CANADIAN ECONOMY

Economy Unexpectedly Contracts in Second Quarter; Manufacturing Output Flat in June

HIGHLIGHTS

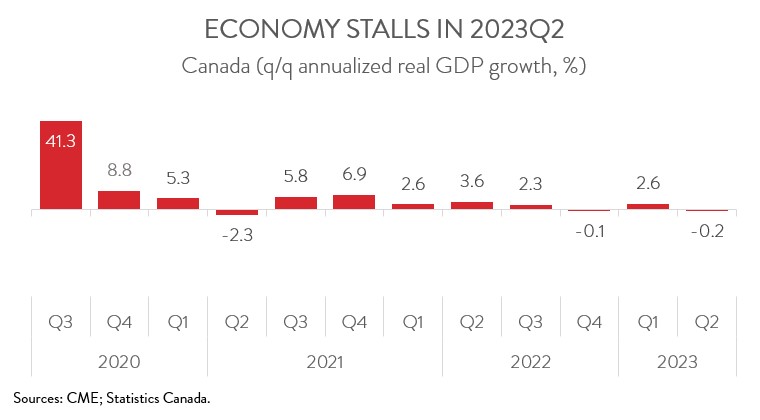

- The Canadian economy inched down 0.2% at an annualized rate in the second quarter of 2023, well below the consensus estimate of a 1.2% rise.

- The slowdown was attributable to continued declines in housing investment, smaller inventory accumulation, as well as slower exports and household spending.

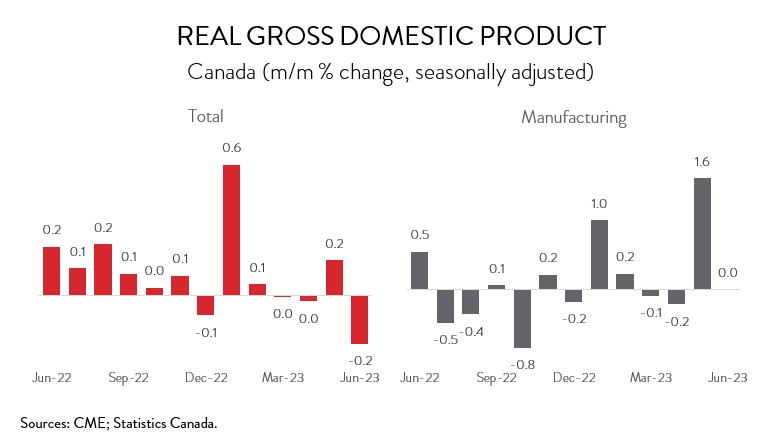

- Real GDP contracted 0.2% in June and, according to a preliminary estimate, was essentially unchanged in July.

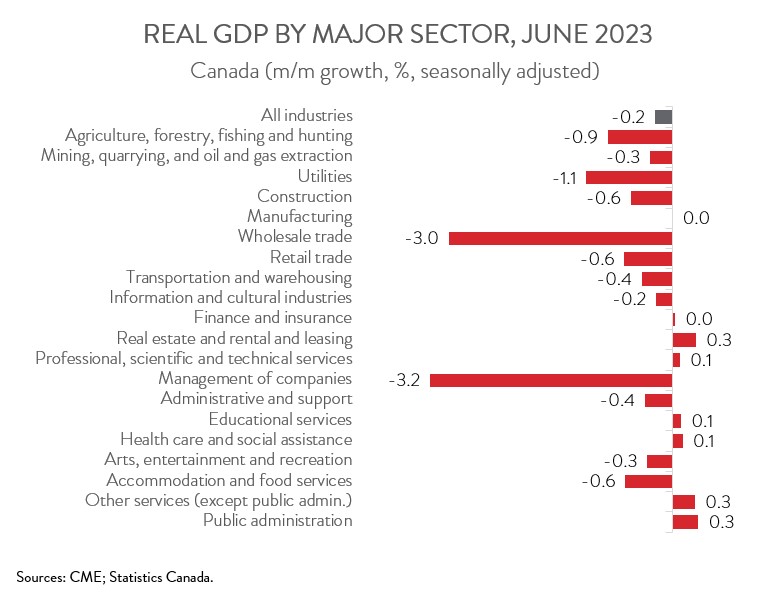

- Decreases were observed in 12 of 20 industries in June, with wholesale trade contributing the most to the decline.

