Canadian Economy

Canadian Economy

SEPTEMBER 2023/Q3 2023

Economy Shrinks in Third Quarter; Manufacturing Output Rises in September

HIGHLIGHTS

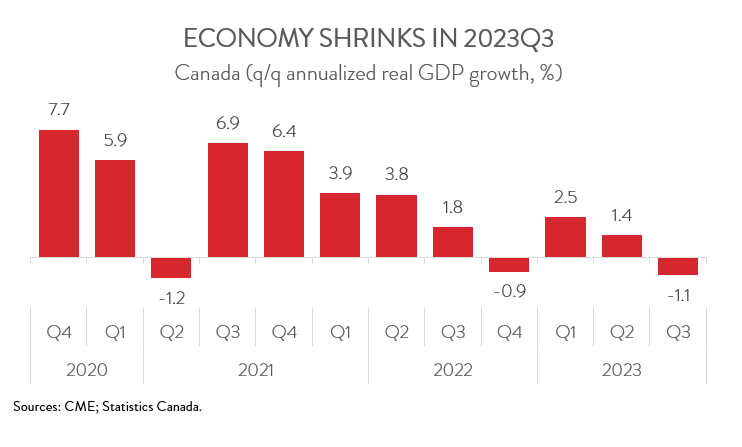

- The Canadian economy contracted at a 1.1% an annualized rate in the third quarter of 2023, though the prior quarter was revised significantly upward to growth of 1.4% from a decline of 0.2%.

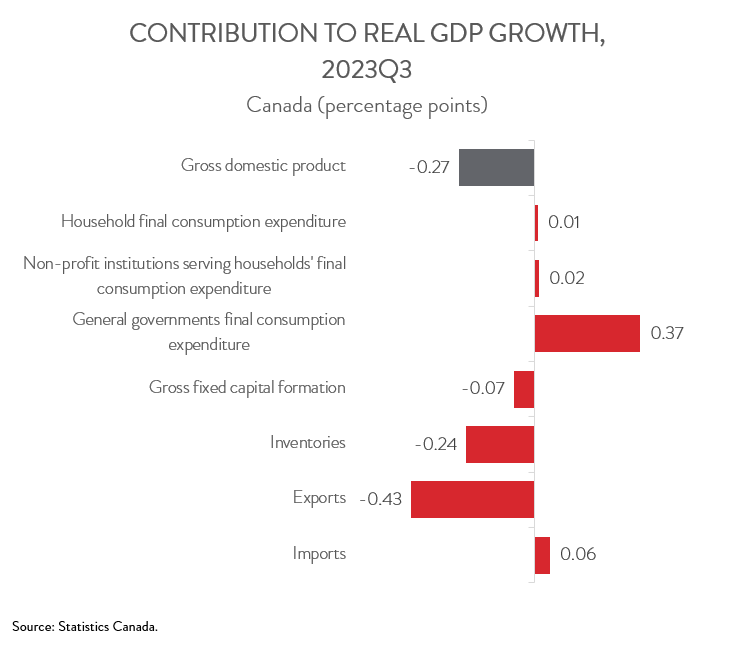

- The decline in Q3 was driven by a decrease in international exports and slower inventory accumulation, which more than offset gains in government spending and housing investment.

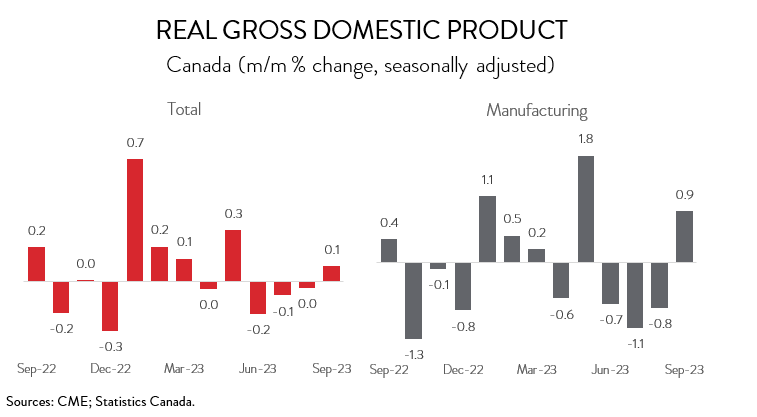

- Real GDP edged up 0.1% in September and, according to a preliminary estimate, climbed a further 0.2% in October.

