Labour Market Trends

Labour Market Trends

October 2023

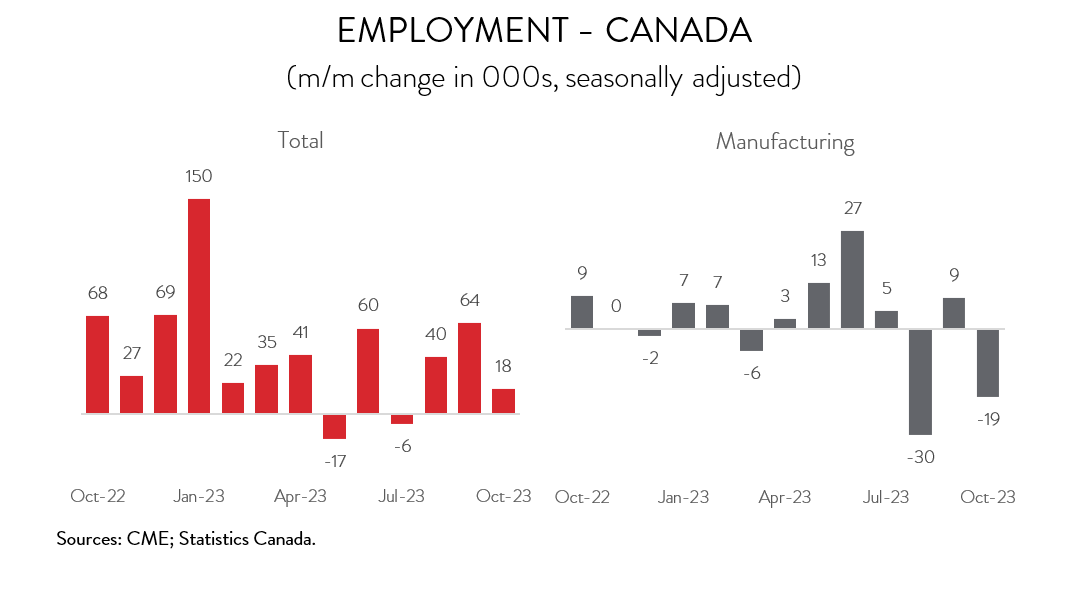

Economy Adds a Modest 17,500 Jobs in October, with Manufacturing Employment Falling for the Second Time in Three Months

HIGHLIGHTS

- Employment rose by a modest 17,500 (+0.1%) in October.

- The increase spanned 10 of 16 industries, led by construction and information, culture and recreation.

- Manufacturing employment fell by 18,800 (-1.0%) last month, down for the second time in three months.

