Canadian Economy

Canadian Economy

DECEMBER 2023/Q4 2023

Economy Returns to Growth in Fourth Quarter, Manufacturing Output Shrinks in December

HIGHLIGHTS

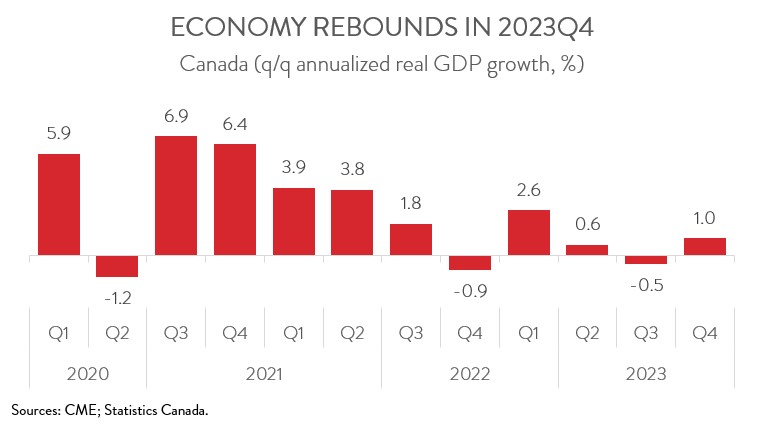

- The Canadian economy rose at a 1.0% annualized rate in the fourth quarter of 2023.

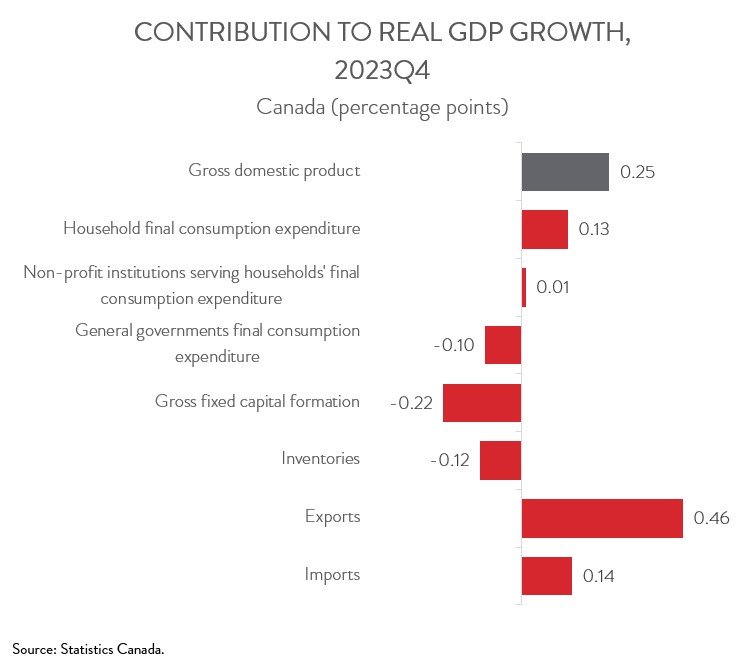

- The quarterly increase was driven by net exports and consumer spending, while declines in residential and non-residential investment and slower inventory accumulation weighed on growth.

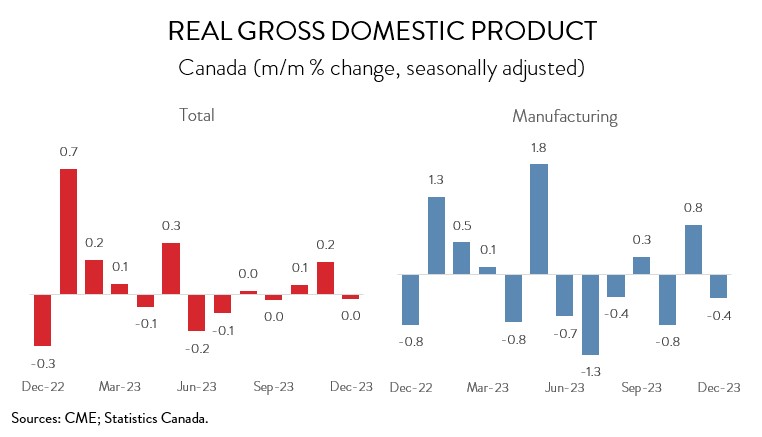

- Real GDP was unchanged in December but, according to a preliminary estimate, rebounded with a 0.4% gain in January.

