Labour Market Trends

Labour Market Trends

January 2024

Job Growth Resumes in January, Though Manufacturing Sees Third Decline in Four Months

HIGHLIGHTS

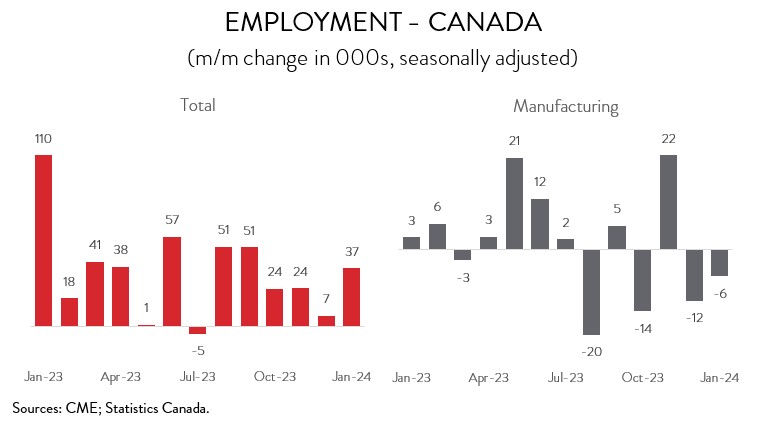

- Employment rose 37,300 (+0.2%) in January, following three months of little change.

- Manufacturing employment fell 6,200 (-0.3%), the third decline in four months.

- Elsewhere, employment was up in 6 of the remaining 15 major industries, led by wholesale and retail trade, finance, insurance and real estate, and educational services.

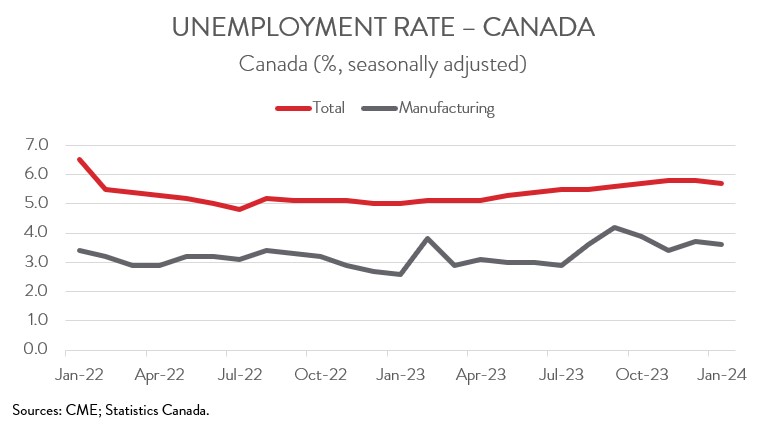

- The unemployment rate fell 0.1 percentage points to 5.7%, the first decline since December 2022.

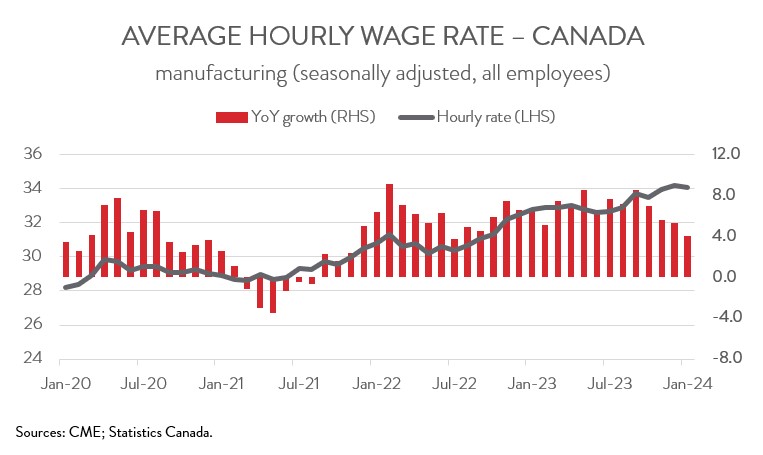

- Year-over-year wage growth in the manufacturing sector eased to 4.0%, the slowest pace since July 2022.

