Manufacturing Sales

Manufacturing Sales

April 2023

Factory Sales Climb 0.3% in April on Higher Volumes

HIGHLIGHTS

- Manufacturing sales rose 0.3% to $72.3 billion in April, the third increase in four months.

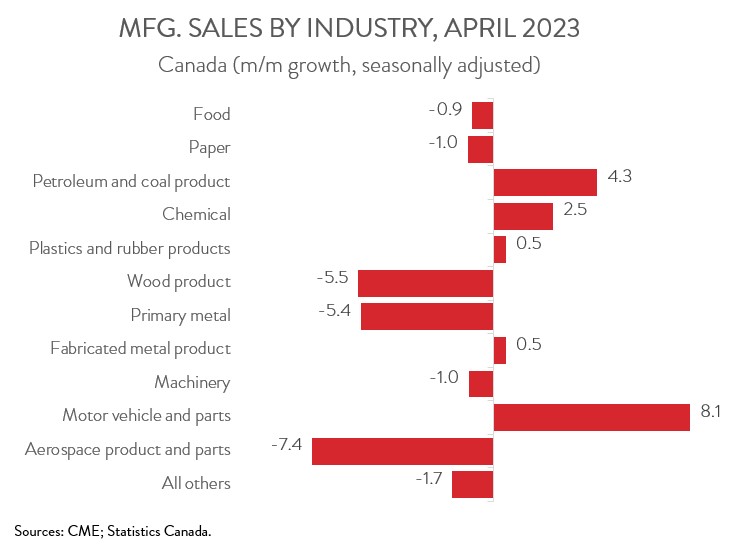

- Sales were up in 5 of 11 major industries, led by the motor vehicle and parts and petroleum and coal product industries.

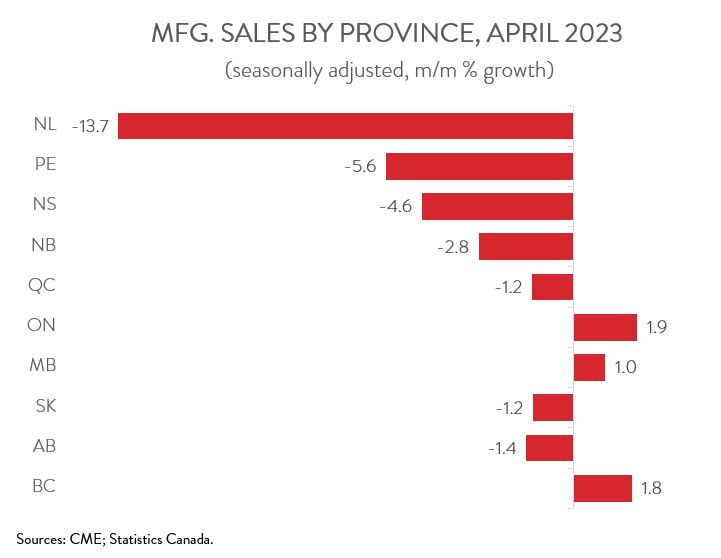

- Regionally, sales rose in just 3 of 10 provinces, with a significant gain in Ontario more than offsetting a notable pullback in Quebec.

- The inventory-to-sales ratio inched down from 1.72 in March to 1.71 in April.

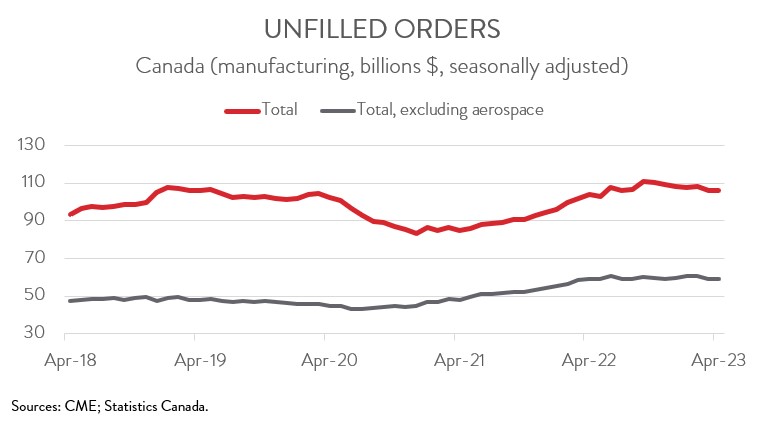

- Forward-looking indictors were mixed, with unfilled orders down 0.2% and new orders up 2.9%.

