Canadian Economy

Canadian Economy

October 2023

Canadian Economy Remains Stuck in a Rut; Manufacturing Contracts for Fourth Time in Five Months

HIGHLIGHTS

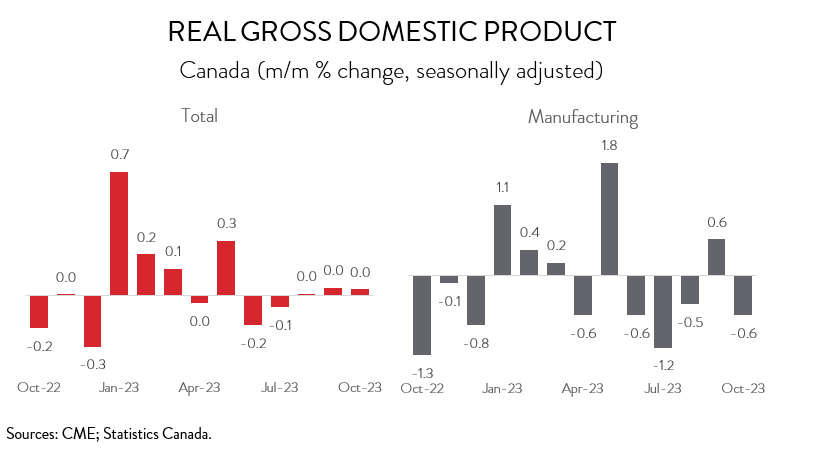

- Real GDP was essentially unchanged for the third consecutive month in October, while a preliminary estimate indicated that the economy edged up 0.1% in November.

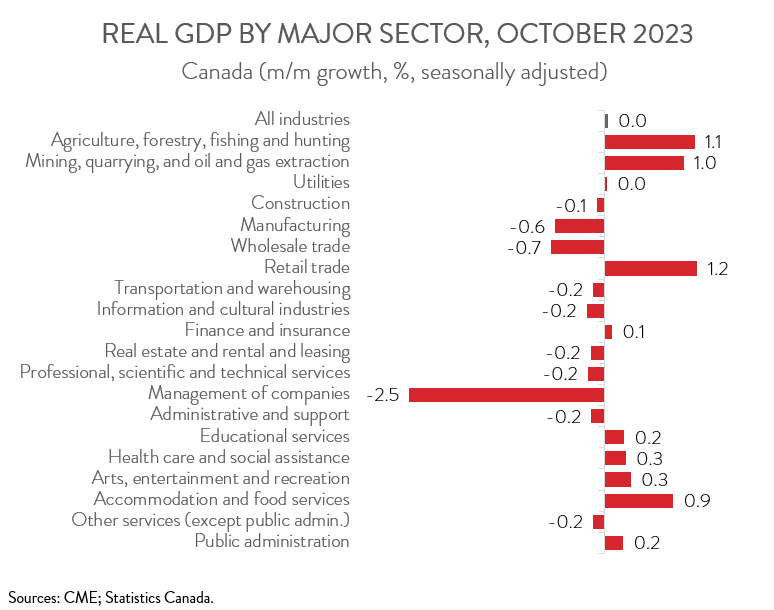

- Increases were observed in 10 of 20 industries in October, with retail trade and mining, quarrying, and oil and gas extraction posting the biggest gains and manufacturing and wholesale trade recording the steepest losses.