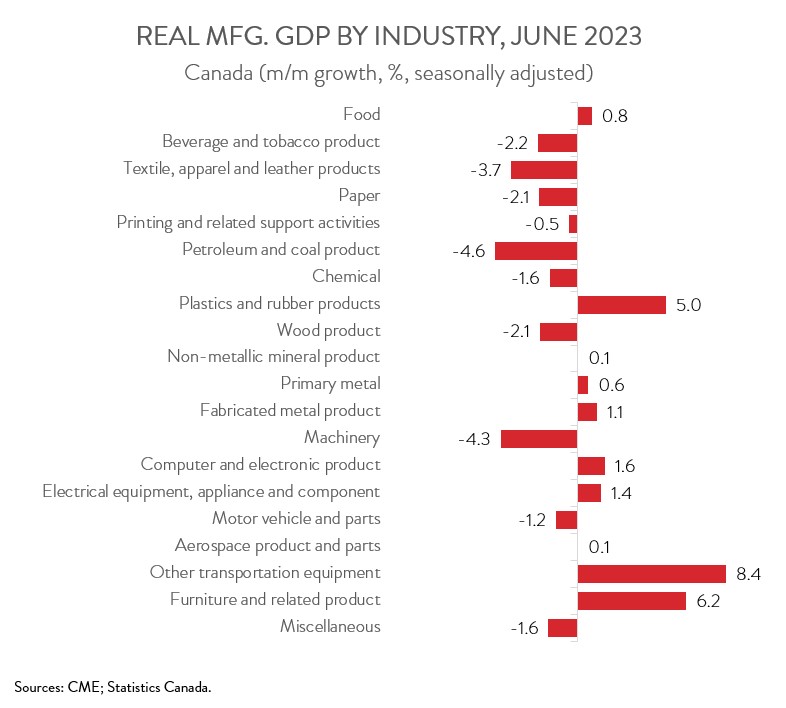

- Manufacturing output was flat in June and was up a modest 1.0% on a year-over-year basis.

- Output increased in 10 of 20 manufacturing subsectors, with plastics and rubber products posting the biggest gain and machinery manufacturing recording the steepest loss.

- With GDP shrinking in June and the BC port strike taking a bite out of the economy in July, there is a reasonable chance we will see the economy shrink in the third quarter. This is substantially weaker than the Bank of Canada’s current projection of 1.5% growth. This all but rules out an interest rate hike from the Bank at its September 6th.

REAL GDP CONTRACTS SLIGHTLY IN SECOND QUARTER

The Canadian economy inched down 0.2% at an annualized rate in the second quarter of 2023, following a 2.6% gain in the first quarter. This was well below the consensus estimate of a 1.2% rise.

With GDP shrinking in June and the BC port strike taking a bite out of the economy in July, there is a reasonable chance we will see the economy shrink in the third quarter. This is substantially weaker than the Bank of Canada’s current projection of 1.5% growth. This all but rules out an interest rate hike from the Bank at its September 6th meeting.