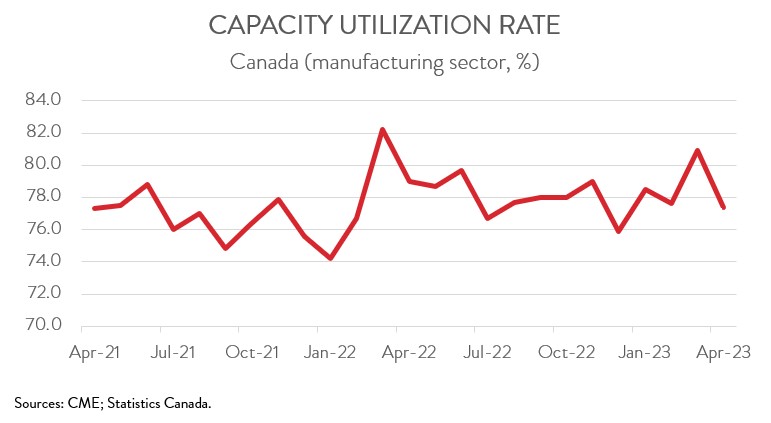

- The manufacturing sector’s capacity utilization rate decreased from a 12-month high of 80.9% in March to 77.4% in April.

- Despite climbing in three out of the last four months, manufacturing sales in April were down 1.6% compared to a year ago, the first year-over-year decline since December 2020. The near-term outlook for Canada’s manufacturing sector remains cloudy, with sharply higher interest rates continuing to act as a drag on global economic growth.

MANUFACTURING SALES UP 0.3% IN APRIL

Manufacturing sales rose 0.3% to $72.3 billion in April, the third increase in four months. Sales in constant dollars climbed 0.8% in April, indicating that the increase in sales was driven by higher volumes.

Despite climbing in three out of the last four months, manufacturing sales in April were down 1.6% compared to a year ago, the first year-over-year decline since December 2020. The near-term outlook for Canada’s manufacturing sector remains cloudy, with sharply higher interest rates continuing to act as a drag on global economic growth.

GAINS DRIVEN BY THE MOTOR VEHICLE AND PARTS AND PETROLEUM AND COAL PRODUCT SECTORS

Sales increased in 5 of 11 major industries in April. Following a 5.0% increase in March, sales in the motor vehicle parts sector increased a further 8.1% to $8.9 billion in April, the highest level since June 2019. Supply chains continue to heal, allowing manufacturers to increase production to meet market demand and reduce order backlogs.

Sales in the petroleum and coal product industry rose 4.3% to $9.1 billion in April, up for the first time in three months. The increase in sales was fueled by higher volumes, as prices for refined petroleum energy products (including liquid biofuels) declined in the month. Statistics Canada noted that petroleum production jumped in BC, following a maintenance shutdown in previous months.

On the negative side, primary metal sales decreased 5.4% to $5.7 billion in April, the second decline in three months. All subsectors contracted, with the non-ferrous metal (except aluminum) production and processing and iron and steel mills and ferro-alloy manufacturing industries falling the most. Sales in volume terms dropped a slightly steeper 5.8%, coinciding with an unexpected contraction in manufacturing production in China that was pinned on a lack of global demand.

SALES UP IN JUST THREE PROVINCES

Manufacturing sales increased in just three provinces in April. Ontario led the way, with sales rising 1.9% to $32.3 billion. The increase was primarily driven by the motor vehicle parts and petroleum and coal product sectors. Sales of motor vehicle parts were particularly strong in Windsor.

At the other end of the spectrum, sales in Quebec fell 1.2% to $18.1 billion in April, following a 2.8% advance in March. The non-ferrous metal (except aluminum) production and processing industry was largely responsible for the decline. Statistics Canada pointed out that Quebec is home to Canada’s biggest non-ferrous metal industry, as it accounts for about 60% of the country’s total sales.

INVENTORIY-TO-SALES RATIO INCHES DOWN

Total inventories were unchanged at $123.8 billion in April, with higher inventories in the primary metal and machinery industries offsetting lower inventories in the paper product and other transportation equipment sectors.

The inventory-to-sales ratio inched down from 1.72 in March to 1.71 in April. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS MIXED

Forward-looking indictors were mixed. The total value of unfilled orders declined 0.2% to $106.2 billion in April, down for the sixth time in seven months. The decrease was largely driven by the primary metal industry. In more positive news, the total value of new orders increased 2.9% to $72.1 billion. However, this was just the second increase in seven months.

CAPACITY UTILIZATION RATE FALLS

Finally, the manufacturing sector’s capacity utilization rate fell to 77.4% in April, down from a 12-month high of 80.9% in March. The decline was broad-based and led by the transportation equipment, primary metal, and fabricated metal product industries.