- The manufacturing sector contracted 0.4% in December, partially offsetting the 0.8% advance recorded in November.

- The decrease in manufacturing spanned 10 of 20 subsectors, led by a steep fall in motor vehicles and parts.

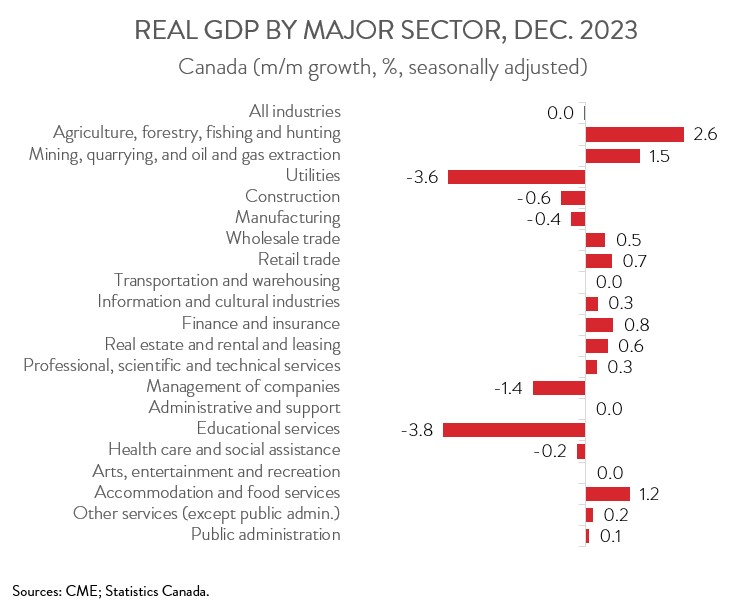

- Real GDP was up in 14 of the remaining 19 industries in December, with the weakness concentrated in the public sector.

- In 2023, the Canadian economy expanded by a modest 1.1%. Even though the early estimate for January is promising, most of the rebound can be attributed to the end of the Quebec public sector workers’ strike and not to any upswing in momentum.

REAL GDP UP 1.0% IN Q4

The Canadian economy rose at a 1.0% annualized rate in the fourth quarter of 2023 and, thus, avoided falling into a technical recession. In more good news, the third quarter was revised upward to a 0.5% drop from an initially reported decline of 1.2%.

The Canadian economy expanded by a modest 1.1% in 2023, down from 3.8% in the prior year. Even though the early estimate for January is promising, most of the rebound can be attributed to the end of the Quebec public sector workers’ strike and not to any upswing in momentum.

In other words, the economy remains fairly stagnant, rising by a total of 0.1% between April and December, weighed down by high interest rates. The situation remains even more concerning when viewing GDP in per capita terms, one of the most common measures of living standards. Per capita GDP has declined by 3.4% over the past year-and-a-half, indicating that Canadians are getting poorer.

QUARTERLY GDP INCREASE LED BY NET TRADE

The quarterly increase in real GDP was driven by net trade, as exports rose 1.4% and imports fell 0.4%. In addition, household spending was up 0.2%, led by higher spending on new trucks, vans, and utility vehicles as supply chain issues continued to ease and back orders were fulfilled. Gains in those expenditure categories were partly offset by pullbacks in residential investment (-0.4%) and non-residential investment (-1.9%) as well as by slower inventory accumulation. The decline in business investment reflected lower spending on aircraft.

REAL GDP FLAT IN DECEMBER

Turning to monthly data, real GDP was unchanged in December. However, according to a preliminary estimate, the economy rebounded in January with a 0.4% gain.

