Manufacturing Sales

Manufacturing Sales

June 2023

Factory Sales Slip in June on Widespread Declines Across Subsectors

HIGHLIGHTS

- Manufacturing sales fell 1.7% to $71.5 billion in June, the second decline in three months.

- Sales were down in 13 of 20 subsectors, with the petroleum and coal product and chemical industries suffering the steepest losses and the motor vehicle and parts and primary metal sectors posting the largest gains.

- Regionally, sales declined in 5 of 10 provinces, led by Alberta and Ontario.

- The inventory-to-sales ratio increased from 1.69 in May to 1.72 in June.

- Forward-looking indictors were encouraging, with unfilled orders and new orders up 0.2% and 1.2%, respectively.

- The manufacturing sector’s capacity utilization rate increased from 80.3% in May to 80.8% in June.

- Canada, along with many other countries around the world, has seen a dip in factory production amid continued weakness in global demand. Unfortunately, the near-term outlook for Canada’s manufacturing sector remains cloudy, as high interest rates are likely to be with us for some time.

MANUFACTURING SALES DOWN 1.7% IN JUNE

Manufacturing sales fell 1.7% to $71.5 billion in June, the second decline in three months. Sales in constant dollars were down 1.0%, indicating that a lower volume of goods was sold.

Canada, along with many other countries around the world, has seen a dip in factory production amid continued weakness in global demand. Manufacturing sales fell 0.8% in the second quarter and were down 1.4% compared to a year ago. Unfortunately, the near-term outlook for Canada’s manufacturing sector remains cloudy, as high interest rates are likely to be with us for some time.

DECLINE WIDESPREAD ACROSS SUBSECTORS

The decrease in June was broad-based, spanning 13 of 20 industries. Sales of petroleum and coal products dropped 8.3% to $7.9 billion, the second straight monthly decline and the lowest level since December 2021. The monthly decrease was attributable to lower volumes, as prices of refined petroleum energy products rose solidly in June.

After increasing for two consecutive months, sales in the chemical industry fell 6.5% to $5.8 billion in June. The decline was mainly driven by a steep decline in sales of pesticide, fertilizer, and other agricultural chemicals. As noted by Statistics Canada, sales of fertilizers declined in June, following the spring planting season in May where sales reached their highest level on record.

In more positive news, sales of motor vehicles and parts increased 3.7% to $9.3 billion in June, the fourth consecutive monthly gain and the highest level sine January 2016. The auto industry continues to benefit from easing supply chain disruptions that have enabled it to increase production.

The primary metal industry also had a strong month, with sales climbing 5.7% to $5.4 billion in June. However, this was just the first increase in three months. Moreover, on a year-over-year basis, primary metal sales were down 14.0%.

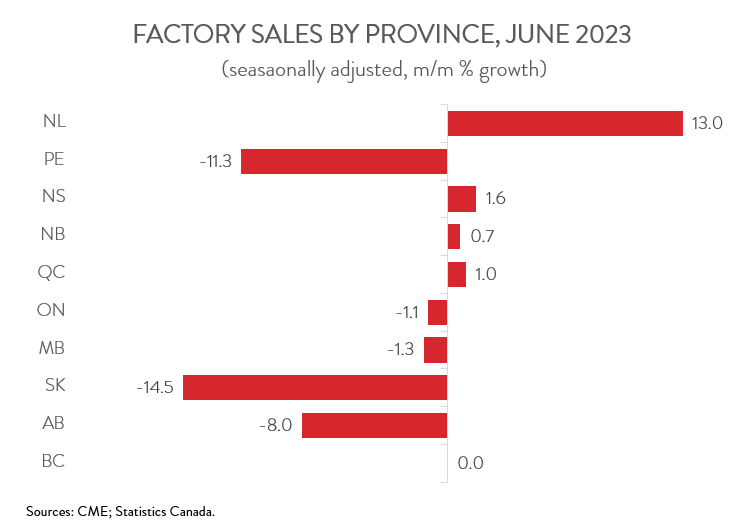

SALES DOWN IN FIVE PROVINCES, LED BY ALBERTA AND ONTARIO

Manufacturing sales were down in 5 of 10 provinces in June. Alberta posted the steepest decline, with sales tumbling 8.0% to $8.5 billion, the lowest level since January 2022. The decrease was largely fueled by lower sales of petroleum and coal products.