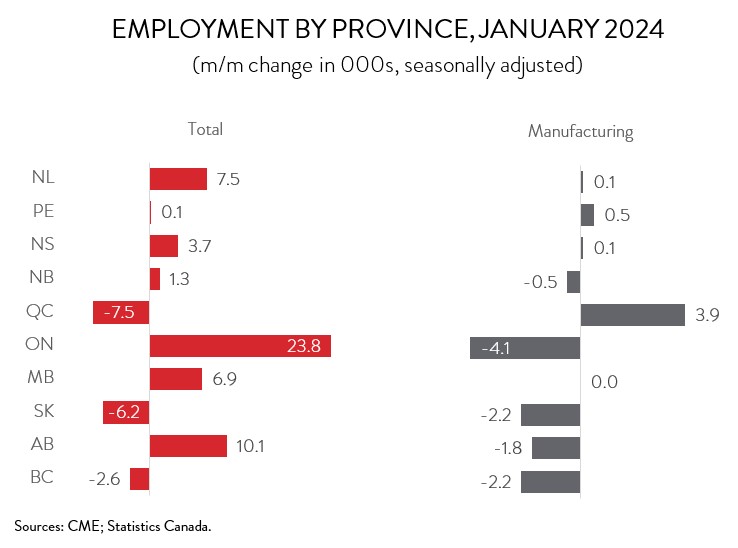

- Total employment was up in 7 of 10 provinces, with Ontario and Newfoundland and Labrador posting the most impressive gains. In manufacturing, Quebec boasted the largest increase and Ontario recorded the steepest loss.

- The underlying details of today’s report were less impressive than the headline figure, so it should not be used as a barometer of the underlying strength of the Canadian economy.

EMPLOYMENT SEES FIRST MEANINGFUL INCREASE IN FOUR MONTHS

Employment rose 37,300 (+0.2%) in January, following three months of little change. The underlying details of today’s report were less impressive than the headline figure, so it should not be used as a barometer of the underlying strength of the Canadian economy. In fact, job growth was primarily driven by part-time work and the public sector. On the positive side, total hours worked rose 0.6%, the biggest monthly gain since January 2023.

The bottom line is that the mixed picture of today’s report will not alter the Bank of Canada’s current course of monetary policy, with most analysts expecting the first interest rate cut to be delivered sometime in the middle of this year.

MANUFACTURING EMPLOYMENT DOWN FOR THIRD TIME IN FOUR MONTHS

Manufacturing employment fell 6,200 (-0.3%) in January, the third decline in four months and indicative of the continuing loss of momentum and weakness in the sector. The last several months have been challenging for manufacturers as they face numerous headwinds, including persistent workforce challenges, high interest rates, and soft global demand. Still, with forecasters predicting that the world economy is heading for a soft landing and that central banks around the world will cut rates this year, manufacturing activity is expected to gradually improve through 2024.

Elsewhere, employment was up in 6 of the remaining 15 major industries, led by wholesale and retail trade (+31,300), finance, insurance and real estate (+28,100), and educational services (+27,700). Along with manufacturing, these gains were partly offset by pullbacks in accommodation and food services (-30,300), professional, scientific and technical services (-16,500), and information, culture and recreation (-12,800).

UNEMPLOYMENT RATE EDGES DOWN

The headline unemployment rate fell 0.1 percentage points to 5.7% in January, the first decline since December 2022. Likewise, the jobless rate in manufacturing inched down a tick to 3.6%, still a full percentage point higher than the record low of 2.6% observed in January 2023.

WAGE GROWTH IN MANUFACTURING SLOWS SHARPLY

Headline wage growth slowed slightly to 5.3% year-over-year in January, from 5.4% in the previous month. Despite the slowdown, this pace of growth is still incompatible with the Bank of Canada’s 2-per-cent inflation target.

Although the manufacturing sector has typically experienced much more intense wage pressures than that of the overall economy, the script flipped in January. In the manufacturing sector, average hourly earnings decelerated sharply from 5.3% year-over-year in December to 4.0% in January, the slowest pace since July 2022.

ONTARIO LEADS OVERALL EMPLOYMENT GAINS, THOUGH FACTORY JOBS FALL

Regionally, employment increased in 7 of 10 provinces in January. The biggest absolute gain was recorded in Ontario (+23,800), while the largest proportional increases were observed in Newfoundland and Labrador (+7,500) and Manitoba (+6,900). However, even with last month’s gain, employment in Ontario has increased by 1.1% over the last 12 months, which trails the national growth rate of 1.7%. On the negative side, employment in Quebec and Saskatchewan declined by 7,500 and 6,200, respectively, last month.

In the manufacturing sector, employment was up in just four provinces in January. Quebec saw the biggest increase (+3,900), while Ontario (-4,100) experienced the steepest decline. In proportional terms, a meaningful increase was also observed in PEI (+500). Taking a longer-term view, manufacturers in Ontario (+9,500) have created the most jobs over the past year, while manufacturers in Newfoundland and Labrador (-2,500) have shed the most workers.