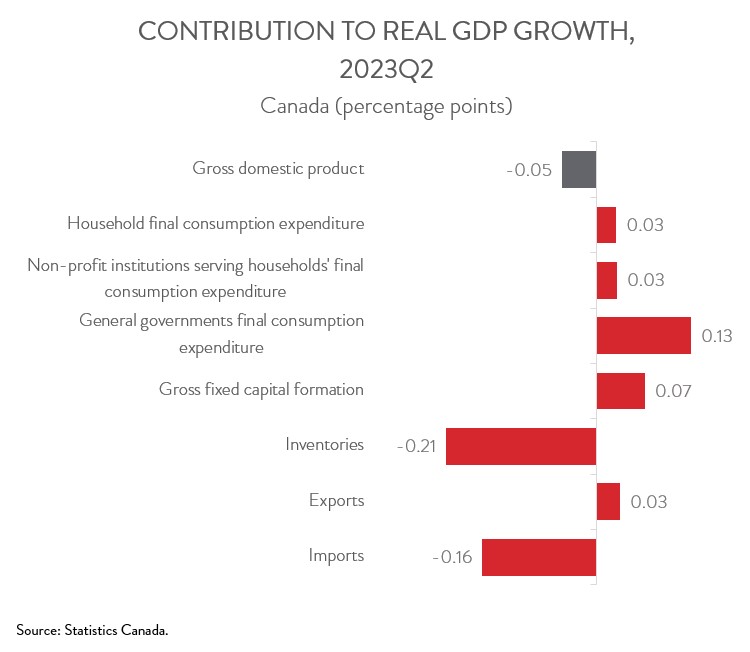

HOUSING INVESTMENT REMAINS DRAG ON GROWTH

Housing investment continued to feel the pinch of higher interest rates, falling 8.2% in the second quarter, the fifth consecutive quarterly decrease. Slower inventory investment was also a drag, subtracting 0.8 percentage points from headline growth. Likewise, with imports rising more than exports, net trade cut 0.5 percentage points from GDP. Finally, household spending slowed sharply, rising at a meagre 0.2% annualized rate in the second quarter, following a 4.7% advance in Q1. On the plus side, business investment on buildings and machinery and equipment climbed a solid 10.3% in Q2, though it still remains well below its 2014 peak.

REAL GDP SHRINKS IN JUNE

Turning to monthly data, real GDP contracted 0.2% in June and, according to a preliminary estimate, was essentially unchanged in July. Excluding a burst of growth in January, the Canadian economy has been basically stagnant all year.

WHOLESALE TRADE PLUNGES

Decreases were observed in 12 of 20 industries in June. Wholesale trade was the biggest contributor to the decline, falling 3.0% and more than erasing the 2.1% gains made in May.

Construction output was down for the second month in a row, decreasing 0.6% in June. Residential building construction has decreased in 14 of the last 15 months.

Wildfires disrupted activity in many industries. Mining and quarrying (except oil and gas) fell 5.7% in June, its largest monthly decline since November 2021, as all subsectors were down in the month. As well, rail transportation plunged 6.6%, its fourth decline in five months. Finally, accommodation and food services dipped 0.6% in June, with forest fires restricting or limiting activity at a number of camping grounds.

On the plus side, oil and gas extraction output rose 1.1% in June, partly offsetting a 3.4% drop in May when wildfires in Alberta impacted the sector. In more good news, real estate and rental and leasing rose 0.3% in June, up for the eighth straight month. Finally, the public sector (educational services, health care and social assistance, and public administration) expanded 0.2% in June, the second consecutive monthly advance. Public administration led the way, as it continued to rebound from the effects of a federal public service strike in April and May.

MANUFACTURING FLAT IN JUNE, DOWN IN JULY

Manufacturing output was flat in June. Still, thanks to robust growth in May, the sector expanded at a 3.6% annualized clip in the second quarter, down only slightly from a 4.4% advance in Q1. The sector’s strong showing in the second quarter was largely attributable to the continued improvement in supply chains, with transportation equipment manufacturing contributing the most to growth.

Unfortunately, the positive momentum is fading. Output contracted in March and April and, according to Statistics Canada’s flash estimate, fell again in July. The near-term outlook remains cloudy, with soft foreign demand expected to weigh on export growth.

Digging deeper, output was up in 10 of 20 major manufacturing subsectors in June. The plastics and rubber products industry made the biggest contribution to growth, with output rising 5.0% in June. However, even with this gain, the sector’s output was down 7.5% year-over-year.

Big increases were also observed in furniture and related product (+6.2%) and in other transportation equipment (+8.4%). The other transportation equipment sector has posted vigorous growth for three consecutive months, a rare piece of good news for an industry whose output is still 16.3% below its pre-COVID level.

At the other end of the spectrum, machinery manufacturing output tumbled 4.3% in June, its biggest monthly drop since September 2020. Output was down in five of seven subsectors, led by agricultural construction and mining machinery manufacturing and other general purpose machinery manufacturing.

In more bad news, wood product manufacturing contracted 2.1% in June, bringing the year-over-year decline to 16.2%. As well, motor vehicle and parts manufacturing contracted 1.2% in June, the first drop in three months. However, even with this decrease, auto and parts production was up 29.1% compared to a year ago.