Labour Market Trends

Labour Market Trends

August 2023

Economy Adds More Jobs Than Expected in August, But Manufacturing Sees Big Decline

HIGHLIGHTS

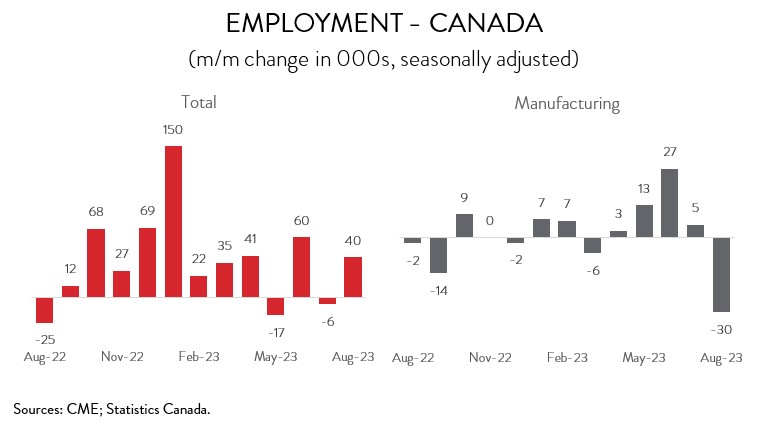

- Employment was solid in August, rising by 39,900 (+0.2%).

- The increase spanned 9 of 16 industries, led by professional, scientific, and technical services and construction.

- Manufacturing employment decreased by 29,500 (-1.6%), partially offsetting cumulative gains of 48,200 between May and June.

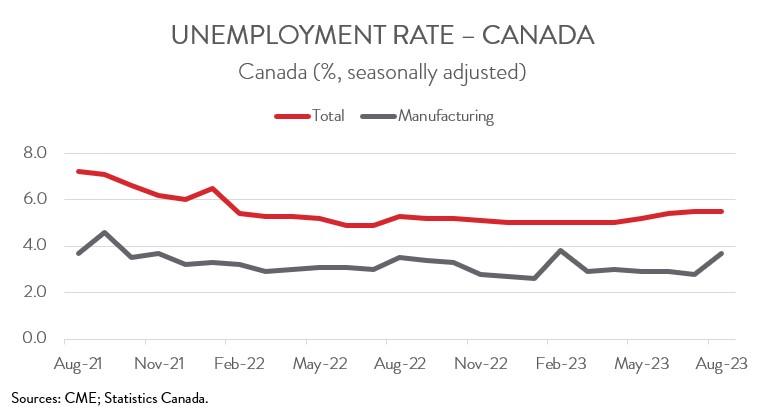

- The headline unemployment rate remained stable at 5.5% in August, while the jobless rate in manufacturing jumped nearly a full percentage point to 3.7%.

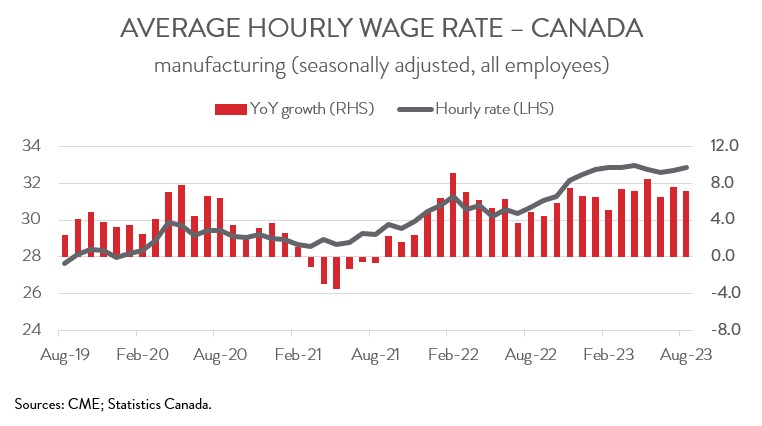

- Year-over-year wage growth in the manufacturing sector decelerated from 7.6% in July to a still-robust 7.2% in August.

