Canadian Economy

Canadian Economy

JANUARY 2024

Canadian Economy Starts Year on a Strong Note, Led by Education and Manufacturing

HIGHLIGHTS

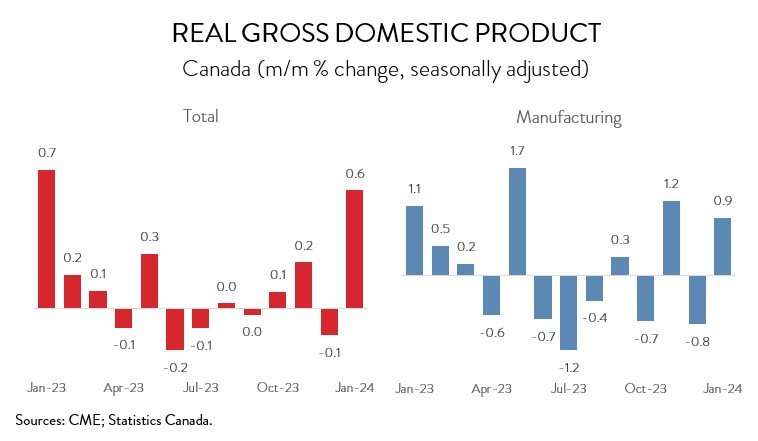

- Real GDP rose 0.6% in January, and a preliminary estimate points to a further gain of 0.4% in February.

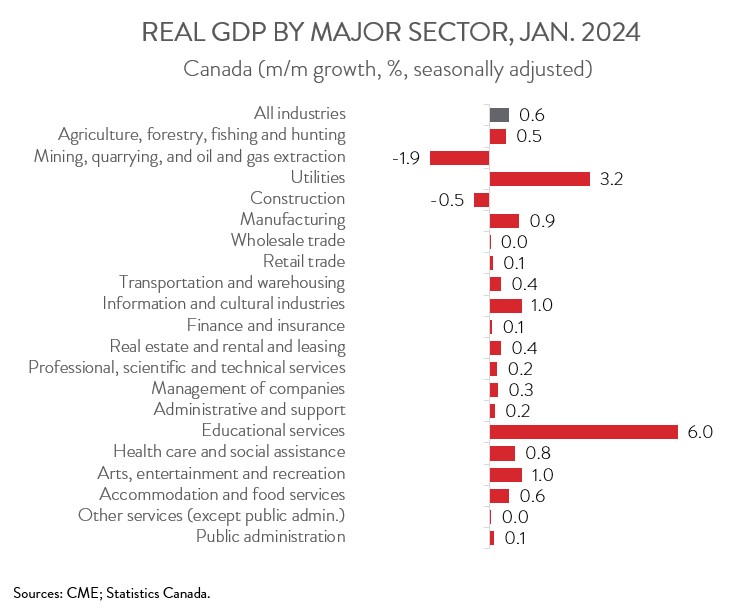

- The increase was broad-based, spanning 18 of 20 industries, with educational services, manufacturing, utilities, and health care and social assistance contributing the most to the growth.

- Manufacturing output expanded 0.9% in January, bouncing back from a 0.8% decline in December.

