Manufacturing Sales

Manufacturing Sales

August 2023

Factory Sales Increase in August, Boosted by Petroleum and Coal Products

HIGHLIGHTS

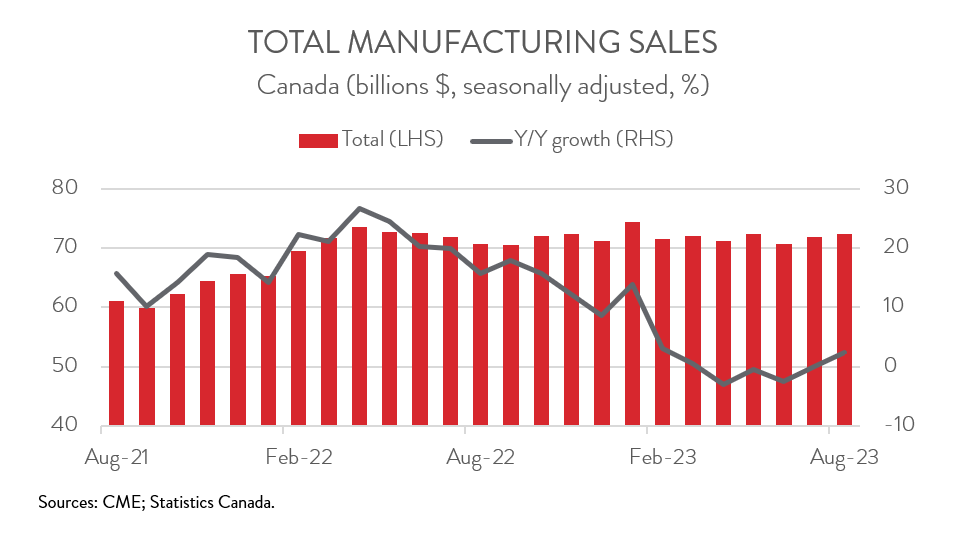

- Manufacturing sales rose 0.7% to $72.4 billion in August, up for the second consecutive month.

- The BC port strike continued to affect the manufacturing sector in August, but to a lesser extent than in July.

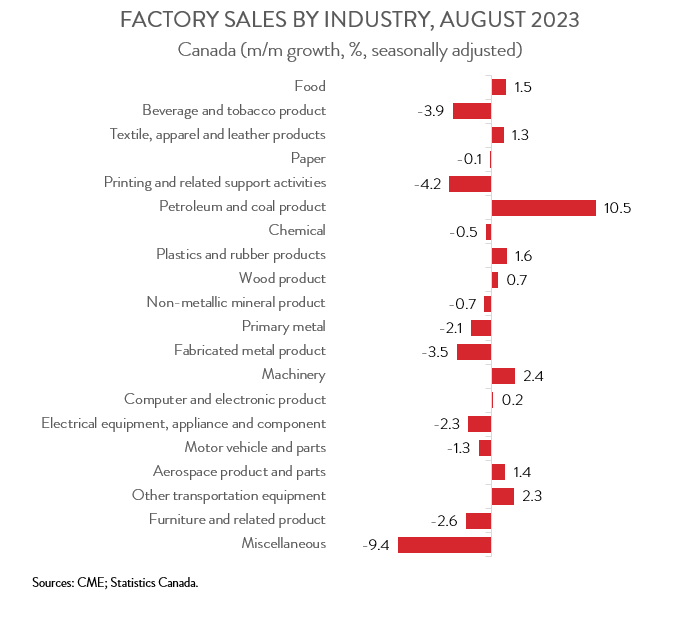

- The increase in sales spanned 9 of 20 subsectors, led by a big gain in petroleum and coal products.

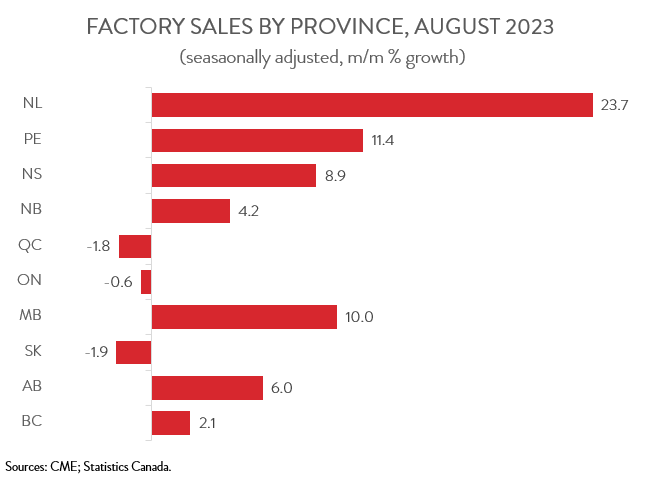

- Regionally, sales were up in 7 of 10 provinces, with Alberta and Manitoba posting the biggest gains and Quebec and Ontario experiencing the steepest losses.

- The inventory-to-sales ratio inched down from 1.70 in July to 1.69 in August.

- Forward-looking indictors were encouraging, with unfilled orders and new orders up 0.5% and 2.8%, respectively.

