Labour Market Trends

Labour Market Trends

September 2022

Employment Rises Slightly in September; Manufacturing Down for Second Month in a Row

HIGHLIGHTS

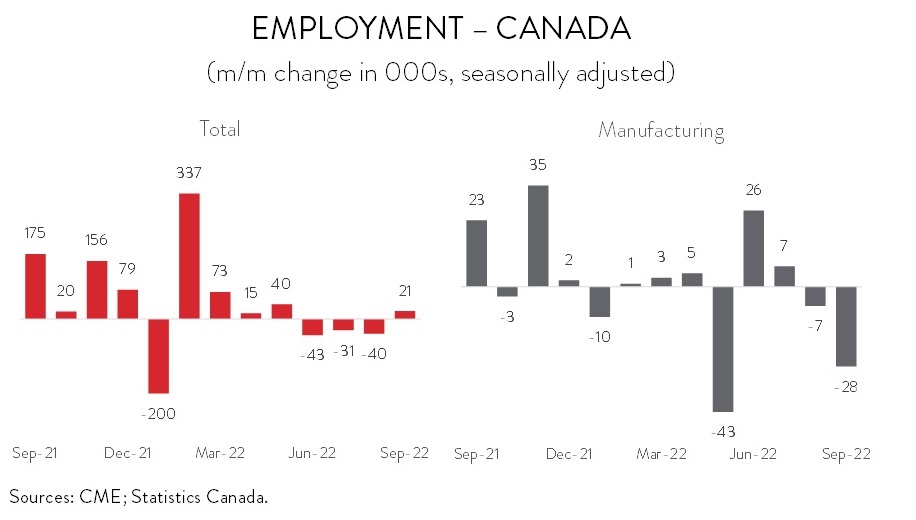

- Employment inched up by 21,100 (+0.1%) in September, the first increase in four months.

- The increase in employment spanned 8 of 16 industries, with educational services and health care and social assistance posting the biggest gains.

- Manufacturing suffered the steepest job losses, with payrolls down 27,500 (-1.6%) in September, the second decline in as many months.

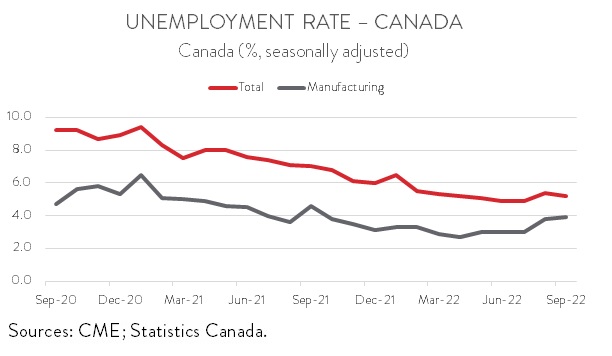

- The headline unemployment rate decreased from 5.4% in August to 5.2% in September, while the unemployment rate in manufacturing inched up from 3.8% to 3.9%.

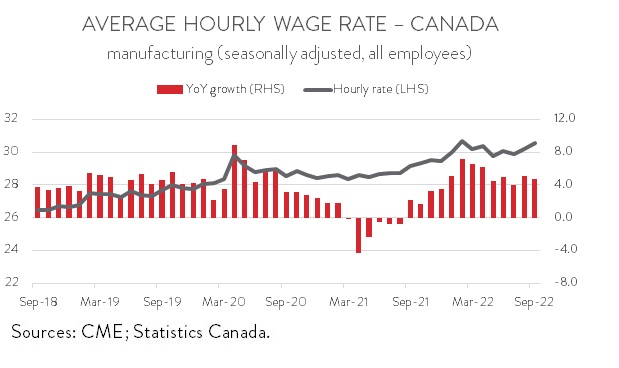

- Year-over-year wage growth in manufacturing decelerated from 5.0% in August to a still-elevated 4.7% in September.

