Labour Market Trends

Labour Market Trends

March 2024

Unemployment Rate Jumps to 6.1%; Manufacturers Add Workers for First Time in Four Months

HIGHLIGHTS

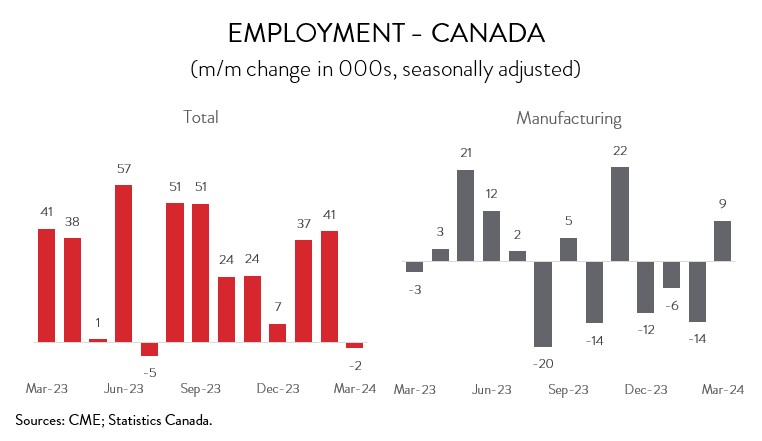

- Employment fell 2,200 (-0.0%) in March, just the second decline in 18 months.

- Manufacturing employment rose 9,300 (+0.5%), the first increase since November 2023.

- Employment was down in 9 of the remaining 15 major industries, led by accommodation and food services, wholesale and retail trade, and professional, scientific and technical services.

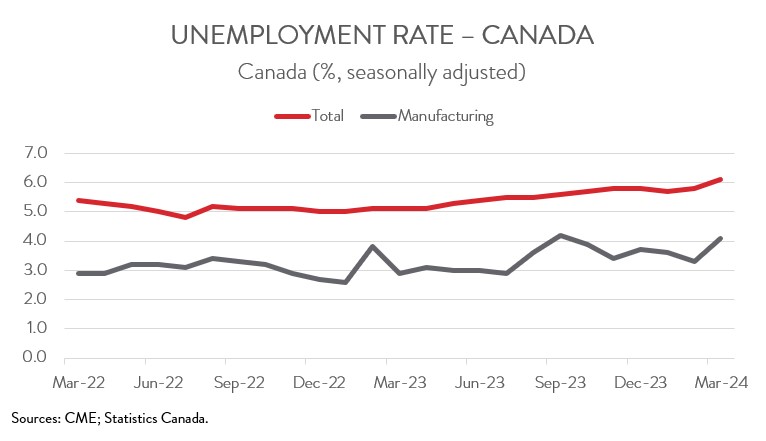

- The unemployment rate shot up to 6.1%, the highest level in more than two years; the jobless rate in manufacturing jumped to a six-month high of 4.1%.

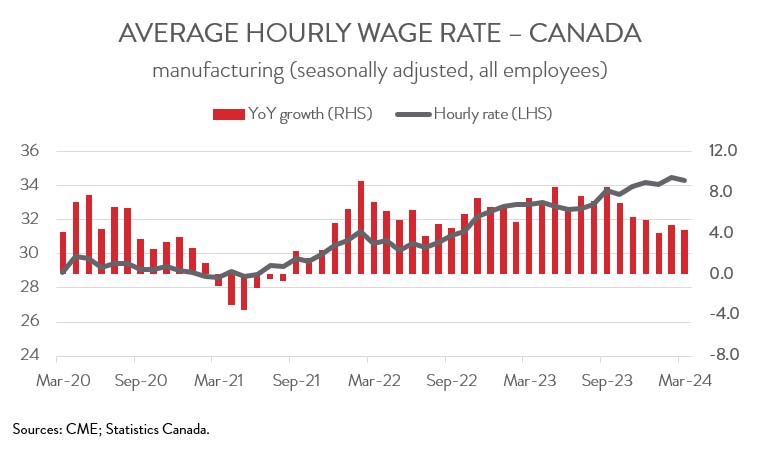

- Year-over-year wage growth edged up from 5.0% in February to 5.1% in March, while wages in the manufacturing sector slowed from 4.8% to 4.3%.