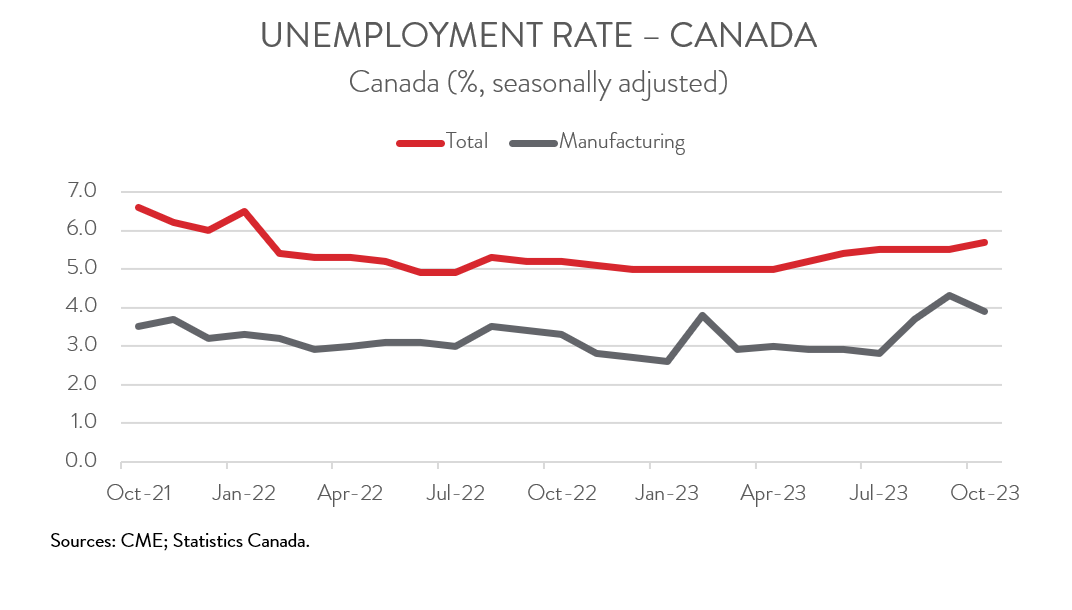

- The headline unemployment rate increased 0.2 percentage points to 5.7% in October, while the jobless rate in manufacturing fell 0.4 percentage points to 3.9%.

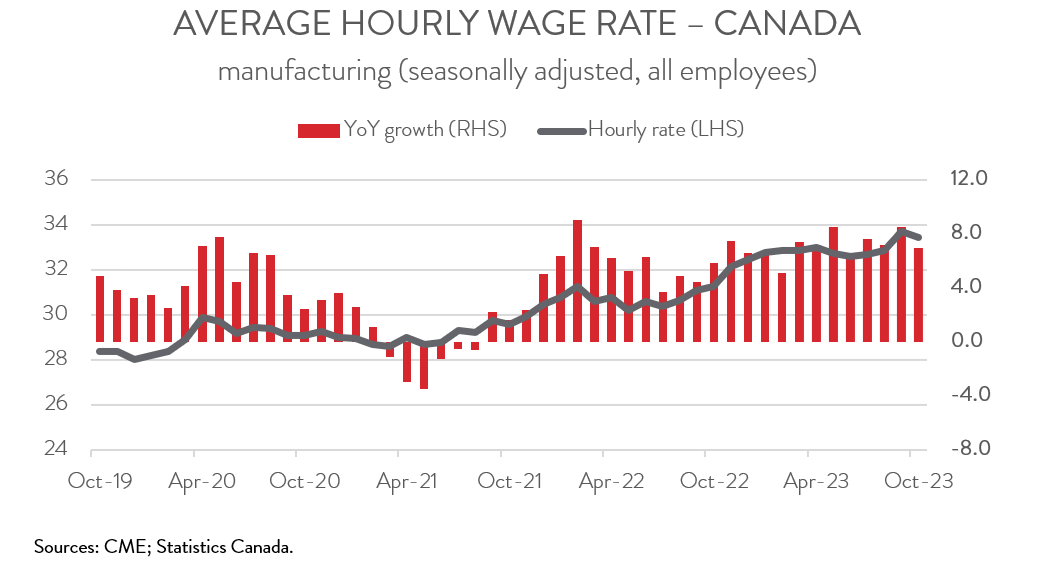

- Year-over-year wage growth in the manufacturing sector decelerated from a near-record high of 8.5% in September to a still-elevated 6.9% in October.

