Manufacturing Sales

Manufacturing Sales

September 2023

Factory Sales Increase for Third Month in a Row in September, but Volumes Down

HIGHLIGHTS

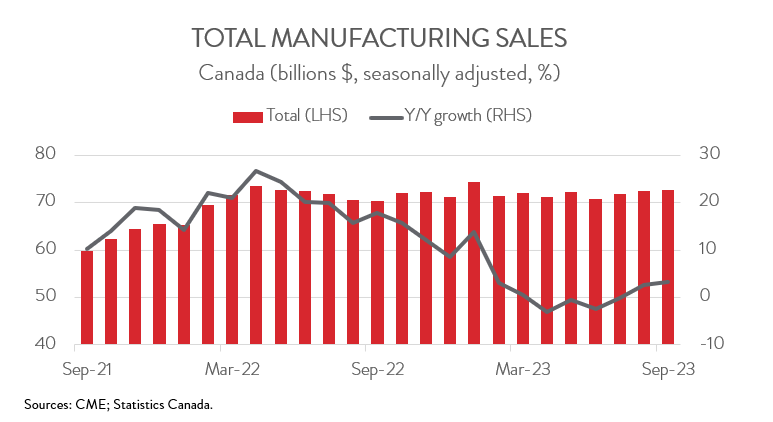

- Manufacturing sales rose 0.4% to $72.8 billion in September, the third consecutive monthly gain.

- The increase in sales spanned 10 of 20 subsectors, with petroleum and coal products making the biggest contribution to growth.

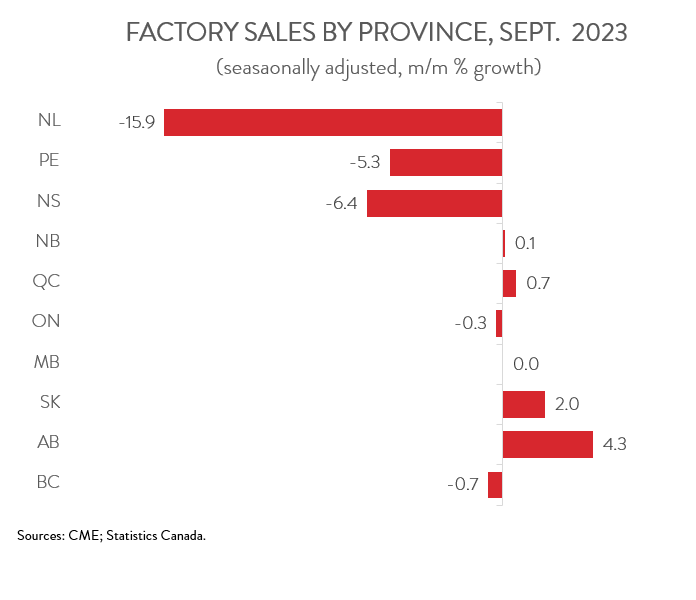

- Regionally, sales were up in 5 of 10 provinces, led by Alberta and Quebec.

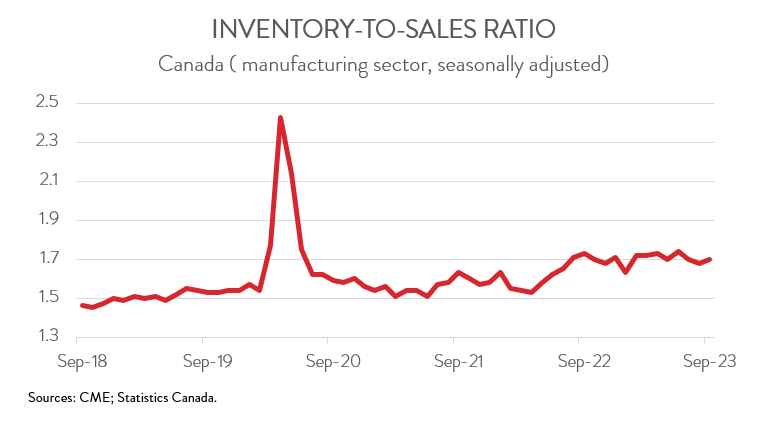

- The inventory-to-sales ratio increased from 1.68 in August to 1.70 in September.

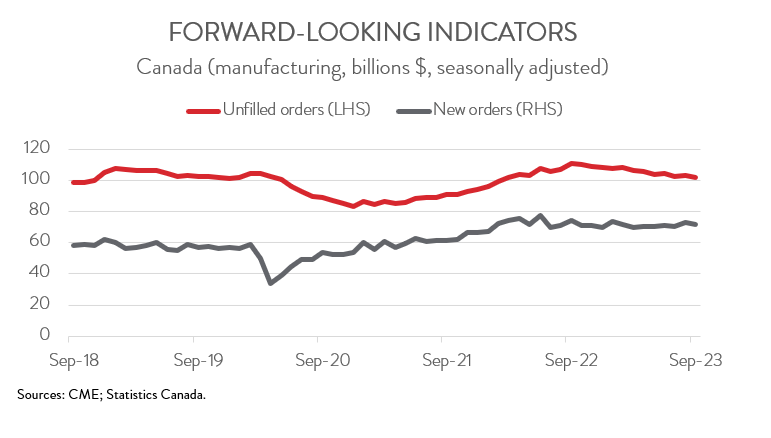

- Forward-looking indictors were discouraging, with unfilled orders and new orders down 1.2% and 1.7%, respectively.

