Labour Market Trends

Labour Market Trends

December 2023

Job Growth Stalls in December, with Manufacturing Seeing Some of the Steepest Job Losses

HIGHLIGHTS

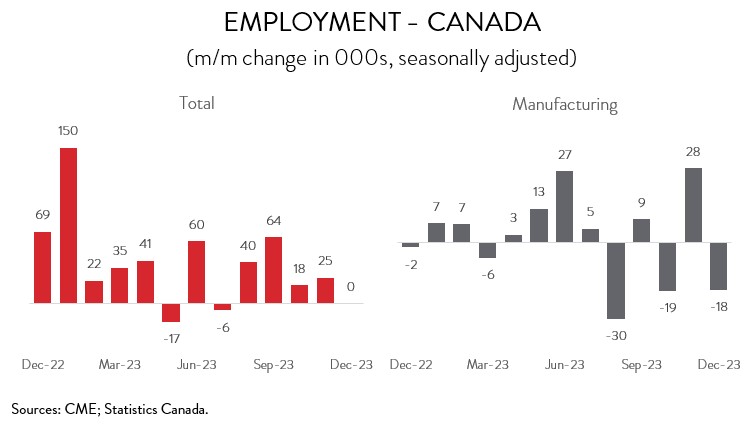

- Canada’s economy added a meagre 100 jobs in December, following increases of 24,900 in November and 17,500 in October.

- Employment increased in 7 of 16 industries, led by professional, scientific and technical services and health care and social assistance.

- Manufacturing employment fell 18,300 (-1.0%) in December, the second decrease in three months.

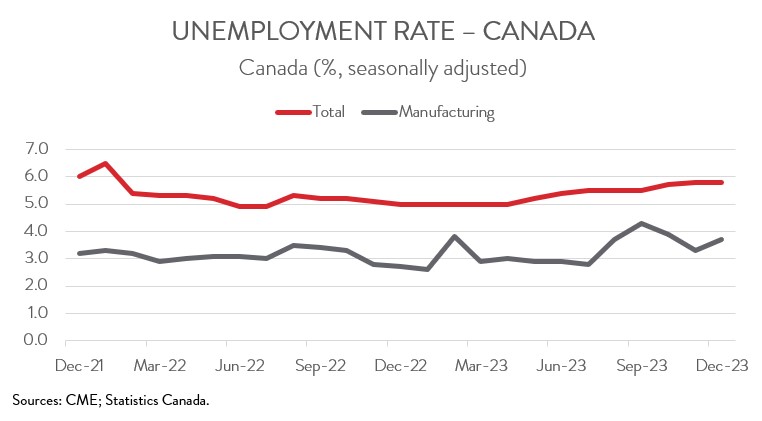

- The headline unemployment rate held steady at 5.8% last month, while the jobless rate in manufacturing rose 0.4 percentage points to 3.7%.

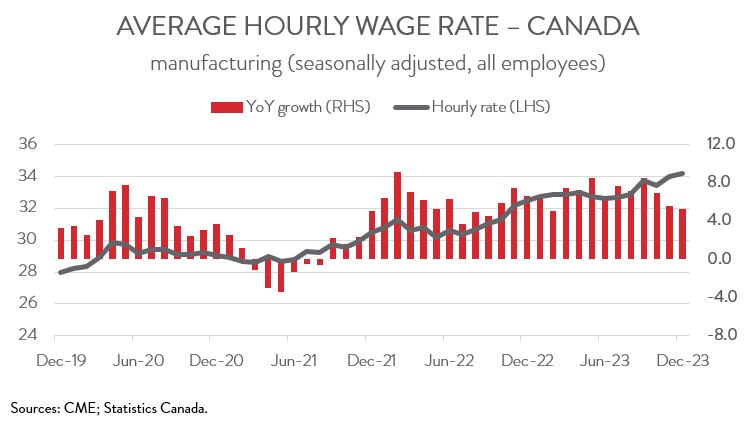

- Year-over-year wage growth in the manufacturing sector decelerated for the second consecutive month, easing from 5.6% in November to 5.3% in December.

