Canadian Economy

CANADIAN ECONOMY

Economy Rebounds in First Quarter; Manufacturing Output Down 0.6% in March

HIGHLIGHTS

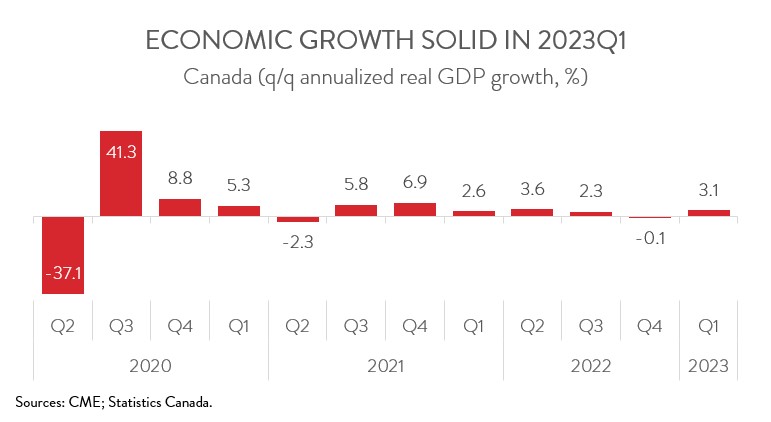

- After posting no change in the fourth quarter of 2022, the Canadian economy expanded at an annualized rate of 3.1% in the first quarter of 2023.

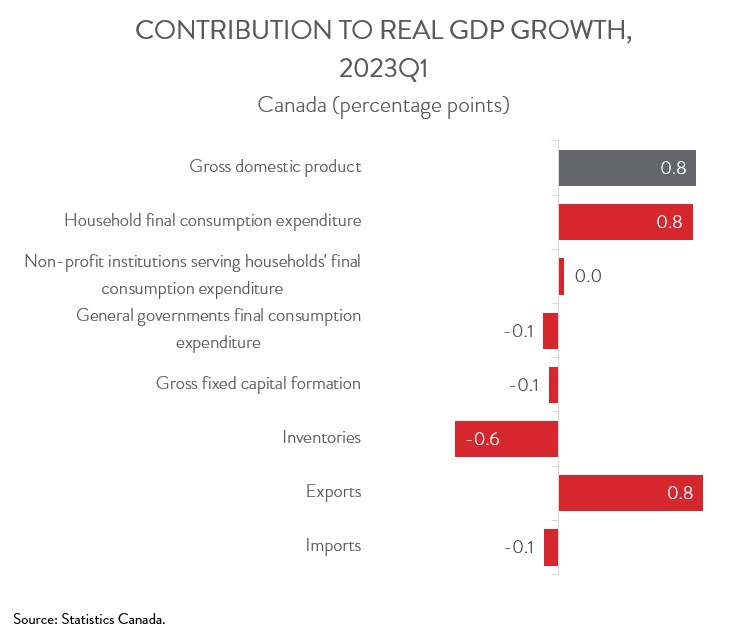

- The first quarter gains were driven by exports and consumer spending.

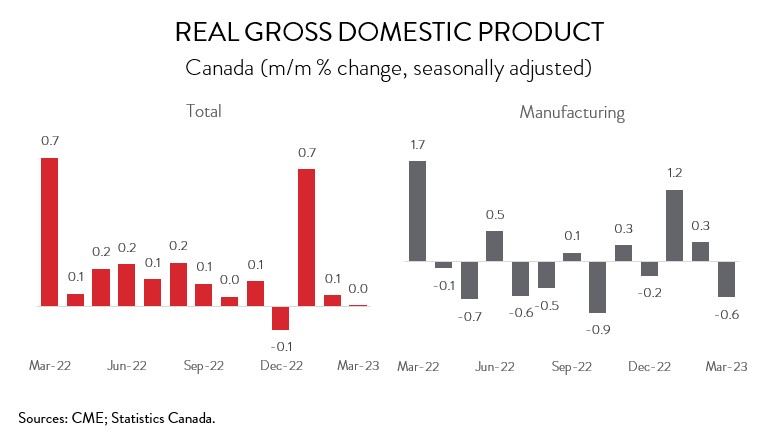

- Real GDP was essentially unchanged in March, while a preliminary estimate indicates that real GDP increased 0.2% in April.

