Canadian Economy

CANADIAN ECONOMY

Canadian Economy Flat in April; Manufacturing Output Shrinks 0.6%

HIGHLIGHTS

- Real GDP was essentially unchanged in April, while a preliminary estimate indicates that real GDP increased 0.4% in May.

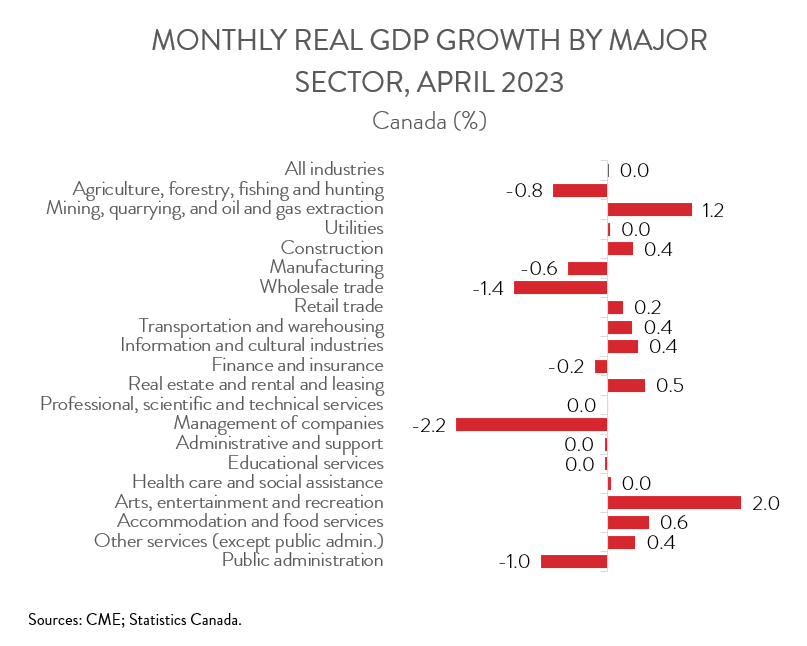

- Increases were observed in 11 of 20 industries in April, led by the mining, quarrying, and oil and gas extraction and real estate and rental and leasing sectors.

- The federal government workers’ strike weighed down public administration output.

- Manufacturing output fell 0.6% in April and was down 0.9% year-over-year.

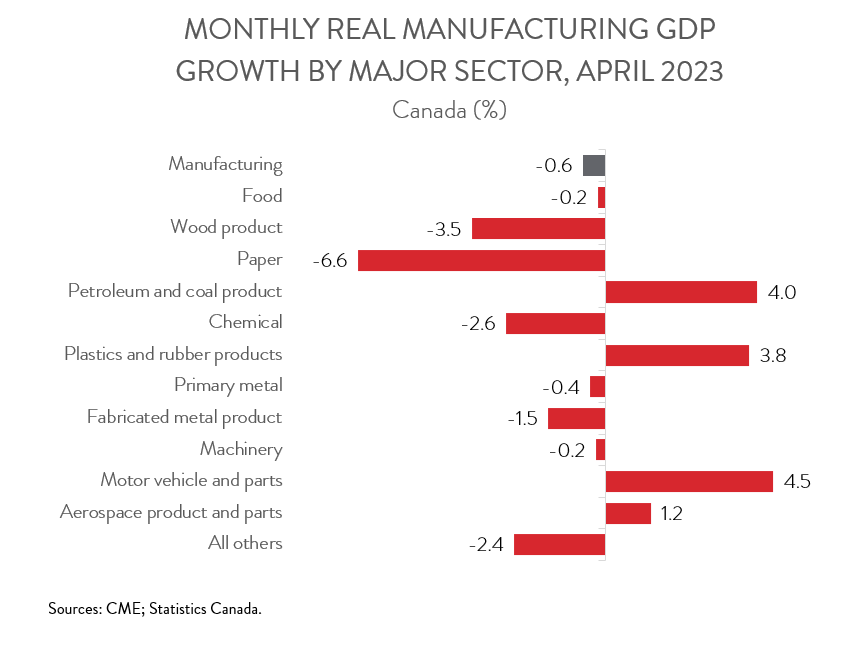

- Output contracted in 7 of 11 major manufacturing subsectors, with the biggest declines recorded in the chemical and paper industries and the strongest gains posted in the motor vehicle and parts and petroleum and coal product sectors.

- The Canadian economy continues to show resilience amid a rapid rise in interest rates. Still, analysts remain split on whether the Bank of Canada will hike interest rates again in July. Next week’s labour force survey may be the deciding factor.