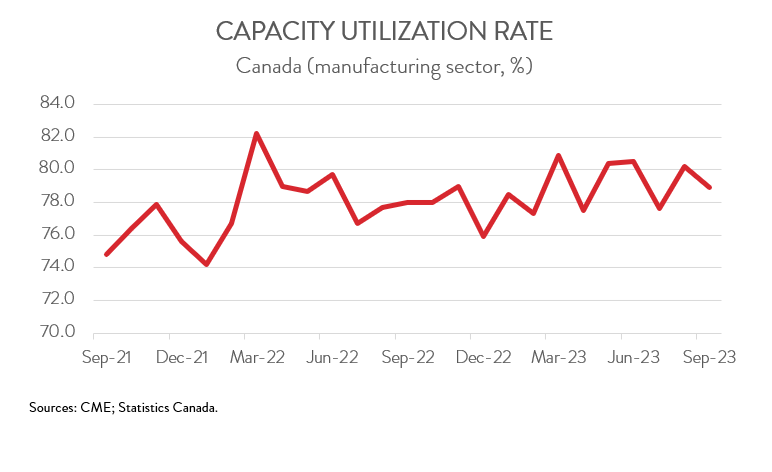

- The capacity utilization rate decreased from 80.2% in August to 78.9% in September.

- The underlying details of recent manufacturing sales reports have been less impressive than the headline figures. Indeed, the three consecutive monthly sales gains were entirely driven by higher prices, as volumes were down 0.4% over this period.

MANUFACTURING SALES UP 0.4% IN SEPTEMBER

Manufacturing sales rose 0.4% to $72.8 billion in September. This was the third consecutive monthly increase in current dollar sales.

However, the underlying details of recent manufacturing sales reports have been less impressive than the headline figures. Indeed, the three consecutive monthly sales gains have been entirely driven by higher prices, as volumes were down 0.4% over this period. Unfortunately, the near-term outlook for the manufacturing sector remains cloudy, as a slowing global economy and high interest rates weigh on demand for manufactured goods.

SALES GROWTH FUELED BY PETROLEUM AND COAL PRODUCTS

The increase in sales in September spanned 10 of 20 industries. The petroleum and coal products industry made the biggest contribution to growth, with sales surging 6.3% to $9.1 billion in September. The gain was mostly driven by higher prices of refined energy products.

Wood product sales increased 2.9% to $3.1 billion in September, the fourth consecutive monthly gain. The 2023 wildfires impacted production in many sawmills across Canada. Partly as a result, the prices of logs, pulpwood and other forestry products have been trending upward since June 2023.

On the downside, sales of chemicals declined 1.8% to $5.5 billion in September, mainly on lower sales in two subsectors: resin, synthetic rubber, and artificial and synthetic fibres and filaments and basic chemicals. According to Statistics Canada, the declines were largely due to maintenance shutdowns in some major petrochemical and resin plants in Alberta and Ontario.

Meanwhile, sales of beverage and tobacco products dropped 5.6% to $1.35 billion in September, the second straight monthly decline and the lowest level since January 2022. Sales in this industry have decreased 9.7% over the last 12 months.

SALES GAINS CONCENTRATED IN ALBERTA AND QUEBEC

Manufacturing sales were up in 5 of 10 provinces in September. Alberta contributed the most to the national increase, as sales rose 4.3% to $9.1 billion. This was the province’s third straight monthly gain and was largely driven by higher sales of petroleum and coal products and fabricated metals.

Sales in Quebec climbed 0.7% to $17.7 billion in September, partly making up for the 1.6% decline in August. Higher sales in the petroleum and coal product and aerospace product and parts sectors more than offset lower sales in the machinery industry.

At the other end of the spectrum, sales in Ontario edged down 0.3% to $32.9 billion in September, the third decline in four months. The decrease was attributable to lower sales of motor vehicle parts and fabricated metals.

Sales in Newfoundland and Labrador plunged 15.9% to $262.5 million in September, fueled by a steep drop in durable goods sales. Notably, the province’s September factory sales were only about half the pre-pandemic level.

INVENTORY-TO-SALES RATIO RISES

Total inventories climbed 1.5% to $123.4 billion in September, led by higher inventories of petroleum and coal products, primary metal products, and beverage and tobacco products. Those gains more than offset lower inventories of plastic and rubber products.

With inventories growing faster than sales, the inventory-to-sales ratio increased from 1.68 in August to 1.70 in September. This ratio represents the number of months it would take to completely clear inventories assuming sales remain at their current level.

FORWARD-LOOKING INDICATORS DISCOURAGING

Forward-looking indictors were discouraging. The total value of unfilled orders fell 1.2% to $101.9 billion in September, primarily due to lower unfilled orders of aerospace products and parts. At the same time, new orders decreased 1.7% to $71.6 billion in September, down for the second time in three months.

CAPACITY UTILIZATION RATE DECREASES

Finally, the manufacturing sector’s capacity utilization rate decreased from 80.2% in August to 78.9% in September. The most notable declines were observed in the petroleum and coal product, transportation equipment, and chemical sectors, while the most significant increase was recorded in the primary metal industry.