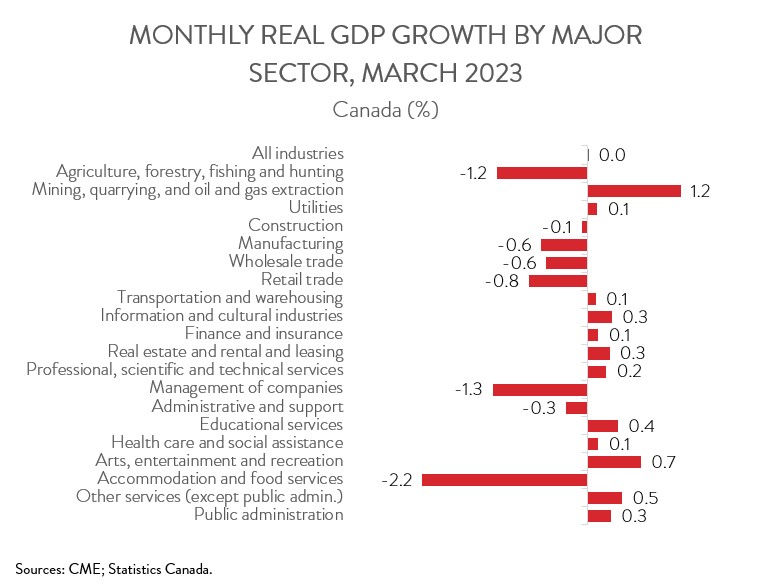

- Increases were observed in 12 of 20 industries in March, with mining, quarrying, and oil and gas extraction posting the biggest gain.

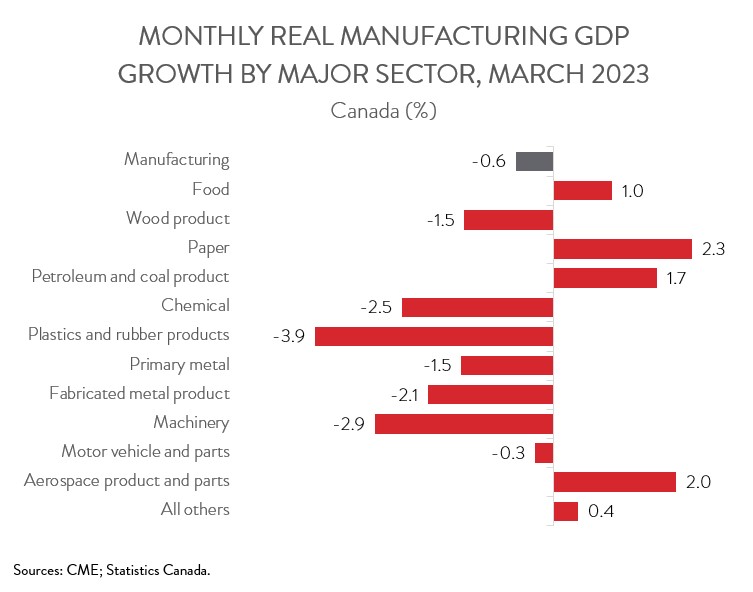

- Manufacturing output fell 0.6% in March and was down 1.1% on a year-over-year basis.

- Output contracted in 7 of 11 major manufacturing subsectors, led by the machinery, chemical, and plastics and rubber products industries.

- The Canadian economy started the year on a solid footing, and it had a little bit more momentum heading into the second quarter than was widely expected. While most analysts still think that the Bank of Canada will keep its key interest rate steady next week, it may be compelled to hike again during the summer if the economic data continue to surprise on the upside.

REAL GDP UP 3.1% IN FIRST QUARTER

After posting no change in the fourth quarter of 2022, the Canadian economy expanded at an annualized rate of 3.1% in the first quarter of 2023. This was the fastest pace of growth since 2022Q2.