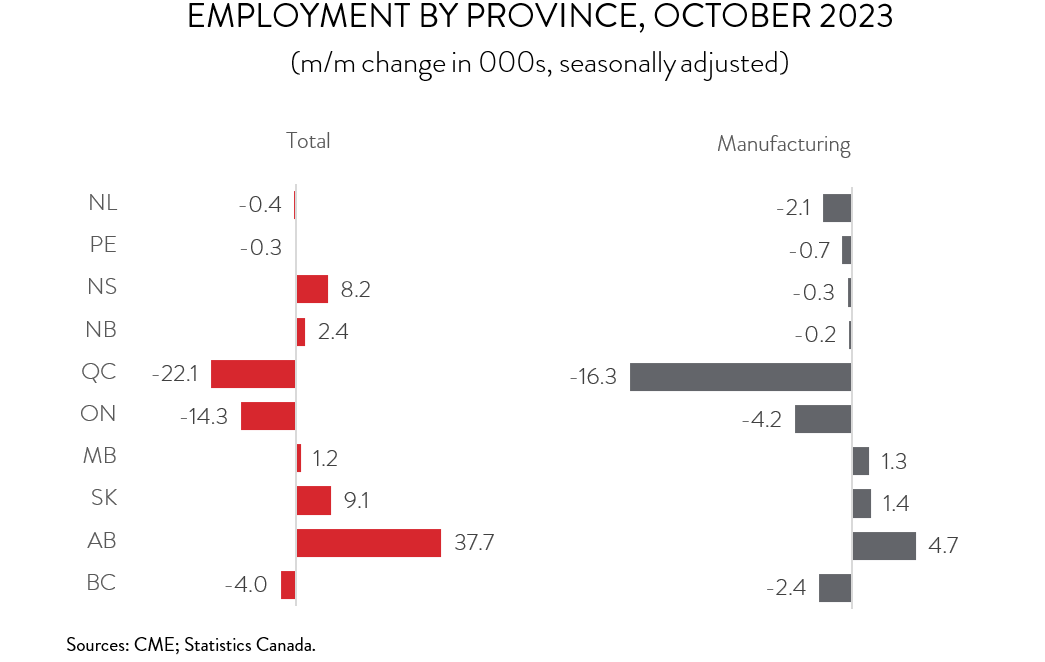

- Total employment was up in 5 of 10 provinces, with Alberta, Saskatchewan, and Nova Scotia posting the most impressive gains. The job losses in manufacturing were concentrated in Quebec.

- The underlying details of the report were mostly soft. As such, signs are mounting that Canada’s labour market is gradually cooling in line with a sluggish economy.

LABOUR MARKET POSTS MODEST GAIN

Following two strong monthly gains, employment rose by a modest 17,500 (+0.1%) in October. The underlying details of the report were mostly soft, as full-time work fell, wage growth slowed, and hours worked were flat.

Even though employment continues to climb, it is important to note that the Canadian economy needs to generate about 50,000 new jobs each month to keep up with the country’s rapid population growth, a much higher threshold than in years past. In other words, signs are mounting that the labour market is gradually cooling in line with a sluggish economy. Notably, the number of private sector jobs has declined by nearly 40,000 over the last four months.

MANUFACTURING EMPLOYMENT DOWN FOR SECOND TIME IN THREE MONTHS

Manufacturing employment decreased by 18,800 (-1.0%) in October, down for the second time in three months. Manufacturing job growth appears to be slowing, coinciding with numerous obstacles such as ongoing workforce challenges, sharply higher interest rates, and soft global demand. Manufacturers have added just 16,700 workers through the first ten months of 2023, down from gains of 78,400 in 2021 and 37,400 in 2022.

Elsewhere, employment was up in 10 of the remaining 15 industries, led by construction (+23,000) and information, culture and recreation (+20,900). Along with manufacturing, these gains were partly offset by a pullback in wholesale and retail trade (-21,700).

HEADLINE UNEMPLOYMENT RATE RISES TO 5.7%

In another sign that the labour market is cooling, the headline unemployment rate rose to 5.7% in October, 0.8 percentage points above the five-decade low hit in the summer of 2022 and back in line with the 2019, pre-pandemic average. Although the jobless rate in manufacturing bucked the trend, falling 0.4 percentage points to 3.9% last month, it is still up significantly from the record low of 2.6% recorded in January 2023.

WAGE GROWTH IN MANUFACTURING REMAINS ELEVATED

Headline wages were up 4.8% year-over-year in October, down slightly from 5.0% in September but well above the historical average of 3.0%. Pay gains remained significantly higher in manufacturing, although average hourly earnings in the sector decelerated from a near-record high of 8.5% in September to a still-elevated 6.9% in October. The average factory worker earned $33.45 an hour in October 2023, up from $31.28 an hour in October 2022.

JOB LOSSES IN MANUFACTURING CONCENTRATED IN QUEBEC

Regionally, the increase in total employment spanned 5 of 10 provinces. The most impressive gains were recorded in Alberta (+37,700), Saskatchewan (+9,100), and Nova Scotia (+8,200). Notably, employment in Alberta has climbed in five out of the last six months. On the negative side, Quebec’s economy shed 22,100 workers in October, following cumulative gains of 53,500 over the previous two months.

In the manufacturing sector, employment was down in seven provinces in October, with the bulk of losses taking place in Quebec (-16,300). In proportional terms, meaningful declines were also observed in Newfoundland and Labrador (-2,100) and PEI (-700). Taking a longer-term view, manufacturers in Alberta (+19,300) have created the most jobs over the past year, while manufacturers in BC (-16,100) have shed the most workers.