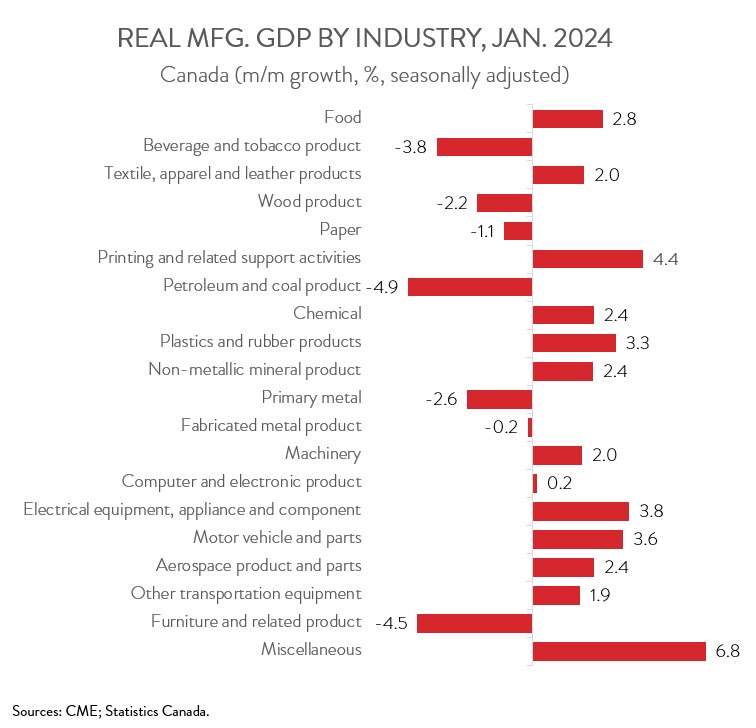

- Output was up in 13 of 20 manufacturing subsectors, with the biggest increases observed in the food and automotive industries and the steepest loss recorded in the petroleum and coal product sector.

- Barring any major revisions, first quarter GDP is on track to significantly beat the Bank of Canada’s current forecast of 0.5% annualized growth.

REAL GDP UP 0.6% IN JANUARY

Real GDP rose 0.6% in January, the strongest monthly gain since last January. In more good news, a preliminary estimate points to a further gain of 0.4% in February. Barring any major revisions, first quarter GDP is on track to significantly beat the Bank of Canada’s current forecast of 0.5% annualized growth. The odds are still tilted towards the Bank cutting interest rates in June, though the economy’s apparent solid rebound makes their job more challenging.

MANUFACTURING GROWTH LED BY FOOD AND AUTO SECTORS

After contracting 0.8% in December, manufacturing output rebounded with a 0.9% gain in January, making it the second biggest contributor to overall economic growth, behind only educational services. Moreover, Statistics Canada’s advance estimate signalled that manufacturing activity continued to expand in February.

These back-to-back gains could be an early sign that the manufacturing sector is starting to recover following a down year in 2023. The rebound in Canada coincides with renewed global manufacturing growth. Indeed, the J.P. Morgan Global Manufacturing Purchasing Managers Index (PMI) rose to 50.3 in February, up from 50.0 in January, its first reading above the neutral mark of 50 since August 2022.

Digging deeper, output was up in 13 of 20 manufacturing subsectors in January. The food industry contributed the most to the growth with a 2.8% gain, bouncing back from a 2.1% decline in the previous month. The increase spanned 7 of 9 subsectors and was led by meat product manufacturing and bakeries and tortilla manufacturing.

The auto sector also had a strong month, as motor vehicle and parts manufacturing jumped 3.6% in January, up for only the second time in six months. As noted by Statistics Canada, production resumed at some auto assembly plants following retooling-induced partial shutdowns in the latter months of 2023.

Chemical manufacturing rose for the fourth month in a row in January, as output climbed 2.4%. The increase was driven by two subsectors: pharmaceutical and medicine manufacturing and resin, synthetic rubber, and artificial and synthetic fibres and filaments manufacturing.

Unfortunately, these gains were partly offset by a 4.9% pullback in petroleum and coal product manufacturing. While this was the biggest monthly decrease since April 2021, it was preceded by four consecutive monthly advances.

END OF QUEBEC TEACHER STRIKE BOOSTS EDUCATIONAL SERVICES

Returning to the broader economy, output was up in 17 of the remaining 19 major sectors in January. Educational services led the way with growth of 6.0%, as activity rebounded from the declines recorded in November and December that resulted from the public sector workers’ strikes in Quebec.

The health care and social assistance sector, which was also affected by the labour disruption in Quebec, rose 0.8% in January. This was the biggest monthly gain since October 2020.

In more good news, utilities output expanded 3.2% in January, the strongest monthly gain in two years. Statistics Canada attributed the growth to a drop in temperatures mid-month in some parts of the country that led to a surge in demand.

On the negative side, mining and oil and gas extraction output decreased 1.9% in January, the first decline in four months. After reaching a record high in December, oil and gas extraction contracted in January, as frigid temperatures across the Prairies impacted production. The coal mining industry also had a tough month, posting its largest monthly decline since March 2022.