MANUFACTURING CONTRACTS IN DECEMBER AND IN 2023

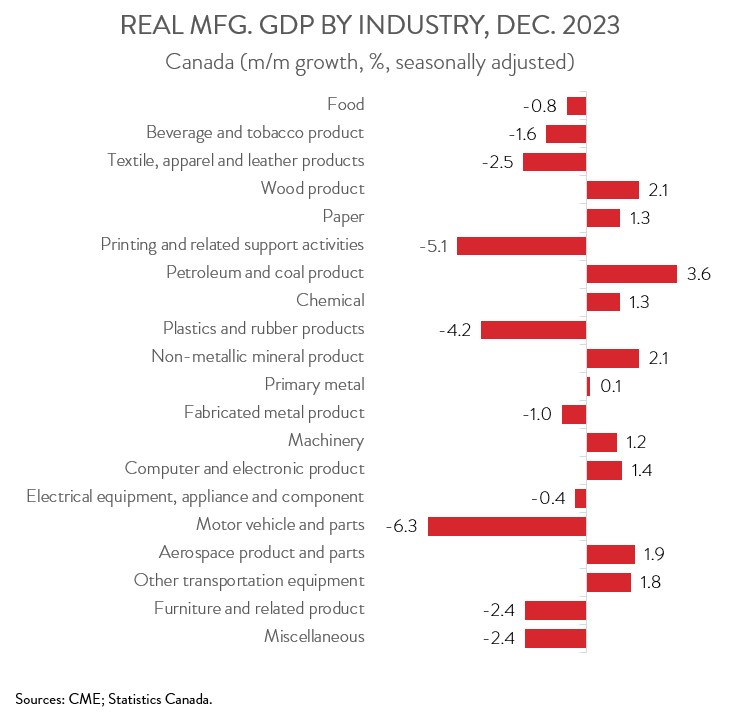

The manufacturing sector contracted 0.4% in December, partially offsetting the 0.8% gain recorded in November. Output was down in 10 of 20 subsectors.

Motor vehicle and parts manufacturing was the largest contributor to the decline in December, with output plunging 6.3%, the largest one-month drop since September 2021. Statistics Canada blamed the downturn on production slowdowns for retooling at some auto assembly plants in Ontario.

Plastics and rubber products manufacturing was another major contributor to the decline in December, as output fell 4.2%. The decline was largely attributable to weaker activity in plastic product manufacturing.

On the positive side of the ledger, petroleum and coal product manufacturing rose 3.6% in December, up for the fourth month in a row. The increase was fueled by a rise in petroleum refining.

In more good news, chemical manufacturing output climbed 1.3% in December. This was the subsector’s third consecutive monthly advance, following maintenance-related shutdowns in the third quarter.

With December in the books, we can now look back at all of 2023. Unfortunately, manufacturing output contracted 0.6% last year, its first decline since 2020. Plastics and rubber products manufacturing was the largest contributor to the decrease, with output down 11.6%. Other subsectors that struggled last year included wood product manufacturing (-8.2%), miscellaneous manufacturing (-12.2%), and paper manufacturing (-10.3%).

Among those that posted growth in 2023, one subsector stood out: motor vehicle and parts manufacturing. In fact, this industry posted impressive growth of 20.6% last year, its second consecutive double-digit gain. Other growth leaders included machinery manufacturing (+7.4%), fabricated metal product manufacturing (+2.9%), and aerospace product and parts manufacturing (+4.3%).

QUEBEC PUBLIC SECTOR WORKERS’ STRIKE WEIGHS ON ECONOMY

Returning to the broader economy, output was up in 14 of the remaining 19 sectors in December. The mining, quarrying and oil and gas extraction sector was a key growth driver, as output rose 1.5%, the third consecutive monthly advance. The oil and gas extraction subsector led the way as crude oil production reached a new record high in December, with facilities continuing to ramp up production following maintenance and turnarounds in the summer and early fall.

The softness in the economy can be traced back to a 1.0% decline in the public sector (educational services, health care and social assistance, and public administration), registering its first back-to-back monthly declines since the onset of the COVID-19 pandemic. The sector was weighed down significantly by the public sector workers’ strike in Quebec, which began in November and lasted until the end of December.

As well, utilities output plunged 3.6% in December. The electric power generation, transmission, and distribution industry contributed the most to the decrease, as unseasonably warm weather cut demand for heating and low reservoir levels caused by drought conditions continued to stymie hydroelectric power generation.

Finally, the construction industry contracted 0.6% in December. The decline was mainly attributable to lower residential building construction.