- Increases were observed in 10 of 20 industries in September, with manufacturing and construction posting the largest gains and mining, quarrying, and oil and gas extraction recording the steepest loss.

- Manufacturing output climbed by 0.9% in September, the first increase in four months.

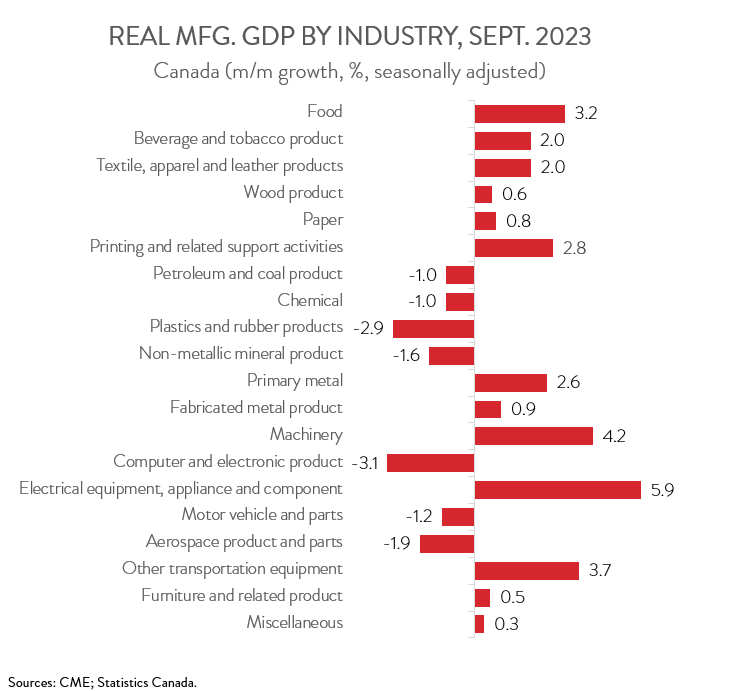

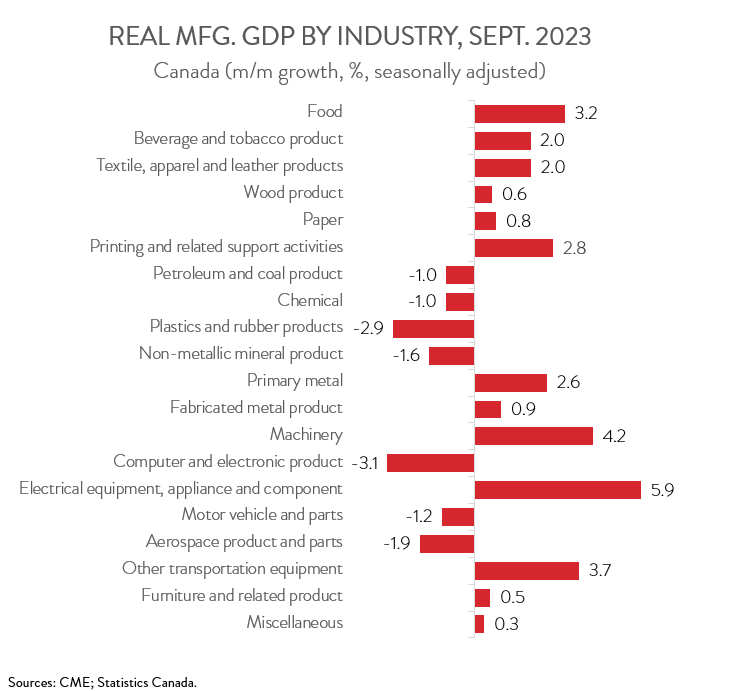

- The increase in manufacturing spanned 13 of 20 subsectors, with the biggest gains observed in food and machinery manufacturing and notable decreases seen in plastics and rubber product and petroleum and coal product manufacturing.