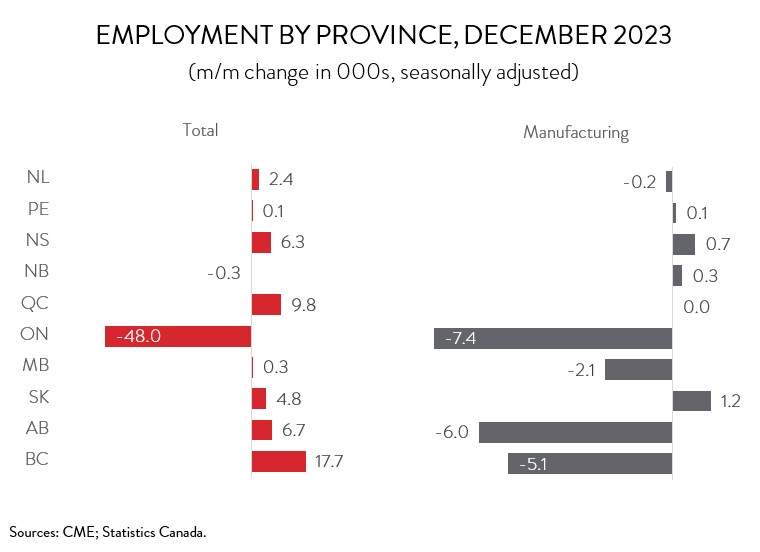

- Total employment was up in 8 of 10 provinces, with Ontario seeing a steep decline. In manufacturing, Saskatchewan posted the largest increase and Ontario and Alberta recorded the biggest losses.

- Canada’s labour market is clearly weakening, coinciding with a broader economic slowdown driven by inflation-fighting interest rate increases.

LABOUR MARKET ENDS YEAR ON SOFT NOTE

Canada’s economy added a meagre 100 jobs in December, following increases of 24,900 in November and 17,500 in October. The underlying details of the report were mixed. While private sector employment and total hours worked increased, the number of full-time positions fell.

Canada’s labour market is clearly weakening, coinciding with a broader economic slowdown driven by inflation-fighting interest rate increases. According to Statistics Canada, monthly job creation averaged 48,000 in the first half of the year, but only 23,000 in the second half.

MANUFACTURING EMPLOYMENT DOWN FOR SECOND TIME IN THREE MONTHS

Manufacturing employment fell 18,300 (-1.0%) in December, the second decline in three months. The sector’s job growth slowed in 2023, coinciding with numerous obstacles such as persistent workforce challenges, sharply higher interest rates, and soft global demand. Manufacturers added 26,800 workers to payrolls in 2023, down from gains of 78,400 in 2021 and 37,300 in 2022. Still, manufacturing employment stood at 1.81 million last year, the highest annual average level since 2008.

Elsewhere, employment was up in 7 of the remaining 15 major industries in December, led by professional, scientific and technical services (+45,700) and health care and social services (+15,500). Along with manufacturing, these gains were mostly offset by pullbacks in wholesale and retail trade (-20,600), agriculture (-17,700), and construction (-13,900).

UNEMPLOYMENT RATE STABLE AT 5.8%

The headline unemployment rate held steady at 5.8% in December, although still up from 5.0% in April 2023. The jobless rate in manufacturing rose 0.4 percentage points to 3.7% last month, largely ending the year where it started.

WAGE GROWTH IN MANUFACTURING GRADUALLY EASING

Even though the labour market is cooling, wage growth remained brisk, with the headline figure accelerating to 5.4% year-over-year in December, from 4.8% in the previous month.

In the manufacturing sector, average hourly earnings decelerated from 5.6% year-over-year in November to 5.3% in December, remaining significantly above the historical average of 2.8%. The average factory worker earned $34.17 an hour in December 2023, up from $32.46 an hour in December 2022.

ONTARIO A CLEAR WEAK SPOT

Regionally, employment increased in 8 of 10 provinces. The biggest absolute gain was recorded in BC (+17,700), while the largest proportional increases were observed in Nova Scotia (+6,300) and Newfoundland and Labrador (+2,400). Despite last month’s gain, Newfoundland and Labrador’s economy has created only 1,000 jobs over the past 12 months. On the negative side, employment in Ontario declined by 48,000 in December, following five months of little change.

In the manufacturing sector, employment was up in just four provinces in December. Saskatchewan saw the biggest increase (+1,200), while Ontario (-7,400) and Alberta (-6,000) experienced the steepest declines.

For 2023 as a whole, manufacturing employment increased in 7 of 10 provinces. Job creation was strongest in Ontario (+20,900) and Alberta (+14,200), while the steepest job losses were observed in BC (-12,300).