Canadian Economy

CANADIAN ECONOMY

Canadian Economy Edges Up in February, but Manufacturing Output Falls

HIGHLIGHTS

- The Canadian economy edged up 0.1% in February, but a flash estimate points to a 0.1% decline in March.

- The increase spanned 12 of 20 industries, with the public sector, professional, scientific and technical services, and construction contributing the most to the growth.

- Manufacturing activity continued its seesaw pattern of recent months, as output edged down 0.1% in February on the heels of a 1.0% gain in January.

- Output was down in 5 of 11 major manufacturing subsectors, with losses in the petroleum and coal product and paper sectors more than offsetting increases in the chemical and machinery industries.

- Manufacturing activity is expected to remain weighed down over the near term amid a shaky global economic backdrop.

REAL GDP EDGES UP 0.1% IN FEBRUARY

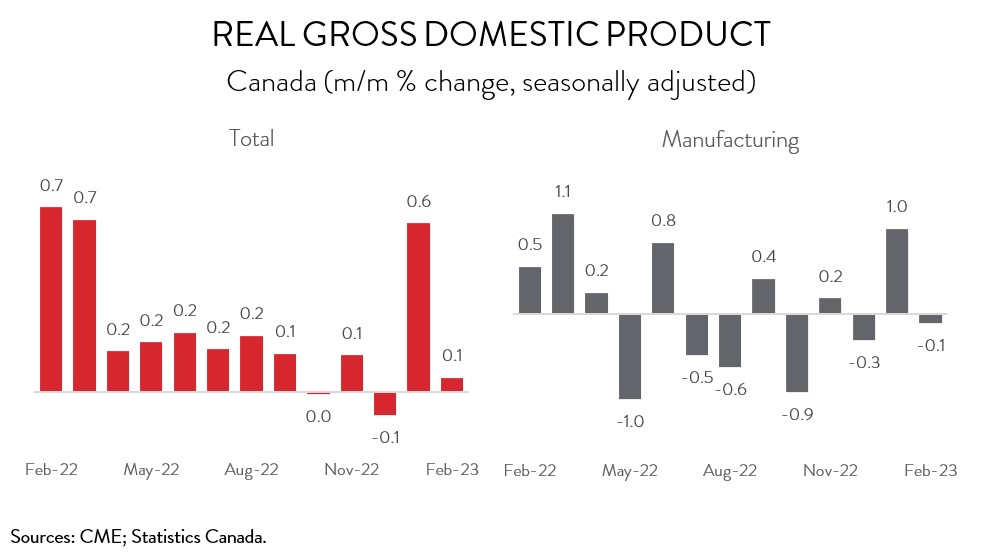

The Canadian economy edged up 0.1% in February, building on the 0.6% gain in January. However, a preliminary estimate indicates that real GDP declined by 0.1% in March. This suggests that the economy is on track for somewhere around 2.5% annualized growth in the first quarter, a solid rebound from the flat reading in the final quarter of 2022. Nevertheless, the weak end to Q1, combined with the impact of the public sector strike, raises the odds that the economy will contract in Q2.

Manufacturing activity continued its seesaw pattern of recent months, as output edged down 0.1% in February on the heels of a 1.0% gain in January. Canada’s manufacturing sector is struggling to gain traction in a challenging economic environment characterized by a sharp rise in borrowing costs, the pandemic’s aftereffects, and geopolitical conflicts. As a result, manufacturing output has increased by a sluggish 0.4% over the past 12 months, well below the overall economy’s 2.5% pace.

Unfortunately, manufacturing activity is expected to remain weighed down over the near term amid a shaky global economic backdrop. On a positive note, pent-up demand for new vehicles and easing supply constraints should allow auto production to gradually return to pre-pandemic levels, limiting the slowdown in manufacturing growth.