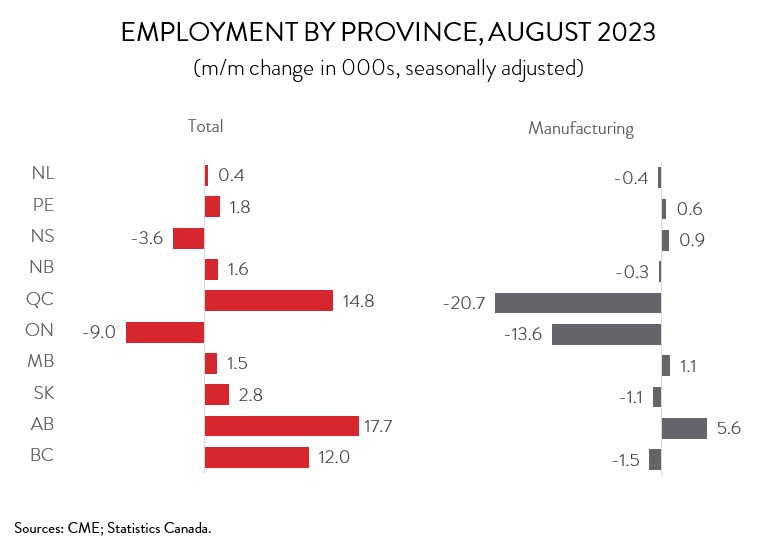

- Total employment was up in 8 of 10 provinces, with Alberta, Quebec, and BC all posting double-digit gains. The job losses in manufacturing were concentrated in Quebec and Ontario.

- A still-low unemployment rate and brisk wage growth, along with the likelihood that headline inflation will accelerate over the near term, help explain why the Bank of Canada has not ruled out further interest rate hikes.

EMPLOYMENT UP 39,900 IN AUGUST

Employment rose by 39,900 (+0.2%) in August, a decent result against the backdrop of a slowing economy. The underlying details of the report were also solid, as the job gains were driven by full-time positions and hours worked increased by 0.5%.

The increase in employment spanned 9 of 16 industries, led by professional, scientific and technical services (+52,100) and construction (+33,800). These gains were partly offset by pullbacks in educational services (-44,200) and manufacturing (-29,500). Employment changes in other industries were more moderate.

The job market defied expectations, adding more than twice as many jobs as the consensus expectation, with recent data releases continuing to send mixed signals about the state of the Canadian economy. All in all, a still-low unemployment rate and brisk wage growth, along with the likelihood that headline inflation will accelerate over the near term, help explain why the Bank of Canada has not ruled out further interest rate hikes.

JOB GROWTH STREAK IN MANUFACTURING COMES TO AN END

As mentioned above, manufacturing employment decreased by 29,500 (-1.6%) in August, partially offsetting cumulative gains of 48,200 between May and June. Manufacturing job growth appears to be slowing down this year, coinciding with numerous obstacles such as persistent workforce challenges, sharply higher interest rates, and soft global demand. Manufacturers have added 26,700 workers through the first eight months of 2023, down from gains of 78,400 in 2021 and 37,400 in 2022.

MANUFACTURING UNEMPLOYMENT RATE JUMPS

After increasing for three consecutive months, the headline unemployment rate remained unchanged at 5.5% in August. In contrast, the jobless rate in manufacturing jumped nearly a full percentage point to 3.7% in August, its highest point since February 2023.

WAGE GROWTH SLOWING BUT STILL BRISK

Similar to overall job growth, wage inflation came in hotter than expected in August. Average hourly earnings climbed 0.7% last month, with the year-over-year increase edging down from 5.0% in July to 4.9% in August.

Wage growth in the manufacturing sector continues to follow a similar trajectory, with average hourly earnings up 0.6% last month. On a year-over-year basis, wages in the sector decelerated from 7.6% in July to a still-robust 7.2% in August. The average factory worker earned $32.86 an hour in August 2023, up from $30.66 an hour in August 2022.

ALBERTA, QUEBEC, AND BC POST DOUBLE-DIGIT JOB GAINS

Regionally, the increase in employment spanned 8 of 10 provinces. Alberta (+17,700), Quebec (+14,800), and BC (+12,000) all posted double-digit gains. In proportional terms, job growth was also impressive in PEI (+1,800). In the last 12 months, Alberta’s economy has created nearly 100,000 jobs, accounting for a fifth of all the jobs created in Canada.

In the manufacturing sector, employment was down in six provinces in August, with the bulk of losses taking place in Quebec (-20,700) and Ontario (-13,600). On the plus side, Alberta added 5,600 manufacturing positions last month. Taking a longer-term view, manufacturers in Ontario and Alberta (+18,000) have created the most jobs over the last year, while manufacturers in BC (-9,000) have shed the most workers.