Canadian Economy

CANADIAN ECONOMY

July 2023

Canadian Economy Stalls in July, as Manufacturing Posts Biggest Decline in Over Two Years

HIGHLIGHTS

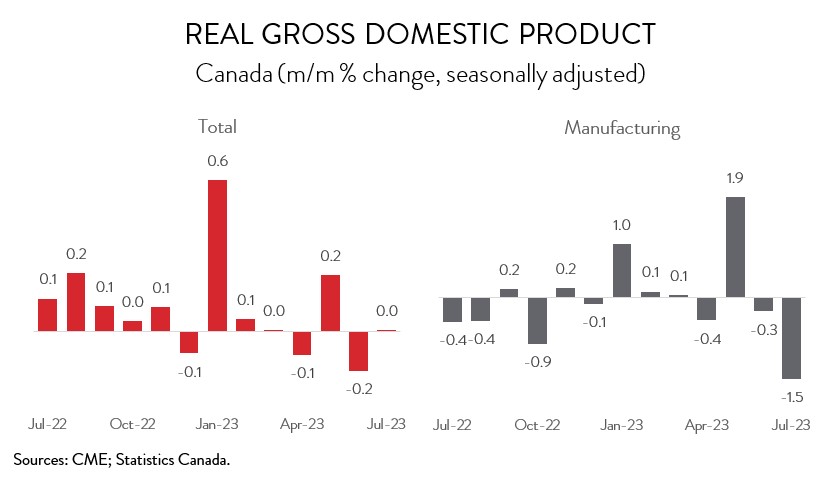

- Real GDP was flat in July and, according to a preliminary estimate, edged up 0.1% in August.

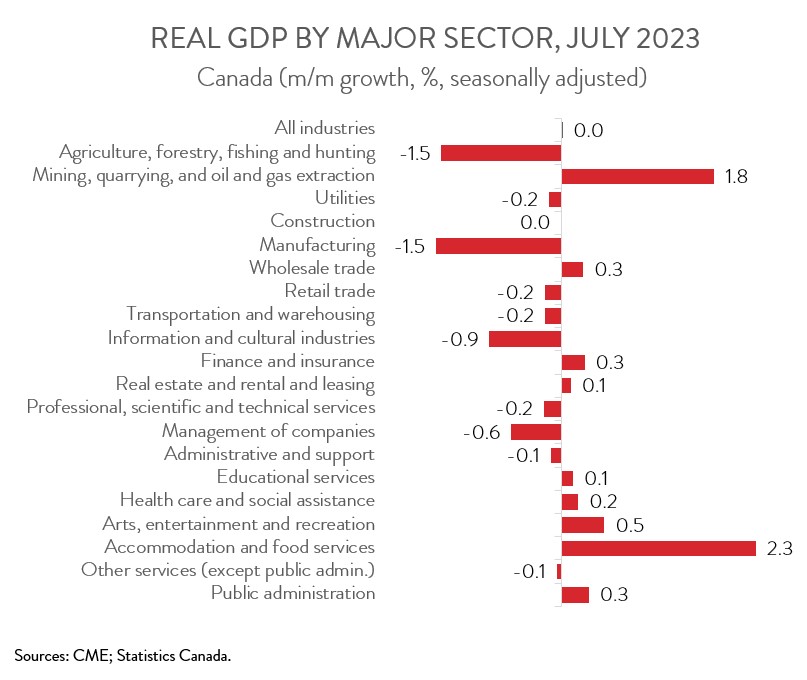

- Increases were observed in 9 of 20 industries in July, with mining, quarrying, and oil and gas extraction posting the biggest gain and manufacturing recording the steepest loss.

- Manufacturing output tumbled by 1.5% in July, the third decline in four months and the biggest one-month drop since April 2021.

