Canadian Economy

Canadian Economy

August 2023

Canadian Economy Remains Stalled in August; Manufacturing Contracts for Third Straight Month

HIGHLIGHTS

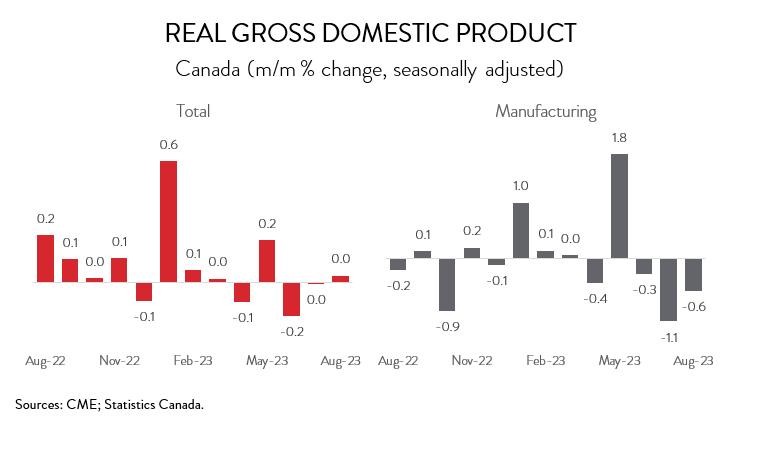

- Real GDP was essentially unchanged for the second consecutive month in August. According to a preliminary estimate, the economy remained stagnant in September.

- Increases were observed in 8 of 20 industries in August, with wholesale trade and mining, quarrying, and oil and gas extraction posting the biggest gains and agriculture, forestry, fishing and hunting and manufacturing recording the steepest losses.

- Manufacturing output contracted by 0.6% in August, the third consecutive monthly decline.

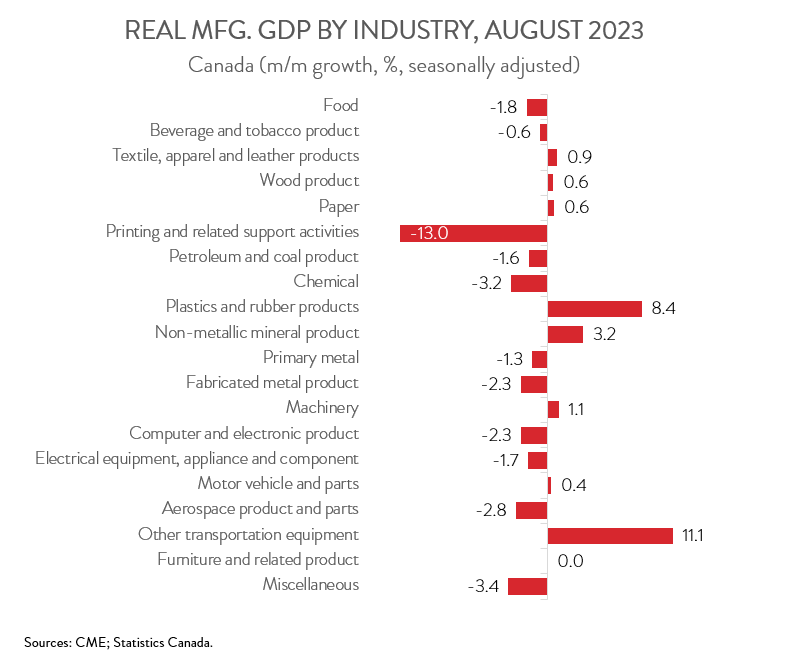

- The decrease in manufacturing spanned 11 of 20 subsectors, with the biggest decline observed in chemical manufacturing and the largest increase seen in plastics and rubber product manufacturing.

- Manufacturing activity has noticeably weakened in recent months, buffeted by numerous headwinds including high interest rates and a slowing global economy.

REAL GDP STAGNANT

Real GDP was essentially unchanged for the second consecutive month in August. According to a preliminary estimate, the economy remained stagnant in September. There is no doubt that the Canadian economy is struggling, weighed down in recent months by factors such as persistent inflation, high interest rates, labour disruptions, and wildfires.

In fact, real GDP growth is on track to edge down by 0.1% in the third quarter, following a 0.2% drop in Q2. In other words, Canada’s economy appears to have entered a technical recession, defined as two consecutive quarters of declining GDP.

MANUFACTURING ACTIVITY CONTRACTS FOR THIRD STRAIGHT MONTH

Manufacturing output contracted 0.6% in August, the third straight monthly decline. As a result, GDP in August was no larger than in February 2020, implying that the sector has not really grown over the last three-and-a-half years. Unfortunately, many of the headwinds that have buffeted the sector in recent months are expected to persist into 2024, particularly high interest rates and a slowing global economy.

Digging deeper, output was down in 11 of 20 major manufacturing subsectors in August. The chemical industry contributed the most to the decline, as output fell 3.2%. Two subsectors were largely responsible for the drop in output: pharmaceutical and medicine manufacturing and basic chemical manufacturing.

Food manufacturing dipped by 1.8%, down for the first time in three months. Declines were widespread, spanning 8 of 9 subsectors, led by bakeries and tortilla manufacturing and other food manufacturing.

Printing and related support activities plunged 13.0% in August, the largest monthly decline since April 2020. Year-over-year, the sector’s output was down 19.3%, the worst performance among all major manufacturing subsectors.

On the positive side of the ledger, plastics and rubber product manufacturing rose 8.4% in August, following two consecutive monthly declines. The increase was entirely driven by the plastics subsector, as rubber product manufacturing fell for the third consecutive month.

In more good news, other transportation equipment manufacturing jumped 11.1% in August, the fourth increase in five months. However, even with these recent gains, the subsector has yet to return to its pre-pandemic level.

MINING SECTOR UP FOR THIRD MONTH IN A ROW

Returning to the broader economy, output was up in 8 of the remaining 19 sectors in August. Wholesale trade led the way with a gain of 2.3%, up for the third time in four months. The machinery, equipment and supplies merchant wholesalers subsector was the main growth driver, posting the biggest gain since July 2020.

Mining, quarrying, and oil and gas extraction rose 1.2% in August, up for the third month in row, as the sector continued to recover from the wildfire-induced drop in output in May. Notably, the oil and gas extraction subsector expanded for the seventh time in eight months, bringing activity to its highest level since April 2019.

The transportation and warehousing sector climbed by 0.8% in August, the first increase in three months. The water transportation subsector experienced a swift rebound in August following the end of the BC port strike in mid-July.

On the downside, agriculture, forestry, fishing and hunting contracted 3.2% in August, its largest decline since August 2021. Crop production plummeted, as dry conditions in Western Canada pushed down expected yields.

As well, accommodation and food services declined 1.8% in August. As noted by Statistics Canada, activity at RV parks, recreational camps, and rooming and boarding houses continued to be held back by wildfires in certain parts of the country.