Sales in Ontario fell 1.1% to $32.6 billion in June, primarily due to lower sales of motor vehicle parts, petroleum and coal products, and machinery. Declines in those sectors were partly offset by higher sales of motor vehicles.

On the positive side of the ledger, sales in Quebec rose 1.0% to $17.7 billion in June, thanks to higher sales of primary metals and chemicals. However, despite this increase, factory sales on a year-over-year basis were down 3.5% in June.

Sales in Newfoundland and Labrador jumped 13.0% to $269.5 million in June, partly recouping the substantial losses registered in April and May. Over the past 12 months, the province’s manufacturing sales have fallen 19.7%.

INVENTORY-TO-SALES RATIO RISES

Total inventories edged up 0.3% to $123.2 billion in June, with higher inventories of aerospace product and parts and chemicals more than offsetting lower inventories of primary metals and machinery.

The inventory-to-sales ratio increased from 1.69 in May to 1.72 in June. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

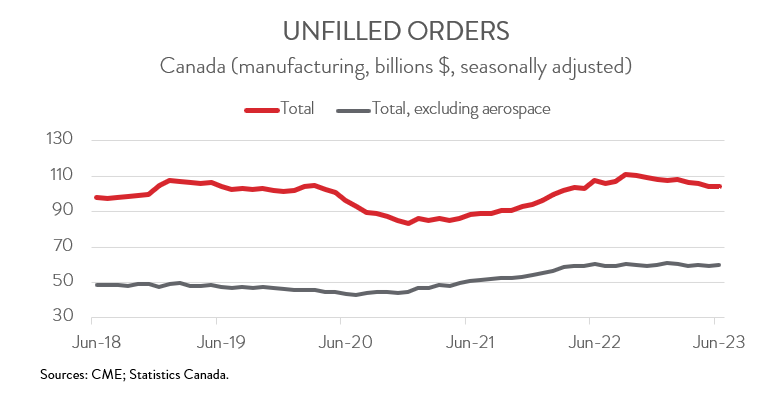

FORWARD-LOOKING INDICATORS ENCOURAGING

Forward-looking indictors were encouraging. After declining for three months in a row, the total value of unfilled orders inched up 0.2% to $104.5 billion in June. The increase was primarily driven by higher unfilled orders of motor vehicles and electrical equipment, appliances, and components. It was a similar story for new orders; they rose 1.2% to $71.7 billion in June, notching only the second increase in the past five months.

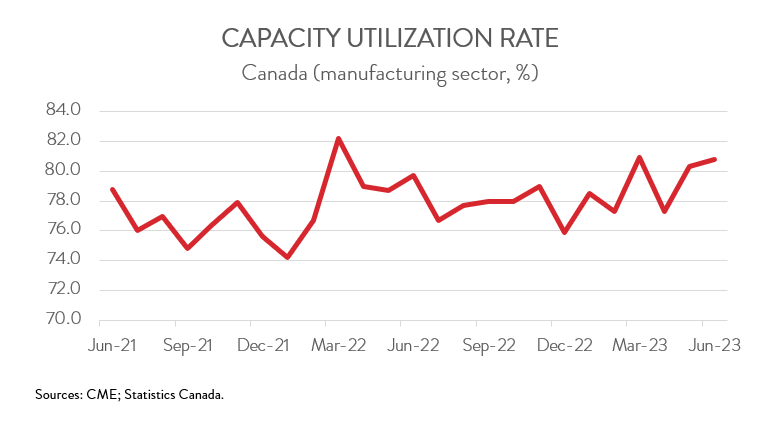

CAPACITY UTILIZATION RATE RISES

Despite the decline in sales, the manufacturing sector’s capacity utilization rate increased from 80.3% in May to 80.8% in June. The most notable gains were observed in the transportation equipment, non-metallic mineral product, and petroleum and coal product sectors.