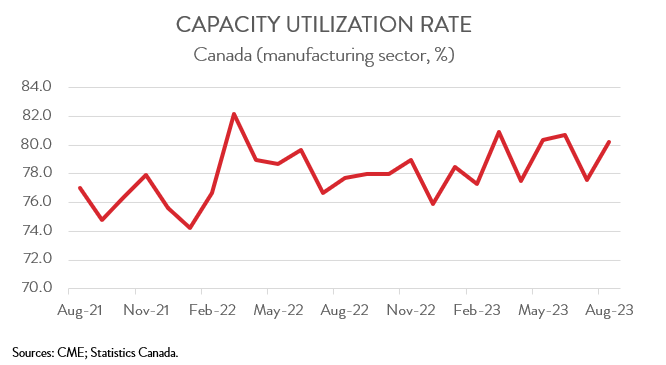

- The capacity utilization rate increased from 77.6% in July to 80.2% in August.

- Despite the back-to-back sales gains, the near-term outlook for the sector remains cloudy, as demand for manufactured products is likely to continue to be held back by high interest rates and a slowing global economy.

MANUFACTURING SALES UP 0.7% IN AUGUST

Manufacturing sales rose 0.7% to $72.4 billion in August, the second consecutive monthly increase. However, sales in constant dollars were down 0.7%, indicating that the monthly increase was entirely due to higher prices.

The BC port strike continued to affect the manufacturing sector in August, but to a lesser extent than in July. According to Statistics Canada, the strike impacted 8.4% of factories in August, down from 13.2% in July. When the 13-day work stoppage ended in mid-July, industry experts warned that it would take months for the backlogs to fully clear.

Despite the back-to-back sales gains, the near-term outlook for the manufacturing sector remains cloudy, as demand for manufactured products is likely to continue to be held back by high interest rates and a slowing global economy.

SALES GROWTH FUELED BY PETROLEUM AND COAL PRODUCTS

The increase in August spanned 9 of 20 industries. Sales of petroleum and coal products increased for the second straight month in August, jumping 10.5% to $8.4 billion, thanks to both higher prices and volumes. As noted by Statistics Canada, lingering concerns over oil production cuts by the Organization of the Petroleum Exporting Countries and its partners (OPEC+) have helped push up petroleum product prices in recent weeks.

Food product sales rose 1.5% to a record high of $12.6 billion in August, thanks to gains in all food industry groups except seafood product preparation and packaging. Year-over-year, food product sales were up 4.6% in August.

Likewise, sales of machinery increased 2.4% to an all-time high of $4.8 billion in August, driven mainly by higher sales of industrial machinery. Sales of machinery were up 15.1% in August compared to the same month last year.

On the downside, sales in the fabricated metal product industry fell 3.5% to $4.5 billion in August, more than offsetting the 3.1% increase in July. The decline in August was largely a result of lower sales in two subsectors: other fabricated metal product manufacturing and architectural and structural metals manufacturing. That said, despite the monthly decline, sales were up 5.1% year-over-year in August.

ALBERTA AND MANITOBA LEAD PROVINICAL GAINS

Manufacturing sales were up in 7 of 10 provinces in August. Alberta contributed the most to the national increase, as sales rose 6.0% to $8.7 billion. This was the province’s second straight monthly gain and was largely driven by higher sales of petroleum products.

Manitoba also had a strong month, with sales rising 10.0% to $2.2 billion, bouncing back from a 12.1% decline in July. The rebound was driven by higher sales of chemical products, transportation equipment, and food products.

At the other end of the spectrum, factory sales were down in Canada’s two biggest manufacturing provinces. Sales in Quebec fell 1.8% to $17.5 billion in August. Primary metals posted the steepest drop, partially due to lower aluminum prices. At the same time, sales in Ontario decreased 0.6% to $33.0 billion, the second decline in three months.

INVENTORY-TO-SALES RATIO INCHES DOWN

Total inventories edged down 0.1% to $122.2 billion in August, the lowest level since January 2023, driven by lower inventories of chemical products and primary metals. This, combined with the increase in sales, pushed the inventory-to-sales ratio down slightly from 1.70 in July to 1.69 in August. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

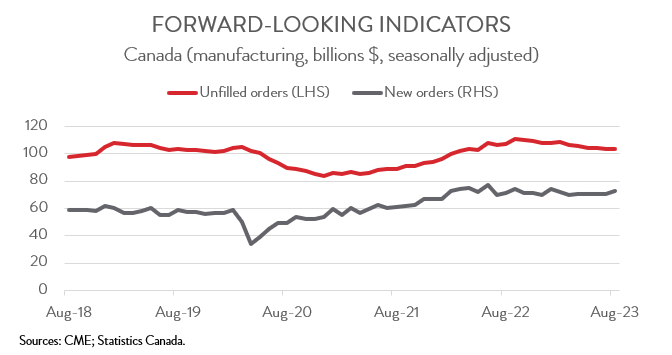

FORWARD-LOOKING INDICATORS ENCOURAGING

Forward-looking indictors were encouraging. The total value of unfilled orders rose 0.5% to $103.8 billion in August, largely on higher unfilled orders of aerospace product and parts. At the same time, new orders jumped 2.8% to $72.8 billion in August, the highest level since January 2023.

CAPACITY UTILIZATION RATE INCREASES

Finally, the manufacturing sector’s capacity utilization rate increased from 77.6% in July to 80.2% in August. The most notable gains were observed in the transportation equipment, petroleum and coal product, and machinery subsectors, while the most significant decline was recorded in primary metal manufacturing.