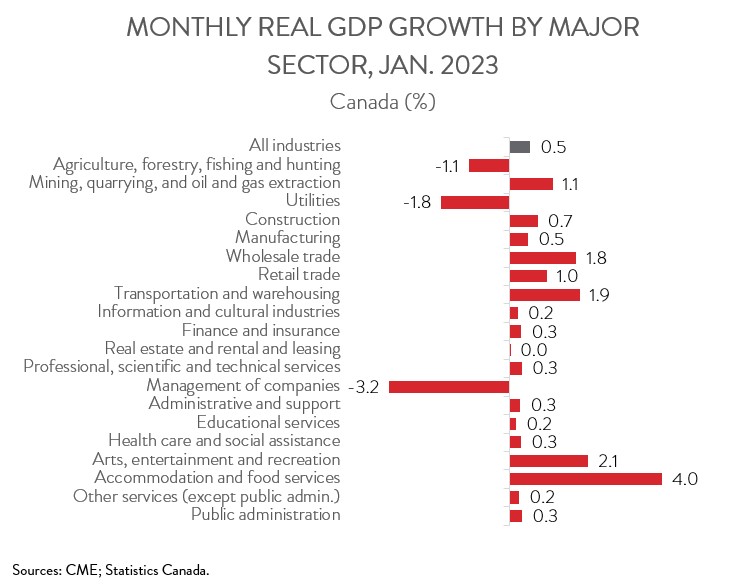

- The increase was widespread, spanning 17 of 20 industries, with wholesale trade, mining and oil and gas, and accommodation and food services contributing the most to the growth.

- The manufacturing sector was also growth driver in January, with output climbing 0.5%. An advance estimate indicates that the sector expanded again in February.

- Output was up in 6 of 11 major manufacturing subsectors, with big gains in the machinery and automotive sectors more than offsetting a notable decline in the chemical industry.

- Although Canada’s manufacturing sector burst out of the gate to start 2023, it struggled to make gains in the second half of 2022 amid rising interest rates, labour shortages, and lingering supply chain issues. With the full impact of rate hikes yet to be felt, spending on interest rate-sensitive goods is expected to remain weak this year, and this will continue to weigh on overall manufacturing activity.

REAL GDP RISES 0.5% IN JANUARY

The Canadian economy expanded by 0.5% in January, bouncing back from a slight contraction of 0.1% in December. A preliminary estimate indicates that real GDP rose a further 0.3% in February. Accordingly, even assuming that March is weak, the economy is on track for somewhere around 2.5% annualized growth in the first quarter, a solid rebound from the flat reading in the final quarter of 2022.

The manufacturing sector kept pace with the overall economy in January, with output rising 0.5%, the strongest monthly gain since June 2022. In more good news, Statistics Canada’s advance estimate indicates that the manufacturing sector expanded again in February.

Nevertheless, while Canada’s manufacturing sector burst out of the gate to start 2023, it struggled to make gains in the second half of 2022 amid rising interest rates, labour shortages, and lingering supply chain issues. As a result, even with January’s solid expansion, manufacturing output has increased by only 0.6% over the past 12 months, well below the overall economy’s 3.0 per cent pace. And, with the full impact of rate hikes yet to be felt, spending on interest rate-sensitive goods is expected to remain weak this year, and this will continue to weigh on overall manufacturing activity.

JANUARY GAINS WIDESPREAD

January’s increase in GDP was broad-based, spanning 17 of 20 industries. The wholesale trade sector led the way with an output gain of 1.8%, more than making up for the declines observed in the previous two months. Wholesalers of construction and industrial equipment drove the increase, coinciding with the LNG Canada construction project importing a large order of machinery and parts.

Mining, quarrying and oil and gas extraction also had a strong month, with output up 1.1% in January. This represented a partial recovery from a sharp drop in December that largely stemmed from unplanned maintenance and a pipeline leak south of the border that disrupted the supply of Canadian crude oil to the Keystone Pipeline System.

Meanwhile, output in the accommodation and food services sector jumped 4.0% in January. Notably, this was the first January without public health restrictions since the start of the pandemic.

Lastly, the transportation and warehousing sector posted output growth of 1.9% in January. This more than offset a 1.1% decline in December that was partly caused by bad weather conditions late in the month that disrupted holiday travel.

MANUFACTURING INCREASE LED BY MACHINERY AND AUTOMOTIVE INDUSTRIES

Turning back to manufacturing, output was up in 6 of 11 major subsectors in January. Output in the machinery manufacturing sector surged 6.3%, building on the 0.8% gain in December. January’s increase was predominately driven by agriculture, construction and mining machinery manufacturing and other general-purpose machinery manufacturing.

Motor vehicle and parts output expanded an impressive 6.4% in January, the third consecutive monthly advance. While still 4.5% shy of its pre-covid levels, Canada’s automotive sector has expanded by nearly 30.0% over the past 12 months, further indication that supply chain disruptions and shipping capacity constraints that have severely hindered production are continuing to ease.

Fabricated metal manufacturing also had a solid month, with output up 4.1% in January, the second increase in three months. The gains were driven by two subsectors: architectural and structural metals manufacturing and machine shops, turned product, and screw, nut and bolt manufacturing.

On the negative side, output in the chemical manufacturing subsector plummeted 6.3% in January, the biggest monthly decline since April 2020. The pharmaceutical and medicine manufacturing industry contributed the most to the decline.