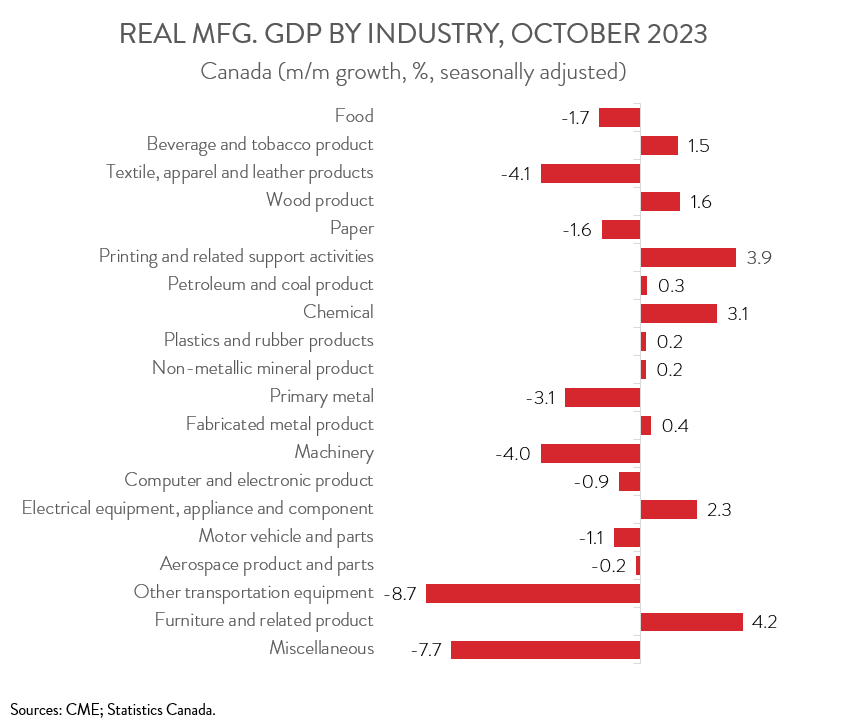

- Manufacturing output contracted 0.6% in October, the fourth decline in five months.

- The decrease in manufacturing spanned 10 of 20 subsectors, with the biggest decline observed in machinery manufacturing and the largest increase seen in chemical manufacturing.

- Canadian manufacturing activity has slowed down noticeably this year, buffeted by numerous headwinds including high interest rates, a slowing global economy, and strike-related disruptions to critical trade infrastructure.

REAL GDP STAGNANT AGAIN

Real GDP was essentially unchanged for the third consecutive month in October, while a preliminary estimate indicated that total output edged up 0.1% in November. The Canadian economy remains stuck in a rut, increasing by a paltry 0.1% over the past seven months. The way population growth has been surging, it is almost a certainty that real GDP per capita, the most common measure of living standards, declined again in October.

MANUFACTURING ACTIVITY CONTRACTS FOR FOURTH TIME IN FIVE MONTHS

Manufacturing output contracted 0.6% in October, the fourth decline in five months. On a cheerier note, Statistics Canada’s advance estimate signaled that manufacturing activity bounced back and posted solid growth in November. Still, manufacturing output is up only 0.6% year-to-date, a dramatic slowdown from gains of 5.9% in 2021 and 3.7% in 2022, as the sector continues to feel the pinch of high interest rates and a slow global economy. Manufacturers have also had to grapple with serious supply chain disruptions caused by strikes at BC ports and the St. Lawrence Seaway, with potential job action looming at the Port of Montreal early in the new year.

Digging deeper, output was down in 10 of 20 major manufacturing subsectors in October. The machinery industry contributed the most to the decline, with output falling 4.0%. The decrease was driven by other general-purpose machinery manufacturing and metalwork machinery manufacturing, as activity related to large projects in these industries has been winding down.

At the same time, food manufacturing contracted 1.7%, down for the second time in three months. Declines were observed in 6 of 9 subsectors, led by meat product manufacturing.

The transportation equipment manufacturing sector also had a tough month. In particular, other transportation equipment plunged by 8.7% in October, attributable to lower inventory formation, and motor vehicle and parts manufacturing decreased by 1.1%, weighed down by a shutdown at a major auto assembly plant for retooling and disruptions related to strike activity by U.S. auto workers.

On the positive side of the ledger, chemical manufacturing output climbed by 3.1% in October, up for the first time in four months. Robust growth in basic chemical manufacturing and resin, synthetic rubber, and artificial and synthetic fibres and filaments manufacturing more than offset a significant pullback in pharmaceutical and medicine manufacturing.

RETAIL TRADE AND MINING SECTORS POST BIGGEST GAINS

Returning to the broader economy, output was up in 10 of the remaining 19 major sectors in October. Retail trade led the way with a gain of 1.2%, up for the second month in a row and the biggest monthly gain since January 2023. The clothing and clothing accessory stores subsector was the main driver of growth, as it bounced back from two consecutive monthly declines.

Mining, quarrying, and oil and gas extraction increased 1.0% in October, up for the first time in three months. All three subsectors contributed to the growth, led by mining and quarrying (except oil and gas). Notably, potash mining posted an impressive gain, as a mine that was temporarily shut down in September resumed activity.

On the downside, along with manufacturing, wholesale trade also experienced a noteworthy decline in October, contracting by 0.7%. This was the sector’s second straight monthly decrease and was driven by machinery, equipment and supplies wholesaling.

Finally, activity at the offices of real estate agents and brokers was down 6.8% in October, the fourth consecutive monthly decline and the biggest one-month drop since April 2022, coinciding with a struggling housing market.