REAL GDP UNCHANGED IN APRIL

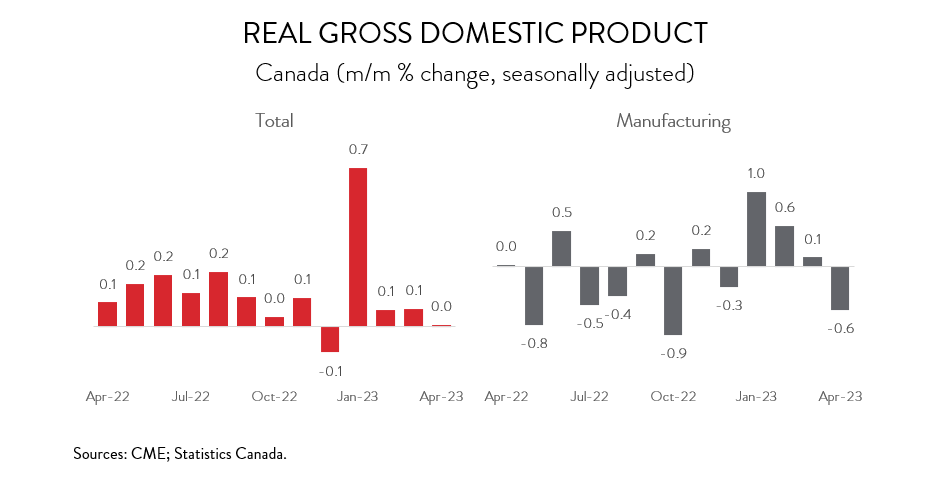

Real GDP was essentially unchanged in April, following a slight uptick in March (+0.1%). A preliminary estimate indicates that real GDP increased 0.4% in May.

After increasing in the previous three months, manufacturing activity contracted 0.6% in April. Taking a longer-term view, real manufacturing GDP has decreased by 0.9% over the past year, as the sector continues to be hampered by high borrowing costs and the ongoing post-COVID shift to spending on services. On a positive note, today’s report signaled that manufacturing activity bounced back in May.

All in all, the Canadian economy continues to show resilience amid a rapid rise in interest rates, posting only one negative monthly reading in the past 15 months. Factoring in the advance estimate for May, growth in the second quarter is tracking at around 1.4% annualized, overshooting the Bank of Canada’s most recent estimate of 1.0%. Still, analysts remain split on whether the BoC will hike interest rates again in July. Next week’s labour force survey may be the deciding factor.

PUBLIC SECTOR CONTRACTS FOR FIRST TIME SINCE JANUARY 2022

Increases were observed in 11 of 20 industries in April. Mining, quarrying, and oil and gas extraction led the way with a 1.2% gain, its fourth consecutive monthly increase. All subsectors were up, with oil and gas extraction (except oil sands) contributing the most to the growth, thanks to an increase in production off Canada’s North Atlantic coast.

The real estate and rental and leasing sector expanded by 0.5% in April, up the for the sixth consecutive month and the biggest monthly gain since December 2020. A swift turnaround in Canada’s resale housing market fueled strong growth in two industry groups: offices of real estate agents and brokers and activities related to real estate.

Construction output rose 0.4% in April, as an increase in non-residential investment more than offset lower residential construction activity. Notably, the construction of a new manufacturing building in Bécancour, Quebec helped industrial building construction continue its uninterrupted expansion that started in April 2022.

On the negative side, the public sector (educational services, health care and social assistance and public administration) experienced its first decline in output since January 2022, down 0.3% in April. While both educational services and health care and social assistance stayed flat, the federal government workers’ strike drove down public administration activity.

In more bad news, wholesale trade contracted 1.4% in April, the third consecutive monthly decrease. Activity was down in six of nine subsectors, with miscellaneous merchant wholesalers contributing the most to the decline. Thankfully, activity at motor vehicle and motor vehicle parts and accessories wholesalers jumped in April, providing one of the few bright spots for the flagging sector.

MANUFACTURING DECLINE DRIVEN BY CHEMCIAL AND PAPER INDUSTRIES

Turning back to manufacturing, output was down in 7 of 11 major subsectors in April. The chemical manufacturing industry contributed the most to the decrease, with output contracting 2.6% in April. Declines in pharmaceutical and medicine manufacturing and in basic chemical manufacturing more than offset a solid advance in pesticide, fertilizer and other agricultural chemical manufacturing.

The paper manufacturing industry also had a tough month, down 6.6% in April, partly attributable to a curtailment of production in B.C. Paper manufacturing output has contracted 13.1% over the past 12 months.

On the positive side of the ledger, output in the motor vehicle and parts sector rose 4.5% in April, up for the sixth consecutive month and surpassing its pre-pandemic level for the first time. The increase in April was largely driven by higher production of engines and other motor vehicle parts.

Finally, petroleum and coal product output expanded 4.0% in April, building on the 2.9% gain in March. The increase was fueled by activity at petroleum refineries, which saw its output climb to its highest level since February 2022.