- Thanks to the upward revision in the second quarter figure, the Canadian economy avoided falling into a technical recession. Nevertheless, the economy is barely growing, rising by a total of less than 0.1% between April and September.

REAL GDP SHRINKS IN Q3, BUT REVISED UP IN Q2

The Canadian economy contracted at a 1.1% an annualized rate in the third quarter of 2023, though the prior quarter was revised significantly upward to growth of 1.4% from a decline of 0.2%.

Thanks to the upward revision in the second quarter figure, the Canadian economy avoided falling into a technical recession. Nevertheless, the economy is barely growing, rising by a total of less than 0.1% between April and September. The situation is even more concerning when viewing GDP in per capita terms, the most common measure of living standards. Per capita GDP has declined in four out the last five quarters, indicating that Canadians are getting poorer.

REAL GDP DECINE LED BY LOWER EXPORTS

The decline in Q3 was led by lower exports of goods and services (-5.1% annualized), weighed down by a significant drop in exports of refined petroleum energy products. Slower inventory investment was also a drag on growth, with the quarter seeing the smallest buildup of inventories since the third quarter of 2021. Notably, manufacturers recorded a withdrawal in inventories in the third quarter of 2023 after six consecutive quarters of accumulations.

On the positive side of the ledger, residential investment rose by 8.3% annualized in the third quarter, the first increase in six quarters. Government spending was also strong, up 7.3% annualized in Q3, as the federal government boosted GST/HST credit payments to provide a one-time “grocery rebate” to Canadians with lower incomes.

REAL GDP EDGES UP IN SEPTEMBER

Turning to monthly data, real GDP edged up by 0.1% in September and, according to a preliminary estimate, climbed a further 0.2% in October. This indicates that the Canada economy entered the fourth quarter with some positive momentum.

MANUFACTURING REBOUNDS IN SEPTEMBER, BUT OUTLOOK CLOUDY

Manufacturing was the biggest driver of growth in September, with output climbing by 0.9%, the first increase in four months. Nevertheless, even with this gain, manufacturing output has contracted by 1.0% over the past 12 months, as the sector continues to be held back held back by high interest rates and a slow global economy, headwinds that are expected to persist at least over the near term.

Digging deeper, output was up in 13 of 20 major manufacturing subsectors in September. Food manufacturing led the increase with a 3.2% gain, as higher animal slaughtering and processing pushed up meat product manufacturing to its highest level on record.

The machinery industry also had a strong month, with output expanding by 4.2% in September. The bulk of the gain was in agriculture, construction, and mining machinery, coinciding with increases in the construction sector along with maintenance activities in the energy sector.

On the downside, plastics and rubber products manufacturing decreased by 2.9% in September, the third decline in four months. At the same time, petroleum and coal product manufacturing contracted by 1.0%, as maintenance activities were performed at several refineries during the month.

CONSTRUCTION SECTOR ANOTHER GROWTH LEADER

Returning to the broader economy, output was up in 9 of the remaining 19 sectors in September. Construction output climbed by 1.0% in September, building on the 0.2% increase in August. The increase in September was driven by residential building construction, which recorded its largest monthly gain since April 2021.

Wholesale trade output rose by 0.5% in September, the third consecutive monthly increase. Output was up in six of nine subsectors, led by motor vehicle and parts wholesalers.

On the negative side, mining, quarrying, and oil and gas extraction tumbled by 1.8% in September, as all three subsectors contracted. Notably, after reaching an all-time high in August, oil and gas extraction pulled back in September, weighed down by maintenance activities at numerous facilities across the country.

Moreover, agriculture, forestry, fishing and hunting declined by 1.4% in September, down for the 13th month in a row. Crop production continued its descent that began at the end of 2022, coinciding with lower wheat and canola yields in 2023 that resulted from dry conditions in the Prairies.