Canadian Economy

Canadian Economy

November 2023

Canadian Economy Expands for the First Time in Six Months, Led by Manufacturing

HIGHLIGHTS

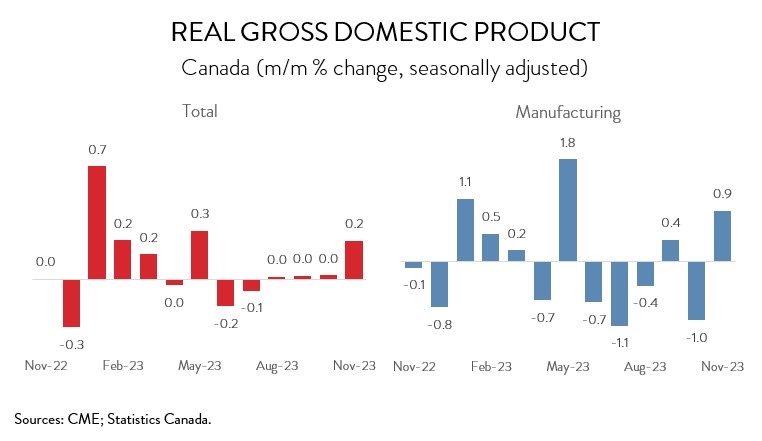

- Real GDP grew 0.2% in November, while a preliminary estimate indicates that the economy expanded a further 0.3% in December.

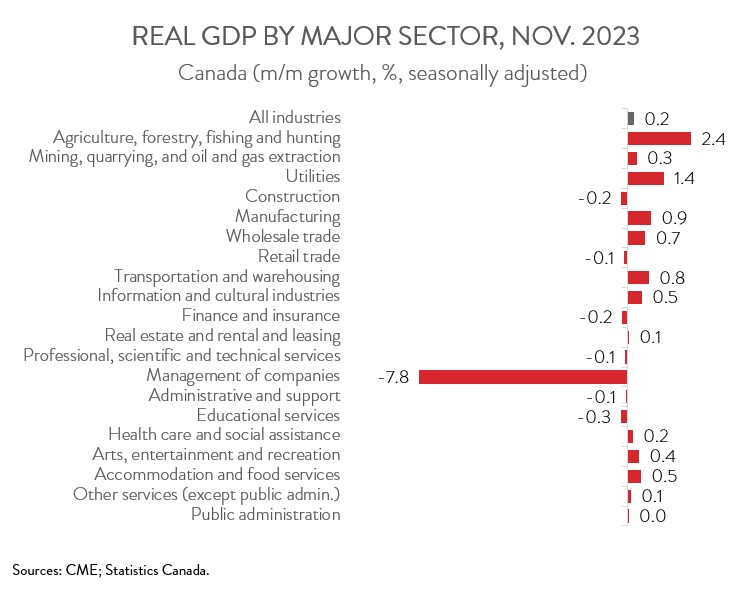

- Increases were observed in 13 of 20 industries in November, with manufacturing, agriculture, wholesale trade, and transportation and warehousing contributing the most to the growth.

- Manufacturing output expanded 0.9% in November, bouncing back from a 1.0% decline in October.