FEBRUARY GAINS POWERED BY THE PUBLIC SECTOR, PROFESSIONAL SERVICES, AND CONSTRUCTION

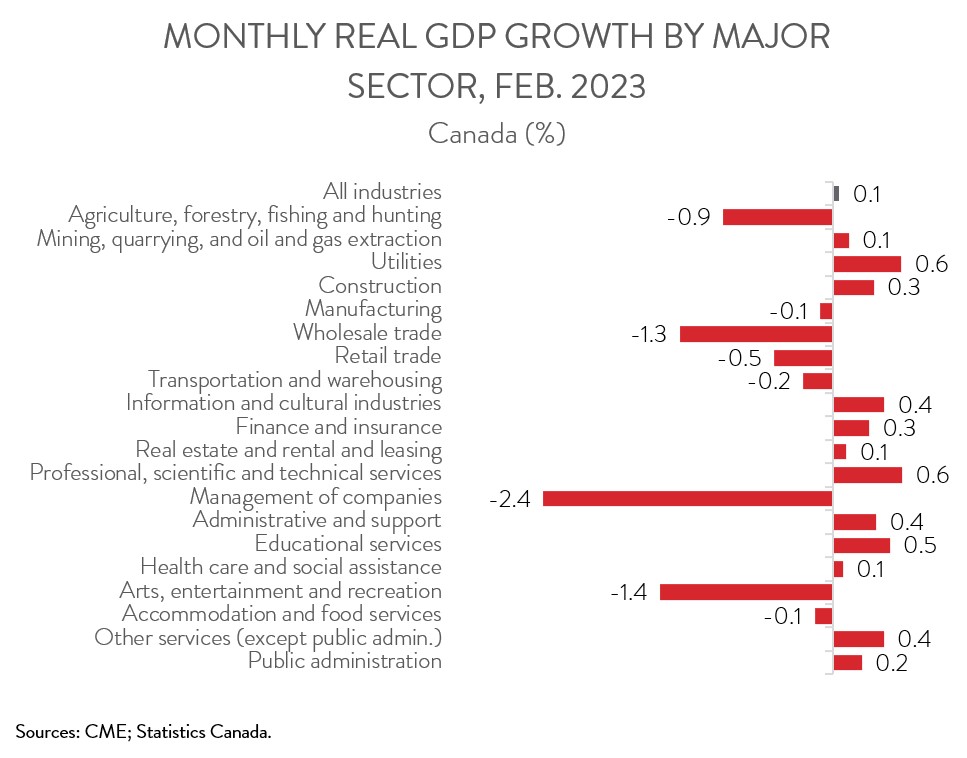

February’s increase in GDP spanned 12 of 20 industries. Output in the public sector (educational services, health care and social assistance, and public administration) expanded by 0.2% in February, extending its streak of monthly gains to thirteen months. However, this streak is set to be broken in April due to the ongoing public sector strike.

Professional, scientific, and technical services also had a strong month, with output rising 0.6% in February. Seven of nine subsectors posted gains, with computer systems design and related services ranking among the top contributors to growth.

Construction output climbed by 0.3% in February, advancing for the fifth straight month. Nevertheless, despite the recent gains, output has increased by a modest 0.6% over the past 12 months, attributable to the sector’s high sensitivity to interest rates.

On the downside, wholesale trade output contracted 1.3% in February, the third decline in four months. At the same time, retail trade output fell by 0.5%, down for the first time in three months and driven by significantly weaker activity at gasoline stations.

MANUFACTURING OUTPUT DECLINE DRIVEN BY THE PETROLEUM AND COAL PRODUCT AND PAPER INDUSTRIES

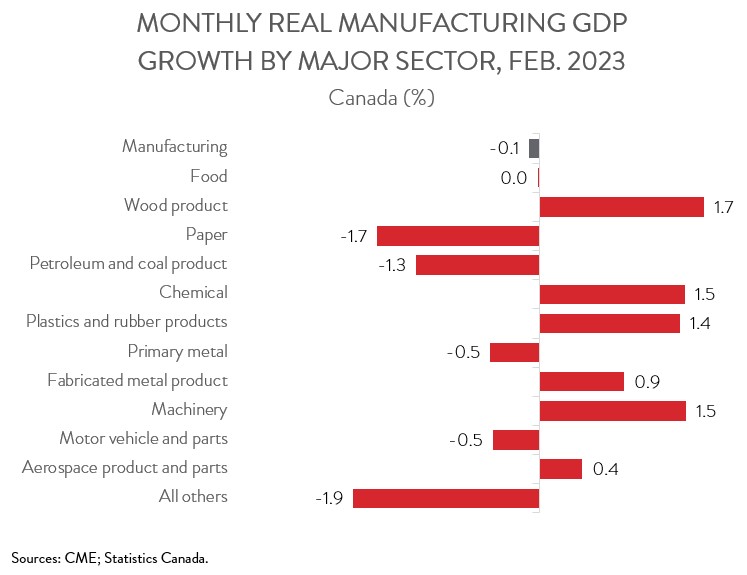

Turning back to manufacturing, output was down in 5 of 11 major subsectors in February. The petroleum and coal product sector contributed the most to the decline, with output dropping by 1.3% in February. Statistics Canada attributed the weakness to maintenance-related shutdowns and lower demand for heating fuel amid mild weather in most of Europe and the US.

At the same time, paper manufacturing output fell by 1.7%, down for the third time in four months. Both subsectors—pulp, paper and paperboard mills and converted paper product manufacturing—contributed to the decline.

After posting substantial growth over the past three months, motor vehicle and parts output pulled back by 0.5% in February. Despite the setback, Canada’s automotive industry has expanded by 20.0% over the past 12 months, attributable to easing supply constraints.

On the positive side of the ledger, chemical manufacturing output expanded by 1.5% GDP in February, partially offsetting the large 7.9% drop in January. The increase was driven by a big rebound in the pharmaceutical and medicine manufacturing industry.

Machinery manufacturing output also climbed by 1.5% in February, up for the third straight month. Two of seven subsectors were responsible for the lion’s share of the growth: agricultural, construction and mining machinery manufacturing and industrial machinery manufacturing.