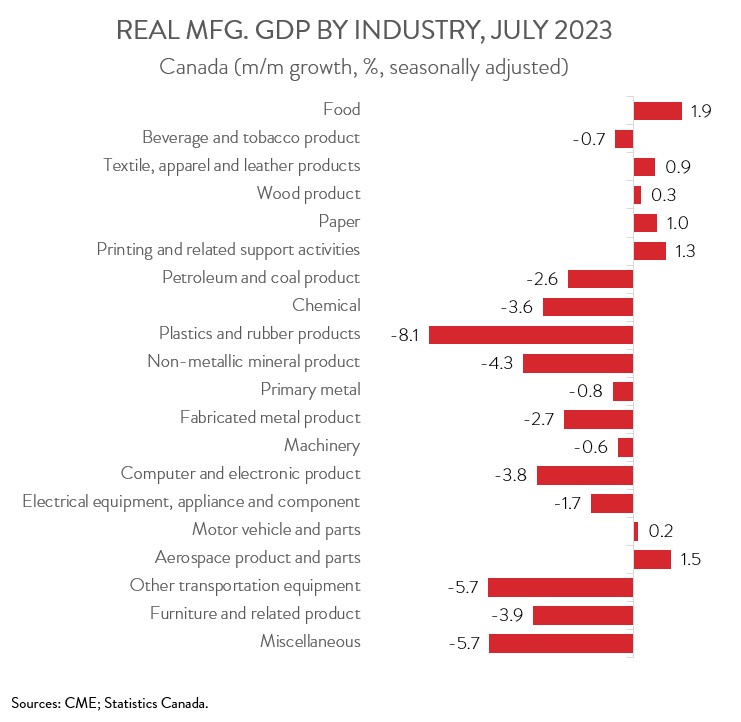

- The decrease in manufacturing was widespread, spanning 13 of 20 subsectors, led by the chemical, plastics and rubber products, and fabricated metal product industries.

- There is no doubt that the Canadian economy is weak, especially when measured in per capita terms, as it continues to be weighed down by stubborn inflation and high interest rates. Supply disruptions caused by wildfires and the BC port strike have also taken their toll on the economy in recent months.

REAL GDP FLAT IN JULY

Real GDP was flat in July and, according to a preliminary estimate, edged up 0.1% in August. There is no doubt that the Canadian economy is weak, especially when measured in per capita terms, as it continues to be weighed down by stubborn inflation and high interest rates. Supply disruptions caused by wildfires and the BC port strike have also taken their toll on the economy in recent months.

Third quarter GDP growth is tracking well below the Bank of Canada’s most recent forecast. As a result, most analysts think the Bank will remain on hold over the rest of this year, even against a backdrop of renewed inflation.

MINING SECTOR REBOUNDS FROM WILDFIRE-RELATED DISRUPTIONS IN JUNE

Increases were observed in 9 of 20 industries in July. Mining, quarrying, and oil and gas extraction posted the most impressive gain, with output rising 1.8% in July. In particular, growth surged in the iron ore mining subsector as production increased following the impact of wildfires in June. At the same time, oil and gas extraction expanded for the sixth time in seven months, aided by the continued ramp of natural gas extraction in Western Canada, following a period of wildfire-induced declines.

The accommodation and food sector also had a strong month, with output up 2.3% in July. RV parks, recreational camps and rooming and boarding houses expanded for the first time in three months, partly offsetting declines recorded in May and June as the risks associated with forest fires limited activity in many parts of the country.

MANUFACTURING ACTIVITY SINKS IN JULY

The manufacturing sector had the largest negative contribution to GDP growth in July, as output tumbled by 1.5%. This was the sector’s third decline in four months and the biggest one-month drop since April 2021. According to Statistics Canada, the July 2023 decrease was largely attributable to lower inventory accumulation.

Taking a longer-term view, manufacturing output has contracted by 0.2% over the past 12 months, as the sector continues to be held back held back by higher interest rates and a slowing global economy. Unfortunately, the near-term outlook for Canada’s manufacturing sector remains cloudy, as high interest rates are likely to be with us for some time.

Digging deeper, output was down in 13 of 20 major manufacturing subsectors in July. The chemical industry contributed the most to the decline, as output fell by 3.6%. Data indicate that the chemical industry was the manufacturing subsector to be most acutely affected by the BC port strike.

The plastics and rubber products sector also had a rough month, with output sinking 8.1% in July, the largest monthly decline since April 2020 when the pandemic was just beginning. Output has fallen by 17.3% over the past 12 months, the weakest performance among the 20 manufacturing subsectors.

Fabricated metal product activity shrank by 2.7% in July, the first decline in three months. Output was down in six of eight subsectors, led by architectural and structural metals manufacturing and machine shops, turned product, and screw, nut and bolt manufacturing.

On the positive side of the ledger, food manufacturing output rose by 1.9% in July, building on the 1.2% increase in June. Among the industry’s nine subsectors, the largest gains were observed in meat product manufacturing and grain and oilseed milling.

Increases in other subsectors were modest. Notably, motor vehicle and parts manufacturing inched up 0.2% in July, the third increase in four months. Year-over-year, output in this subsector was up an impressive 24.1%. The global semiconductor shortage continues to ease, enabling companies to boost production and sell more cars and trucks.