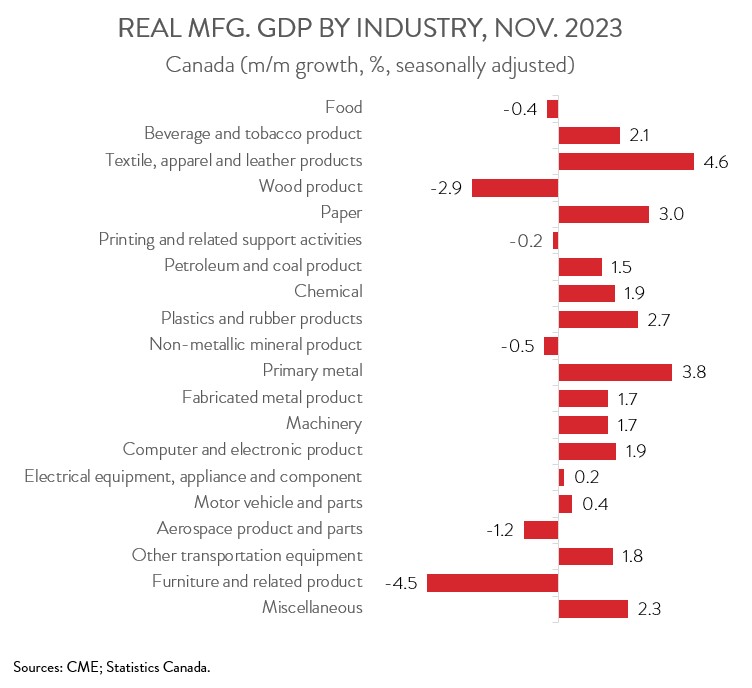

- The gains in manufacturing spanned 14 of 20 subsectors, with the biggest increases observed in the chemical and primary metal sectors and the steepest losses observed in the wood product and furniture and related product industries.

- Barring any major revisions, the Canadian economy likely expanded in the fourth quarter and avoided a technical recession.

REAL GDP UP 0.2% IN NOVEMBER

Real GDP grew 0.2% in November, the first increase in six months. In more good news, a preliminary estimate indicates that the economy expanded a further 0.3% in December. Barring any major revisions, fourth-quarter GDP growth is tracking at an annualized rate of 1.2%, implying that the Canadian economy avoided a technical recession.

MANUFACTURING TOP CONTRIBUTOR TO GROWTH

After contracting 1.0% in October, manufacturing output rebounded with a 0.9% gain in November, making it the biggest contributor to growth. Moreover, Statistics Canada’s advance estimate signalled that manufacturing activity continued to expand in December. Nevertheless, despite this turnaround, manufacturing output is estimated to have contracted 0.7% in 2023, weighed down by high interest rates and slow global demand. Manufacturers have also had to grapple with serious supply chain disruptions caused by strikes at BC ports and the St. Lawrence Seaway, with potential job action looming at the Port of Montreal in February.

Digging deeper, output was up in 14 of 20 manufacturing subsectors in November. The chemical industry led the way with a 1.9% gain, as several petrochemical plants continued to ramp up production following maintenance-related shutdowns in the third quarter.

The primary metal industry also had a strong month, as output jumped 3.8% in November, the fastest pace of growth since August 2020. This marked a sharp turnaround from a 3.3% decline in October, which was attributable to temporary factory shutdowns.

Machinery manufacturing rose for the fourth time in five months in November, with output climbing 1.7%. The increase was led by commercial and service industry machinery manufacturing, coinciding with an increase in exports during the month.

These gains were partly offset by pullbacks in wood product manufacturing (-2.9%) and furniture and related product manufacturing (-4.5%). Activity in both these industries continues to be weighed down by a sluggish North American housing market, as high mortgage rates strain affordability. Year-over-year, wood product manufacturing and furniture and related product manufacturing were down 3.4% and 6.5%, respectively.

In addition, food manufacturing contracted 0.4% in November, down for the third time in four months. The decline in November was mainly driven by a double-digit decrease in the seafood product preparation and packaging industry.

WHOLESALE TRADE AND TRANSPORTATION AND WAREHOUSING REBOUND

Returning to the broader economy, output was up in 12 of the remaining 19 major sectors in November. Output in agriculture, forestry, fishing and hunting rose 2.4% in November, building on the 1.4% increase in the previous month. However, despite these back-to-back gains, the sector’s output has declined 8.7% over the past 12 months, attributable to lower wheat and canola yields in 2023 that resulted from dry conditions in the Prairies.

Wholesale trade grew 2.4% in November, rebounding from two consecutive monthly declines. Output was up in six of nine subsectors, led by personal and household goods wholesaling and motor vehicle and motor vehicle parts and accessories wholesalers.

After edging down 0.3% in October, transportation and warehousing output bounced back with a 0.8% gain in November. Notably, the water and truck transportation subsectors recovered from declines in October that were mainly caused by the disruptive effects of the St. Lawrence Seaway strike.

On the downside, construction output contracted 0.2% in November, the second straight monthly decline following three consecutive monthly advances. On a year-over-year basis, output was down 0.7% in November, dragged down by high interest rates.

At the same time, education output shrank 0.3% in November, the biggest one-month drop since January 2022. However, this will likely be a temporary setback, as the main driver of the decline was the teachers’ strike in Quebec, which was resolved at the end of December.