Canadian Economy

CANADIAN ECONOMY

Canadian Economy Grew 0.3% in May, but a Downturn Projected in June

HIGHLIGHTS

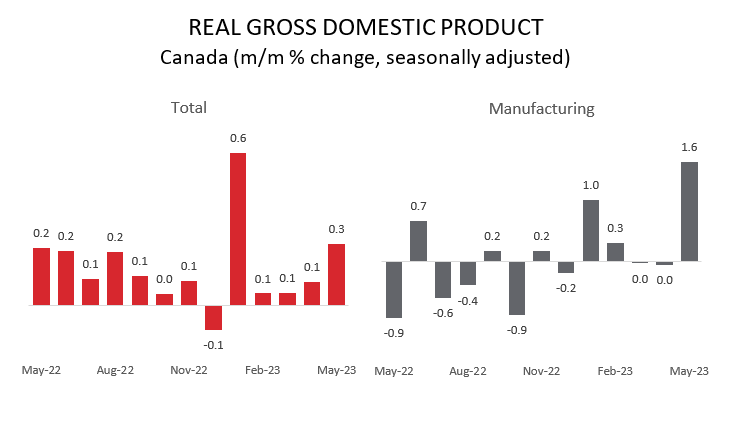

- Real GDP climbed 0.3% in May, the fifth straight monthly increase. However, a preliminary estimate indicates that the economy contracted 0.2% in June.

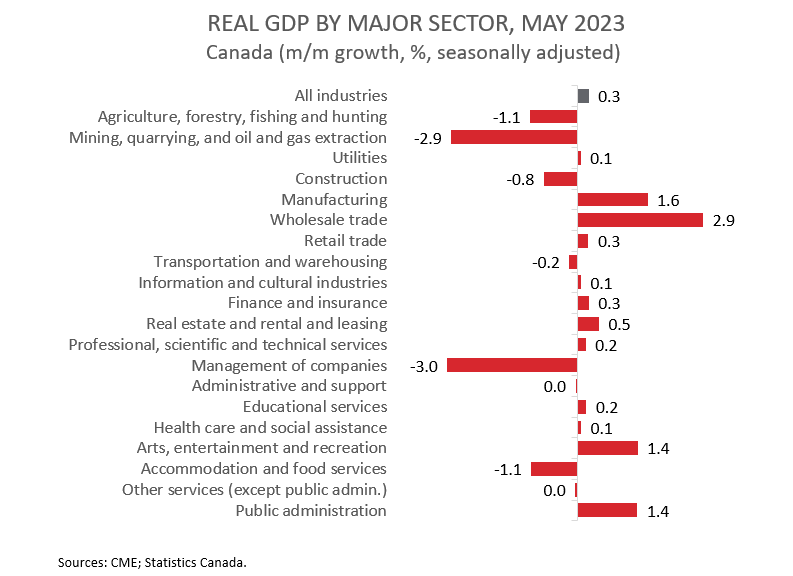

- Increases were observed in 12 of 20 industries in May, led by the manufacturing, wholesale trade, and public administration industries.

- Manufacturing output rose 1.6% in May, the biggest monthly advance since October 2021.