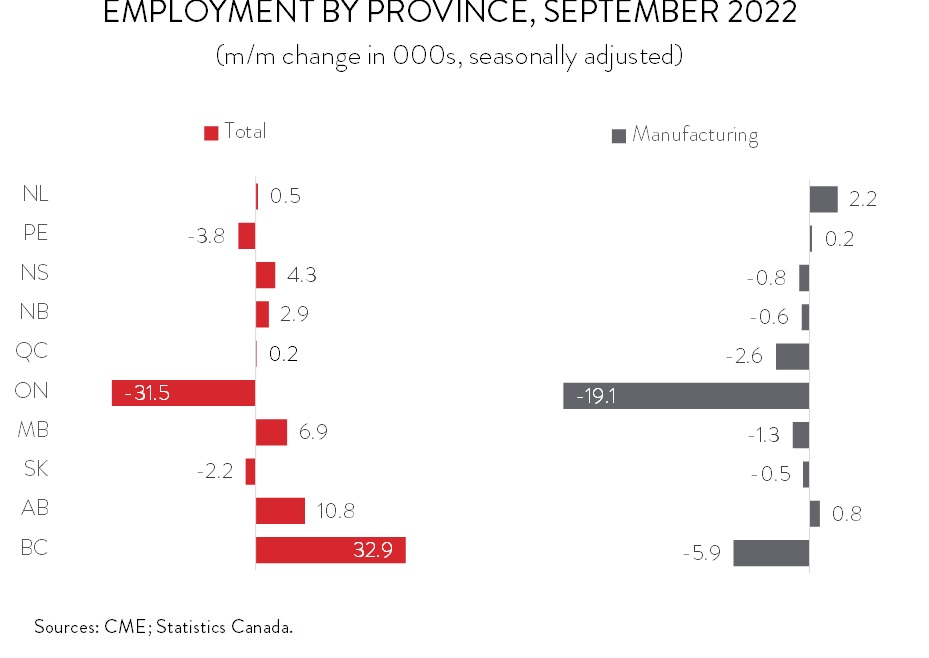

- Employment was up in seven of ten provinces, with BC posting the biggest gain.

- The bulk of the job losses in manufacturing occurred in Ontario, while the largest increase took place in Newfoundland and Labrador.

- Even though employment was up in September, total hours worked dipped 0.6%, signaling that the Canadian economy continues to cool. Nevertheless, labour conditions remain very tight, supporting the view that the Bank of Canada will hike interest rates again at its next meeting on October 26th

ECONOMY SEES MODEST JOB GAIN

Employment inched up by 21,100 (+0.1%) in September, the first increase in four months. In all, the Canadian economy has created 171,700 jobs over the first nine months of 2022.

By industry, the job increases spanned 8 of 16 industries. After declining for two consecutive months, the number of employees in the public sector increased by 35,000 (+0.8%) in September. The bulk of the gains were in educational services and health care and social assistance. In contrast, private sector employment was little changed in September. Manufacturing saw the steepest losses (see below), while notable declines were also recorded in information, culture and recreation (-21,500), transportation and warehousing (-18,200), and public administration (-11,800).

Even though employment was up in September, total hours worked dipped 0.6%, signaling that the Canadian economy continues to cool. Nevertheless, labour conditions remain very tight, with fewer people looking for work and job vacancies at a record high. This supports the Bank of Canada’s hawkish tone, with most analysts expecting it to raise its policy interest rate by 50 basis points at its October 26th meeting.

MANUFACTURERS SHED WORKERS FOR SECOND STRAIGHT MONTH

Manufacturing employment fell by 27,500 (-1.6%) in September, the second consecutive monthly decline and the steepest monthly loss since May 2022. As a result, the manufacturing sector has shed 45,500 workers over the first nine months of this year. The weak job figures for September coincide with other recent reports showing manufacturing sales falling for three straight months through July and merchandise exports down two months in a row through August.

UNEMPLOYMENT RATE MOVES LOWER

The labour force participation rate edged down by 0.1 percentage points in September. This, combined with the uptick in employment, pushed down the headline unemployment rate from 5.4% in August to 5.2% in September. At the same time, the jobless rate in manufacturing ticked up from 3.8% to 3.9%, the second straight monthly increase.

WAGE GROWTH STAYS ELEVATED

The combination of fewer people looking for work and record-high job vacancies boosted average hourly earnings in the overall economy by 1.1% in September, the biggest monthly increase since January 2022. On a year-over-year basis, wages were up 5.2%, well above the historical average of 2.8%.

A similar story is unfolding in manufacturing. Average hourly earnings rose 1.2% in September, the biggest one-month gain since January 2022. Year-over-year, wage growth decelerated from 5.0% in August to a still-elevated 4.7% in September. This pace of growth is nearly double the sector’s historical average of 2.5%.

EMPLOYMENT INCREASE LED BY BRITISH COLUMBIA

Regionally, the employment increase spanned seven of ten provinces. Employment in BC rose by 32,900 in September, more than offsetting a decrease of 28,100 in August. Manitoba also saw healthy gains, with employment up 6,900 in September, partly making up for the 10,000 jobs lost in August. On the flipside, employment in Ontario tumbled by 31,500 in September, the fourth consecutive monthly decline. It should be noted that the survey was completed well before post-tropical storm Fiona struck Eastern Canada, so its impact is not captured in this report.

In the manufacturing sector, employment was down in seven provinces in September. The bulk of the losses were recorded in Ontario (-19,100), the first decline in four months. BC suffered the largest proportional decrease, with employment falling by 5,900, the third straight monthly decline. On a positive note, manufacturers in Newfoundland and Labrador added 2,200 workers to payrolls in September, the largest monthly gain since November 2021.