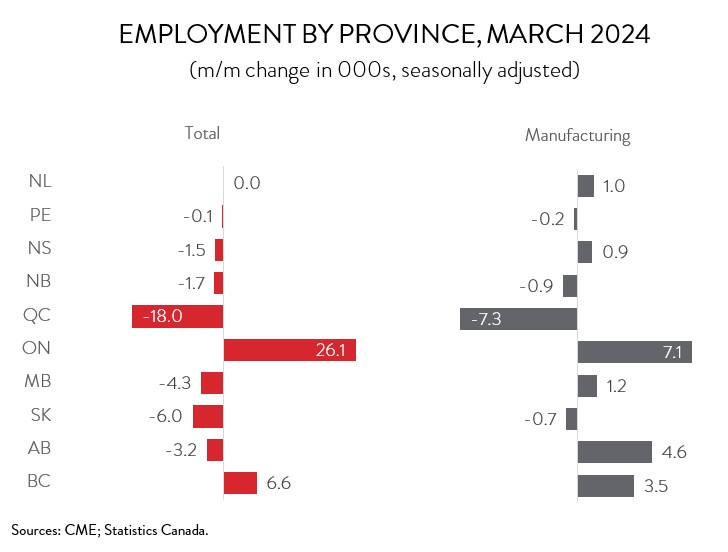

- Total employment was down in 7 of 10 provinces, with Quebec, Saskatchewan, and Manitoba recording the steepest losses. Ontario and Alberta drove the job growth in manufacturing.

- Although wage growth remains relatively brisk, analysts still expect the Bank of Canada to start cutting interest rates in June.

LABOUR MARKET SHEDS JOBS IN MARCH

Employment fell 2,200 (-0.0%) in March, just the second decline in 18 months. The underlying details were not much better, as both full-time jobs and total hours worked were down. An increase in private sector employment was one of the report’s few silver linings.

Canada’s labour market continues to show signs of weakening, with employment lagging population growth for several months. Although wage growth remains relatively brisk, analysts still expect the Bank of Canada to start cutting interest rates in June.

MANUFACTURERS ADD WORKERS FOR FIRST TIME SINCE NOVEMBER

Manufacturing employment rose 9,300 (+0.5%) in March, the first increase in four months. Facing numerous headwinds such as persistent workforce challenges, high interest rates, and soft global demand, the sector has shed nearly 30,000 workers since July 2023.

Elsewhere, employment was down in 9 of the remaining 15 major industries, led by accommodation and food services (-26,600), wholesale and retail trade (-23,100), and professional, scientific and technical services (-19,900). Along with manufacturing, these declines were partly offset by gains in health care and social assistance (+39,900) and construction (+15,300).

UNEMPLOYMENT RATE SHOOTS UP TO 6.1%

The unemployment rate shot up to 6.1% in March, the highest level in more than two years and up a full percentage point from a year ago. Similarly, the jobless rate in manufacturing jumped 0.8 percentage points to 4.1%, the highest level since September 2023.

HEADLINE WAGE GROWTH TICKS UP

Despite the drop in employment, averaged hourly wages actually edged up to a 5.1% year-over-year pace in March from 5.0% in the previous month. However, it should be noted that last month’s job cuts, predominantly occurring in lower-paying industries, likely inflated the headline average wage, reflecting how changes in employment quality can significantly affect this metric.

Year-over-year wage growth in the manufacturing sector also decelerated last month, slowing from 4.8% in February to 4.3% in March. The average factory worker earned $34.27 an hour in March 2024 compared to $32.86 an hour in the same month a year ago.

ONTARIO AND ALBERTA DRIVE EMPLOYMENT GAINS IN MANUFACTURING

Regionally, employment decreased in 7 of 10 provinces in March. The biggest absolute decline was recorded in Quebec (-18,000), while the largest proportional decreases were observed in Saskatchewan (-6,000) and Manitoba (-4,300). This was Quebec’s biggest monthly drop June 2022. On the positive side, Ontario’s economy created 26,100 jobs in March, bringing the year-over-year increase to 86,200.

In the manufacturing sector, employment was up in six provinces in March, led by Ontario (+7,100) and Alberta (+4,600). In proportional terms, Newfoundland and Labrador also experienced a strong rise in factory payrolls (+1,000) last month. These increases were partially offset by a significant pullback in Quebec (-7,300). Taking a longer-term view, Ontario’s manufacturers (+23,200) have created the most jobs over the last year, while Quebec’s manufacturers (-22,300) have shed the most workers.