The Canadian economy started the year on a solid footing, and it had a little bit more momentum heading into the second quarter than was widely expected. As of now, it looks like real GDP will post modest growth in Q2, despite the negative impacts of the public service strike and Alberta wildfires. While most analysts still think that the Bank of Canada will keep its key interest rate steady next week, it may be compelled to hike again during the summer if the economic data continue to surprise on the upside.

EXPORTS AND CONSUMER SPENDING DRIVE FIRST QUARTER GAINS

Exports of goods and services rose 10.1% at an annualized rate in the first quarter of 2023, led by passenger cars and light trucks. With imports coming in at a relatively flat 0.9%, net trade was a big growth driver in Q1. At the same time, after two quarters of minimal growth, household spending rose 5.7% in Q1. Durable goods spending was particularly strong, boosted by motor vehicle purchases.

Gains in those expenditure categories were sufficient to overcome a big drop in residential investment, which recorded an annualized drop of 14.6% in Q1. This was the fourth straight quarterly decline and coincides with higher borrowing costs and slowing mortgage borrowing. At the same time, while total non-residential business investment posted a modest gain of 3.3% in Q1, spending on machinery and equipment was down for the third quarter in a row. This bodes ill for Canada’s already weak productivity growth.

REAL GDP UNCHANGED IN MARCH

Turning to the monthly data, real GDP was essentially unchanged in March, following a 0.1% gain in February. A preliminary estimate indicates that real GDP increased 0.2% in April.

After increasing in the previous two months, manufacturing activity contracted 0.6% in March, the biggest decline among 20 major industries. As a result, real manufacturing GDP has decreased 1.1% over the last 12 months, as the sector continues to be hampered by higher borrowing costs and the ongoing post-COVID shift to spending on services.

MINING, QUARRYING AND OIL AND GAS EXTRACTION EXPANDS FOR THIRD STRAIGHT MONTH

Increases were observed in 12 of 20 industries in March. Mining, quarrying, and oil and gas extraction led the way with a 1.2% gain, its third consecutive monthly increase. All subsectors were up, with oil sands extraction contributing the most to the growth.

Output in the public sector (educational services, health care and social assistance, and public administration) expanded by 0.3% in March, extending its streak of monthly gains to fourteen months. However, this streak was likely broken in April due to the public service strike.

The real estate and rental and leasing sector also had a good month, with output up 0.3% in March, its fastest pace of growth since February 2022. The sector received a boost from a rebound in home sales and a pick-up in rental and leasing activity that coincides with a slight easing in the shortage of rental cars.

On the negative side, accommodation and food services output tumbled 2.2% in March, its largest monthly decline since January 2022. This sector has yet to fully recover from the pandemic, with output 5.6% below its February 2020 level. At the same time, retail trade output fell 0.8%, as motor vehicle and parts dealers experienced their first decline in eight months. Meanwhile, wholesale trade output contracted 0.6% in March, down for the fourth time in five months.

DECLINE IN MANUFACTURING BROAD-BASED ACROSS INDUSTRIES

Turning back to manufacturing, output was down in 7 of 11 major subsectors in March. The machinery industry contributed the most to the decline, with output dropping by 2.9% in March. The decrease was largely attributable to the agricultural, construction and mining machinery manufacturing industry.

The chemical industry also had a tough month, with output down 2.5% in March. The pharmaceutical and medicine manufacturing industry contributed the most to the decline.

At the same time, plastics and rubber products manufacturing GDP contracted 3.9% in March, the first decline in three months. Plastic product manufacturing fell steeply, while rubber product manufacturing edged down slightly.

On the positive side of the ledger, food manufacturing output climbed 1.0% in March. Increases were observed in seven of nine subsectors, led by bakeries and tortilla manufacturing.

Activity in the petroleum and coal product manufacturing industry was up 1.7% in March, more than making up for the 1.4% decline in February. The gain was concentrated in petroleum refineries.

Finally, paper manufacturing rose 2.3% in March, only its second increase in five months. Converted paper product manufacturing drove the gain.