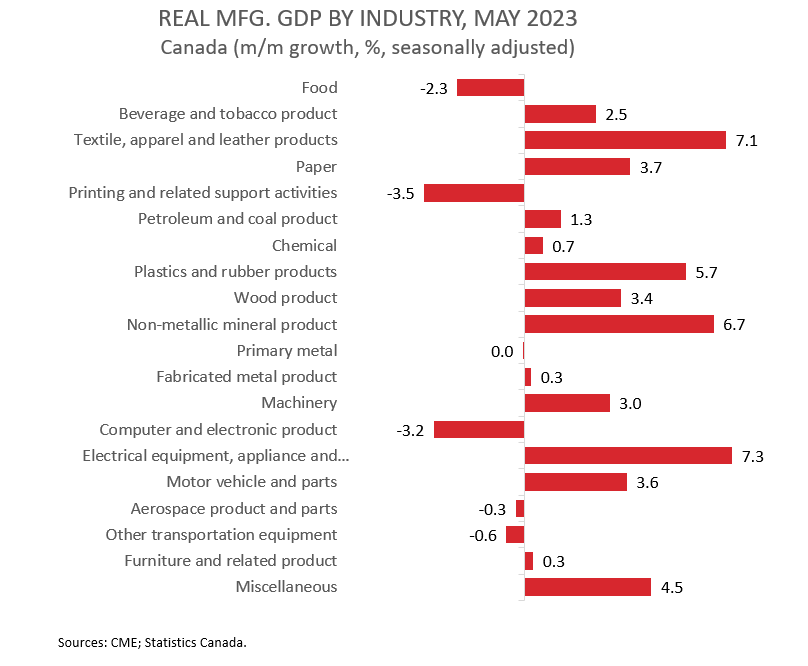

- Output was up in 14 of 20 manufacturing subsectors, with the biggest gain recorded in plastics and rubber products and the steepest loss observed in food manufacturing.

- On the negative side, wildfires curtailed production in the energy sector.

- Economic momentum appears to be fading, with the June estimate providing a weak hand-off to the third quarter and with growth in July likely to feel the pinch of the BC port strike.

REAL GDP UP FOR FIFTH STRAIGHT MONTH IN MAY

Real GDP climbed 0.3% in May, the fifth straight monthly increase. However, a preliminary estimate indicates that the economy contracted 0.2% in June.

After two flat months, manufacturing activity bounced back with a 1.6% increase in May, the biggest contributor to growth among major industries. This was also the sector’s largest monthly advance since October 2021.

Taking a longer-term view, real manufacturing GDP has grown by 1.9% over the past year, a decent showing considering that the sector continues to be hampered by high borrowing costs and the ongoing post-COVID shift to spending on services. On a negative note, today’s report signaled that manufacturing activity contracted in June.

Factoring in the advance estimate for June, Canada’s real GDP growth in the second quarter is tracking around 1.0% annualized, 0.5 percentage points below the Bank of Canada’s most recent forecast. Economic momentum appears to be fading, with the June estimate providing a weak hand-off to the third quarter and with growth in July likely to feel the pinch of the BC port strike.

IMPROVING SUPPLY CHAINS BOOST MANUFACTURING AND WHOLESALE TRADE

Increases were observed in 12 of 20 industries in May. Along with manufacturing, the wholesale trade sector also had a strong showing, with output up 2.9% in May, led by big gains among machinery, equipment and supply wholesalers and motor vehicle and motor vehicle parts and accessories wholesalers. Statistics Canada chalked up the robust growth in manufacturing and wholesale trade to the continued improvement in supply chains.

At the same time, public sector output climbed 0.6% in May. The federal government public administration subsector contributed the most to the growth, as the majority of workers represented by the Public Service Alliance of Canada labour union returned to work in May following strike action that began in April.

Real estate and rental and leasing rose 0.5% in May, thanks to a big jump in activity at the offices of real estate agents and brokers and activities related to real estate. The growth in these subsectors was driven by higher home reselling activity in many of Canada’s major markets, including the Greater Toronto Area, Montreal, and Vancouver.

On the downside, output in the mining, quarrying, and oil and gas extraction sector plunged 2.9% in May, the first decline in five months and the largest since November 2021. In particular, forest fires in Alberta drove a steep decline in the oil and gas extraction subsector.

In more unwelcome news, construction output contracted 0.8% in May, as almost all subsectors posted declines. Residential building construction contributed the most to the decrease, driven by declines in home alterations and improvement and construction of new single-detached homes. Non-residential building construction also contracted in May, posting its first decline in five months.

MANUFACTURING INCREASE DRIVEN BY PLASTICS AND RUBBER PRODUCTS

Turning back to manufacturing, output was up in 14 of 20 subsectors in May. The plastics and rubber products manufacturing industry contributed the most to the increase, with output rising 5.7% in May. This was just the sector’s second increase in five months.

Meanwhile, activity in the motor vehicle and parts sector remained on an upward trend, with output climbing 3.6% in May. The auto industry has expanded by nearly one-quarter over the last year, fastest among all manufacturing subsectors, as the improved supply of semiconductors has continued to help boost production.

Machinery manufacturing rose 3.0% in May, the fourth increase in five months. The increase in May was driven by two subsectors: agricultural, construction and mining machinery manufacturing and commercial and service industry machinery manufacturing.

On the negative side, food manufacturing output contracted 2.3% in May, down for the first time in three months. The decline spanned 6 of 9 subsectors, with the steepest losses coming in seafood product preparation and packaging and meat product manufacturing. These declines were partly offset by a solid advance in grain and oilseed milling.